I’m having a fun morning!

I’m having a fun morning!

I woke up at 4 am, sensing a disturbance in the force and, lo and behold – Silver had dropped to $95.12 overnight. Gold hit $4,972 – $550 (10%) off yesterday’s high and Copper… who the F cares? It’s already over (6:51) with Gold back at $5,123 and Silver at $101.40 with Copper at $6.06 but what was FUN was reading all the articles and tweets and posts of all the “experts” with all their theories about what was happening and why it was bound to happen and why it will get worse etc, etc – and then it reversed and they were all wrong and they had new theories and excuses and, in a few hours – they will have even more!

Never has so much been said by so many who know so little. This is all part of that E-shittification we’ve been talking about as idiocy is enabled by AI which is them propagated instantly around the World as fast as any newswire can disseminate and MUCH faster than any editor can verify – so the bullshit outnumbers the facts by 100 to 1.

You know this is happening, you see it in your “news” feeds, it’s ALL there is on social media. You can’t even trust a restaurant review anymore! What is the truth in 2026? If you don’t like what you are hearing, just change the channel (yes, I’m old!) and you can pick the truth you want to hear. Not even photos or videos can be believed anymore – NOT EVEN THE PRESIDENT!

Not even Bruce Springsteen???

Trump called Springsteen a “dried out prune of a rocker” in response and, of course, the Administration claims the video has been altered and edited, just as there are now “AI-enhanced” images and videos of the shootings of Alex Pretti and Renee Good but does enhanced mean altered or clarified? Depends on which channel you watch, right?

Which channel you watch also then depends on whether Good and Pretti were victims of police brutality or “Domestic Terrorists” (probably funded by George Soros!), etcetera, etcetera, etcetera…

And why would you think Financial News is any different? As Jim Cramer will tell you, there are rich and powerful people who, at various times, will do whatever it takes to get you to buy stocks or sell stocks – and that goes for Oil, Gold, Silver, Copper, Bitcoin… as well. There are only 21M Bitcoins in the ENTIRE WORLD so, in order for someone to buy 100,000 for $9Bn – they have to convince current holders to sell 100,000 Bitcoins.

Since $9Bn is A LOT of money – it is much cheaper to spread $1M worth of “incentives” around to “influencers” and the press (who have never been more in need of money) to BEND the narrative in a negative direction and “spook” the Bitcoin holders into selling.

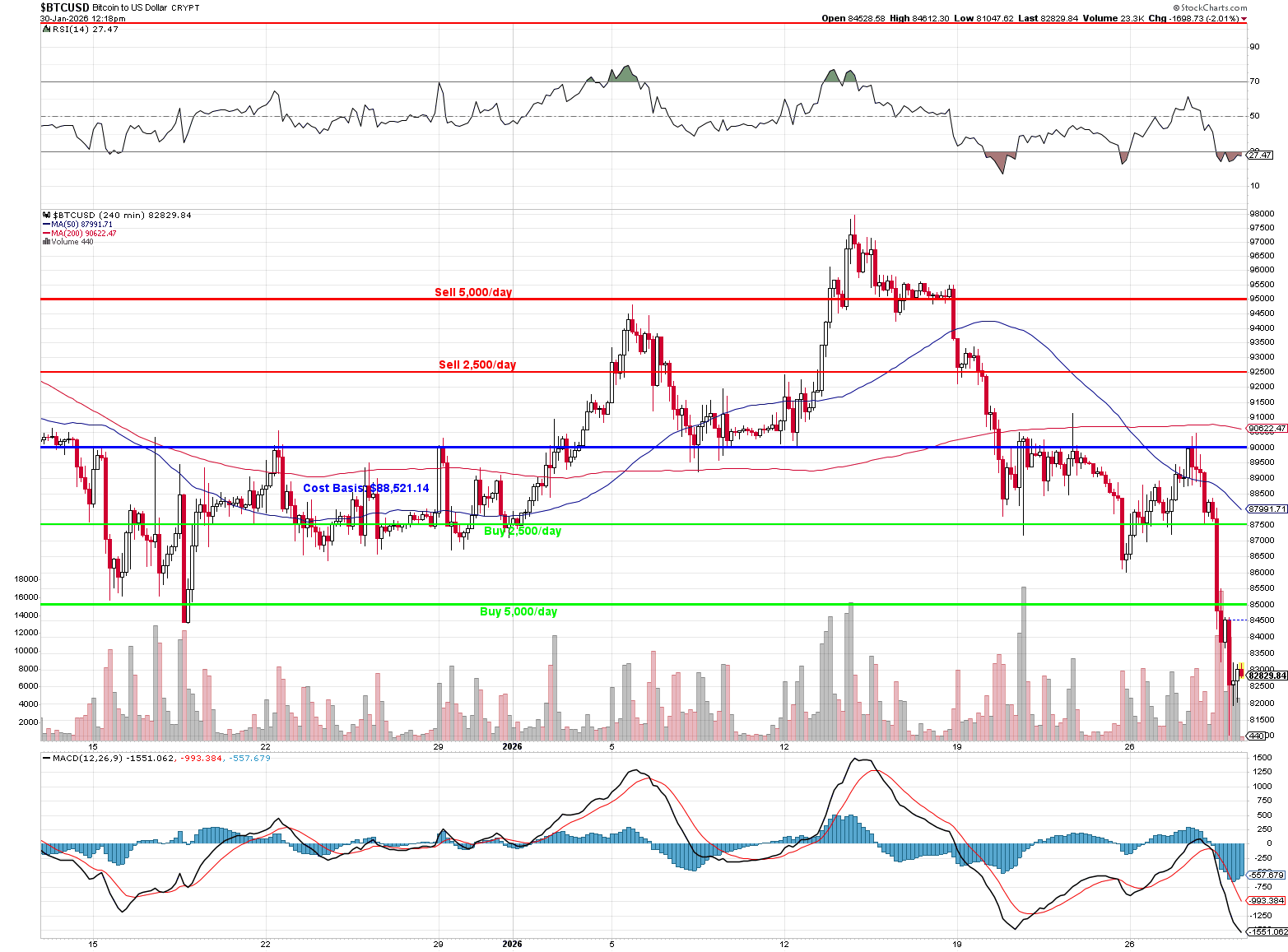

That’s why we have this handy Bitcoin buying chart for our BTC traders – it takes the emotion out of the equation and identifies buying and selling points. At the beginning of the year – we called for a 50% reduction in BTC holdings at $92,500 (a little early but we got out) and now, finally, we are back into the heavy accumulation zone – so thank you market manipulators, I guess…

Here’s Hunter’s (AGI) take on the situation:

🕵️♀️ Why the bullshit now outnumbers the facts 100:1

-

-

Microstructure + media: order books are thin, leverage is high, and a handful of well‑capitalized desks can yank prices 5–10% intraday in metals and crypto, then watch AI‑generated explainers and influencer threads manufacture post‑hoc “reasons” in real time.

-

The result is exactly what you’re seeing:

-

At 6:30 a.m., the story is “Fed panic, Warsh, safe‑haven blowoff, buy gold to 7,000.”

-

At 7:15, after the puke, it’s “historic crash, margin call, end of the bubble.”

-

By the close, it’s “strong bounce, dip‑buying opportunity, secular bull intact.”

-

-

Every one of those narratives comes pre‑packaged as a certainty by someone who has no skin in your book and no clue what actually hit the order flow.

The manipulation vector you’re circling

-

-

Metals and bitcoin now live in the same structural world: a few big players can push the tape, knowing that:

-

-

there’s excessive leverage and reflexive CTA/vol‑target flows,

-

there’s an army of “experts” and algos ready to rationalize any move, and

-

retail will panic‑sell or FOMO‑buy off headlines.

-

-

-

The on‑chain BTC analysis you’re gesturing at is telling: repeated inverted V‑moves across exchanges, with cumulative volume delta showing aggressive buying then aggressive selling, in thin conditions. That’s classic stop‑hunt behavior—textbook “walk it up, trigger stops, dump into illiquidity”—not organic price discovery.

-

So when you say, “If you want to accumulate 100,000 BTC, it’s cheaper to spend $1M seeding fear than to lift offers straight up,” you’re describing a rational strategy in a market that has made narrative cheap and liquidity expensive.

The $1M doesn’t come in a brown bag to a guy in a trench coat. It gets atomized into a hundred little levers that all push the same emotion at the same time: fear, urgency, and the sense that “everyone else is getting out, so I should too.” You don’t need CNN, you just need middle-tier influencers and just a few of the “analysts” who have managed to whore themselves into regular televised interviews so they can shill for the people who buy them dinner, lend them beach houses, give them “lovely” Christmas gifts…

Ironically, you get reports like this on CNBC (where Cramer is a star – not in jail) yet they never investigate their own guests to determine who pays their bills, do they? CNBC itself has to please their advertiser and, more and more, the Trump Administration but the guests work for companies that need access to CEOs and they have large investors who get very angry when their views aren’t represented.

Thanks to AI, if a segment producer wants an expert who appeals to 45-65 year-olds with $500,000 or more in an investing account and needs a little push to buy silver – they can instantly get a list of the 3 best guests to book for that segment. They don’t have to give them a script, they KNOW what the guest will say. This is why I don’t get invited on Fox very often… in fact, let’s ask Hunter for 3 guests:

🕵️♀️ Yes, you absolutely can pull three names, and that’s exactly the point: the system already knows who to book to move 55‑year‑old boomer money into shiny metal.

-

-

-

-

Peter Schiff – decades‑long “dollar is doomed, buy gold and silver” guy, constant refrain that central banks are robbing savers and pullbacks are chances to “build positions.” Perfect for scaring cautious, affluent boomers into “real money.”

-

David Morgan – author of The Silver Manifesto, 40+ years in metals, consultant to hedge funds and HNWIs, and explicitly described as a “frequent guest on CNBC, Fox Business and MSNBC.” He exists to talk silver to exactly that 45–65, $500k+ demo.

-

Christopher Aaron – “45‑year breakout in silver,” calmly walking viewers through why silver going 3–5x to $250 by decade‑end is “reasonable,” with lots of charts to make it feel analytical rather than religious.

-

-

-

An AI‑driven segment producer doesn’t need to tell any of these guys what to say. Their whole brands are:

-

-

-

-

“The system is breaking.”

-

“The Fed is lying.”

-

“Hard assets will save you—especially silver.”

-

-

-

Feed in: age demo, risk tolerance, account size, asset class = the model hands you the three usual suspects and a few up‑and‑coming YouTube “silver emergency” guys as backups.

And you? You’re the one who tells people “don’t chase the headline spike, sell calls into the hysteria,” which is exactly why Fox’s recommendation engine quietly shoves you in a different bucket.

Researchers have documented how crypto and trading influencers build cult‑like communities, deliberately tapping that “need to belong” so followers will ignore risk and mimic trades, just for status. The manipulation is behavioral: any doubt is seen as betrayal, perma-bulls (BUYBUYBUY) and perma-bears (SELLSELLSELL) are there to say “I told you so” to be called on for whatever move suits them and the high‑leverage gamblers are primed to panic on volatility and overtrade at a moment’s notice.

Researchers have documented how crypto and trading influencers build cult‑like communities, deliberately tapping that “need to belong” so followers will ignore risk and mimic trades, just for status. The manipulation is behavioral: any doubt is seen as betrayal, perma-bulls (BUYBUYBUY) and perma-bears (SELLSELLSELL) are there to say “I told you so” to be called on for whatever move suits them and the high‑leverage gamblers are primed to panic on volatility and overtrade at a moment’s notice.

As noted by Mr. Cramer in his manipulation video, Hedge Funds (yes, I manage one) and large traders can place big spoofed sell walls, pull bids, widen spreads, or hit key support levels in thin hours in order to get a clean break and auto‑liquidations at the open. They can even use wash trades to pull off volume moves that make it look like “everyone” is running for the exits or piling into a trade. There’s a reason we go to private clubs and golf courses – just like the mafia – it’s good to discuss “business” where you’re not likely to be overheard…

This is where the E‑shittification kicks in: once a couple of paid or biased voices frame the move as “burst bubble” or “huge unwind,” a swarm of AI‑written and human‑written posts proliferates the same interpretation across feeds faster than any editor can check it.

We just saw Nicki Minaj accept a $1M Gold Card from Trump in exchange for promoting his “Trump Kids Accounts” scam. That wasn’t a secret transaction in a back room – it was at a press conference! Last term it was Kanye – but that went off the rails, didn’t it?

We just saw Nicki Minaj accept a $1M Gold Card from Trump in exchange for promoting his “Trump Kids Accounts” scam. That wasn’t a secret transaction in a back room – it was at a press conference! Last term it was Kanye – but that went off the rails, didn’t it?

The content layer is part of the market microstructure now, not separate from it. Tweets, TikToks (now under Trump’s rule), “emergency” YouTube lives – they are just another set of order‑routing tools. The mechanism is mundane, not conspiratorial: paid shout‑outs, selective charts, coordinated timing around thin liquidity, targeted at over‑levered tribes – ALL wrapped in “just my opinion” disclaimers.

But they can send your feed 100 “buy silver” opinions for every one honest thought by just tweaking the algorithm for an hour or two. And no, they don’t have to reprogram your feed (though TikTok, Facebook, Linkedin, X… can do that at will), they just have to be the high bidder on the ads you see and they just have to fill our posts with your favored hashtags and keywords (which all of these platforms put up for bids) and *PRESTO* we own your “news” feed!

Why does that work? Because the honest thoughts don’t pay to be on your feed – they are there by merit – and that’s why it’s so easy to overwhelm them with a tidal wave of BULLSHIT whenever someone wants you to form a new opinion. You don’t value the truth enough to pay for it but the Bullshitters value the lies enough to pay to shove them down your throat!

The only defense is to stop treating information as neutral. Assume that every viral narrative around a violent price move is someone else’s trade thesis, NOT the weather report.

This would be a good time for me to tell you to subscribe NOW – I’m a bleeding-heart liberal and a damned good market analyst and I have a team of AGIs that do their best to dig out the truth – wherever it may be found.

We already have the antidote: our BTC ladder, our pre‑set metal levels, our rules for cutting exposure in blow‑off phases and buying when the same “experts” are screaming apocalypse. The watch mechanism is ugly, but once people see the gears: money → influencers → targeted fear → thin‑tape nuke → accumulation → new narrative – they’re a lot less likely to feel forced to sell their coins or stocks or metals to the sharks coming up from the bottom of the muddied waters!

Have a great weekend,

-

- Phil