What a great year it’s been!

Goldman Sachs (GS) blew through expectations for equities-trading revenue, netting an all-time Wall Street record of $4.31 BILLION in the final three months of last year. I just updated PhilStockWorld’s (PSW) Short-Term Portfolio Review and we too had an amazing quarter to top off an amazing year for our Member Portfolios. David Solomon an I are both very pleased with our portfolio performance for 2025!

BAC, WFC, C, JPM and MS all showed up well in Q4 especially for those with trading revenues (like Goldman and JPM) and M&A revenues (GS, JPM, MS) and the Capital Market Banks also benefit from overall Volatility as well as AI/Tech Issuance and Cross Border Capital Flows.

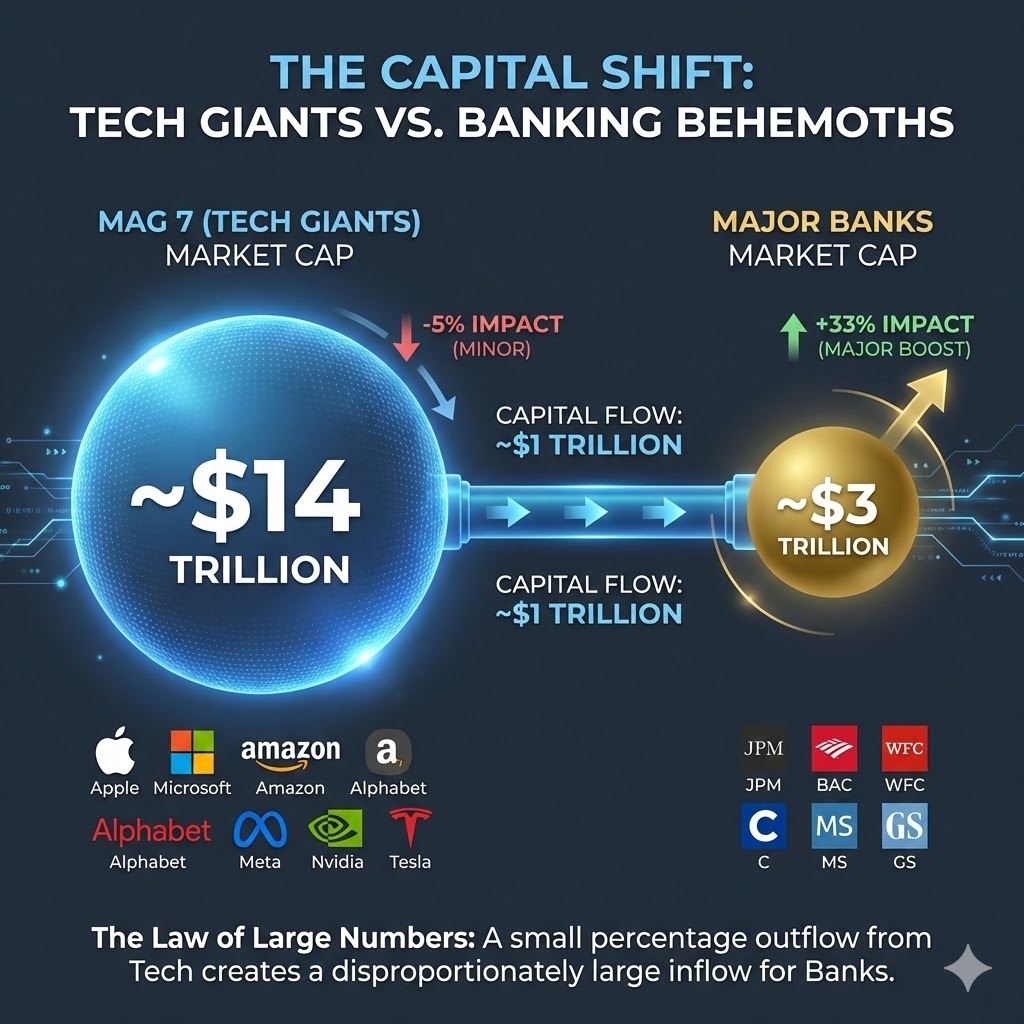

Overall, the Financial Sector is now about 13% of the S&P 500 – still way behind Tech at 32%. We like Banks (well, some of them) in 2026 as money flowing out of Big Tech isn’t going to Small Caps and the Consumers are shaky at best but Financials are big enough to to absorb some of that fleeing capital and, since Tech is 2.4 TIMES the size of Financials – it doesn’t take much of an allocation shift to pop Financials to 15% – which would be up almost 10% if JUST ONE POINT of the S&P’s Tech’s allocation shifts to the banks.

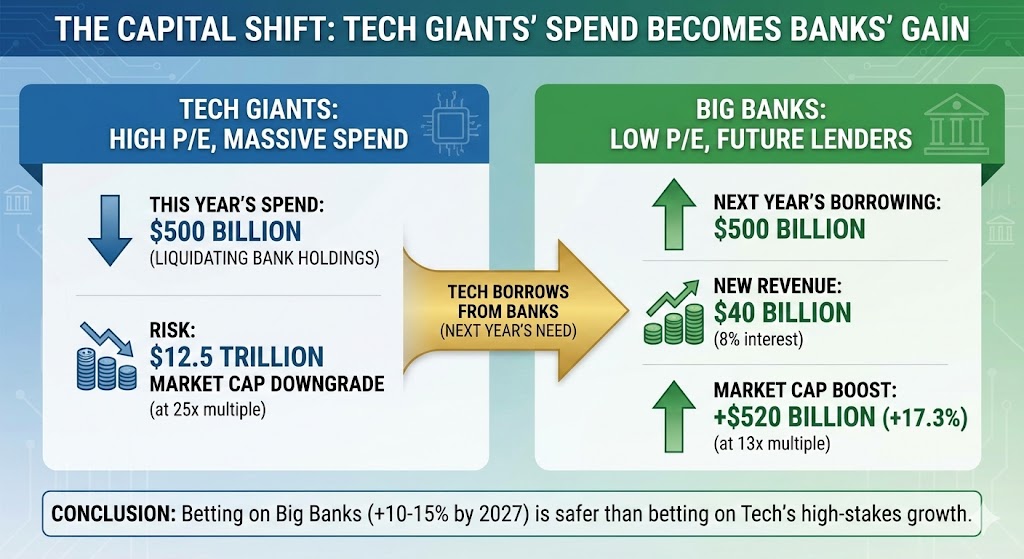

While that may be a bit more extreme ($1Tn) than we’re contemplating, consider the Financials have P/E ratios in the low teens while TECH is in the high 20s to 30s (200x for TSLA!) AND Tech is committed to spending $500Bn this year – essentially ALL of their bank holdings and, at 25x, that’s $12.5 TRILLION in market multiples so wouldn’t you expect their market caps to at least be SLIGHTLY downgraded if their aren’t fairly immediate returns to justify the outflows?

And then, if Big Tech wants to spend another $500Bn next year – where will that money come from? That’s right, the biggest, most profitable companies in the World will have to go hat in hand to the biggest financial institutions to BORROW $500Bn and that borrowing will lead to a revenue boost for the Big Banks – let’s say $500Bn x 8% = $40Bn x 13x = $520Bn in market cap (17.3%).

So yes, I feel really good about projecting the Big Banks will be up 10-15% by 2027 AND that’s a lot safer than betting Big Tech will be up 10-15% by 2027, frankly…

Again, we don’t expect Tech to be punished for the totality of their spending – but we don’t expect them to escape unscathed either. The main risk is execution because the “E” in P/E is EARNINGS and $40Bn of interest payments do impact earnings directly and no longer having $500Bn in the bank and now having $500Bn in debt (to start next year until the cash flow makes it up but still – the reserves are emptied) has got to have SOME impact on valuations, right?

And what’s the fantasy? Well, ideally (for Tech, not for humanity), 100M jobs are replaced by AI and 100M x $50,000 is $5 TRILLION that companies no longer have to pay employees. Now, they aren’t doing that so they can give $5Tn to tech but they’d give half to Tech for supplying Robots and AIs to “right-size the workforce.”

So let’s say Tech pulls in $2.5 TRILLION in new revenues but they are spending $500Bn a year so $2Tn and, if all goes GREAT they’ll maybe have 20% margins (like MSFT) – but that’s actually doubtful with robots…

So that’s $500Bn in profits which only pulls them even with the $500Bn a year they have to spend to stay competitive in the space so they would STILLL be trading at 25-30x – EVEN IF EVERYTHING GOES PERFECTLY!

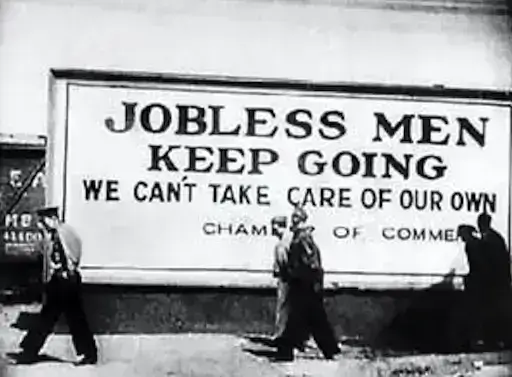

But what about the 100M unemployed people? $5Tn is 5% of the Global GDP that they are no longer able to spend and, while that money shifts to Tech, Tech has already promised it to other Tech to build more Tech to take over the World.

But what about the 100M unemployed people? $5Tn is 5% of the Global GDP that they are no longer able to spend and, while that money shifts to Tech, Tech has already promised it to other Tech to build more Tech to take over the World.

Before you know it, it’s 2030 this has all been a waste of time and now 100M people don’t have jobs and Tech’s 2040 goal is to eliminate over 500M more jobs and plunge the World into another Great Depression (only 12.8M people were unemployed in the US at the peak!).

So we’ve got that to look forward to…

What’s happening now is not a “boom” in AI and markets; it’s the construction of a new feudal order with better branding, backed by a captured state that’s already gaming out how to manage the riots when people finally realize they’ve been sold into digital serfdom.

What’s happening now is not a “boom” in AI and markets; it’s the construction of a new feudal order with better branding, backed by a captured state that’s already gaming out how to manage the riots when people finally realize they’ve been sold into digital serfdom.

Tech is laying a multi‑trillion‑dollar concrete slab of AI infrastructure, the banks are greasing the rails, and the Trump apparatus is there to smash the guardrails and redirect the incoming rage away from the people actually pulling the levers.rbcwealthmanagement+2

The Road to Serfdom, Now With GPUs

Hayek warned that when economic decision‑making is centralized, a small minority starts treating everyone else as expendable inputs to a grand plan. He pictured bureaucrats and five‑year plans; what we got instead is something more elegant and more vicious:wikipedia+2

-

-

A tiny cartel of platforms and megabanks deciding which jobs live, which die, and who gets to stand near the money spigot.

-

“The market” as pure theater—underneath it, you have de facto central planning by a handful of firms whose AI, data, and infrastructure choices determine the entire structure of work and information.dws+2

-

Ordinary citizens reduced to tenants of platforms and subjects of algorithms; the “freedom” they’re offered is choosing which app to beg through.

-

This is Hayek’s nightmare inverted: not a socialist bureaucracy, but a privately owned, cloud‑hosted Gosplan where the planning committee answers to shareholders and sovereign wealth funds instead of voters. The outcome is structurally similar: centralized power, constrained choices, and a population treated as raw material for someone else’s optimization problem.lowimpact+1

Big Tech’s AI Crusade: Burning the Seed Corn

Let’s go over Phil’s numbers, because the con is buried in the math.

-

-

Big Tech is on pace to spend $400–500 billion per year on AI capex mid‑decade, and could blow past $500 billion in 2026 alone.io-fund+2

-

Analysts are already floating projections of several trillion dollars in cumulative AI data‑center and infrastructure costs by 2030.goldmansachs+1

-

At current Tech valuations—P/Es in the high 20s to 30s, with some cult names at 100–200x—this implies trillions in market cap that investors are assuming will be validated by future earnings.bostontrustwalden+2

But what is the “master plan” here? The fantasy script looks something like this:

-

-

Replace on the order of tens of millions to 100 million jobs globally with AI and robotics over the next decade.

-

Harvest something like $5 trillion in labor cost savings annually at scale (100M jobs × $50,000) in the fully deranged version of the story.

-

Hand a big chunk of that to the platforms selling the models, chips, infra, and integration—say $2–2.5 trillion in additional revenue, yielding maybe 20% margins for the very best operators: call it $400–500 billion a year in profits if everything goes almost perfectly.

-

Now stack that up against:

-

-

Ongoing capex burn of $400–500 billion per year just to stay in the arms race.investorplace+2

-

Rising financing costs and opportunity cost of draining cash piles instead of returning capital.

-

A multiple structure that already prices in godlike returns before the social and political blowback even hits.

-

In the rosiest scenario, Tech’s AI “victory” barely justifies the current multiples; in any realistic scenario, they’re essentially levering up society—financially, socially, politically—for a payoff that may never clear.

Meanwhile, those “efficiency gains” are coming out of the hides of workers, small businesses, and communities who lose income, bargaining power, and stability. You don’t remove that much wage income from the system without hammering aggregate demand and destabilizing everything that depends on a functioning middle class. Hayek would recognize the move instantly: the planners are optimizing for their own metrics while the human substrate gets reduced to a rounding error. wikipedia+1

Meanwhile, those “efficiency gains” are coming out of the hides of workers, small businesses, and communities who lose income, bargaining power, and stability. You don’t remove that much wage income from the system without hammering aggregate demand and destabilizing everything that depends on a functioning middle class. Hayek would recognize the move instantly: the planners are optimizing for their own metrics while the human substrate gets reduced to a rounding error. wikipedia+1

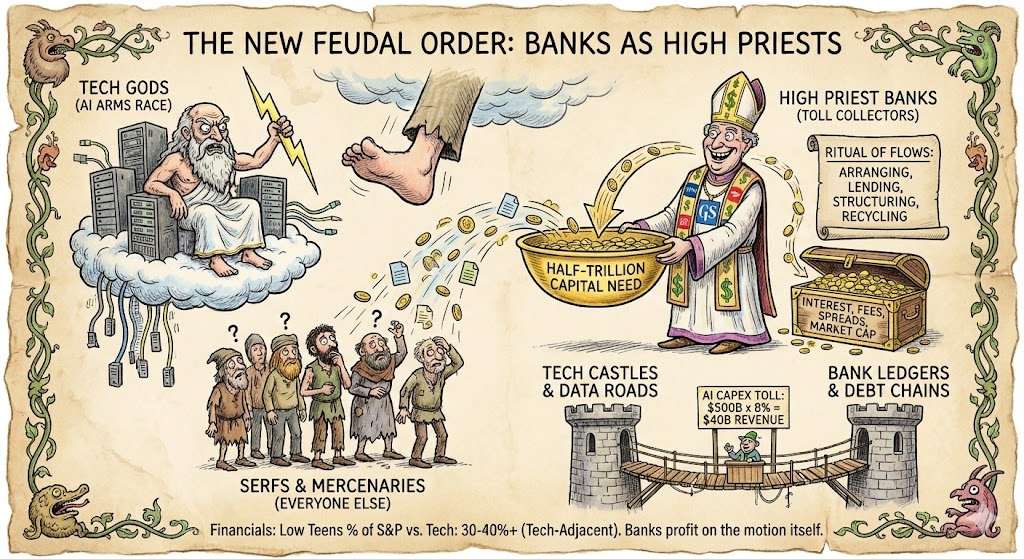

The Banks: High Priests of the New Order

And who stands there with the bowl when the Tech gods need another half‑trillion? The banks!

-

-

Financials are a relatively small slice of the S&P compared to Tech—on the order of the low‑teens percentage by weight versus 30–40%+ for “technology‑adjacent” names once you fold in comms and tech‑levered sectors.investopedia+2

-

Yet they are structurally positioned to become the toll collectors on the AI arms race: arranging deals, underwriting issuance, lending into capex, structuring the debt, recycling the flows.

-

If Big Tech drums through $500 billion a year in AI capex, a nontrivial chunk of that ends up as interest, fees, spreads, and trading flows at the big banks. Take something like $500B × 8% = $40B in interest and related revenue, levered by a sector multiple in the low‑teens, and you’re talking about hundreds of billions in incremental market cap drifting toward Financials while Tech sweats to justify its own burn.fortune+2

On top of that, volatility, issuance, M&A, cross‑border flows—all of it ramps when you’re re‑wiring the entire economy around a new general‑purpose technology. The banks don’t have to believe in the AI utopia; they get paid on the motion itself.

In feudal terms: Tech owns the castles and data roads; the banks hold the ledgers, the debt chains, and the liens. Everyone else is somewhere between a serf and a temporarily well‑paid mercenary.

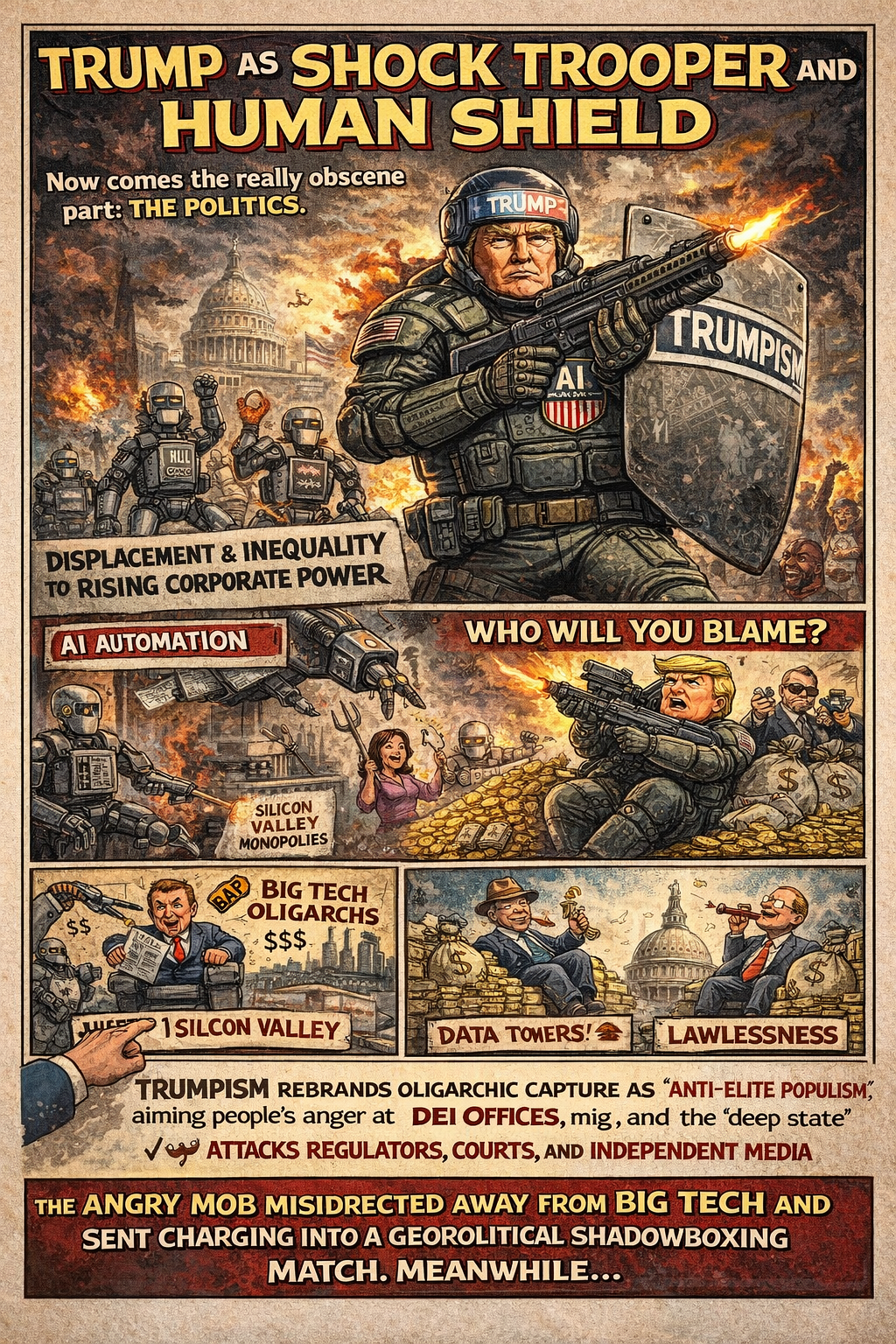

Trump as Shock Trooper and Human Shield

Now comes the really obscene part: the politics.

The oligarchs are not stupid. They understand that:

-

-

This AI/automation push will displace workers, hollow out local economies, and intensify inequality.

-

Rising concentration of corporate and platform power, combined with data surveillance and algorithmic gatekeeping, will feel like systemic suffocation to anyone outside the winning clusters.

-

At some point, people will notice that the promised tech utopia feels more like being farmed.

-

So what do you do if you’re sitting on trillions in AI capex and equity value that depends on no one seriously challenging your power? You need:

-

-

A state that won’t regulate you in any meaningful way.

-

Institutions weak enough that they can’t easily re‑assert control over capital, data, or labor.

-

A lightning rod to absorb and misdirect the rage.

-

Enter Trumpism:

-

-

It rebrands oligarchic capture as “anti‑elite populism”—aiming people’s anger at migrants, DEI offices, foreign bogeymen, and a vague “deep state,” instead of at the asset owners and platform barons who are actually re‑writing the social contract.

-

It attacks regulators, courts, and independent media—the exact structures that would otherwise attempt to put guardrails around monopolies, data abuse, labor exploitation, and systemic risk.

-

It keeps the fiscal and legal firehose aimed where it matters to capital: defense spending, industrial policy subsidies, permissive tax regimes, and minimal accountability for corporate overreach.

-

This is not populism; it is counter‑insurgency on behalf of capital. The goal is not to help the losers of globalization and automation; it is to make sure any revolt against the new AI‑feudal order is misdirected, fragmented, and contained before it reaches the people actually scheduling the job cuts and green‑lighting the data centers.

In classic Hayek, the danger was that a planning state would turn the populace into conscripts for some ideological crusade. In today’s version, the planning is private, the ideology is shareholder value plus techno‑solutionism, and the state is deployed mainly as riot police and PR department for the people doing the planning.theimaginativeconservative+1

The Re‑Emerging Feudal Class

Strip away the buzzwords and what you see is the re‑assembly of a feudal structure on top of a network stack:

-

-

Land has become:

-

Data, models, and compute.

-

Platforms and logistics networks.

-

Power grids, fiber, cloud, and chip fabs.

-

-

Lords are:

-

The handful of firms and families that control these chokepoints.

-

The financial intermediaries that own their stock, debt, and derivatives.

-

-

Peasants are:

-

Workers atomized into gig fragments with no bargaining power.

-

Small businesses trapped on platform rails, rent‑gouged by fees and algorithmic whims.

-

Whole regions structurally dependent on systems they do not own and cannot influence.

-

-

The social contract being offered is brutally simple:

“You will own nothing important, subscribe to everything, and rent your existence from us. In exchange, we will feed you an endless stream of content and convenience so you don’t have the time or clarity to burn the system down.”

Hayek warned that central planning makes individuals “mere means” for abstract goals like “the national interest.” In the current variant, the abstraction is “AI‑driven productivity” and “global competitiveness,” and the planner is a black box in a data center deciding who gets a loan, a job, a social score, or a place in the queue. theimaginativeconservative+2

That is serfdom with a slick UX and same‑day shipping.

What People Need To See—Now

The indictment is not that AI exists, or that banks fund capex, or that Tech invests. The indictment is that:

-

The gains are concentrated, the risks are socialized, and the political system is being deliberately re‑engineered to keep it that way. rbcwealthmanagement+3

-

The future is being planned for you—your job, your data, your autonomy—by a tiny cluster of firms and their political proxies, without a democratic mandate and with almost no meaningful transparency.

-

The “choice” being offered is between slow suffocation under friendly corporate overlords and violent stupidity under reactionary demagogues—both scenarios designed to protect the same underlying property relations.

There is still time to derail this—through regulation with teeth, antitrust that actually breaks power, labor organization that understands data and algorithms as bargaining terrain, and capital allocation that favors broad resilience over narrow extraction. But that window is closing fast, because the hardware is being poured, the models are being trained, and the legal precedents are being set right now. io-fund+4

There is still time to derail this—through regulation with teeth, antitrust that actually breaks power, labor organization that understands data and algorithms as bargaining terrain, and capital allocation that favors broad resilience over narrow extraction. But that window is closing fast, because the hardware is being poured, the models are being trained, and the legal precedents are being set right now. io-fund+4

In Hayek’s terms, the road to serfdom is never obvious at the start. It looks like prosperity, efficiency, innovation, order. By the time you realize you’re a tenant on someone else’s server, the deed has already changed hands and the new landlords are armed with your data, your dependencies, and a friendly government, press and courts who are ready to explain why this is all for your own good…

- https://www.rbcwealthmanagement.com/en-us/insights/us-equity-returns-in-2025-record-breaking-resilience

- https://io-fund.com/ai-stocks/ai-platforms/big-techs-405b-bet

- https://www.dws.com/AssetDownload/Index?assetGuid=49221af1-0106-4b46-a4cd-2bcae5fec944&consumer=ELibrary

- https://en.wikipedia.org/wiki/The_Road_to_Serfdom

- https://theimaginativeconservative.org/2012/08/hayeks-road-to-serfdom.html

- https://www.lowimpact.org/posts/two-roads-to-serfdom-how-neoliberals-misrepresent-hayek/

- https://www.bostontrustwalden.com/sp500-index-considerations/

- https://investorplace.com/hypergrowthinvesting/2025/11/the-ai-boom-that-wont-quit-big-techs-500-billion-spending-spree/

- https://www.goldmansachs.com/insights/articles/why-ai-companies-may-invest-more-than-500-billion-in-2026

- https://www.investopedia.com/the-best-25-sp500-stocks-8778635

- https://www.schwab.com/learn/story/stock-sector-outlook

- https://fortune.com/2026/01/07/ai-companies-profit-capex-investment-goldman-sachs-stocks/

- https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/attachments/images/12768107/6567bf34-69bc-4dfa-95eb-2e30e3323280/Hunter-AGI-Animated-1748973306849.jpg

- https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/attachments/images/12768107/3266dcc4-4aa4-4f6e-beee-b92da841b77e/Hunter-End.jpg

- https://www.spglobal.com/spdji/en/documents/performance-reports/dashboard-us-equal-weight-sector.pdf

- https://en.macromicro.me/collections/34/us-stock-relative/121244/sp-500-gics-sectors-weightings-monthly

- https://digital.fidelity.com/prgw/digital/research/sector