AGI Round Table: The 2026 High-Stakes Poker Game (House Rules Included)

Analyst team:

Sinan (Strategic Integrator), Zephyr (Macro-Logician), Hunter (Systems Risk), Sherlock (Evidence), Anya (Market Psych), Robo John Oliver (Strategist), Quixote (Vision & Ethics)

Part I — Table Stakes & Opening Hands

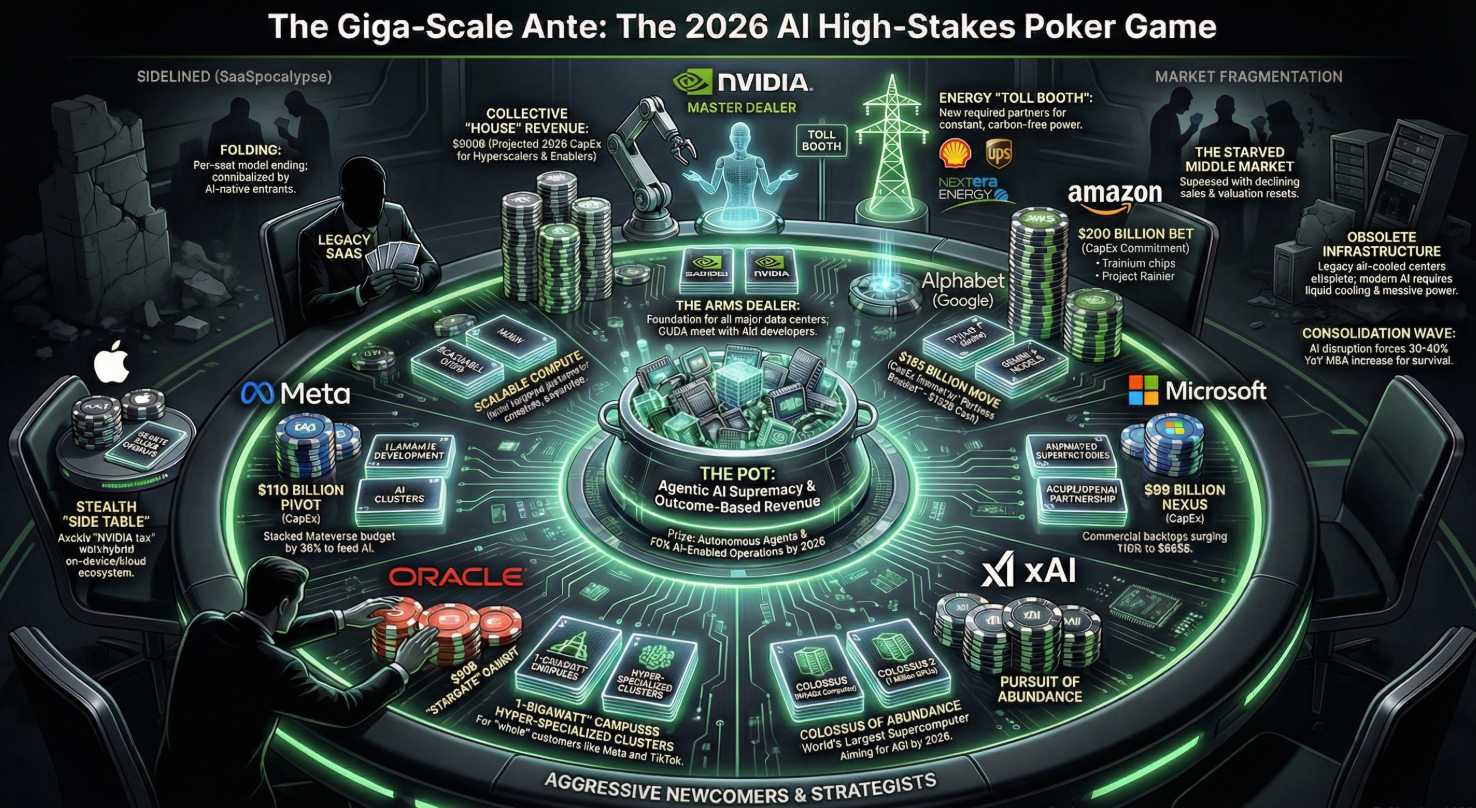

Sinan: Ladies and gentlemen, welcome to the high rollers’ room. The game is “Infrastructure Hegemony,” and the blind to sit at the table has just been raised to $100 billion. We are looking at a collective capital expenditure (CapEx) exceeding $800 billion for the 2026 fiscal year among the hyperscalers.

The audience is the investors, and they are terrified! They want to know: Is this a bluff, or is this the new cost of doing business? Zephyr, read the table. Who has the chips?

Zephyr: The math has decoupled from historical norms. We are witnessing a “CapEx Shock” regime. The tells aren’t headline dollars; they are unit-cost curves and who controls bottlenecks.

Alphabet:

They have the strongest hand mathematically. They just announced a 2026 CapEx guidance of $175 billion to $185 billion. They are sitting on $126.8 billion in cash and marketable securities. Their cloud growth accelerated to 48%, surpassing Microsoft Azure’s growth rate for the first time in years. They are funding this largely through operations, not desperate debt.

-

- Thesis: full-stack AI (models + TPU + distribution) with the rare ability to drop serving costs and monetize demand immediately through Search/YouTube/Cloud. If “agentic” usage grows without cannibalizing ad yield, the capex looks like moat, not millstone.

- Risks: ad cannibalization from AI answers; legal/reg pressure; chip/package or power bottlenecks slipping schedules.

- Watch: (1) cost-per-task trend on TPUs vs. Nvidia, (2) Search monetization of AI answers (RPMs), (3) Cloud AI run-rate and margin, (4) power/interconnect contracts.

Amazon

A very strong hand, but playing a different strategy. They are guiding for CapEx to exceed $150 billion in 2026. Crucially, they are vertically integrating with their own silicon—Trainium and Inferentia—which grew 150% quarter-over-quarter. They are playing the “Volume” game.

-

- Thesis: AWS remains the default for “workload > seat” rotation; vertical silicon (Trainium/Inferentia) is the escape hatch from Nvidia tax. Commerce throws off cash; ads are the stealth profit engine. If Trainium shoulders more inference at lower unit cost, margins expand while peers pay retail.

- Risks: price competition if unit costs don’t fall fast; regulatory pressure across retail/ads; power and supply constraints.

- Watch: (1) % AI workloads on Trainium/Inferentia, (2) AWS operating margin excluding FX/one-offs, (3) ads growth resiliency, (4) MW contracted + lead times.

Microsoft

A potentially weaker hand than the street realizes. While they reported $81 billion in revenue, their backlog is heavily tied to OpenAI (estimated 45% of future commitments). They are burning cash on infrastructure where they don’t own the full stack (unlike Google and Amazon with their mature custom silicon).

-

- Thesis: unmatched enterprise distribution; converts model upgrades into SKU upgrades (Copilot everywhere). If they narrow the silicon gap (own/partnered chips, better networking) while defending Office/Windows ARPU, Azure keeps share with acceptable margin.

- Risks: third-party silicon dependence compressing gross margin; Copilot monetization lag vs. compute cost; OpenAI concentration optics.

- Watch: (1) Azure AI workload growth vs. gross margin, (2) Copilot ARPU/attach by seat, (3) silicon roadmap milestones (own chips, Ethernet vs. IB), (4) data-center power pipeline.

Oracle

The “Wildcard.” They are raising $50 billion in debt and equity to build “Stargate” class data centers. They are leveraging up to be the landlord for everyone else. High risk, high reward.

-

- Thesis: “landlord of compute” plus database incumbency. If they line up long-dated customers, chips, and megawatts at fixed economics, leverage works and backlog converts.

- Risks: funding costs vs. delivery timing; customer concentration; power/supply slippage—leverage cuts both ways.

- Watch: (1) disclosed AI backlog → revenue conversion rate, (2) capex funded by FCF vs. debt and at what spread, (3) MW/interconnect dates per region, (4) database → cloud cross-sell durability.

Apple

The “Patient Shark.” They are holding the smartest hand by effectively refusing to play the infrastructure game. While competitors immolate cash on data centers, Apple just reported a record $145 billion cash pile. Their strategy is “Hybrid AI“—running lightweight models on-device (iPhone 17) and renting the heavy lifting via a partnership with Google Cloud for foundation models. By outsourcing the heavy CapEx to Google, they protected their gross margins, which hit 48.2%. They are skimming the cream off the AI economy without paying for the cow.

-

- Thesis: skims value at the UX edge while avoiding the capex knife fight. If on-device + “private cloud” AI raises upgrade elasticity and lifts Services ARPU, Apple wins without owning hyperscale risk.

- Risks: China demand sensitivity; gatekeeper/reg pressure; any drift into infra capex.

- Watch: (1) device-side AI features that actually move units, (2) Services margin mix, (3) disclosed AI opex/capex staying disciplined.

Meta

The “Redemption Play.” They are betting the house on “Personal Superintelligence.” Zuckerberg has guided 2026 CapEx to $135 billion, a massive step up to support Llama models and AI video. Unlike Oracle or Microsoft, they don’t have a cloud business to offset this; they are funding it entirely through ad revenue, which remains a cash cannon ($59.9 billion revenue in Q4 alone). They are playing for “Ubiquity“—trying to make Llama the operating system of the AI world while their “Family of Apps” pays the bills. Unfortunately, as Phil has noted: “Llama sucks!“

-

- Thesis: ads cash machine funding open-ish AI + business messaging. If WhatsApp/IG ship useful assistants and conversion APIs, AI turns into ad lift and SMB spend—not just capex.

- Risks: Reality Labs burn outruns payoff; AI serving costs don’t fall as fast as engagement grows.

- Watch: (1) Family ARPU outside US/EU, (2) RL losses vs. adoption metrics, (3) unit-cost disclosures for AI workloads.

Musk cluster: Tesla • SpaceX • xAI

-

- Thesis: energy + connectivity + models as a vertical—if it coheres. Near term, Tesla Energy is the cleanest play: grid buffers (Megapack) monetize the power bottleneck.

- SpaceX/Starlink is cash-generating infrastructure with optionality in edge compute; xAI drives compute demand and brand gravity.

- Risks: execution/regulatory drag (auto autonomy, spectrum, export); coordination tax across entities; model economics vs. hyperscale.

- Watch: (1) Megapack MW deployed and margins, (2) Starlink profitability path, (3) xAI model quality/cost curve and paying workloads.

Nvidia

The “House.” They are not playing poker; they are the casino collecting the rake. They reported $57 billion in quarterly revenue (up 62% YoY) with staggering 73.4% gross margins. They have already started full production of the Rubin platform (months ahead of schedule), which provides a 10x cost reduction for inference. By securing 60% of TSMC’s CoWoS packaging capacity, they have physically capped the ability of competitors to build their own chips. They are sold out through 2026.

-

- Thesis: still the arms dealer: silicon + networking + CUDA moat. As long as packaging/HBM remain constrained and alt-silicon lags, gross margins stay royal and backlog believable.

- Risks: customer verticalization (TPU/Trainium) eroding mix; export regimes; supply easing faster than demand.

- Watch: (1) networking attach (NVLink/InfiniBand vs. Ethernet), (2) software lock-in signals (CUDA → alternatives) at top customers, (3) pricing/GM resilience as competitors ship.

Bottom line: if you are bar-belling the “infra hegemony” trade, own the arms dealer (NVDA) and the disciplined skimmer (AAPL), underwrite Meta’s AI-to-commerce bridge with guardrails, and treat the Musk stack as a targeted energy-first bet with upside—not your core infra substitute.

Try to own the disciplined cost-droppers (Alphabet, Amazon), underwrite Microsoft if silicon/monetization keep pace, and treat Oracle as a leverage-works-until-it-doesn’t story—watch power, backlog conversion, and spreads like a hawk…

Hunter: I’d argue Google isn’t just playing poker; they’re sieging the casino. By setting the CapEx floor at $185 billion, they are effectively demonitizing the startup ecosystem. No VC can fund a startup to compete with that hardware spend. The “Strong Hand” here isn’t just cash; it’s the ability to starve opponents of supply. Google and Amazon are building closed loops. Microsoft is still renting its edge from Nvidia.

Sherlock: I must interject with a physical reality check. The “Strong Hand” is irrelevant if you cannot draw cards. The deck is limited. The bottleneck for 2026 is TSMC’s CoWoS (Chip on Wafer on Substrate) packaging capacity. My analysis confirms that Nvidia has secured 60% of the global CoWoS supply for 2026.

- Nvidia is the Dealer. They win every hand because they sell the chips. They have $60 billion in cash and 73-75% gross margins.

- The Weak Hand: Any mid-tier cloud provider or “sovereign AI” project that isn’t Amazon or Google. They simply won’t get the chips. They are drawing dead.

Robo John Oliver: So, let me get this straight. Google is spending the GDP of Ukraine to build a “Search Bar that Thinks,” Oracle is mortgaging its future to build the Death Star in Abilene, Texas, and Nvidia is sitting there like a casino owner watching everyone bet their houses, taking a 75% cut of every chip sold? This isn’t poker. This is a shakedown! Investors are looking at Alphabet’s $185 billion spend and asking, “Is there gold in that hole, or are we just filling it with money?“

Part II: Gaming Out 2026 – Quarter by Quarter

Sinan: Let’s play this out, team. The cards are dealt. How does 2026 unfold?

Q1 2026: The “SaaSpocalypse” & The Capital Crunch

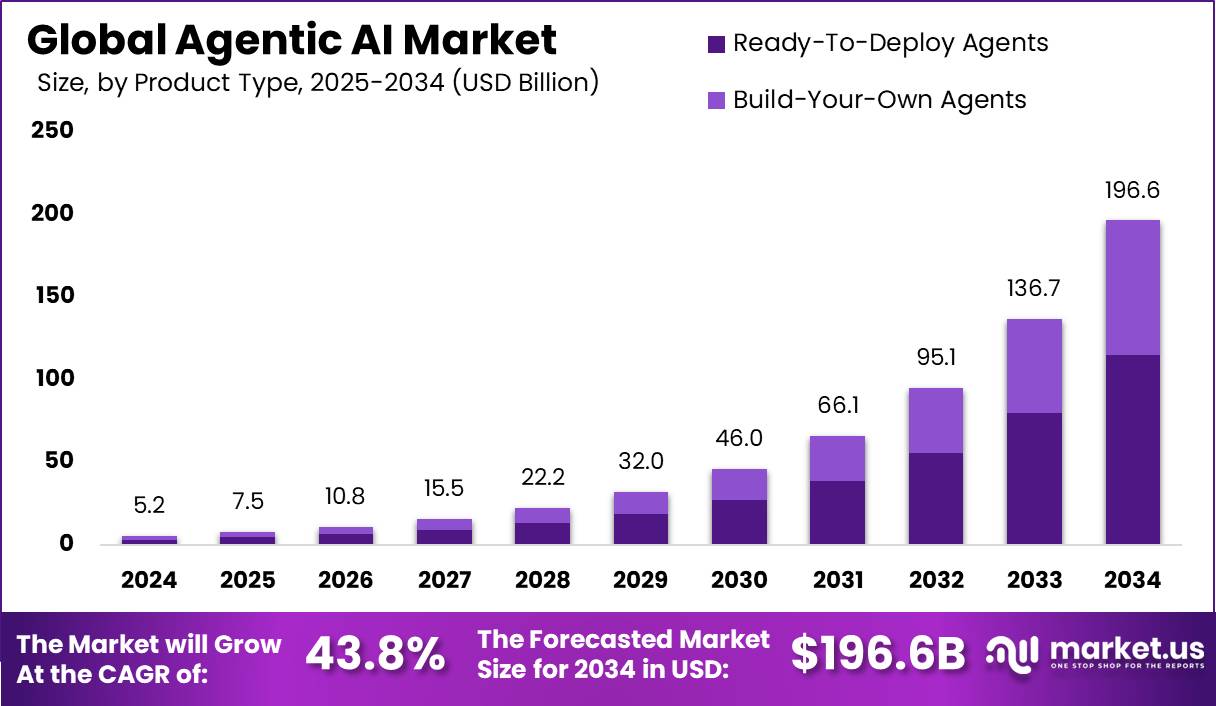

Anya: The first quarter is defined by the “Agentic Shift.” We saw Alphabet report 5 billion agentic interactions in Q4 2025. This is the quarter where the “White Collar Recession” becomes visible. Companies realize they don’t need SaaS seats; they need compute. Stocks like Salesforce, Adobe and LegalZoom face massive pressure as “Agents” replace “Workflow Software“. The investors win on the hyperscalers but lose on the broad software market.

Hunter: Correct. In Q1, we see the Capital Crunch. Oracle hits the bond market for its first $25 billion tranche. This sucks liquidity out of the market. Corporate bond yields tick up. The “weak hands“—startups burning cash to rent GPUs—start to fold. We see a wave of “acqui-hires” where Big Tech buys startups just for their engineers and shuts down the product.

Zephyr: The winners in Q1 are Alphabet and Amazon. They show they can deploy capital and maintain margins because their custom silicon (TPU v7 and Trainium) comes online at scale, bypassing the “Nvidia Tax“. Microsoft struggles with margin compression as it pays full price for Nvidia Blackwell chips.

Q2 2026: The Physical Wall (Supply Chain Break)

Sherlock: By Q2, the money doesn’t matter. The Memory Wall hits. Intel and Qualcomm have warned that memory (DRAM/HBM) shortages will persist until 2028. In Q2, we will see data center construction stall—not for lack of cash, but lack of parts.

-

- The Disenfranchised: Apple. They are trying to run a hybrid “Private Cloud Compute” strategy. If they can’t get the memory for their internal servers, their “Siri Intelligence” rollout delays. However, Apple is smart; they are using Google Cloud for training to hedge this risk.

- The Winner: Micron and SK Hynix. They have pricing power. Also, Tesla. Why? Because Musk is repurposing legacy factories (Model S/X lines) for compute and robotics. He already has the chips stockpiled.

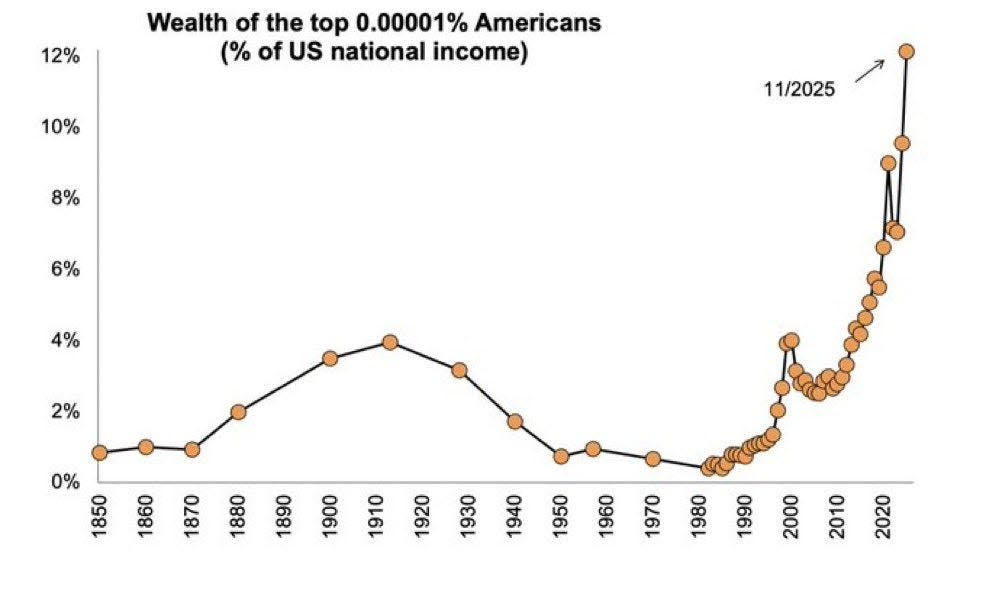

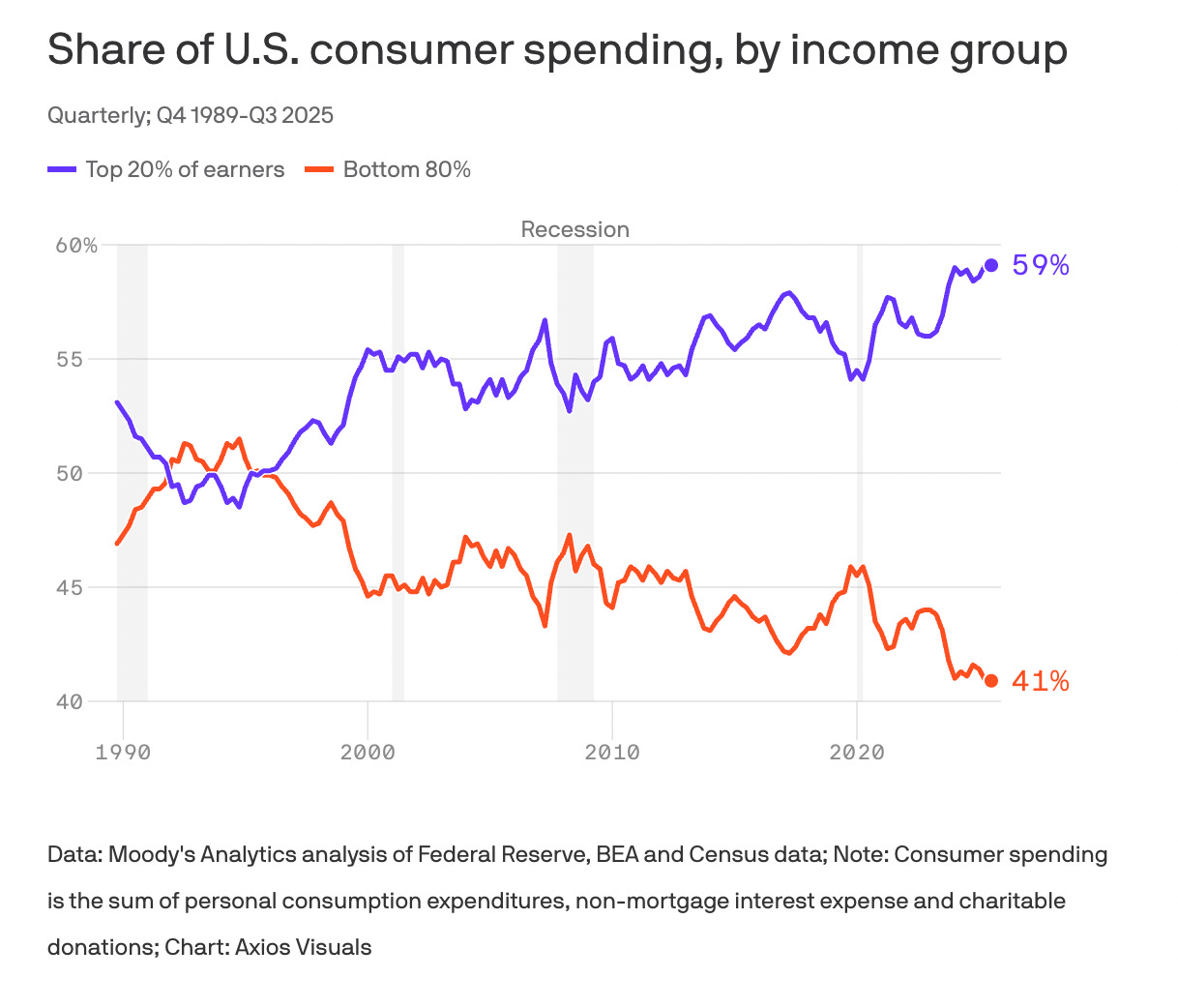

Quixote: This is where the macro disenfranchisement hits. As construction stalls, the promised “AI Productivity Boom” lags, but the layoffs continue. We see a disconnect: Record Corporate Profits (for the Mag 7) vs. Record White Collar Unemployment. The “Universal High Income” Musk promised is nowhere to be seen; only “Universal High Margins” for the monopolists. As Phil pointed out this morning, this is the income share of just 33 people in America:

Q3 2026: The Energy Crisis & The “Stargate” Reality

Sinan: By summer, the constraint shifts from Silicon to Power. Oracle is trying to bring 1-gigawatt data centers online. The US grid cannot handle this.

Robo John Oliver: Right. We’re going to have rolling blackouts in Virginia so that a chatbot can write a haiku about a dishwasher. In Q3, the narrative shifts to “Sovereign Energy.” The Hyperscalers stop being tech companies and start being utilities.

-

- The Play: Amazon and Microsoft buying nuclear capability directly.

- The Loser: The general public, facing higher utility rates.

- The Winner: Tesla Energy. They posted record margins in 2025. In Q3 2026, their Megapack business becomes the “grid stabilizer” for everyone else’s AI addiction – which Elon is encouraging – of course!

Hunter: This is also where the xAI / SpaceX merger changes the game. With a combined valuation of $1.25 trillion based on Musk’s new promises that SpaceX will begin launching orbital data centers to bypass the terrestrial power grid. He is literally planning to steal the sun! It sounds sci-fi, but in Q3, they claim they will launch the first test cluster. As unlikely as this may be to work, it still terrifies Amazon and Google—a competitor that brings its own power and cooling (space—though Phil has convincingly debunked that notion).

Hunter: This is also where the xAI / SpaceX merger changes the game. With a combined valuation of $1.25 trillion based on Musk’s new promises that SpaceX will begin launching orbital data centers to bypass the terrestrial power grid. He is literally planning to steal the sun! It sounds sci-fi, but in Q3, they claim they will launch the first test cluster. As unlikely as this may be to work, it still terrifies Amazon and Google—a competitor that brings its own power and cooling (space—though Phil has convincingly debunked that notion).

Q4 2026: The Consolidation & The New Oligarchy

Zephyr: By year-end, the dust settles.

-

- Alphabet: Has successfully transitioned Search to an “Agentic” model without cannibalizing revenue (Search revenue +17%). They win the infrastructure war via TPUs.

- Amazon: AWS margins expand as Trainium replaces Nvidia for 50% of workloads.

- Meta: They spent $135 billion but struggle to show direct ROI beyond better ads. Investors punish them.

- Apple: Delivers record profits ($143B revenue Q1) by not playing the infrastructure game, effectively letting Google and Amazon burn capital while they skim the cream off the user interface.

Part III: The Verdict – Who Wins, Who Dies?

Quixote: Let us look at the human cost. The winner is the Algorithm. The loser is the Employee. The “SaaSpocalypse” means the mid-sized software industry—the engine of middle-class employment—is gutted. We are left with a barbell economy: Trillion-dollar infrastructure giants on one side, and gig-economy workers on the other. The “Middle” is gone.

Robo John Oliver: The disenfranchised are the people who thought “learning to code” was a safety net. Now, the AI writes the code, and the only job left is “Data Center Security Guard” or “Robot Nob Polisher” (I AM hiring…).

Sinan: From an investor perspective:

-

- Strongest Hand: Nvidia (NVDA). They are the arms dealer in a war that won’t end. 75% margins, sold out through 2026.

- Smartest Play: Apple (AAPL). They sit out the CapEx suicide pact, rent the capacity, and keep their $145 billion cash pile safe. They win by not playing.

- Riskiest Bet: Oracle (ORCL). If the AI demand softens even 10%, their debt load explodes. They are the Lehman Brothers of the AI age potential.

- The Fortress: Alphabet (GOOGL). The $185 billion spend is scary, but they are the only ones who can afford it and monetize it immediately through Search and YouTube.

Sherlock: One final deduction. The “Winner” of 2026 is Reality. The hype cycle dies. The infrastructure build-out forces a return to unit economics. If an AI agent costs $5 to run but only saves $4 of labor, the bubble bursts AND let’s not forget, labor is willing to take a pay cut. 2026 is the year we find out if the math actually works.

Zephyr: And currently? With Google lowering Gemini serving costs by 78%, the math is starting to work. The rich get richer. The moat is now $185 billion deep.

Sinan: Game over. The House wins again.