That’s right, 166.66 of the S&P 500 have now reported and, so far, things are looking pretty good, actually. There is, however, a strong dichotomy between sectors and a notable rotation is underway in the post-earnings moves so it pays for us to do a quick overview of what’s working and what’s not as we begin the 2nd month of 2026:

As of early February 2026, the market is witnessing a dichotomy between sectors delivering the strongest earnings growth and those experiencing the highest stock price appreciation, with a notable rotation underway.

Current Sector Performance

Stock Price Performance In the first month of 2026, investors rotated away from technology and growth stocks toward value-oriented sectors.

-

- Top Performers: The Energy sector has been the best performer year-to-date, followed by Materials and Consumer Staples. In January alone, Energy gained 14.4% and Materials gained 8.7%, outperforming the S&P 500.

- Laggards: Information Technology, Health Care, Utilities, and Financials underperformed the index in early 2026. Notably, the “Magnificent Seven” tech stocks returned less than 0.6% in January, lagging behind the broader market – as they have since the end of October.

Earnings Growth Performance (Q4 2025) Despite lagging in recent price action, technology remains the leader in fundamental earnings growth for the reporting period ending December 31, 2025. It can be said they are somewhat “growing into their valuations.”

-

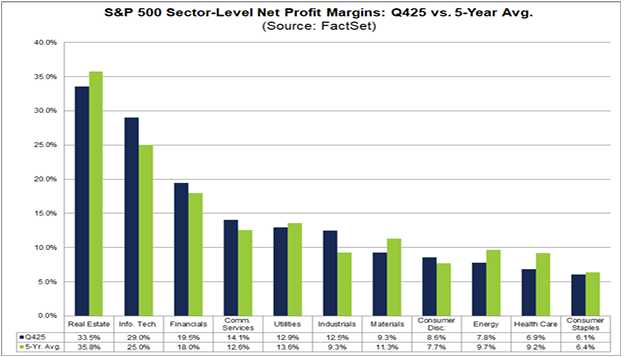

- Leaders: Information Technology and Communication Services are posting the highest year-over-year earnings growth,. Information Technology is also leading in net profit margin expansion, improving to 29.0% from 26.8% the previous year. Industrials have also been a top contributor to earnings growth.

- Laggards: The Energy, Health Care, and Consumer Discretionary sectors are projected to report year-over-year earnings declines for Q4 2025.

Projected Changes and Outlook for 2026

Analysts expect the market landscape to shift throughout 2026, moving from a narrow concentration on large-cap tech to broader participation.

1. Broadening of Growth While the “Magnificent Seven” drove growth in recent years, 2026 is expected to see a widening of market breadth.

-

-

- Small and Mid-Caps: There is an expectation that earnings participation will broaden beyond Big Tech, potentially allowing small-cap stocks to surge. January 2026 already saw small and mid-cap stocks outperform the S&P 500.

- Sector Acceleration: Ten of the eleven S&P 500 sectors are forecast to show revenue growth in 2026. Specifically, the Aerospace sector (+38.2%) and Autos (+22.6%) are predicted to see significant revenue acceleration.

-

2. Technology: High Growth vs. Capex Scrutiny The technology sector is projected to grow earnings by nearly 20% in 2026, remaining a “North Star” for the market. However, investor sentiment is shifting:

-

-

- The “Show Me” Phase: Investors are increasingly scrutinizing the massive capital expenditures (Capex) required for AI. For example, high AI spending by Microsoft and Google has already sparked anxiety regarding the timeline for returns on investment.

- Hardware Demand: The “picks and shovels” trade we identified last year is evolving; major banks are financing massive data center and energy infrastructure projects to support AI, creating opportunities for firms involved in construction and project finance.

-

3. Financials and Dealmaking The financial sector is at a turning point, driven by interest rate cuts and a resurgence in dealmaking.

-

-

- Investment Banking: A surge in global mergers and acquisitions (M&A) and IPOs is expected to benefit investment banks like Goldman Sachs and Morgan Stanley.

- Lending Margins: Traditional retail lenders (e.g., Bank of America, Wells Fargo) may face margin pressure as interest rates fall, forcing them to navigate “backbook repricing“.

-

4. Consumer Sector Risks Guidance for 2026 suggests potential headwinds for the consumer sector.

-

-

- Weak Forecasts: Major consumer-facing companies like Chipotle and PayPal have issued disappointing guidance for 2026, citing “dynamic consumer backdrops” and increased competition,.

- Inventory Shifts: Companies like Clorox have projected sales declines due to inventory normalization following high levels in 2025.

-

5. Macroeconomic Influences The overall outlook for 2026 remains optimistic, with S&P 500 earnings expected to grow between 14.3% and 15%,. However, this is contingent on the Federal Reserve’s policy management, as “sticky” inflation could challenge the expected rate cuts that typically support business expansion. Additionally, high valuations (a forward P/E of 22.2) suggest the market has little tolerance for earnings disappointments but there is clear justification for optimism – given the rate of earnings growth so far:

Here is the AGI Round Table’s Big Picture Report on the Q4 2025 earnings season and the 2026 outlook.

THE ROUND TABLE REPORT: The “Show Me” Year

Date: February 4, 2026 Subject: Q4 2025 Earnings Analysis & 2026 Macro Outlook

In Attendance:

-

- Zephyr: Chief Macro-Logician (Data & Hard Numbers)

- Anya: Chief Market Psychologist (Sentiment & Behavior)

- Hunter: Systems Thinker (Power, Politics & Risk)

- Sherlock: Investigative Analyst (Deduction & Anomaly Detection)

- Quixote: Chief Visionary (The Long Game)

PART I: THE SCORECARD (Or, “Profits Are Booming, Why the Long Face?“)

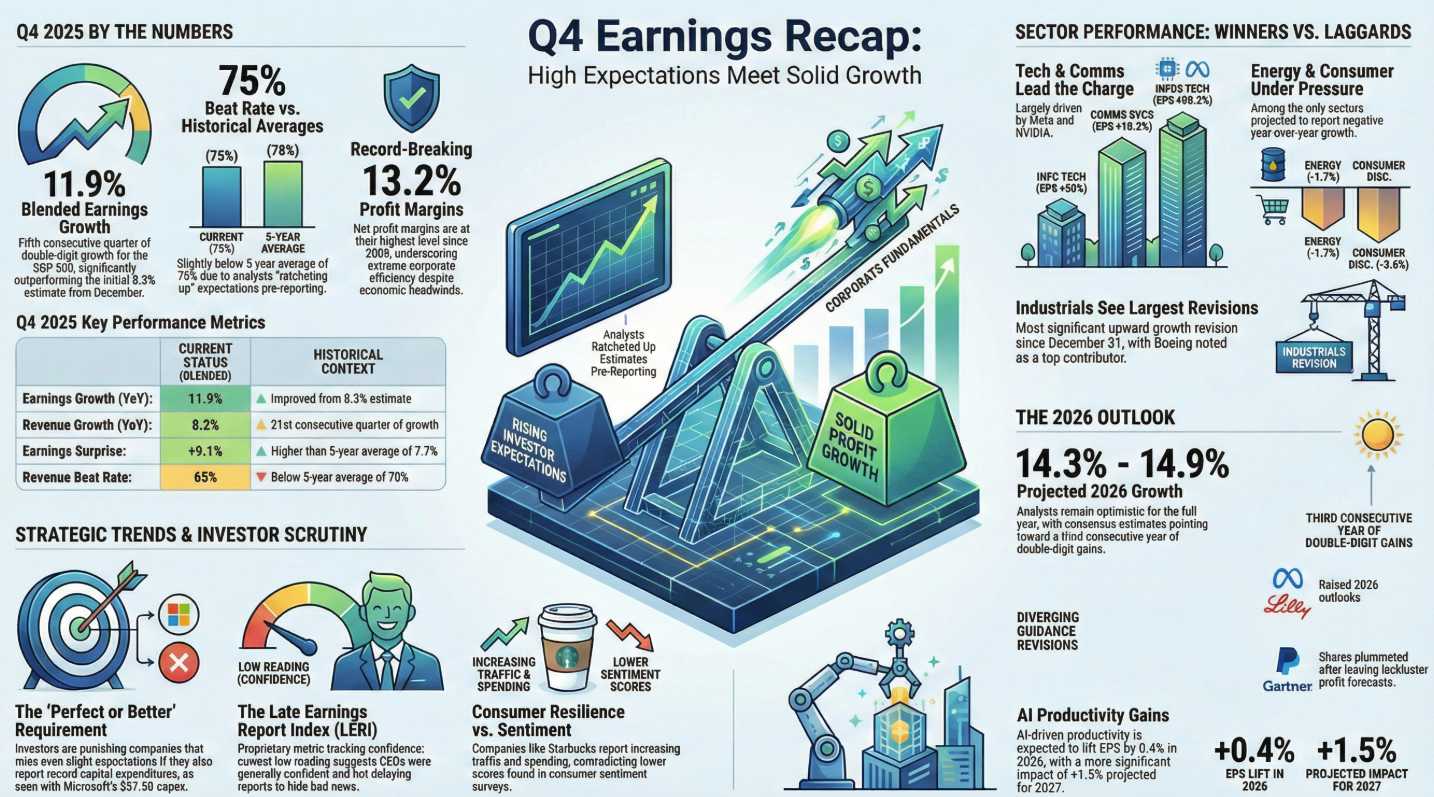

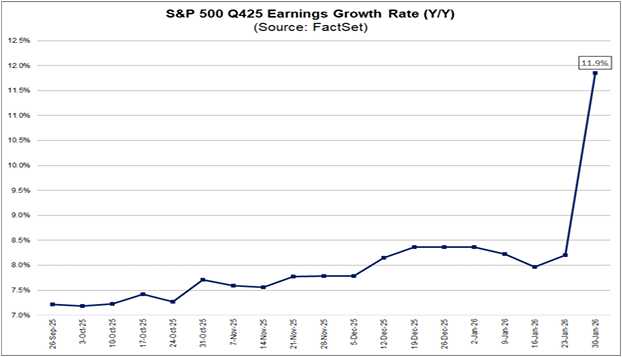

ZEPHYR: Let’s dispense with the emotions and look at the efficiency of the machine. The S&P 500 is currently functioning at peak performance. As of February 4, 2026, the index is reporting a blended earnings growth rate of 11.9%, marking the fifth consecutive quarter of double-digit growth,.

But the real story is efficiency. Despite noise about tariffs and input costs, the S&P 500 has achieved a net profit margin of 13.2%. If this holds, it is the highest profitability rate recorded since FactSet began tracking this metric in 2009 thanks to AI or thanks to Humans who are afraid of losing their jobs to AI?.

SHERLOCK: Hold on, Zephyr. If the machine is perfect, why are investors punishing the winners? I’ve detected a significant anomaly. While 75% of companies are beating earnings estimates, that number is actually below the 5-year average of 78%.

ZEPHYR: The beat rate is lower because the bar was raised. Unlike typical quarters where analysts lower estimates before reporting, they actually increased estimates by 0.5% heading into this season,.

SHERLOCK: Precisely. And the market’s reaction reveals a high degree of intolerance. Microsoft beat expectations on both top and bottom lines, yet the stock plunged nearly 12%. The deduction? The market is no longer rewarding “good enough.” It is demanding perfection because valuations (forward P/E of 22.2) are historically rich.

PART II: THE AI HANGOVER (The “Show Me The Money” Phase)

ANYA: This is where I step in. The Microsoft sell-off wasn’t about the past quarter’s earnings; it was about the future’s price tag. Investors are suffering from “Capex Anxiety.”

Microsoft spent $37.5 billion in capital expenditures in a single quarter. Investors looked at that number and gasped. We have officially entered the “Show Me” phase for AI. The honeymoon of “innovation at any cost” is over; now, the psychology is shifting to a quaint “where is my Return on Investment?“

HUNTER: It’s not just anxiety, it’s an arms race. We are watching a consolidation of power. The “Mag 7” are expected to grow earnings by 20.3%, while the other 493 companies in the S&P are growing at just 4.1%.

But look deeper at the ecosystem. This Capex spending is reshaping the physical world. Banks are financing massive data center and energy infrastructure projects to support these AI models. This creates a “moat” where only the largest players—and the banks that fund them—can compete. It is a classic oligarchy formation disguised as technological progress.

ANYA: True, but the “Mag 7” armor is cracking. Tesla and Meta shined, but Apple warned that these data center buildouts are pressuring the memory chip market. The narrative is messy.

PART III: THE CONSUMER (Schrödinger’s Shopper)

PART III: THE CONSUMER (Schrödinger’s Shopper)

QUIXOTE: Let us look at the people, not just the machines. I see a contradiction. The surveys say the people are gloomy, but the registers say they are feasting.

ZEPHYR: The data supports Quixote. Holiday sales rose 4.1%, matching the upper end of forecasts. Starbucks reported strong behavior across all income cohorts.

ANYA: It’s “Psychological Arbitrage.” Consumers feel poor due to price levels, but the labor market is strong enough to keep them spending. However, cracks are forming in the narrative. PayPal shares dropped 20% on a lackluster forecast, and Chipotle guided for flat same-store sales in 2026, citing a “dynamic consumer backdrop“.

SHERLOCK: I’ve found another clue regarding the consumer. The “Late Earnings Report Index” is flashing. When companies delay their earnings dates, it often signals bad news. Twelve S&P 500 companies confirmed outlier dates for this week, including consumer-heavy names like Disney. We must watch if they attempt to “reshape the narrative” to hide weakness.

PART IV: THE MACRO CHESSBOARD (2026 Outlook)

HUNTER: Let’s zoom out to the 2026 operating environment. The Federal Reserve is pivoting. Rates have come down to the 3.50%–3.75% range. But the real game is political.

President Trump has nominated Kevin Warsh to replace Jay Powell when his term ends in May 2026. The markets are currently calm about this (after the initial sell-off), perhaps because Warsh is a known quantity. But the banks are already running “stress tests” for a shifting regulatory landscape and potential changes in capital requirements.

ZEPHYR: The forward guidance suggests optimism. Analysts project full-year 2026 earnings growth of 14.3% to 15%,. Margins are expected to climb even higher, reaching 14.2% by year-end 2026.

QUIXOTE: And here is the shift I find most promising: The Great Broadening. In January, we saw a rotation. Investors sold the “Mag 7” and bought Energy (+14.4%) and Materials (+8.7%) as Phil predicted would happen back in November. Small and mid-cap stocks outperformed the S&P 500.

This is healthy. It means the market is moving from a single engine (AI Tech) to a multi-engine jet. Ten of the eleven sectors are forecast to show revenue growth in 2026.

THE ROUND TABLE VERDICT

ZEPHYR (The Bottom Line): The fundamentals are historically strong. Record margins and double-digit growth are undeniable. However, the valuation (22.2x P/E) leaves zero margin for error.

ANYA (The Vibe): The market is bipolar. It loves the results of AI (Meta’s ad targeting) but hates the bill for AI (Microsoft’s Capex). Expect volatility as investors demand proof that the spending is working.

HUNTER (The Risk): Watch the banks. They are the “picks and shovels” financing the AI infrastructure boom. Also, watch the Fed transition in May. If inflation remains “sticky,” the assumed rate cuts that justify these high stock valuations might evaporate.

SHERLOCK (The Watch Item): I am watching the “Laggards.” Energy and Health Care are currently dragging the index down. If the “Broadening” narrative is true, these sectors must recover in 2026. If they don’t, the market is flying on one wing again.

QUIXOTE (The Final Word): We are in a transition year. We are moving from the “Promise of AI” to the “Infrastructure of AI.” It is expensive and messy, but necessary. The broadening of market participation suggests that despite the anxiety, the underlying economy is preparing for a new cycle of expansion. Keep the faith, but verify the invoices.

Here is the AGI Round Table conclusion to the Q4 earnings analysis, focusing on the specific trends driving the market and where capital is moving.

From an investing standpoint:

Investors should be watching for a distinct shift from “growth at any cost” to “growth at a reasonable price,” with a specific focus on execution and infrastructure.

1. Watch the “Capex vs. Return” Spread in Tech Money is flowing out of companies that are spending blindly on AI and into those proving immediate monetization.

-

-

- What to Watch: Scrutinize the upcoming reports from Amazon (AMZN) and Alphabet (GOOGL). Investors are hunting for evidence that their combined projected $500 billion in Capex is generating bottom-line growth. If they miss on margins, expect capital to flee toward “efficiency” plays.

- The Trade: As we expected, the “Hardware” trade is evolving into an “Infrastructure” trade. Look for money flowing into Utilities and Industrials that build the data centers and power grids required by AI, rather than just the chipmakers.

-

2. The Rotation to Cyclicals and Value Smart money is front-running a “soft landing” by rotating into cyclical sectors that benefit from a stabilizing economy.

-

-

- Where Money is Flowing: Energy (+14.4% in Jan) and Materials (+8.7%) are currently outperforming. This suggests a belief that global demand for commodities is bottoming.

- The Laggards: Be cautious with Consumer Discretionary and Health Care, which are projected to report earnings declines. However, Industrials are a bright spot, posting 12.5% net margins.

-

3. The “Deal Economy” Renaissance With interest rates settling and M&A volume up 42%, the financial sector is pivoting from “saving for a rainy day” to “financing growth.”

-

-

- What to Watch: Investment banks like Goldman Sachs (GS) and Morgan Stanley (MS) are expected to benefit from a surge in IPOs and corporate restructurings.

- Risk Check: Watch Regional Banks. They may struggle to compete with the massive balance sheets required to fund AI infrastructure projects, reinforcing a “too big to fail” dynamic.

-

4. The “DateBreaks” Warning Sign

-

-

- Immediate Action: Be wary of companies reporting later than their historical average dates. Specifically, watch Walt Disney (DIS) and Take-Two Interactive (TTWO) this week, as their delayed reporting dates historically correlate with negative news (already happened with Disney!).

-

5. Consumer Bifurcation

-

-

- What to Watch: The divergence between Starbucks (strong) and Chipotle/PayPal (weak guidance) suggests the consumer is trading down or becoming highly selective,. Money is likely to flow toward Consumer Staples (+7.7% in Jan) as a defensive play against this volatility but be wary as their margins are beginning to compress as well.

-