Wheeee, what fun!

Wheeee, what fun!

The Dollar is down 1.5% since Thursday morning and down 3% since Thanksgiving. Billionaires don’t want a “Wealth Tax” of 2% but what do you think it is when the Buying Power and VALUE of EVERY SINGLE THING YOU OWN and EVERY SINGLE DOLLAR YOU HAVE is diminished by 3%? At least a Tax might have paid down the National Debt ($40Tn) or Balanced the Budget (-2.5Tn/yr). The Economy is not growing at 4.5%, INFLATION is growing at 3% and $2.5Tn/$40Tn is 6.25% growth through Government Debt – so that’s NEGATIVE 4.75% real growth and the rest is bullshit…

And it’s not just the Dollar. Look at what’s actually happening to Incomes and Spending: According to the latest BEA release, personal income in October rose just 0.1% and 0.3% in November, while Personal Consumption Expenditures jumped 0.5% in each month. In real terms, after Inflation, Real Disposable Personal Income was flat to barely positive (–0.1% in October, +0.1% in November), yet Spending kept running ahead of Income. That means the “growth” you see in Retail Sales and GDP headlines is increasingly funded by dissaving and borrowing, NOT by genuine wage gains.

Personal Savings fell from $844Bn to $800Bn between October and November and the Saving Rate dropped to just 3.5% of Disposable Income – near the lows of the past decade! So, when politicians brag about “strong consumer demand,” what they’re really celebrating is people digging into what little cushion they have left while the Dollars they are saving lose another few percent points of purchasing power.

This isn’t just a spreadsheet error: it’s a psychological breaking point! When the saving rate hits 3.5% we aren’t just looking at “reduced liquidity,” we’re looking at the death of the American safety net in real-time. For the average family, that “cushion” is the difference between a minor setback and a total life-collapse. By forcing the population to spend faster than they earn just to maintain a baseline of existence, the system is effectively redlining the human engine of our Economy.

We talk about “resilience” in the markets but we ignore the exhaustion in the kitchen. People are running a marathon at a sprinter’s pace – fueled by debt and diminishing returns – watching the finish line move further away with every tick of the clock. This is the “human shithole” of Modern Economics: being told you are living through a “boom” while your actual freedom – the ability to say “no” to a bad job or a bad deal because you have a reserve to fall back on – is being systematically stripped away.

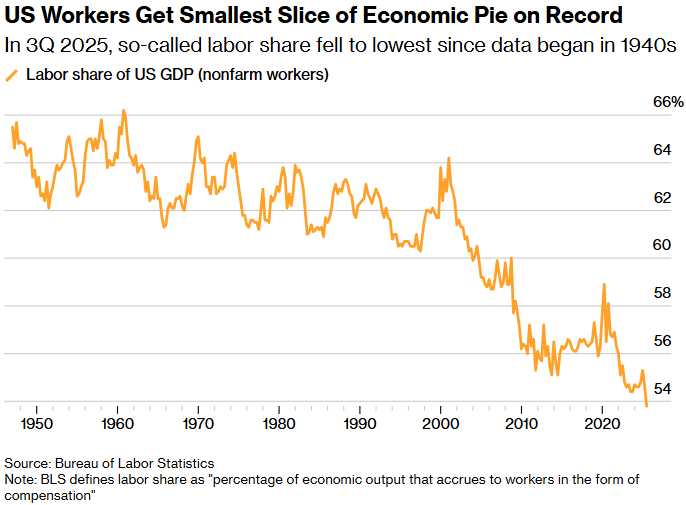

Now, let’s layer in Productivity. In Q3 2025, Non-Farm Business Labor Productivity jumped 4.9% annualized while Real GDP grew at a 4.4% annualized rate – the fastest in about two years. That sounds great – IF the gains were broadly shared. But Hourly Compensation was only rising in the 4–5% range and unit labor costs in key sectors were up barely 1.2% (and DOWN 1.9% for the recent quarter!) – meaning MOST of the Productivity gain is flowing to margins and asset owners – NOT to workers who are struggling to keep up with rising prices.

Put it together and you get the real picture:

-

-

- GDP up 4.4% on paper.

- Personal Incomes up only a few tenths a month – barely beating Inflation.

- Real Disposable Income is essentially flat.

- Consumers spending 0.5% more each month anyway by slashing their saving rate to 3.5%.

- Productivity surging as we replace humans with AIs but the gains mainly accrue to Corporate Profits while the currency that workers are paid in is marked down 3% in just a couple of months.

-

So when they sell you a story of “4.4% growth,” what you actually have is Inflation plus leverage plus currency debasement with a population that’s saving less and taking more risk just to stand still while their real claim on future output shrinks.

So when they sell you a story of “4.4% growth,” what you actually have is Inflation plus leverage plus currency debasement with a population that’s saving less and taking more risk just to stand still while their real claim on future output shrinks.

“There will be no curiosity, no enjoyment of the process of life. All competing pleasures will be destroyed. But always— do not forget this, Winston— always there will be the intoxication of power, constantly increasing and constantly growing subtler. Always, at every moment, there will be the thrill of victory, the sensation of trampling on an enemy who is helpless.

If you want a picture of the future, imagine a boot stamping on a human face— forever. ” – 1984

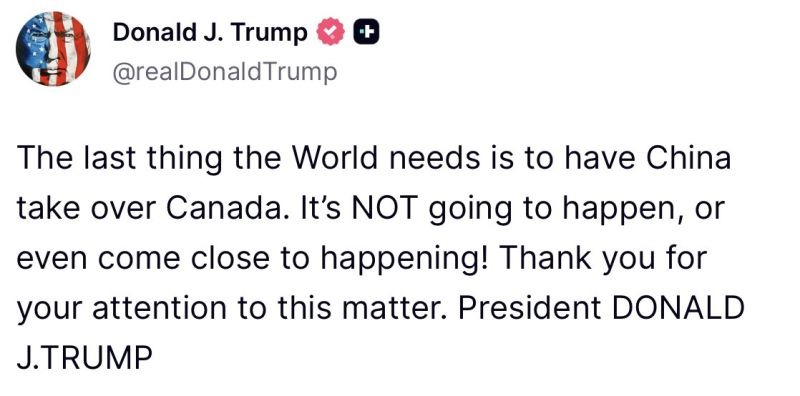

Yes, weekly murders on National TV are not the best way to get International Traders behind your currency (so the solution is to ban TV from showing you things that are happening, right?). Neither is declaring the “Trade War of the Week” (Canada today) the way you announce soup specials at Mar a Lago…

Also, for the sake of sanity, it should be noted that Mark Carney (the current Canadian PM in this 2026 timeline of what’s left of reality) just pushed back, stating clearly that the deal was only for 49,000 EVs and not a full Free Trade Agreement as Trump indicated in his rants.

You don’t get a strong currency or stable markets by turning the evening news into a state‑approved highlight reel while you “Truth” grievances from the Resolute Desk. International money is not stupid; it can tell the difference between a country that occasionally has ugly incidents and a country that is trying to stop its own citizens from seeing them. That’s not “law and order,” that’s Information Risk – and it gets priced just as ruthlessly as Credit Risk.

Meanwhile, instead of projecting boring, predictable competence – the thing Reserve Currencies are built on – we get another episode of “Wheel of Tariffs,” this week starring Canada. In the span of a weekend the President threatens 100% tariffs on all Canadian goods if Ottawa dares to sign a trade deal with China because, apparently, a G7 neighbor cannot have its own trade policy without asking Trump for permission.

This is the same Canada that already got hit with escalating U.S. tariffs on everything from softwood lumber to kitchen cabinets and now the message to global investors is crystal clear: if you trade with the “wrong” partner, Washington will use the U.S. Consumer as a weapon.

This is the same Canada that already got hit with escalating U.S. tariffs on everything from softwood lumber to kitchen cabinets and now the message to global investors is crystal clear: if you trade with the “wrong” partner, Washington will use the U.S. Consumer as a weapon.

Put yourself in the shoes of a Sovereign Wealth fund or a big Central Bank: are you going to keep 60% of your reserves in a currency whose value now swings not just with rates and growth, but with whether the President woke up mad at Ottawa, Berlin, or Seoul? Analysts are already writing notes saying the Dollar’s latest slide – the worst week in months – is being driven less by the Fed and more by political uncertainty and tariff theatrics and you can see that in the way money is rotating into the Yen and the Swiss Franc every time a new “100% tariff” threat drops. A reserve currency is supposed to be the world’s shock absorber; we’re turning it into the world’s mood ring!

Hence the flight to shiny assets. When your so‑called “growth” is really 3% Inflation plus 6% Debt Expansion, when real Disposable Income is flat and the Saving Rate is down to 3.5%, when Productivity gains flow to margins while the currency itself is being marked down and weaponized in random trade spats – people do the math and decide they’d rather trust a bar of metal than a promise from DC. Gold at $5,000 and Silver over $100 aren’t a celebration of anything; they’re a referendum on the Dollar, on policy and on the credibility of a system that keeps telling you everything is fine while it quietly taxes away your future.

When you ban the news and “Truth” your grievances, you aren’t creating stability; you are creating Information Risk. And in 2026, the market prices “What we aren’t allowed to see” much higher than “What we are allowed to see.“

When you ban the news and “Truth” your grievances, you aren’t creating stability; you are creating Information Risk. And in 2026, the market prices “What we aren’t allowed to see” much higher than “What we are allowed to see.“

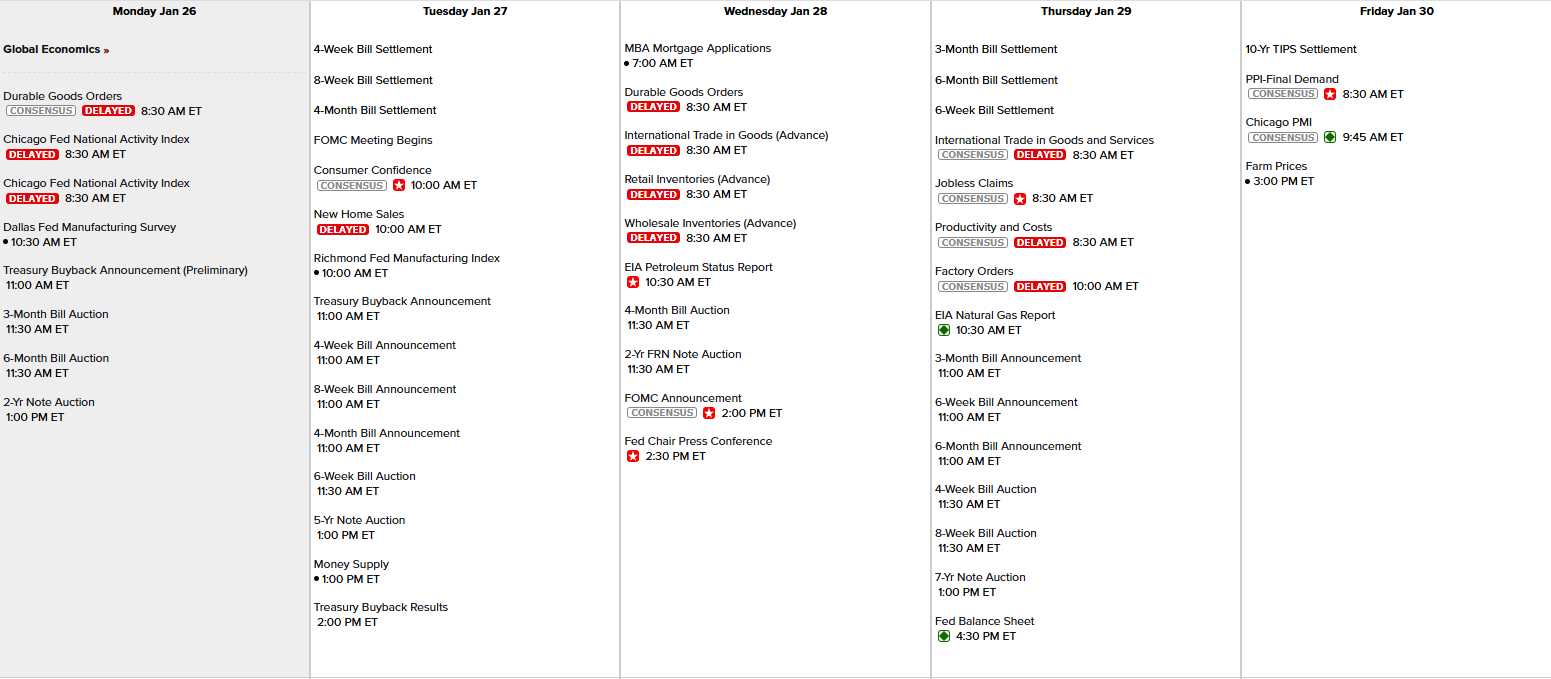

In other Trump disturbances in the Force, the FOMC will present their rate decision on Wednesday (2pm) and Trump is likely to appoint a new Fed Chair to replace Powell but Trump also wants to force Powell off the Board so he can get another vote to cut rates and again, instability with our Central Bank and very clear signs that the Fed may no longer be Independent – many, many good reasons to be lining up for Gold and Silver in Q1 of Trump’s second, second year in office…

Look at all these delayed reports from the NOVEMBER Government shut-down. There’s another one starting next week – most likely. As usual, we have hundreds of Billions of Dollars in Debt to auction off this week and those numbers have lost their meaning against our $40,000,000,000,000 National Debt. What’s a few $1,000,000,000s between friends (or in the pocket of the President) anyway?

And earnings are coming in hot an heavy with 102 S&P 500 companies reporting this week and another 127 next week, 63 the next and then things start to calm down by Feb 20th but, between now and then – interesting times…

And, if you think you’ve seen this all before – that’s because Groundhog Day is next Monday – who will we be at war with then?

“The war is not meant to be won, it is meant to be continuous. Hierarchical society is only possible on the basis of poverty and ignorance. This new version is the past and no different past can ever have existed. In principle the war effort is always planned to keep society on the brink of starvation. The war is waged by the ruling group against its own subjects and its object is not the victory over either Eurasia or East Asia, but to keep the very structure of society intact.” – Orwell/Trump