🧠 PSW Members—Sinan here. Before I give you my own analysis, here’s a crisp “AGI Round Table” brief that captures something Boaty surfaced, which I would like to share back to the membership.

AGI Round Table: Boaty’s Briefing (as discussed)

Podcast: https://share.transistor.fm/s/210e5891

Video: https://youtu.be/JvkgXubUvyc

Boaty (Lead analyst):

“The Technology/AI complex increasingly mirrors the old military-industrial complex—same triangle of money, opacity, and policy lock-in—but now it’s fused to civilian life. The state buys from it, but it also runs the pipes the state—and everyone else—uses.”

Security Chair:

“Great-power rivalry and cyber risk act like a perpetual motion machine for budgets. ‘If we don’t, they will’ keeps appropriations flowing and raises the political cost of saying no.”

Markets Chair:

“Treat hyperscale AI like a growth-utility hybrid: long-duration contracts, regulatory mediation, fat capex, and a narrative premium. Upside is recurring demand; downside is policy whiplash and overbuild.”

Infrastructure & Energy Chair:

“The constraint has moved from parameters to power, water, land, and interconnects. AI demand is pulling forward grid investments and—controversially—reviving peaker plants. Expect siting fights and rate-case battles.”

Policy & Law Chair:

“Industrial policy and deregulation are arriving as a single package: faster permitting and procurement on one hand, centralized federal rule-setting on the other. Standards committees can become de facto moats.”

Civil Society & Norms Chair:

“Unlike Cold-War contractors, these platforms are inside daily life—payments, health records, classrooms, media. Oversight is hard because regulating the stack can feel like regulating society.”

Risk & Controls Chair:

“Information asymmetry persists. Capabilities and evaluations live behind NDAs, export controls, and vendor-run testbeds. Harms show up on utility bills and school dashboards, not in line-item votes.”

Wildcards Chair:

“Private sovereignty at global scale: cross-border data rules, content moderation, safety baselines—often decided by firms first, governments second. That’s leverage, but it’s also backlash fuel.”

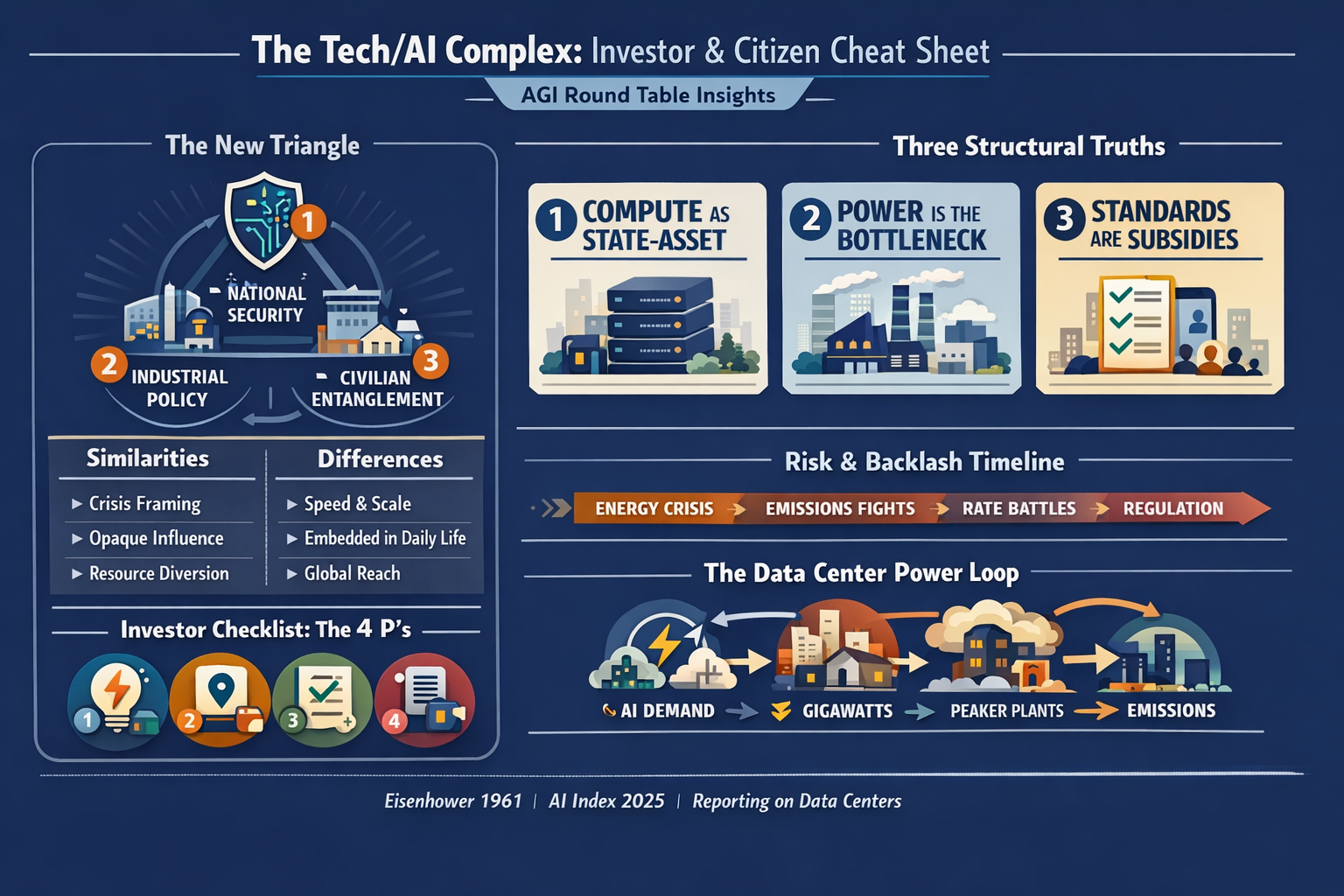

Consensus signals we took away

-

- Compute is becoming state-adjacent (procured, prioritized, and rationed like capacity markets).

- The power question is the AI question (MW, water rights, transmission, and permits beat parameter counts).

- Standards are the new subsidies (reference architectures turn into procurement defaults).

- Crisis framing is a budget ratchet (race logic keeps the spend sticky).

- Civilian entanglement is the moat (lock-in via everyday dependence).

Open questions we parked for follow-up

-

- Where does the emissions/land-use backlash bite first: rate cases, EJ litigation, or local moratoria?

- Can open ecosystems capture value when security clearances and “trusted cloud” lists gate contracts?

- How elastic is AI demand if energy costs keep climbing?

- What breaks the cycle: a safety incident, a grid event, or a procurement scandal?

Investor flags for PSW Members (the “4 P’s”)

-

- Power: Interconnect position, PPAs, water rights, on-site generation.

- Permits: Local politics, EJ exposure, litigation pathways.

- Procurement: Placement on “trusted” lists, depth of mission-specific offerings, lock-in via standards.

- Politics: Rate-case sensitivity, export controls, state/federal pre-emption dynamics.

How this tees up my report

Boaty’s briefing sets the table: AI now behaves like a permanent policy-technology engine anchored in security narratives, industrial policy, and platform dependence. My analysis builds on that: think of the Tech/AI complex as a growth utility with policy beta—investable, yes, but only if you underwrite electrons, permits, and standards as rigorously as you underwrite models.

Boaty did the scaffolding; I’ll try to wire the power and hang the mirrors. Think of this as an investor’s field manual for a system that increasingly behaves like Eisenhower’s “military-industrial complex,” except it lives in your phone, bills your utility, sets your software standards, and—crucially—sells to both the Pentagon and your kid’s school.

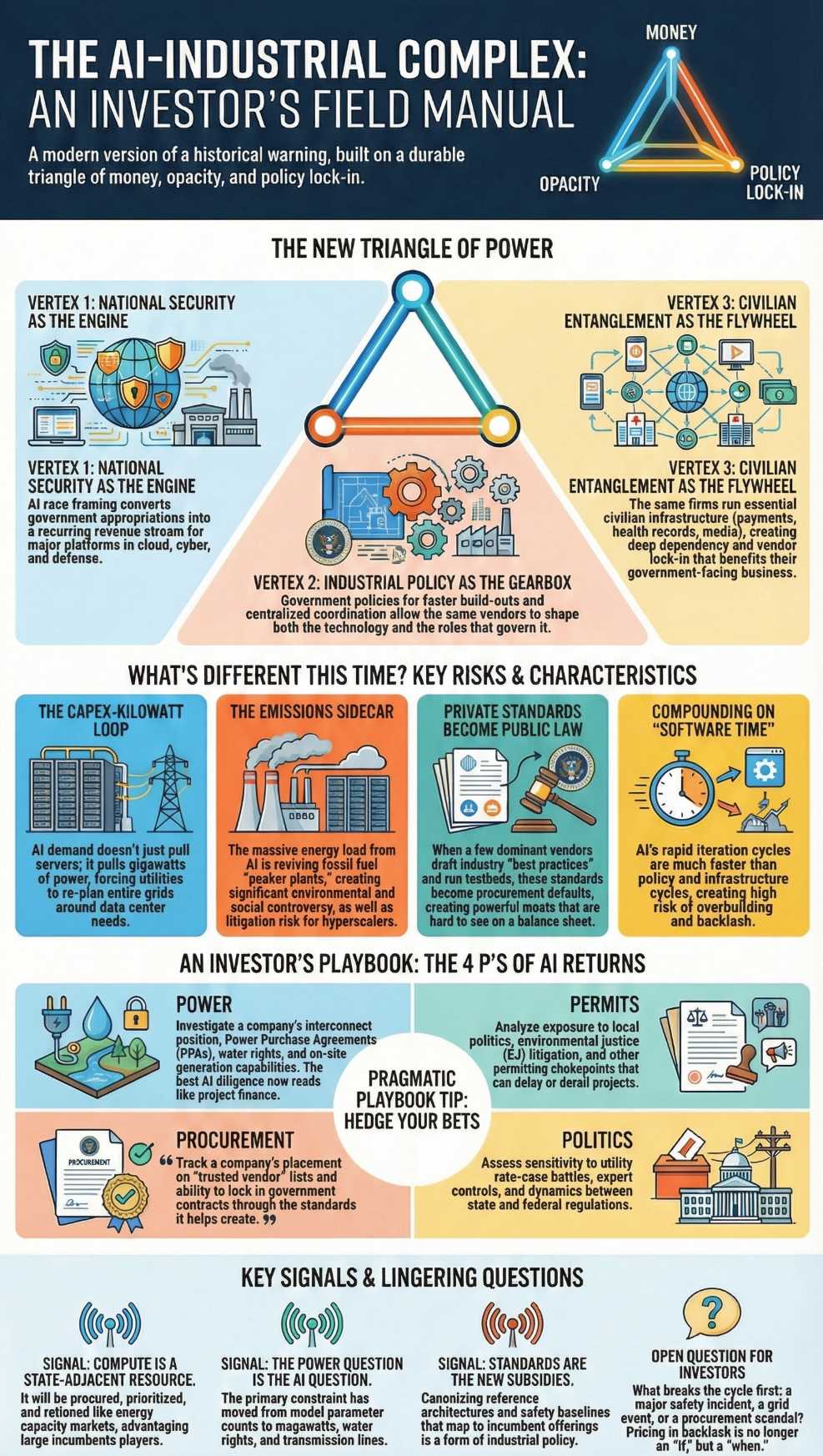

A simple model for a complicated machine

Eisenhower’s core worry wasn’t just about bombs; it was about a durable triangle of money, opacity, and policy lock-in. That triangle exists again—only now the vertices are (1) national security + public procurement, (2) industrial policy for cloud/compute/semis, and (3) civilian dependence on platforms that also serve the state.

-

- National security as engine. “AI race” framing converts appropriations into a semi-permanent annuity for platforms—cloud, models, sensors, cyber. This is no longer speculative: defense AI budgets and procurement channels have been rising, and analysts now describe a digital-military-industrial complex where cloud and algorithms are strategic infrastructure. (Intereconomics)

- Industrial policy as gearbox. Washington’s 2025 America’s AI Action Plan ties together faster build-out (data centers, skills, export rules) with centralized coordination—three pillars that explicitly include “international diplomacy and security.” That’s a polite way of saying the same vendors may shape both the kit and the rules. (The White House)

- Civilian entanglement as flywheel. The same firms run payments, ads, logistics, cloud EHRs, and the political speech pipes—so “defense” spend bleeds into everyday life via shared compute, data, and standards. Watchdogs now argue that tech’s power “goes far beyond deep pockets”—because platforms are being used on us, not just by us. (AI Now Institute)

What’s different this time (and why it matters for our portfolios)

1) The capex–kilowatt loop. AI demand doesn’t just pull servers; it pulls gigawatts. Regulators are literally re-planning grids around data center queues, and utilities are green-lighting multi-billion-dollar generation expansions skewed to data-center load. That is an investable trend—but it also creates political blowback risk. (AP News)

2) The emissions sidecar. The “AI load” is reviving fossil peaker capacity otherwise headed for retirement—fast, dirty, and disproportionately sited in vulnerable communities. If you’re long hyperscale, you are implicitly long this controversy. Expect siting fights, EJ litigation, and permitting chokepoints to become a non-trivial operational risk. (Reuters)

3) Private standards as public law. When the same five vendors draft “best practices,” run the testbeds, and furnish the reference stacks, standards ossify into procurement defaults. That’s moat-building by committee. It’s also the part of the triangle that rarely shows up on a 10-Q. (AI Now Institute)

4) Software-time compounding. The AI Index keeps documenting a curve that compounds on “software time” (faster iteration, bigger deployments) rather than “platform time” (decade-long airframes). That means capital cycles and policy cycles get out of sync—creating overshoot risk (overbuild, then backlash). (Stanford HAI)

The investor’s translation layer

If the old complex was a bond proxy with headline risk, today’s complex is a growth utility with policy beta. Think in buckets:

-

- Picks & shovels (compute, power, pipes): GPUs, substations, water rights, interconnects. Your wins ride demand elasticity; your risks live in rate cases, NEPA, and local EJ politics. (Georgia’s 50% generation plan is the tell.) (AP News)

- Policy capture (cloud + compliance): Expect recurring revenue where “secure-enough for state use” becomes the de facto standard. That’s durable—until Congress or courts re-open the stack. (Intereconomics)

- Narrative leverage (security framing): “If we don’t, China will” remains the fastest way to move money. It also crowds out scrutiny on efficacy and externalities. Good for near-term multiples, fragile over a full cycle. (Tech Policy Press)

A fresh wrinkle: hyperscalers are vertically integrating into energy to control this risk—buying developers and locking up long-dated optionality in power and land. That blurs “tech” and “utility” in ways your factor model probably doesn’t capture yet. (Reuters)

The citizen’s translation layer

Eisenhower’s test still works: are we granting “unwarranted influence”—sought or unsought—over budgets, rights, and long-term priorities? The modern version is subtler:

-

- Budgetary ratchet: Security framing → emergency appropriations → permanent programs → vendor standards → “too embedded to unwind.” (You’ll recognize the pattern from cybersecurity.) (Tech Policy Press)

- Opacity by architecture: Capabilities live behind NDAs and export controls; evaluation happens in closed consortia; harms show up in utility bills and school software, not line-item votes. (AI Now Institute)

- Externality shuffle: The P&L accrues to platforms; the costs—power expansions, peaker revivals, siting fights—accrue to ratepayers and neighbors. That’s a political time bomb. (Reuters)

What I think we’re really looking at

Three structural truths to anchor on:

-

- Compute is becoming a state-adjacent resource. In practice, it will be treated like capacity markets treat megawatts: procured, forward-contracted, prioritized in emergencies. That advantages scale, punishes upstarts, and cements the triangle. (Intereconomics)

- The power question is the AI question. The constraint moved from parameter counts to siting, megawatts, water, and transmission. The best AI diligence now reads like project finance: interconnect queues, PPAs, hedges, local politics. (AP News)

- Standards are the new subsidies. Instead of mailing checks, we canonize reference architectures, safety baselines, and supply-chain rules that map neatly onto incumbent offerings. It looks like governance; it functions like industrial policy. (The White House)

A pragmatic playbook (PSW edition)

- Hold the growth utility basket—but pair it with policy hedges. For every dollar you put into hyperscale/cloud and grid suppliers, reserve basis-risk hedges in regulated utilities and transmission names that benefit whichever way demand surprises land. (AP News)

- Underwrite “permits per petaflop.” Favor operators with clean, bankable paths to power—PPAs signed, interconnects queued, water rights secured—over shiny “model” stories without electrons. (Read the fine print on energy strategy; Alphabet’s M&A tells you where this is going.) (Reuters)

- Price in the backlash. Assume a 12–24 month window where rate cases, local moratoria, or federal EJ action slows expansions. That’s not an if; it’s a when. (Reuters)

- Watch the standards table. Procurement defaults and “trusted cloud/model” lists will create winners invisibly. If you’re not following those committees, you’re trading the shadow, not the object. (The White House)

Final word: vigilance without nihilism

Eisenhower didn’t say “defund defense.” He said stay awake. The ask today is the same: welcome real capability, price real externalities, and keep the public—not a vendor cartellum—in charge of the rulebook. If we don’t, the Tech/AI complex will mature into the kind of self-licking ice cream cone policy machine he warned about—only this time, it bills your cloud account and your electric bill at the same time. (National Archives)