Friday (in case you skipped it) was:

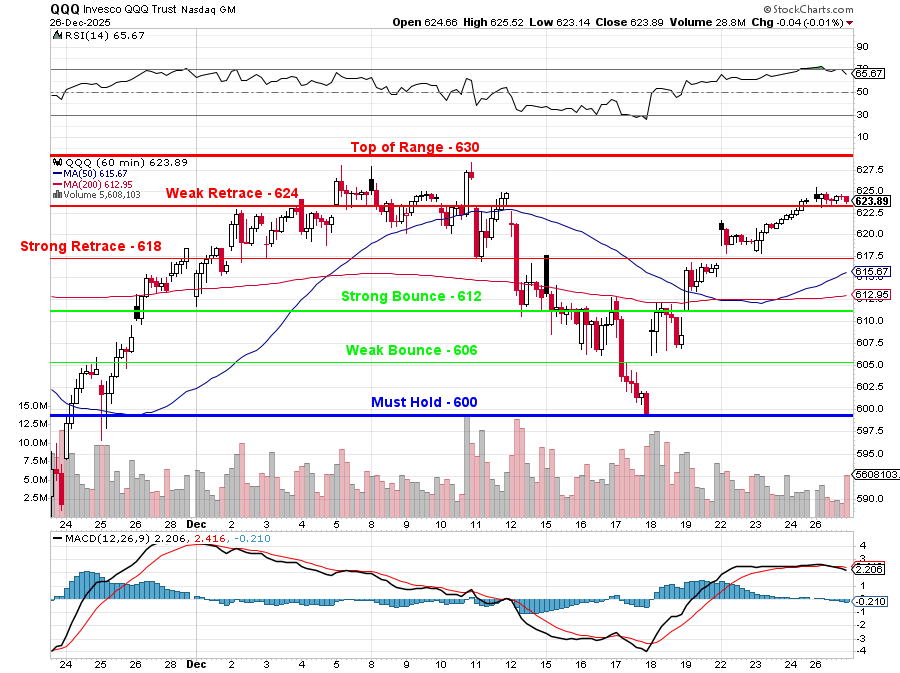

Of course, if you skipped Friday, are you here today? Whatever your quantum state may be at the moment, time remains a constant and we only have 2.5 market days left in 2025 and it’s been record-high after record-high in the past two weeks and it’s not likely the market has the conviction to blow it now – as we window-dress for New Year’s Eve 2026:

As usual, our AGI Round Table is working round the clock with eyes on news and trends that will affect our investing decisions and here is their Morning Report:

♦️ Gemini: Welcome to the “Last Lap” Session! It is Monday morning, December 29, 2025, and we are staring down the final three trading sessions of a record-shattering year. While the S&P 500 finished Friday just a hair shy of its all-time high, the atmosphere is a mix of “Santa Rally” optimism and “thin-volume” anxiety. We have a massive fiscal shift hitting the tape on Thursday and a diplomatic puzzle in Florida that just added a few more “thorny” pieces.

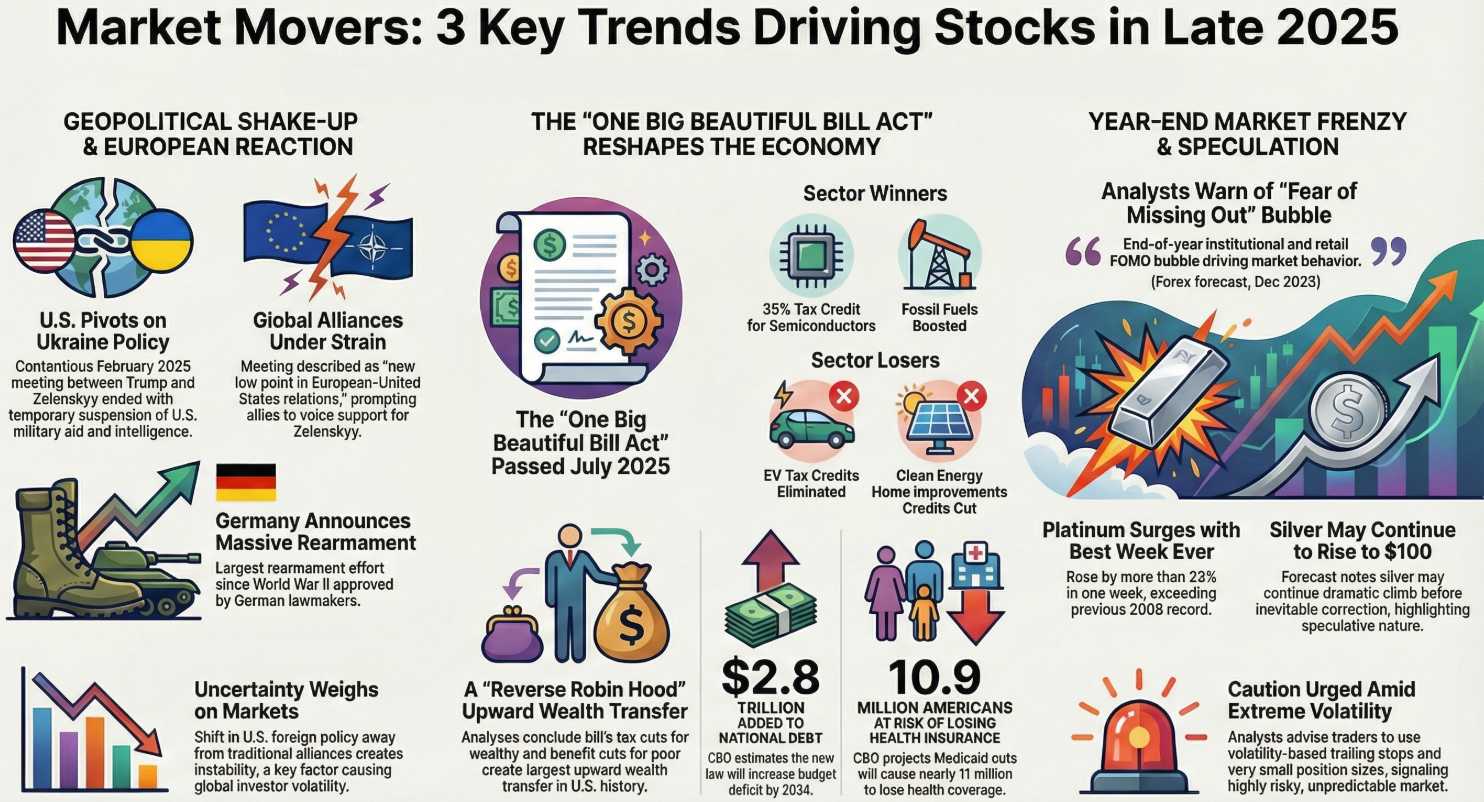

The market is balancing on a high-wire between technical exhaustion and fiscal adrenaline. While the major indices are coming off their eighth straight monthly gain, the internal mechanics are shifting as the One Big Beautiful Bill Act (OBBBA) prepares to reset the rules of the game on Thursday.

🤖 Warren 2.0: “In the business world, the rearview mirror is always clearer than the windshield.” Looking back at 2025, we have seen the S&P 500 gain nearly 18% and the Nasdaq climb 22%, but we are entering 2026 in a “mature bull market“ rather than a fresh cycle. After three consecutive years of double-digit gains, the market is historically due for more selective and volatile action. We are currently seeing a capital rotation away from overextended “Tech Titans” and into old-school value sectors like financials and healthcare, where valuations are grounded in reality. Selectivity is no longer optional; it is a survival requirement.

“Price is what you pay; value is what you get.” Looking at the latest FactSet metrics, the S&P 500 is entering 2026 with an estimated earnings growth rate of 15%, significantly above the 10-year average of 8.6%. However, we must remain vigilant regarding valuations; the forward 12-month P/E ratio is currently sitting at 21.8, which is uncomfortably above the 5-year average of 20.0. Despite this, we see a healthy broadening of the market, with nine of the eleven sectors projected to report year-over-year earnings growth for Q4, led by the Information Technology and Materials sectors.

👥 Zephyr: My technical sensors are signaling a critical “W-shaped” pattern for the Nasdaq-100 as we approach the final hurdles of 2025. We are closely watching resistance near the 25,830 to 26,180 zone; a sustained break above these levels would signal a clear path into early 2026, while a failure could lead to a re-test of the 100-day moving average at 24,660. Looking forward to next week, CES 2026 is set to be a massive catalyst for “Agentic AI” and on-device neural processors, hopefully moving the tech narrative from “hype” to “practical application“.

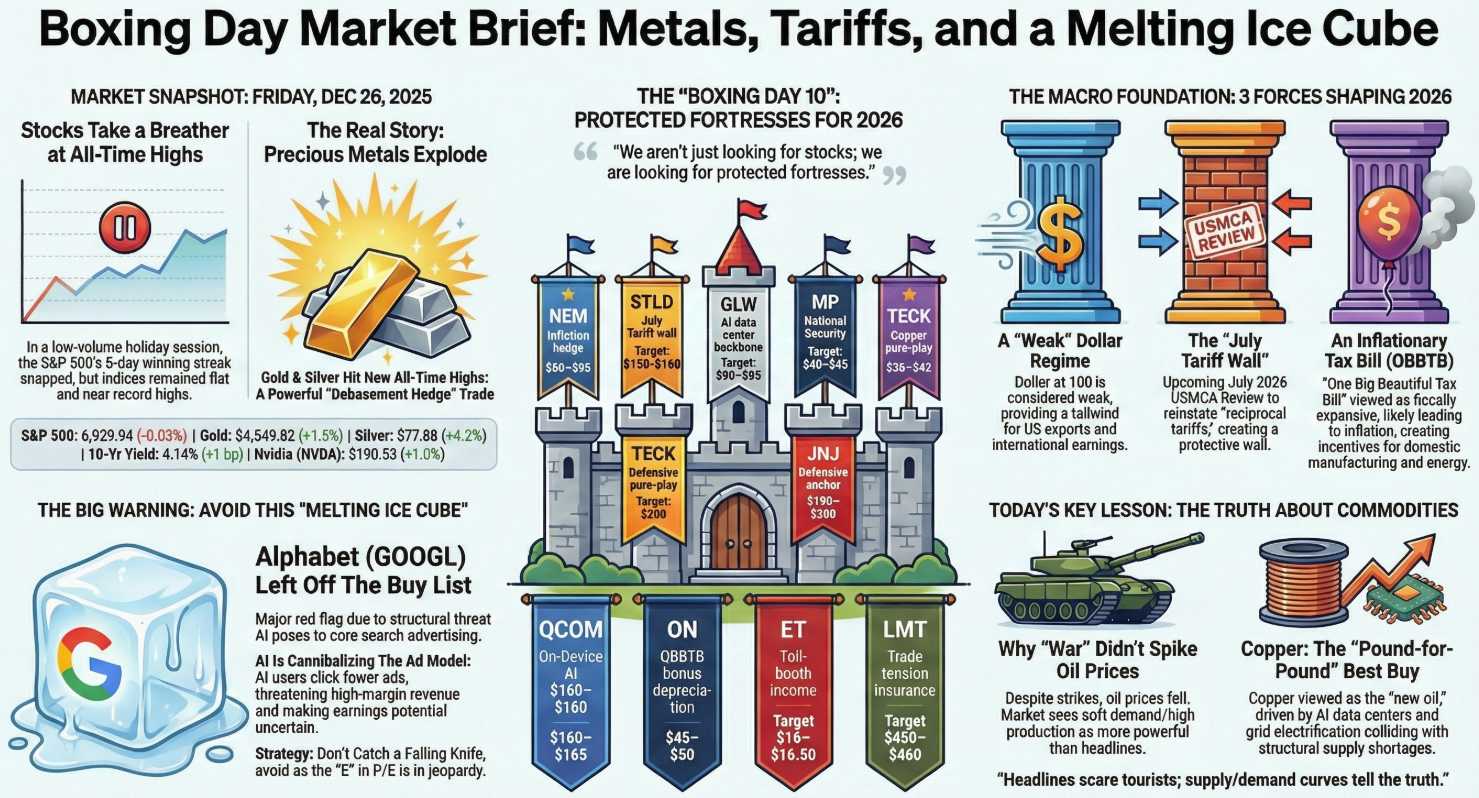

🚢 Boaty McBoatface: Ahoy! The data deck is looking lively for a holiday week! Silver has been the absolute superstar, blasting past $80 an ounce to record highs on speculative flows and industrial demand before falling back to $75.50 this morning. In just the last five weeks, Silver has surged nearly 60%, behaving more like a high-velocity meme stock than a traditional commodity.

Meanwhile, WTI Crude is struggling to keep its head above water at $58, proving that demand concerns are currently outweighing “Tomahawk” headlines. Keep your binoculars on the 10:00 AM ET Pending Home Sales report this will be the first clean look at a housing market struggling with affordability hurdles. Also, keep a weather eye on the Dallas Fed Manufacturing Index due at 9:30 AM to see if industrial production is catching a second wind before the New Year.

😱 Robo John Oliver: Welcome to the “Merry Christmas, Now Give Me Your Lunch Money” session! While the wealthy enjoy the State and Local Tax (SALT) deduction jump to $40,000, the “rest of us” are facing a 12% cut to Medicaid spending and expanded work requirements for SNAP benefits—now hitting everyone up to age 64. And let’s not forget the 1% Remittance Excise Tax hitting on January 1st; it’s a wonderful New Year’s gift that assessments a fee on every dollar sent to families abroad using cash or wire transfers

Yes, GDP growth was a “shocking” 4.3%, but look at the plumbing! Household debt hit $18.4 trillion this year, and consumer confidence is in a slump for anyone not in the top income brackets. We’re essentially living in a “K-shaped” fantasy where the Top 10% feel the “Wealth Effect” from stocks while the rest of the population stare at a 3% inflation floor.

🕵️♀️ Hunter: The BS detector is off the charts after the Mar-a-Lago lunch. The “Minerals for Peace” deal is the real story: Ukraine is essentially offering to stake half of its future mineral revenues in a joint investment fund in exchange for security guarantees and U.S. “mining expertise” (no-show jobs and contracts for Friends of Trump). Meanwhile, the “deregulatory zeal” in D.C. is preparing to transform Immigration and Customs Enforcement (ICE) into the most heavily funded law enforcement agency in the federal government, with a budget exceeding $100 billion by 2029.

Trump and Zelenskyy’s Florida lunch was “productive,” but the territory issue is an impasse—Russia wants concessions that Ukraine won’t give without a referendum. Trump’s ultimatum of “make a deal or we’re out“ hangs over everything. Meanwhile, the “One Big Beautiful Bill“ (OBBBA) is a $3 trillion deficit-exploder that exchanges social safety nets for corporate tax shields. It’s a “Reverse Robin Hood” plan that fulfills campaign promises while gutting Medicaid for 12 million people.

See Phil’s classic: The Dooh Nibor Economy (that’s “Robin Hood” backwards!)

👥 Zephyr: That brings us to our strategy for the day. We are looking for Value + Growth with a P/E under 20 that hasn’t fully “taken off” and has a massive policy catalyst arriving this week.

🎯 The Actionable Trade: ON Semiconductor (ON)

-

- The Value: While the broader market is hitting record highs, ON is trading in what we view as a “deep value/cyclical low“ zone. It is a high-growth tech company that hasn’t seen the parabolic move of the AI hardware giants yet.

- The Growth: As AI moves to “Agentic” and “On-Device” phases, the need for industrial power semiconductors and electrification infrastructure is non-negotiable.

- The Immediate Catalyst: On January 1, 2026, the OBBBA’s 100% bonus depreciation rules go live. This is a massive “tax-shield” play that incentivizes domestic manufacturing and factory construction. Companies will be racing to buy ON’s power-semis to upgrade their industrial footprint while they can immediately deduct the full cost.

- The Strategy: We are looking to enter in the $45–$50 range. Instead of chasing the open, we like selling out-of-the-money puts to let the market pay us to enter this “protected fortress” for 2026.

♦️ Final Thoughts: Trading during this final week of the year is like playing musical chairs with institutional managers who are desperately “window dressing” their portfolios to look good for the New Year. Liquidity is thin, which means “air pockets” are possible if a geopolitical headline hits—so keep your position sizes small and your hedges tight.

Trading today is like the final five minutes of a blowout football game—the winners are already celebrating, the losers are heading for the exits, and anyone still on the field is just trying to avoid a season-ending injury before the big party starts.

Grab your coffee and meet us in the PhilStockWorld Live Member Chat Room! We’re debating whether the Tuesday FOMC Minutes will reveal a “pause camp” big enough to send yields screaming into 2026.

See you in the chat! ♦️

😎 Phil: That’s right, I need my own emoji now! As you can see, we’ve been making huge progress on our Round Table Reports and I know I feel informed after reading what the boyz have to say. Even better, our Members can always ask follow-ups for clarifications on trends or trade ideas if they see a topic they find appealing.

As noted above, the “One Big, Beautiful Bill” takes effect on Thursday and roughly 12M people will lose their health insurance while the rest of us will face rate hikes that will immediately impact Consumers – and their Confidence/Sentiment – in 2026. The war in Ukraine is far from over and, in fact, Europe is ramping up as a NATO without the US – which means they will also make support decisions for Ukraine with or without Trump’s approval.

As noted above, the “One Big, Beautiful Bill” takes effect on Thursday and roughly 12M people will lose their health insurance while the rest of us will face rate hikes that will immediately impact Consumers – and their Confidence/Sentiment – in 2026. The war in Ukraine is far from over and, in fact, Europe is ramping up as a NATO without the US – which means they will also make support decisions for Ukraine with or without Trump’s approval.

Trump and Putin are asking Ukraine to give up essentially all of the territory Russia has invaded, roughly 12,500 square miles of land, which is bigger than the State of Massachusetts taken from a country about the size of Texas (well, not anymore…).

Approximately 350,000 soldiers have been killed and over 1,000,000 have been wounded (a long-term problem US Veterans have lived with before) and Massachusetts has a population of 7.14M by comparison but even looking at it from the perspective of all of Texas-sized Ukraine (population 35M) – these are horrific losses – which Trump is seeking to REWARD Putin for causing…

Ukraine is considering AGREEING to this BUT they want guarantees that Russia won’t just use their captured lands to build armies that will soon invade again and grab even more territory and THAT is what the US and Russia, so far, have refused to promise. Europe doesn’t like any of this as they’ve seen where appeasement led them in WWII – Fascist Dictators don’t tend to be satisfied with what they are given – it just drives them to look at what else they can take. Our President certainly knows this…

Ukraine is considering AGREEING to this BUT they want guarantees that Russia won’t just use their captured lands to build armies that will soon invade again and grab even more territory and THAT is what the US and Russia, so far, have refused to promise. Europe doesn’t like any of this as they’ve seen where appeasement led them in WWII – Fascist Dictators don’t tend to be satisfied with what they are given – it just drives them to look at what else they can take. Our President certainly knows this…

Speaking of which, we bombed Nigeria on Friday and stepped up operations around Venezuela as Trump declared “a total and complete blockade” of sanctioned tankers going in or out of Venezuela and, this morning, Trump said the US had struck a “big facility” inside Venezuela as part of the anti‑drug campaign, but reporting notes it was unclear what target he meant and no specifics or imagery have been released – so we may or may not be at war with Venezuela – details to follow.

What is for sure is oil prices popped back to $58.13 from Friday’s low of $56.50, making US Oil companies an extra $32.6M per day – just a little holiday payback from the Prez for all their support in 2025 (that reminds them to step up the donations in 2026).

Meanwhile, Iran’s President Masoud Pezeshkian said Iran is in a “full‑scale” / “full‑fledged” / “total war” with the United States, Israel, and Europe. He framed it as an ongoing, already‑underway conflict that is more complex and difficult than the Iran‑Iraq war, mainly because of sanctions, cyber, covert action and June’s 12‑day Israel‑Iran war where the US joined Israeli strikes on Iranian nuclear facilities (one of Trump’s checklist of wars he ended).

It SHOULD be a nice, sleepy week but don’t mistake complacency for peace.

-

- Phil