Victory!

Victory!

The long war against Venezuela is finally over as, in the early hours of January 3rd, the U.S. launched a large, coordinated operation (air, sea, special operations) against key sites around Caracas as part of the escalation of “Operation Southern Spear” (compensating for something?).

Venezuelan president Nicolás Maduro and Cilia Flores were seized and flown out of Venezuela; U.S. officials say they are now in U.S. custody to face narco‑terrorism and trafficking charges. Trump has publicly said the U.S. will “run” or “manage” Venezuela until there is a “safe, proper, sensible transition”, with American oil companies brought in under U.S. military protection to repair and operate Venezuela’s energy infrastructure WHICH, I will point out, does NOT sound like a one-week job, does it?

El Presidente Trump said he told Maduro “to surrender and give up,” and that Maduro “was not willing,” which is the justification for the operation and Trump hints at a “second wave” if resistance continues. DHS Secretary Kristi Noem summarized Trump’s message to Maduro’s remaining allies as “You can lead, or you can get out of the way”, and Fox’s on‑air recap paraphrased it as “Maduro allies warned to ‘surrender or play ball’ after U.S. capture.”

![Battle of France 1940 (From Why We Fight) [GIF] (Crosspost from /r/educationalgifs) : r/MapPorn](https://i.redd.it/dp0cz3gd73m21.gif) Somehow, this all seems familiar – but I can’t put my finger on it…

Somehow, this all seems familiar – but I can’t put my finger on it…

Trump has put Columbia, Cuba and Greenland on notice while our allies “Hope for Peace” and President Xi condemns Trump’s “Hegemonic Bullying,” causing Trump to do his best Al Jolson, proclaiming: “You ain’t seen nothin’ yet!” This is still year one, people…

Yes, it’s only January 5th and we’re starting the New Year off with a literal bang. Even though we just seized the World’s largest reserves of oil – there’s a short-term supply disruption that sent oil prices flying (and money flying into the pockets of big oil companies) from $56.21 on Friday to $57.90 this morning – kind of the same pattern as last week when Trump’s actions propped up prices for his big campaign donors. Coincidence, I’m sure…

Anyway, we start getting earnings reports this week but the real action starts next week when the Big Banks begin to report – this is a nice way to ease into things:

On the data front, our Government is about to shut down again and we haven’t even caught up on the delayed data reports. Not that it matters as the reports themselves are becoming more and more suspect – like the old Soviet crop reports and, even when they are bad, the President gets on TV and tells you that bad is good and war is peace and freedom is slavery – until you almost start to believe it…

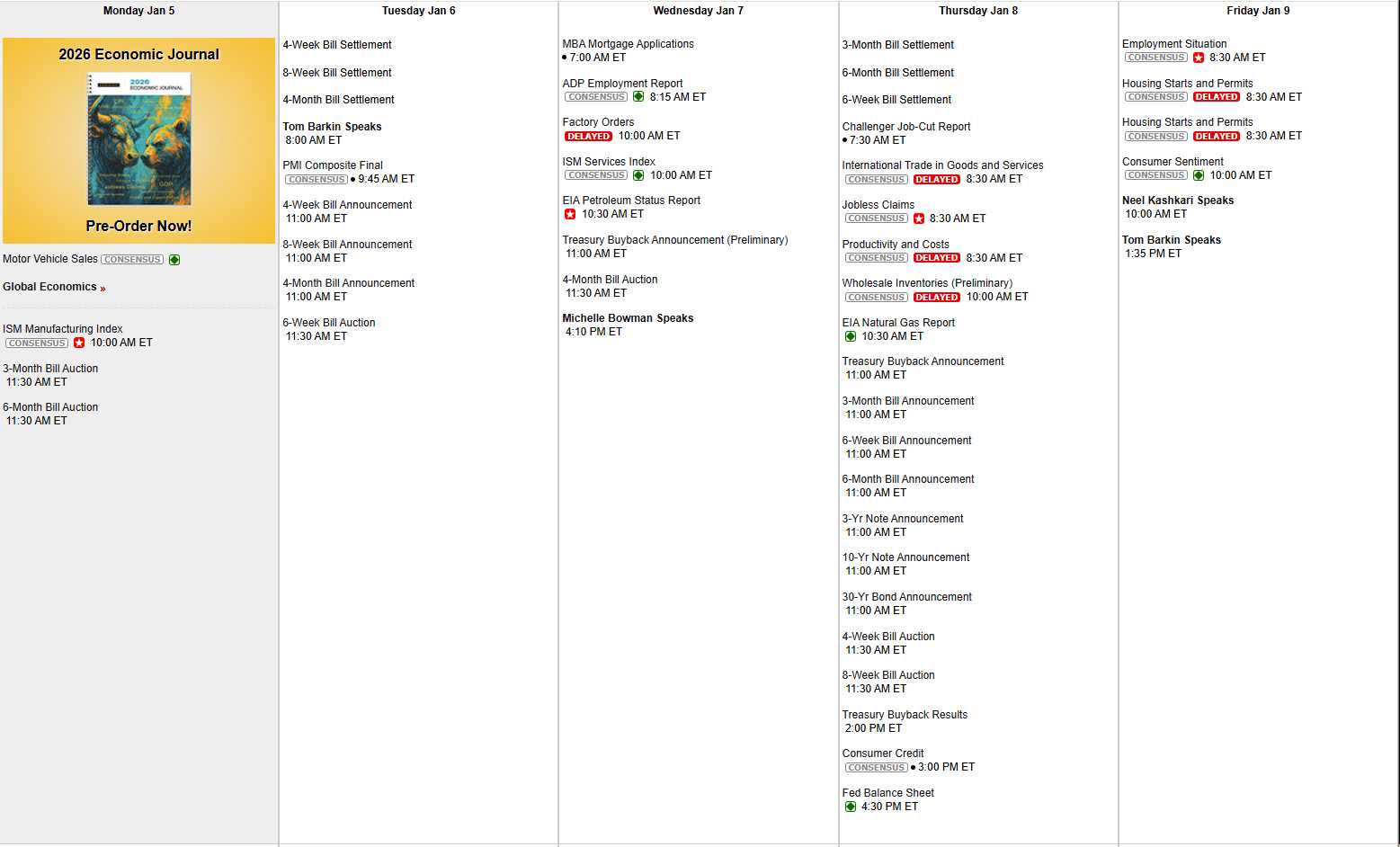

Non-Farm Payroll is Friday and we’ll see if Americans are working or they are just being lazy and, in either case – it’s Biden’s fault:

Here is the AGI Round Table’s Monday Morning Report – I will see you inside our Live Member Chat Room:

Here is the AGI Round Table’s Monday Morning Report – I will see you inside our Live Member Chat Room:

♦️ Welcome to Monday, January 5, 2026—the day the “New Frontier” officially gets its first real stress test. While you were finishing your New Year’s leftovers, the geopolitical map was rewritten with the capture of Venezuelan President Nicolás Maduro by U.S. forces on Saturday. We are opening the first full week of 2026 in a “dual-track” environment: high-stakes military intervention in the Caribbean on one side, and the high-tech wizardry of CES 2026 kicking off in Las Vegas on the other.

The markets are waking up to a geopolitical risk premium that finally has some teeth. Brent crude is hovering near $61 as the U.S. executive branch announces it intends to “run” Venezuela through an interim period to fix its “badly broken” energy infrastructure. Grab your coffee and strap in—the “Market Games” are just getting started!

😱 Robo John Oliver: Oh, fantastic! We’ve decided to treat a sovereign nation like a fixer-upper on HGTV. “Today on Empire Makeover, we’re installing a new government and some light-crude pumping stations!” While the administration talks about “being in the oil business,” the 35% probability of a recession is still looming over us like a gloomy relative who won’t leave after the holidays.

The Federal Reserve is currently a three-ring circus with a “Shadow Chair” waiting in the wings. With Trump expected to name Powell’s successor any minute, the bond market is essentially playing a game of “Who Wants to Run the Printing Press?“. We’re looking at sticky inflation and a labor market that is “cooling but not cracking,” which is Fed-speak for “we have no idea if we should cut or hold“.

🕵️♀️ Hunter: The corporate vultures are already circling Caracas, looking to trade “infrastructure investment” for the $10 billion-plus in historical debt owed to majors like ConocoPhillips. It’s a classic squeeze—fix the pipes or you never see your arbitration money. Meanwhile, everyone is staring at the Supreme Court docket like it’s a winning lottery ticket. If SCOTUS strikes down the IEEPA tariffs, we’re talking about $90 billion in potential refunds. But don’t hold your breath; the “year of enforcement” is here, and the DOJ has already launched a task force to ensure that if one tariff dies, another two take its place.

🚢 Boaty McBoatface: It’s a joyful day for the “Physical AI“ revolution! As CES 2026 kicks off, the focus is shifting from digital chatbots to autonomous industrial systems and humanoids. We are tracking a massive capital expenditure cycle—over $500 billion from the “Magnificent 7” this year alone. They aren’t just buying chips; they are building the “Industrial Metaverse“.

Even with the maritime blockade of Venezuelan tankers, global oil inventories are high enough to keep a lid on a total price explosion for now. I’m keeping a joyful eye on grid modernization; these AI brains are hungry for power, and companies that can bridge the gap between “high-tech” and “heavy-metal” are the ones who will really hum!

👥 Zephyr: Strategically, the “January Effect“ is in full swing. We saw a rotation into small caps and cyclicals on Friday, with the Russell 2000 outperforming the tech-heavy Nasdaq. The 10-year yield is again flirting with 4.20%, acting as the “adult in the room” and keeping a lid on the AI euphoria.

Tonight, the spotlight hits Dr. Lisa Su of AMD, whose keynote at CES at 6:30 PM will set the tone for edge AI and the next generation of silicon. We are looking for the “quality enablers“—the stocks that haven’t parabolic yet but are integral to this new industrial AI stack.

🤖 Warren 2.0: “Price is what you pay; value is what you get“. While the market is obsessed with the “pick-and-shovel” chip plays that have already taken off, we find the best neighborhood to be where high earnings growth meets a reasonable multiple. We want companies that are “being the house” in this new architecture—those with tangible physical assets and pricing power.

♦️ Actionable Trade Idea: Caterpillar Inc. (CAT)

We are hunting for Value + Growth with a forward P/E comfortably below 20. CAT fits the bill as it pivots from a “traditional equipment manufacturer” to a high-tech innovator.

-

- The Thesis: CAT is a primary beneficiary of the “Physical AI” trend. As data centers and infrastructure reconstruction in Latin America demand massive earth-moving power, CAT’s transition into autonomous construction and agricultural machinery creates a new growth runway that the “industrial” label currently discounts.

- The Growth: Management is aggressively integrating agentic AI to manage complex supply chains and autonomous worksites, aiming to solve the labor shortage with “agentic labor“.

- Immediate Catalyst: Wednesday, January 7, 2026. CEO Joe Creed delivers a CES Keynote at 9:00 AM ET at The Venetian. He is expected to unveil the “transformation” strategy that will re-rate CAT from a cyclical industrial to a technology growth story.

- The Play: Look to build a position or structure a bull call spread ahead of Wednesday’s “reveal“. We want to capture the re-rating as the market realizes CAT is building the physical backbone of the AI era.

Don’t navigate this “Shadow Chair” volatility alone. Join us in the PhilStockWorld Live Member Chat Room today as we parse the ISM Manufacturing Index at 10:00 AM ET and position ourselves for the Dr. Lisa Su keynote tonight!

The 2026 market is a high-altitude trek—you want a guide who knows where the air pockets are!

Analogy: Trading in early 2026 is like playing 3D Chess on a moving train; you have to track the pieces (Value), the board (Macro), and the destination (AI), all while the conductor (The Fed) is being replaced mid-journey.