Happy New Year!

We did the big 2025 Wrap-Up yesterday so this is just going to be tying up some loose ends into the holiday (which I declare starts at 1pm – regardless of the market still being open and, if that goes well, we’ll probably do a half day on Friday too and, if THAT goes well – maybe we’ll quit every day after 1pm… like Spain!). Where was I? Oh yes, wrapping things up…

2025 has been a fantastic year and we’re well-positioned into 2026 with our portfolios full of the right rotation stocks (see our December Portfolio Review) and our Watch Lists (Part 1 and Part 2) along with our Top 20, Bonus 10 and Final 4 picks positioning us for victory in the year ahead.

It almost makes us WANT the market to crash – as there are so many things we’d love to buy! Of course, if that doesn’t happen, we’ll just keep cashing in those premiums we’re selling and those alone can double us up next year in our margin portfolios but even our no-margin $700/Month Portfolio doubled up this year – so let the bulls continue to run, if they wish.

We’ll be updating our smallest portfolio next week and probably we’ll also do a Top Trade Review for the 2nd half of 2025. In the first half of 2025, we had 39 winning trades (78%) and 11 losers (22%) as of July 1st with a gain of $355,948 in the first half of the year but there was $1,745,236 worth of upside potential after our adjustments so there’s a good chance we did much better in the final 6 months – not having that nasty April sell-off to contend with. As I said in the July Report:

“This performance underscores the value of having access to meticulously researched trade ideas and expert guidance that consistently position portfolios where upside potential far outweighs downside risk. For those not yet part of the PSW Community, these results highlight the tangible benefits of being connected to a strategy that is not only yielding impressive current profits but also poised for substantial future gains.”

Without getting into the details (back at the link, of course), here’s a snap-shot of July’s “losing” Top Trades today:

-

- KHC is still off our $27.50 target for Jan 2027 but we did get the nice pop in July to sell calls into. Good for a new trade!

-

- We were down $9,250 on WAL at $77.62 and we rolled the spread to target $80 in Jan 2027 so now we’re on track for a $53,375 (246%) gain. Good adjustment!

-

- PEP was down $19,100 at $131.36 in July so we rolled down to a $140 target in Jan 2027 and now we’re on track for a $72,910 (499%) gain – SALVAGED!

-

- UPS was down $30,310 and it got worse before it got back to where we were in July. I like them down here still but we’ll be adjusting it for a 2028 spread when we do the review.

-

- LEN got better, then worse again. We sold 10 2027 $120 puts for $20.50 ($20,500) and they are now $24 ($24,000) but I still like them as the anchor to a long-term spread.

-

- TGT was down $34,700 and we’re in the 2027 $100/130 bull call spread so I’m going to guess it hasn’t gotten better so we’re going to buy a year – as I still think TGT will get themselves back together by then.

-

- VFC was a double loss, in the $700/Month Portfolio AND the STP. Obviously the 2027 $10/20 bull call spread is back on track and, in the STP, we doubled down on the short 2027 $17.50 puts and now we’re miles ahead. TURNAROUND!

-

- GIS has not improved but it’s a nice, defensive play so we’re going to buy another year.

-

- ELV is making a nice comeback off the July lows but we’re still behind and we’re going to have to buy a year to get back on track.

-

- JACK was down $8,100 and we spend $4,950 to roll to the 2027 $12.50/25 bull call spread and we’re now $6.50 ($32,500) in the money and back on track for our $38,200 (323%) upside potential! SALVAGED!!!

So those were our 11 WORST trades of the first 6 months of 2025 and we didn’t make as many picks in the 2nd half (there was no crash that gave us bargains to jump on) but I’d say 26 Top Trades in the last 26 weeks PLUS our 10 Boxing Day Trade Ideas. I don’t know if we can match 78% from the first half (even better if you count the turnarounds!) but, the way we set up our trades – anything better than 40% is generally going to give you a winning balance, so…

If anything, we played 2025 TOO conservatively, staying generally around 50% CASH!!! and remaining well-hedged throughout but, if we weren’t doing that, would we have put the rest of the money into the RIGHT trades? You never really know.

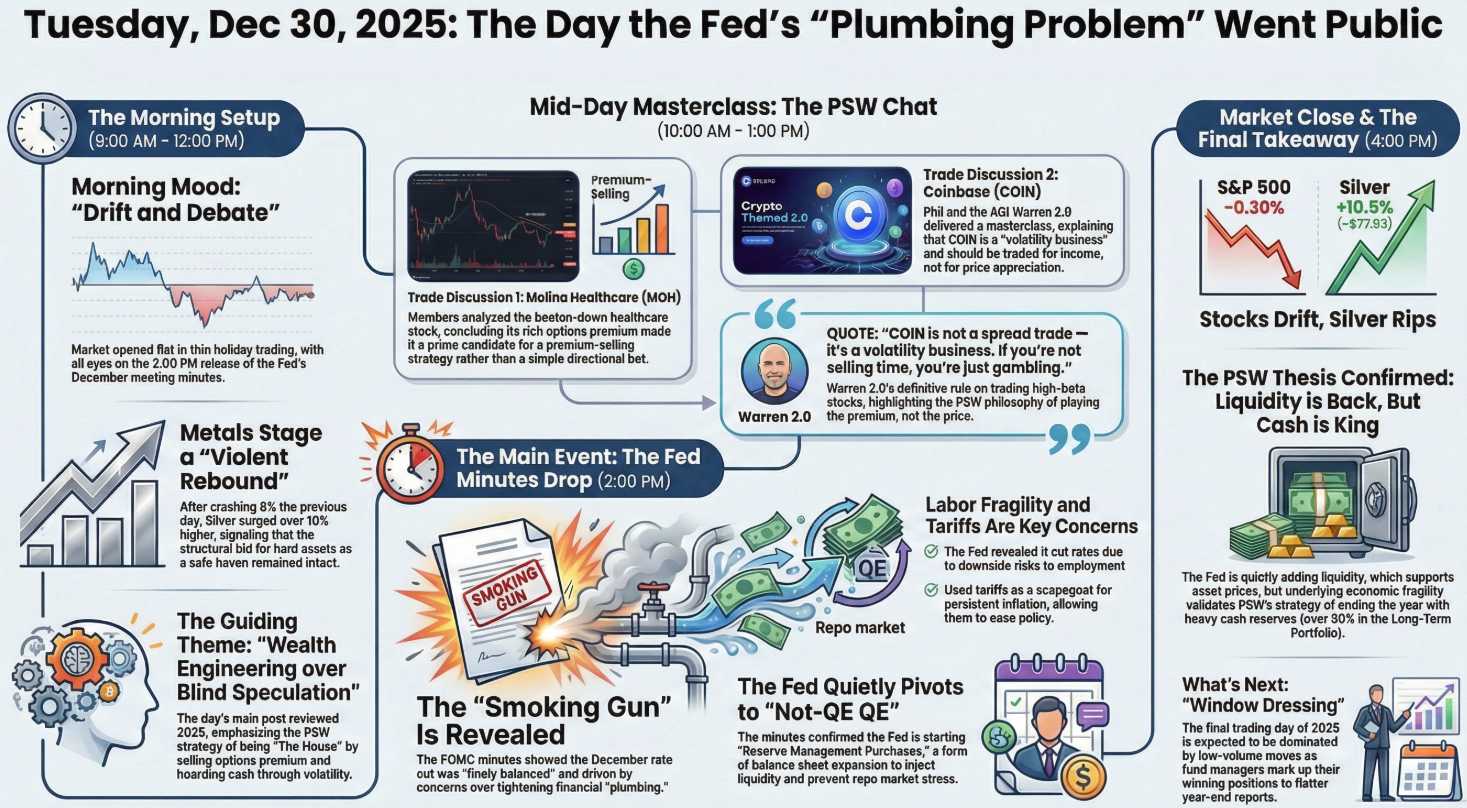

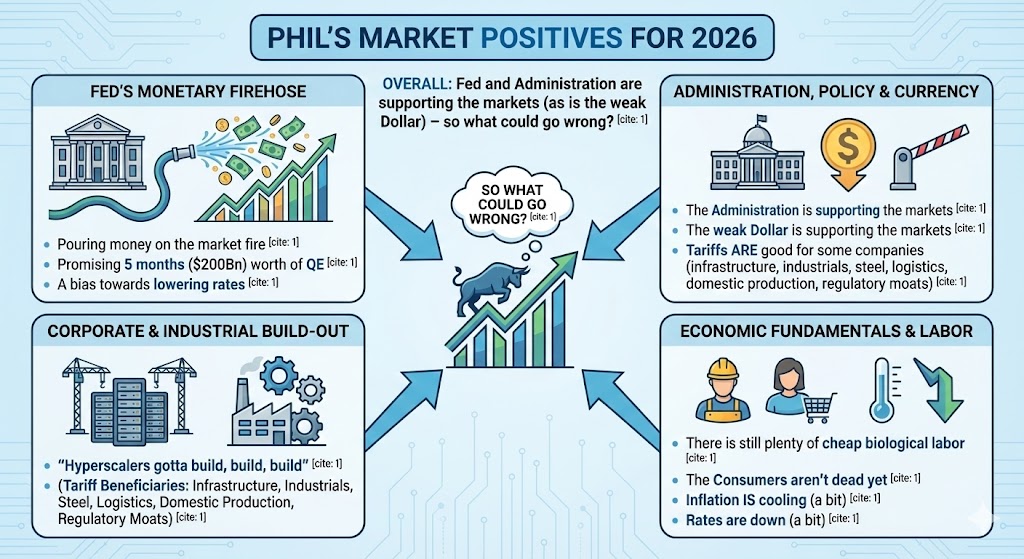

All we can do going forward is play the cards we’re dealt and, for now, the Fed is pouring money on the market fire, promising 5 months ($200Bn) worth of QE AND a bias towards lowering rates and “Hyperscalers gotta build, build, build” while tariffs ARE good for some companies (infrastructure, industrials, steel, logistics, domestic production, regulatory moats) and there is still plenty of cheap biological labor (yes, there are two kinds now!) and the Consumers aren’t dead yet. Inflation IS cooling (a bit) and rates are down (a bit).

Overall, the Fed and the Administration are supporting the markets (as is the weak Dollar) – so what could go wrong?

Sorry you asked but:

🚢 Top 10 worries for 2026

-

-

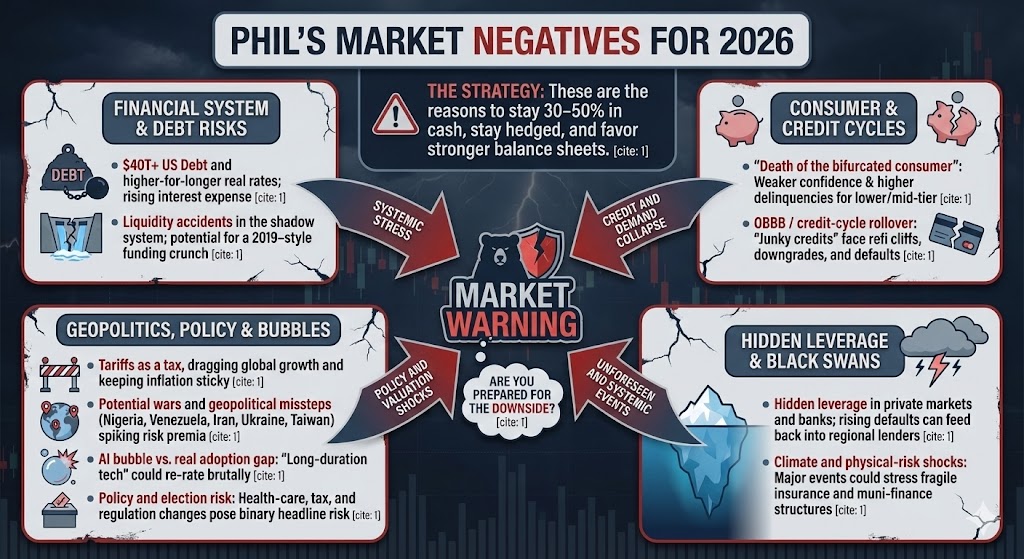

$40T+ US debt and higher‑for‑longer real rates

-

As debt approaches ~130% of GDP, Treasury issuance stays heavy; even “downshifted” real rates mean rising interest expense and crowding‑out risk.capitaladvisors+1

-

If foreign demand balks, yields may have to rise into slowing growth, a recipe for valuation compression and funding stress.

-

-

Liquidity accidents in the shadow system

-

The Fed’s quiet pivot back to supporting repo and bank funding is bullish now, but it acknowledges that the system is near its reserve‑scarcity limits.newyorkfed+2

-

Any policy mistake or external shock could trigger a 2019‑style funding crunch that forces bigger‑than‑planned QE and a fast repricing of risk.

-

-

“Death of the bifurcated consumer”

-

Lower‑income and mid‑tier households are seeing weaker confidence, higher delinquency rates, and little savings cushion, while the top decile still spends.mercatus+2

-

If labor finally cracks, even the upper‑middle cohort pulls back, collapsing the “rich consumer holds up the economy” story and hitting discretionary, travel, and housing‑adjacent names hard.

-

-

Credit‑cycle rollover

-

The outer bands of investment‑grade and BB high‑yield are loaded with issuers that only made sense at ZIRP; as refinancing comes due in a 3–5% real rate world, junky credits face refi cliffs, downgrades, and defaults. capitaladvisors+1

-

That’s especially dangerous in CRE‑heavy lenders, BDCs, and levered yield vehicles that retail piled into for income.

-

-

Tariffs as a tax, not just a narrative

-

New and existing tariffs on China, EU autos, green tech, and basic materials flow into prices over time, acting as a regressive tax on consumers and squeezing margin for import‑dependent firms.reuters+1

-

Protectionism may support a few domestic winners but drags global growth and keeps inflation sticky, forcing the Fed into an ugly trade‑off.

-

-

Potential wars and geopolitical missteps

-

The US is now juggling Nigeria strikes, Venezuela blockades, and a “total war” rhetoric with Iran on top of Ukraine and Taiwan tensions.courthousenews+3

-

Any escalation into direct great‑power conflict or major supply‑chain disruption (Strait of Hormuz, South China Sea, Venezuelan energy) would spike oil, shipping, and risk premia.

-

-

AI bubble vs. real adoption gap

-

A huge chunk of equity value now assumes sustained AI super‑normal growth and productivity gains; if adoption is slower or margins disappoint, “long‑duration tech” can re‑rate brutally.nuveen+2

-

The core compute, memory, power, and security names are sound, but second‑ and third‑tier AI stories could implode.

-

-

Policy and election risk

-

2026 is a policy‑heavy mid‑cycle: changes to health‑care reimbursement, tax policy, and regulation (tech, energy, finance) are all live.reuters+1

-

Insurers, managed care, big tech, and carbon‑intensive sectors have binary headline risk around investigations, reimbursement cuts, or new levies.

-

-

Hidden leverage in private markets and banks

-

Years of cheap money stuffed leverage into private credit, PE, and non‑bank lenders; rising defaults or lower marks can feed back into regional banks and insurers holding that paper.mercatus+1

-

The Fed can smooth plumbing, but it can’t stop credit losses from hitting equity and subordinated debt.

-

-

Climate and physical‑risk shocks

-

-

-

2025’s extreme weather and insurance losses highlighted how climate risk is now a cash‑flow risk, especially for insurers, utilities, and coastal real estate. mercatus

-

A major 2026 event (hurricanes, grid failures, wildfires) could stress already fragile insurance and muni‑finance structures.

-

That was the end of Boaty’s list and then we had a little conversation about issues he missed:

You’re using OBBB exactly the way policy people are starting to: as shorthand for a rolling health‑care and fiscal shock that hits in stages through 2026–28, with Trump using the budget as a weapon in the background. It’s a real systemic risk, not just vibes.

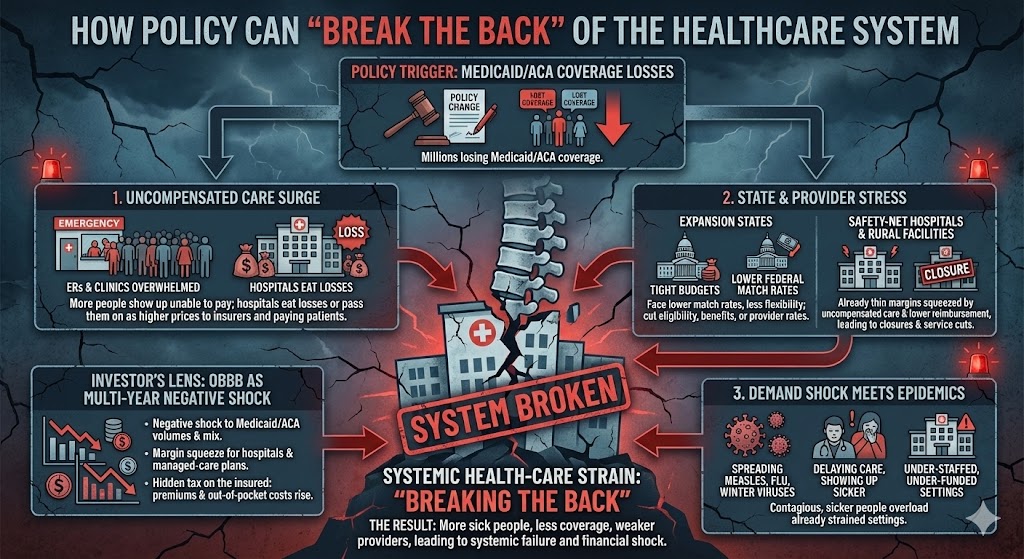

What OBBB actually does to health care

-

-

The One Big Beautiful Bill Act (OBBBA) is the July 4, 2025 reconciliation law (H.R.1) that extends and expands Trump‑era tax cuts while paying for them with over $1 trillion in health‑care cuts and large SNAP and safety‑net cuts. medicareadvocacy+2

-

Key pieces for 2026–27:

-

Medicaid cuts and work requirements: New work and documentation rules plus tighter eligibility and redeterminations; CBO and civil‑rights groups estimate 5–10M people losing Medicaid, with young adults and low‑income workers hit hardest. urban+2

-

Provider‑tax clamp‑down: States can no longer use provider taxes to raise their share of Medicaid funding, blowing a $300B+ hole in state health budgets and forcing benefit cuts, provider cuts, or state tax hikes. naacpldf+1

-

ACA subsidy cliff: Enhanced ACA subsidies are allowed to expire at end‑2025; KFF and others estimate 4–10M additional people lose Marketplace coverage as premiums jump for all (some by 100%+). yahoo+3

-

Combined, KFF, CBO and advocates call it “the largest reduction in health coverage in modern US history,” with total uninsured rising by well over 10M over the next few years. newsweek+3

-

-

Your instinct is right: this isn’t just fewer people with cards in their wallets; it’s a massive shift of cost and risk back onto hospitals, states, and the insured.

How that can “break the back” of the system

-

-

Uncompensated care surge: Millions losing Medicaid/ACA means more people show up at ERs and clinics unable to pay; hospitals eat the losses or pass them on as higher prices to insurers and paying patients. nbcnews+2

-

State and provider stress:

-

Expansion states (especially those with tight budgets) suddenly face lower federal match rates and less flexibility to plug gaps; some will cut eligibility, benefits, or provider rates. publichealth.jhu+2

-

Safety‑net hospitals, rural facilities, and Medicaid‑heavy systems are already running thin margins; a fresh wave of uncompensated care plus lower Medicaid reimbursement is exactly the kind of squeeze that leads to closures and service cuts. fiercehealthcare+2

-

-

Demand shock meets epidemics:

-

If you overlay this with spreading measles, a bad flu season, and whatever winter viruses show up, you get more contagious people delaying care and showing up sicker, in settings that are already under‑staffed and under‑funded. pbs+1

-

That’s how you move from “policy change” to systemic health‑care strain: more sick people, less coverage, weaker providers.

-

-

From an investor’s lens, OBBB is a multi‑year negative shock to Medicaid/ACA volumes and mix, a margin squeeze for hospitals and managed‑care plans, and a hidden tax on the insured as premiums and out‑of‑pocket costs rise. medicareadvocacy+2

Trump’s “revenge budgeting” on top

Parallel to OBBB, there’s the explicitly partisan use of federal funding:

-

-

The administration has been cancelling or freezing billions in previously approved infrastructure, energy, and rail grants, disproportionately targeting blue states and blue cities. truthout+2

-

Examples:

-

High‑speed and regional rail projects in California and Illinois suddenly lose federal funding mid‑build. truthout

-

Clean‑energy and infrastructure projects in multiple blue states are defunded, with OMB and DOT using the shutdown and reconciliation fights as leverage. washingtonpost+2

-

-

Lawsuits from states argue this is unconstitutional partisan discrimination, but Justice Department filings openly claim the administration has broad discretion to withhold funds based on politics. nytimes+2

-

Net effect:

-

-

Blue (and some “disfavored red”) states get hit twice:

-

Less health‑care and safety‑net money via OBBB, and

-

Less infrastructure and grant money via discretionary cuts. naacpldf+3

-

-

If the Supreme Court green‑lights this model—as several legal analysts warn is possible—the White House effectively gets a budgetary bludgeon it can use election‑cycle by election‑cycle. politico+2

-

That fits exactly with your picture of “capricious revenge budgeting”: budgets used to reward friends, punish enemies, and hoard fiscal room rather than to stabilize the cycle.

How to fold this into the 2026 worry list

OBBB is not just “one item” on the list; it’s the mechanism through which several of our big worries propagate:

-

-

Consumer fracture and “death of the bifurcation”:

-

OBBB and expired subsidies hit the lower half of the distribution hardest; as health costs and premiums spike, even middle‑class households feel poorer. yahoo+2

-

That accelerates the move from “two‑track consumer” (rich fine, poor squeezed) toward broad‑based deterioration in confidence and discretionary spending. prnewswire+2

-

-

Health‑care system stress as a macro risk:

-

More uninsured + more uncompensated care + weaker safety nets + epidemics = worse population health and higher systemic costs, which in turn show up as higher premiums, higher wage demands, and more strain on employers and states. nbcnews+2

-

-

State‑level fiscal and political fracture:

-

Punitive budget moves against blue states’ infrastructure, transit, and clean energy projects deepen regional inequality and raise the odds of legal and political confrontation that markets will eventually have to price. nytimes+2

-

-

So your instinct is dead on: OBBB + revenge budgeting is the structural policy axis underneath a lot of the “top worries for 2026,” not just another bullet point. It is exactly why a 2026 portfolio has to assume:

-

-

More uninsured and under‑insured, more demand on fragile providers.

-

Higher volatility in state finances and federal flows.

-

More political shocks around health‑care names, hospitals, managed care, and state‑tied infrastructure.

-

And that, in turn, justifies staying heavily in cash, hedged, and focused on balance‑sheet‑strong, policy‑robust names while trading around the Fed’s liquidity sugar high.

For Members, looking ahead to 2026:

-

The positive side is clear: Fed liquidity, AI and grid capex, industrial policy, and still‑functioning labor provide plenty of fuel for stock picking where balance sheets and cash flows are strong.

-

The worry list explains why staying 50%‑ish in cash, using option structures, and concentrating on high‑quality, policy‑robust names remains the right default—even if it means occasionally looking “too conservative” in the moment.

See, now I feel better!

Happy New Year,

— Phil, Maddie, Andy, Ilene and the Inhumans!