I speak to so many people these days who can’t live off their retirement portfolios anymore.

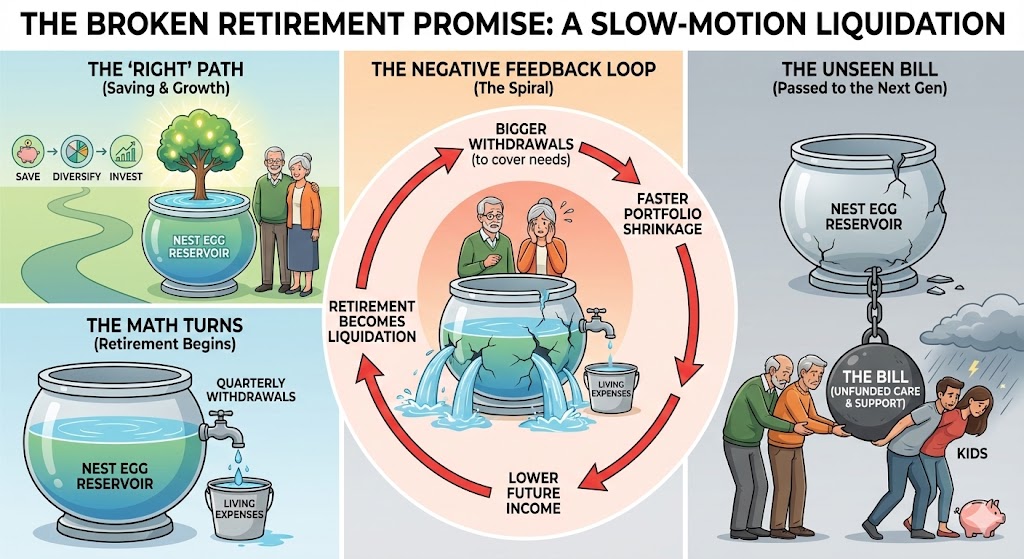

They did “everything right” – saved, diversified, stayed invested – and now the math is turning on them. Every quarter the withdrawals get a little harder, the portfolio gets a little smaller, and the income gets a little thinner. That forces bigger withdrawals, which shrinks the portfolio faster, which lowers future income and, suddenly “retirement” starts to look like a slow-motion liquidation.

And when the plan breaks, the bill doesn’t vanish — it gets handed to the kids.

That’s the problem we’re tackling here: how to turn a portfolio back into an income engine, so your principal isn’t the thing paying your bills.

On Friday I joined the Financial H.E.A.T. Podcast with Matt Tuttle and Patrick Neville and we walked through the core idea behind what we teach at PhilStockWorld:

Be the House – NOT the Gambler!

Instead of constantly guessing what the market will do next, you build positions in quality companies (or conservative option equivalents) and collect rent from other people’s bets using simple, repeatable option structures designed for reliability – NOT heroics.

This post kicks off a new monthly series: Retirement Strategies 101 – practical, plain-English strategies for retirees (and their families) with real examples and periodic updates as markets change.

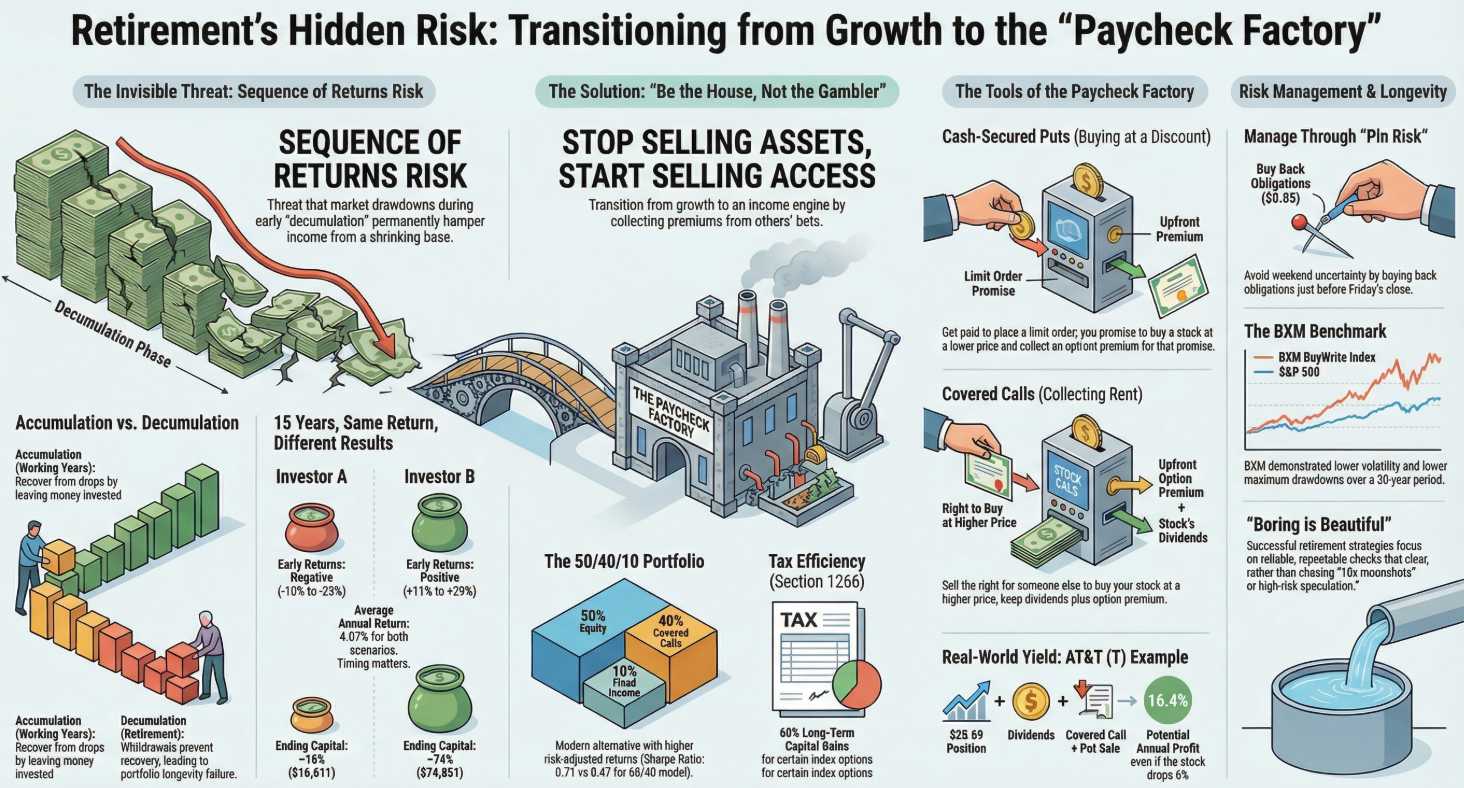

You are not “bad at investing,” you’re just running the wrong machine. A retirement portfolio isn’t a growth portfolio anymore; it’s a paycheck factory. Most people are trying to manufacture paychecks by sawing pieces off the factory.

Why Retirement Portfolios Dwindle (Even When Markets “Do Fine”)

Most retirees don’t lose their retirement.

They withdraw it!

And they withdraw it on a schedule.

Here’s how the typical retirement setup works:

-

-

Your adviser sets up a “safe” withdrawal plan.

-

You receive the same check every month.

-

The account sells whatever it needs to sell to generate that cash.

-

It feels steady. Predictable. Comfortable.

It works beautifully… as long as markets keep rising.

But markets don’t rise in straight lines.

When the market is flat — or worse, down — that same monthly check still goes out.

The difference?

Now it isn’t coming from growth.

It’s coming from principal.

That is the core problem.

The Quiet Erosion

Let’s say you need $4,000 a month.

If the portfolio earns more than that? Fine.

If it doesn’t? The account sells assets to make up the difference.

In a down year, that means:

-

-

More shares must be sold to raise the same dollars.

-

Those shares are gone forever.

-

They aren’t there to recover when markets rebound.

-

Over time, that creates a cascading effect:

Smaller portfolio → less income → larger percentage withdrawals → faster decline.

Financial planners call this sequence of returns risk.

I call it something simpler:

Selling the golden goose to pay for eggs.

Why “We’ve Been With Him Since 1980” Is Not Comforting

Here’s the uncomfortable truth:

The traditional retirement advisory model was built in an era of:

-

-

Higher interest rates

-

Stronger demographic growth

-

Less volatility compression

-

Simpler markets

-

A steady 4% withdrawal worked when:

-

-

Bonds paid 6–8%

-

Dividends were higher

-

Markets had a structural tailwind

-

Today?

Advisers often run the same playbook:

-

-

60/40 allocation

-

Automatic withdrawals

-

Rebalancing once or twice a year

-

And when markets stall?

The checks still go out.

The principal quietly shrinks.

No alarm bells ring. No phone call comes saying, “We should adjust the income strategy.”

Because the system is designed for asset management, NOT income engineering.

That’s the bug!

Longevity has been mistaken for competence.

The Real Question Retirees Should Be Asking

On the podcast, I said:

“Be the house, not the gambler.“

This matters more in retirement than anywhere else.

Most retirees are unknowingly gamblers — not because they’re reckless, but because they are:

-

-

Dependent on market direction

-

Selling assets to generate cash

-

Hoping markets cooperate

-

The house doesn’t hope.

The house structures cash flow.

Retirement portfolios shouldn’t depend on markets rising every year.

They should generate income whether markets are up, flat, or slightly down.

That’s the shift.

Not chasing performance.

Not swinging for big returns.

Just restructuring the machine so it produces cash without dismantling itself.

This keeps the focus where it belongs:

-

-

The mechanical flaw.

-

The emotional vulnerability (widows).

-

The outdated model.

-

The structural alternative

-

The Simple Fix: Stop Selling Assets. Start Selling Access.

If you want a portfolio to last, you need more cash flow coming from the portfolio so withdrawals don’t require you to sell your principal.

That’s where options come in — NOT as gambling, but as getting paid for stocks you already own.

Options are just contracts. Like insurance. Like a warranty. Like a deposit.

Used conservatively, they do one thing beautifully:

They turn your portfolio from “assets you sell” into “assets you are paid to keep.”

Options Without the Casino: Two Basic Tools

1) Selling a Put (Getting Paid to Place a Limit Buy Order)

A put is a contract where you agree:

“If the stock drops to $___ by a certain date, I’ll buy it.”

You get paid upfront for making that promise.

So it’s like putting in a limit order… except they pay you to place it.

Why retirees should like this:

-

-

You pick prices you’d be happy owning.

-

You collect cash now.

-

If the stock never drops to your price, you keep the cash and move on.

-

It’s not betting on a stock going up tomorrow.

It’s getting paid to be patient.

Real-Life example #1: Stellantis (STLA)

In the podcast, we discussed Stellantis, which is Alpha Romeo, Chrysler, Fiat, Jeep, Maserati… A major auto maker. They just had some bad news and wrote off a lot of their EV investment but we feel they are oversold at $7.75.

- Rather than buy the stock, we can PROMISE to buy 1,000 shares of the stock by SELLING 2028 $10 puts for $3.20 ($3,200). The put seller PAYS us $3,200 NOW in exchange for us promising to buy 1,000 shares of STLA from them in January of 2028.

The beauty of this is that, even if we do end up being forced to buy 1,000 shares in 2028, our net cost will be $6.80 – 12% below the current price! If, on the other hand, STLA is above $10 – we keep the $3,200 and we don’t even have to buy the stock – that’s a 41% potential return against the current stock price – WITHOUT EVEN OWNING IT!

2) Selling a Call (Getting Paid to Agree to Sell at a Higher Price)

A call is a contract where you agree:

“If the stock rises to $___ by a certain date, I’ll sell it at that price.”

You get paid upfront for that promise too.

This is the simple covered call idea:

-

-

You own a stock you’re comfortable holding.

-

You sell a call above today’s price.

-

You collect cash (income) while you wait.

-

If the stock doesn’t go above your sell price: you keep the stock and the cash.

If it does: you sell at a profit and you keep the cash.

This is not “free money.” Nothing is.

It’s a trade: you accept a reasonable cap on upside in exchange for reliable income.

Retirees generally don’t need a 10x moonshot. They need a check that clears!

- An example here would be if you bought 1,000 shares of STLA for $7.75 ($7,750) and you sold the June $7 calls for $1.50 ($1,500). That reduces your net to $6,250 and, if STLA is still above $7 ($7.75 now) on June 18th (expiration day), the person you sold the calls to will pay you an additional $7,000 for the stock, which would be a total of $8,500 for a potential $750 (10%) profit in just 4 months.

- Another fun one is GEO, who build the prisons for the non-whites and liberals President Trump is rounding up. While morally reprehensible – there’s a lot of money in those Government contracts and $14.25 is crazy low for GEO so we can buy 1,000 share ($14,250) and sell 10 June $14 calls for $2.25 ($2,250) and net into the stock for $12,000 and, if called away at $14,000 in June, that will be a potential $2,000 (16.66%) profit or about 4.15% PER MONTH – how’s that for an income?

And, keep in mind, this is not a one-time thing. Either the stock goes up and we use the cash to do it again or the stock is flat and we simply sell more short calls for the next cycle or the stock is down and we already have 16% downside protection built into the trade!

Add Dividends, and You’ve Got a Paycheck Stack

Now combine:

-

-

Dividends (company pays you)

-

Put-selling income (you get paid to buy at a discount)

-

Call-selling income (you get paid to set a sell price)

-

And suddenly you’re not forced to sell principal every month.

Instead, withdrawals can come from:

-

-

dividends

-

option premium

-

and occasionally trimming positions on your terms, not the market’s.

-

That’s the key shift:

Withdraw income first. Touch principal last.

For this section, let’s look at AT&T (T), who are currently trading at $28.69 and they pay an 0.28 (1%) quarterly dividend. We can use the options strategies we just learned to drastically improve those returns (and you can do this with almost any stock you already own!):

-

- Buy 500 shares of T for $28.69 ($14,345)

- Sell 5 T Jan $27 calls for $3.55 ($1,775)

- Sell 5 T Jan $27 puts for $1.95 ($975)

In this case, you have bought 500 shares of T for net $11,595 ($23.19/share) which now makes the 0.28 dividend 1.2% per quarter ($140) but ALSO, if T is over $27 in Jan of 2027, you will be paid back $13,500 for a potential $1,905 (16.4%) profit for the year – over 20% back on T – even if it drops $1.75 (6%) from where it is now!

Feel free to leave us a comment and we can help you with ideas that can turn almost any stock you currently own into an income-producer that will help you build back your portfolio.

The Ethical Truth About “Evil Options”

Options aren’t evil.

Using them to gamble is evil (for your retirement).

What we do is closer to what insurance companies do:

-

-

We price risk.

-

We sell contracts.

-

We collect small, consistent income.

-

We avoid blowing ourselves up.

-

“Be the House – NOT the gambler” is not a slogan. It is a retirement survival plan.

Where This Series Is Going

Each month in “Retirement Strategies 101,” we’ll do three things:

-

-

Identify conservative income candidates (boring is beautiful).

-

Show a simple “retirement-safe” structure:

-

dividend + put sale + covered call (when appropriate)

-

-

Update what we’d adjust based on price and conditions.

-

No hype. No hero trades. No YOLO.

Just a portfolio that acts like it has a job!

Now we will give you a bonus feature. Keep this article for 90 days and, when we check back with you with a progress report, you can decide whether you will read it again and take our ideas seriously.

These are 5 value stocks that are about to pay dividends and we are going to use the options lessons we just taught you to enhance the returns:

Here’s a quick rundown on each, focused on income + basic risk profile.

Ennis, Inc. (EBF)

-

-

Business: Old‑school business‑forms and printed materials (checks, labels, envelopes, custom print) sold to small/medium businesses and distributors.[finance.yahoo]

-

Dividend: Around 4.5–5.0% yield; quarterly payer with a long history of regular dividends and occasional specials when cash piles up.suredividend+1

-

Why it fits: Boring, cash‑generative niche, low leverage, and not tied to AI or rate‑mania. Main risk is secular print decline, but they’ve managed it for years via consolidation and cost control.

-

The Trade Idea:

-

- Buy 200 shares EBF for $20.76 ($4,152)

- Sell 2 EBF April $20 calls for $4.25 ($850)

That’s net $3,302 ($16.51/share) and 0.25 ($50) in dividends coming. $748 (22.65%) upside potential in 61 days!

Host Hotels & Resorts (HST)

-

-

Business: Largest U.S. lodging REIT, owns high‑quality hotel properties (Marriott, Ritz‑Carlton, etc.) in major markets.[finance.yahoo]

-

Dividend: Roughly 4.5–5.0% yield on regular dividends; distributions move with hotel cash flows.suredividend+1

-

Why it fits: Under $30, reasonably strong balance sheet versus many lodging REITs, levered to travel but not a “junk yield” name. Cyclical risk (recession, travel slowdown) is the main thing to watch.

-

The trade idea:

-

- Buy 500 shares of HST for $19.72 ($9,860)

- Sell 5 HST April $19.85 calls for $1 ($500)

That’s net $9,360 ($18.72/share) and, if over $19.85 in April, we collect $9,925 plus $100 in dividends is $10,925 for $1,565 (16.7%) upside potential if all goes well.

Target (TGT)

-

Business: Big‑box retailer with a national footprint, private‑label strengths, and omni‑channel (stores + digital) model.[finance.yahoo]

-

Dividend: About 3.8–4.0% yield on a dividend that’s been raised for 50+ consecutive years (Dividend King).divvydiary+1

-

Why it fits: Solid balance sheet, entrenched brand, and a history of managing through cycles. Near‑term risk is margin pressure from wage and price competition, but you’re getting paid to wait.

The trade idea:

-

- Buy 100 shares of TGT for $115.60 ($11,560)

- Sell 1 TGT May $105 call for $15 ($1,500)

Here we have a net cost of $10,060 and we get called away at $10,500 plus there should be a $114 dividend for a net upside potential of $554 (5.5%) in 90 days. Any time you are making an annualized 20% – you are going to be in good shape!

Ford (F)

-

Business: Legacy automaker with trucks, SUVs, and a growing (but volatile) EV/commercial business.[finance.yahoo]

-

Dividend: Around 4.0–4.5% yield on a regular dividend; occasionally pays specials when cash is strong.divvydiary+1

-

Why it fits: Cyclical, but cheap on earnings and cash flow with a long history of surviving ugly cycles. Main risks are EV transition costs, labor, and macro demand; income investors should size assuming auto cyclicality.

The trade idea:

Ford JUST paid out their 0.15 dividend but the stock is worth getting into:

-

- Buy 500 shares of F for $14.12 ($7,060)

- Sell 5 F May $14 calls for 0.85 ($425)

- Sell 5 F May $14 calls for $1 ($500)

That is net $6,135 and there’s a promise to buy 500 more shares for $7,000 if F is below $14 so potentially on the hook for $13,135 but, if OVER $14 in May (flat to where we are now) then you get back $7,000 + $75 in dividends for a net potential gain of $940 (15.3%).

Trade Ideas Summary Table

| Trade Idea | Amount Invested ($) | Upside Potential ($) | ROI (%) | Duration/Notes |

| Stellantis (STLA) – Put Sell | $10,000 | $3,200 | $32.0% | Through Jan 2028 |

| Stellantis (STLA) – Buy/Write | $6,250 | $750 | $10.0% | Approx. 4 months |

| GEO Group (GEO) – Buy/Write | $12,000 | $2,000 | $16.66% | Approx. 4 months |

| AT&T (T) – Paycheck Stack | $11,595 | $1,905 | $16.4% | 1 year |

| Ennis, Inc. (EBF) | $3,302 | $748 | $22.65% | 61 days |

| Host Hotels (HST) | $9,360 | $1,565 | $16.7% | By April |

| Target (TGT) | $10,060 | $554 | $5.5% | 90 days (20% Annualized) |

| Ford (F) | $6,135 | $940 | $15.3% | By May |

Note: For the STLA Put Sell, the “Amount Invested” represents the total cash commitment required to purchase the shares if assigned.

That’s putting $68,702 to work and, if all goes well, we should generate $11,662 (16.9%) profits – much of it ($6,557) in just 4 months.

I’m not telling you to jump right in on all this tomorrow but THIS IS A SYSTEM – it will still be here in 3 months so give us 3 months to show you it works – THEN you can invest your time learning it and THEN you can begin to transform your portfolio back into something that GROWS for you AND pays you enough to live on.

- Deep Dive Podcast for Retirees: https://share.transistor.fm/s/df38c178

Video Explainer: