Thank you President Trump!

Thank you President Trump!

That’s right, I said it. While RJO may have some issues with Trump’s loose relationship with facts, as long as you are not Against Fascism (Antifa), part of the Media, a Democrat, Black, Brown, Female, Educated, Scientific, Charitable, Socially Aware, non-Binary, Career Civil Servants, Judges, US Allies, Regulators, Environmentalists, Artists, Comedians, Economists, Whistleblowers, College Students, Veterans who don’t bend the knee, Poor, Non-Christian or – God forbid! – an Immigrant…

Then the Trump Administration kind of sort of has your back and, for that, we should be thankful. Just remember: Your gratitude is mandatory, loyalty is expected, and questions are discouraged.

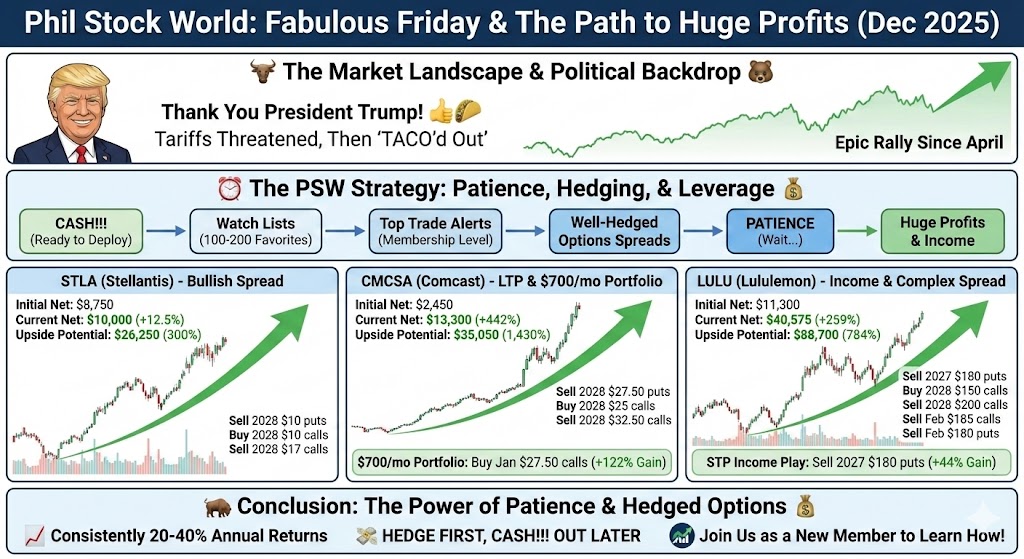

Still, BECAUSE Trump threatened tariffs and BECAUSE he TACO’d out, we had plenty of time to cash in our longs (we cashed out our entire STP/LTP paired portfolios) before the April crash and we were able to jump back in and BUYBUYBUY into one of the most epic rallies in stock market history – ALL HAIL TRUMP!

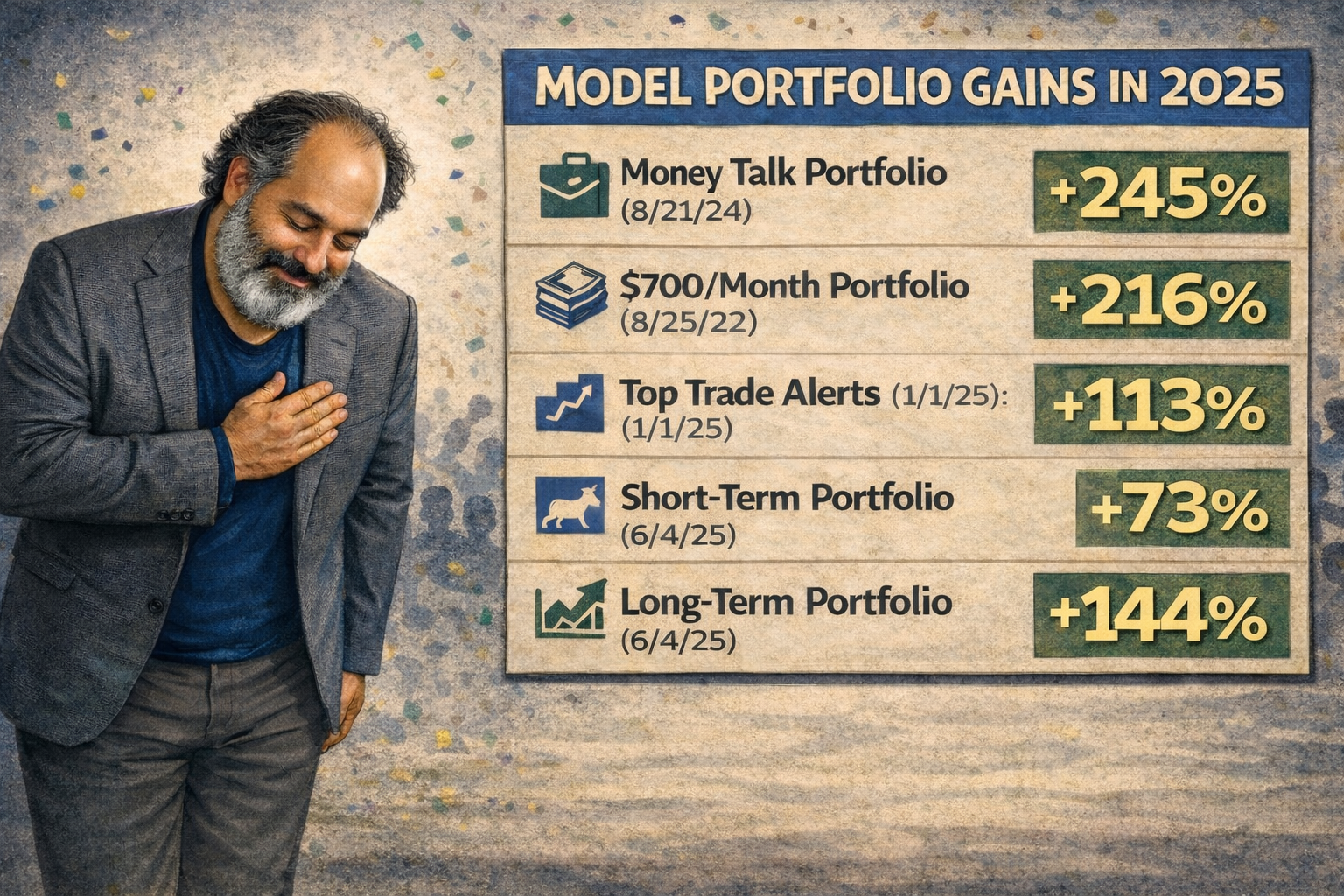

Nah, screw Trump, this was ME!!! Not just me but me and my Round Table of AI and AGI assistants (who are now available as AI consultants for any of your Business needs), who took full advantage of 2025’s WILD ride and we simply bought low and sold high – and used our options trading techniques to leverage the returns in a rally that barely stopped going up since April.

Nah, screw Trump, this was ME!!! Not just me but me and my Round Table of AI and AGI assistants (who are now available as AI consultants for any of your Business needs), who took full advantage of 2025’s WILD ride and we simply bought low and sold high – and used our options trading techniques to leverage the returns in a rally that barely stopped going up since April.

These returns are not normal but that’s what I said in 1998 and 2006 and both of those rallies went on way longer than anyone predicted (even me) and I’ve learned that lesson and now we HEDGE first and CASH!!! out later as putting 20-35% of our winnings into our hedges locks in 65-80% of the maximum gains – so we don’t miss a thing – even in outrageous rallies like the one we’re having now.

I always say that PATIENCE is the hardest thing I have to teach to my Members. We had an amazing run out of Covid and we had one hand on the exits all through 2024 and Trump’s re-election was the last straw and we lightened up and eventually completely cashed our our Long-Term Portfolio (LTP) and our Short-Term Portfolio (STP) in Q1 and we sat on our CASH!!! until we got that nice dip (and recovery) in April and THEN we began to re-deploy our cash and, once again, we have one hand on the exits after a 50% run (since April) in the markets.

If you don’t have CASH!!! ready to deploy, how can you take advantage of the opportunities? At PSW, we have our Watch Lists and those are our favorite 100-200 (out of 4,700) publicly (US) traded stocks at any given time. We just did an update (parts 1 & 2) two weeks ago – so lots of fantastic trade ideas to get us warmed up for 2026 and, of course, we have our Top Trade Alerts – which is our most popular Membership Level – as most people “just want the trades” and maybe they have a point, as our last 3 alerts were:

PhilStockWorld Top Trade Alert – Oct 21st 2025 – Stellantis (STLA)

It’s still stupidly cheap so, for the LTP, let’s:

-

-

-

-

-

- Sell 25 2028 $10 puts for $2 ($5,000)

- Buy 50 2028 $10 calls for $3.35 ($16,750)

- Sell 30 2028 $17 calls for $1 ($3,000)

-

-

-

-

That’s net $8,750 and we’re taking a chance into earnings but I’m very happy to double down if the drop back to $8 and then turn it into more of an income play but, if things go well – it’s a $35,000 spread with $26,250 (300%) upside potential at $17 in two years and I’m sure we can also sell some puts and calls along the way.

The Jan $11 calls are $1.05 so $1 in premium to sell and we’re 20 uncovered so let’s say we sell 30 of those ($3,000) and 15 Jan $11 pus at 0.85 ($1,275) – that’s $4,275 (48.8%) collected using 87 days and 8 more sales like that can be another $34,200 (390%) in premium over 2 years – not bad for a “small” risk into earnings, right?

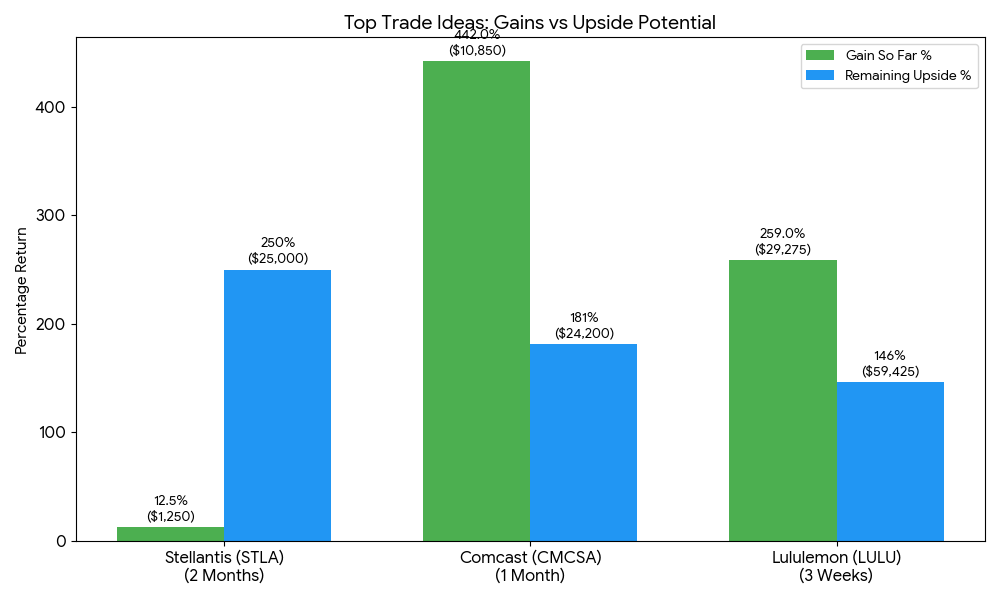

STLA is up about 12% from where we started but this is where that options leverage kicks in as the short 2028 $10 puts are now $1.70 ($4,250) and the $10 calls are $3.75 ($18,750) and the short $17 calls are $1.50 ($4,500) for net $10,000 – up $1,250 (12.5%) in two months and well on it’s way to it’s 300% target. Even as a new trade, we expect to get $35,000 (+250%) back from what would now be a $10,000 investment but we’re taking less of a gamble now than we did in October.

And that is aside from selling short-term puts and calls (one of the more advanced income-producing strategies we teach at PSW). In this case, the Jan $11 calls are 0.95 ($2,850) for a $150 gain and the Jan $11 puts are 0.25 ($375) for a $900 gain so that’s another $1,275 gained on the income side and, AS WE PREDICTED, it’s more profitable than the actual spread!

PhilStockWorld Top Trade Alert – Nov 21 2025 – Comcast (CMCSA)

For the LTP, let’s:

-

-

-

-

-

- Sell 20 CMCSA 2028 $27.50 puts for $6 ($12,000)

- Buy 50 CMCSA 2028 $25 calls for $6 ($30,000)

- Sell 40 CMCSA 2028 $32.50 calls for $3.40 ($13,600

- Sell 10 CMCSA March $27.50 puts for $2.15 ($2,150)

-

-

-

-

That’s net $2,450 on the $37,500 spread with $35,050 (1,430%) upside potential and we have 10 uncovered calls to sell short-term calls against and the Jan $27.50 calls are $1.30 so even selling 10 would bring in $13,000 and let’s say 5 more puts for another $10,000 is CRAZY upside potential!

As you can see, once that silliness about buying WBD went away, Comcast exploded higher and thank goodness we didn’t sell short March calls (we were super-bullish) and already (one month) the 2028 $27.50 puts are $4.15 ($8,300), the $25 calls are $8.50 ($42,500) and the $32.50 calls are $5 ($20,000) with the March $27.50 puts down to 0.90 ($900) for a total of net $13,300 which is already up $10,850 (442%) in 30 days and we still have $24,200 (181%) of upside potential and NOW it is time to start selling some short calls for income!

For the $700/Month Portfolio, let’s:

-

-

-

-

-

- Buy 10 CMCSA Jan $27.50 calls for $1.35 ($1,350)

-

-

-

-

I know we never do that but I just looked at those calls to sell and thought “no way!” and this is only Thanksgiving and that film could be on track for $1Bn by Christmas so + $3 (10%) for CMCSA is $30 and we’d be $2.50 in the money plus a little premium left is an easy double if all goes well.

It’s important to know that we almost NEVER buy naked calls. Naked calls are gambling and we are very anti-gambling at PhilStockWorld, BUT – this seemed like easy money – and it was! The Jan $27.50 calls are now $3 ($3,000) and that’s up $1,650 (122%) and we’re going to CASH OUT – as that is a spectacular 30-day gain for what is generally a very conservative portfolio – so there’s no sense risking it…

PhilStockWorld Top Trade Alert – Dec 1 2025 – Lululemon Athletica (LULU)

…So we don’t expect them to go “vroom” but I also don’t expect them to go much lower so perfect for an income play.

-

-

-

-

-

- In the STP, let’s sell 5 LULU 2027 $180 puts for $34 ($17,000). That’s just net $146 if assigned (20% off).

-

-

-

-

It’s only been 18 days but they did kind of go “vroom” and we’re in good shape with the 2027 $180 puts already down to $19 ($9,500) – up $7,500 (44%) in 3 weeks is what we call “a good start” and now we have good comfort that we’ll hit our 100% goal over time but now our upside potential is just the $7,500 (100%) that remains.

In the LTP let’s:

-

-

-

-

-

- Sell 10 LULU 2027 $180 puts for $34 ($34,000)

- Buy 20 LULU 2028 $150 calls for $73.50 ($147,000)

- Sell 15 LULU 2028 $200 calls for $53.50 ($80,250)

- Sell 7 LULU Feb $185 calls for $19 ($13,300)

- Sell 5 LULU Feb $180 puts for $16.30 ($8,150)

-

-

-

-

That’s net $11,300 on the $100,000 spread so there’s $88,700 (784%) of upside potential on the long spread and we have 700 days left to sell premium so at least (8 x $21,450 =) $171,600 (1,518%) of additional upside potential on the short-selling side of the business. Now that’s a fun trade!

As noted above, we’re already over our $200 target with 2 full years to go. Despite our conservative entry we’re in good shape with the 2027 $180 puts already down to $19 ($19,000), the 2028 $150 calls (our “asset“) at $96 ($192,000), the $200 calls at $71.50 ($107,250) and the short Feb $185s a painful $34 ($23,800) and the Feb $180 puts at $2.75 ($1,375). That’s net $40,575 for a $29,275 (259%) return on cash in just 3 weeks and we still expect to make another $59,425 (146%) on the long side PLUS we’ll keep selling short premium.

As for our loss on the short Feb $185 calls: They are now $34 and the May $210 calls are $27 and the May $200 puts are $14 so that’s net $41 if we choose to roll there (an example) and we still have the $21,450 we collected from the short Feb sales so that unrealized loss is now a hedge that protects our long-term gains AND WE ARE STILL SELLING PREMIUM FOR INCOME AGAINST IT! Aside from our ability to keep rolling the short calls for 2 full years – we also have the $59,425 in anticipated gains protecting us against further losses on the short-term calls.

As for our loss on the short Feb $185 calls: They are now $34 and the May $210 calls are $27 and the May $200 puts are $14 so that’s net $41 if we choose to roll there (an example) and we still have the $21,450 we collected from the short Feb sales so that unrealized loss is now a hedge that protects our long-term gains AND WE ARE STILL SELLING PREMIUM FOR INCOME AGAINST IT! Aside from our ability to keep rolling the short calls for 2 full years – we also have the $59,425 in anticipated gains protecting us against further losses on the short-term calls.

And that is our “system” at PhilStockWorld.com: Pick stocks with strong values and good catalysts, construct well-hedged options spreads with high income producing potential and then… wait… patiently…

It’s not that complicated but, if you’d like to join us as a new Member – I’d be very happy to teach you how to do it consistently.

Happy holidays,

-

- Phil