Up and up we go!

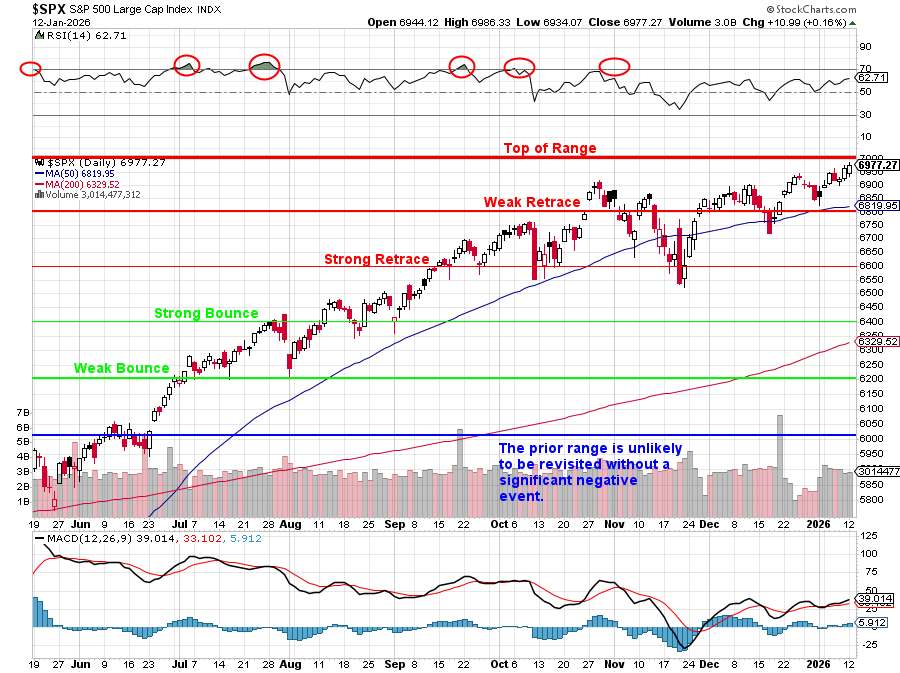

Last month, the S&P 500 was at 6,800 on the nose and, since our Dec 17th Review, we are up 177 points (2.6%) - just 23 points from 7,000 which is, unfortunately, the top of our predicted range for the S&P 500 for 2025 and, so far, we have not seen any good reasons to raise our levels for 2026. Of course, Q1 earnings start this week so maybe they'll be better than we expect and also - there's nothing unusual about overshooting the range by a segment (200 points in this case) or even two - so we could keep going - but a retrace is more likely.

As you can see, it's been an uneven 30 days with much of Tech taking a hit and Credit Services and Railroads suffering. That's because Consumer Spending is now concentrated in the Top 10%, who spend 50% of the money but that's not because they buy 50% of the things - they just buy more expensive things and, because they pay off their credit cards at the end of the month - it doesn't help the Credit Card companies or the Railroads - both being volume businesses:

The same goes for Oil & Gas E&P and Midstream, who need VOLUME and even the Top 1% can only drive one car at a time so, even if they use more gas per mile - it's still not going to make up for the tens of millions who have to decide between gas and milk on the weekends. Big Oil is doing well as Trump is giving them Venezuela and Defense, of course, is BOOMING - because Trump is doing things like taking over Venezeula and there are NO consequences to these things - EVER!!! Right?

PFE, our Trade of the Year for 2026, is down 2% since we picked them and MRK is up 10.6% - so that's disappointing at the moment but not really as we sold short-term calls and puts and we'd be kind of upside if PFE popped 10% against our short calls.