Well, what did you think "Top of Range" meant?

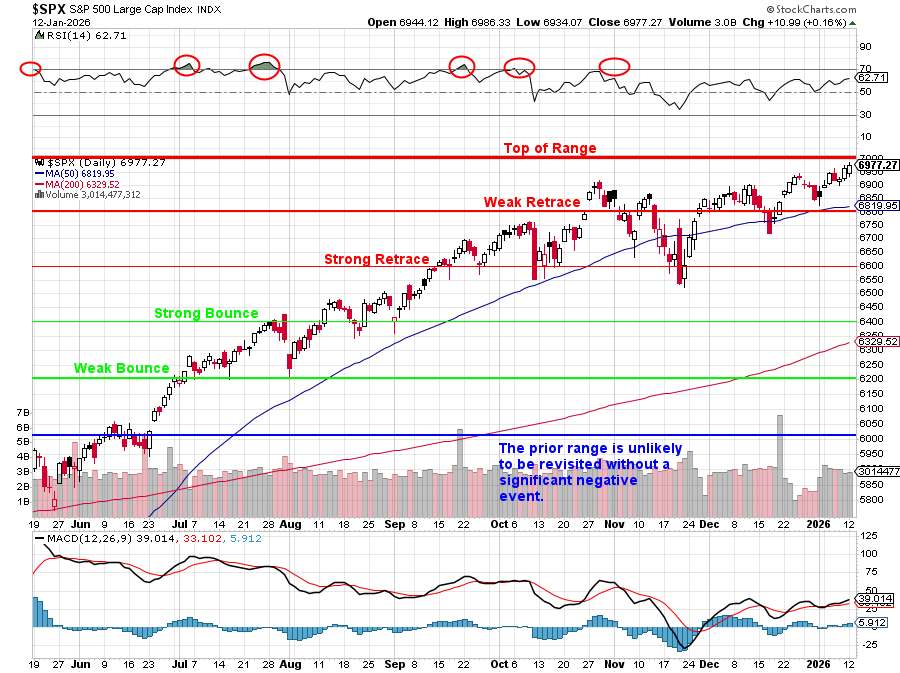

This was the S&P 500 chart from our Jan Portfolio Review(on the 13th) when I said:

"Last month, the S&P 500 was at 6,800 on the nose and, since our Dec 17th Review, we are up 177 points (2.6%) – just 23 points from 7,000 which is, unfortunately, the top of our predicted range for the S&P 500 for 2025 and, so far, we have not seen any good reasons to raise our levels for 2026. Of course, Q1 earnings start this week so maybe they’ll be better than we expect and also – there’s nothing unusual about overshooting the range by a segment (200 points in this case) or even two – so we could keep going – but a retrace is more likely. "

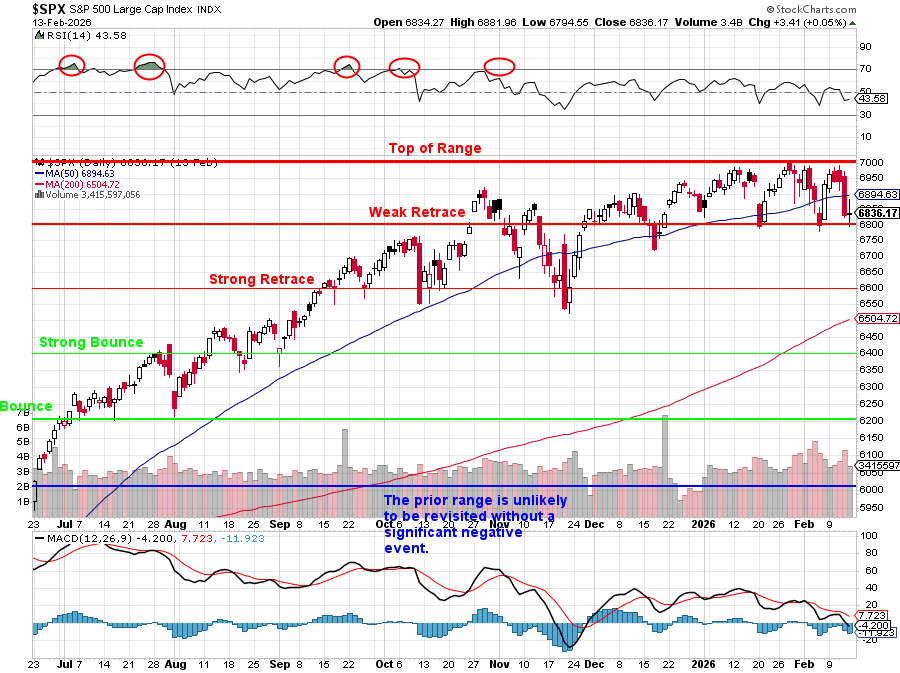

We doubled our hedges and covered our positions and, of course, we focused our short plays on the 40x earnings, overbought Nasdaq 100 for ALL the obvious reasons I've been talking about since we built our new Watch List (s) at Thanksgiving. In fact, our Trade of the Year for 2026 is Pfizer (PFE) - a safety stock!

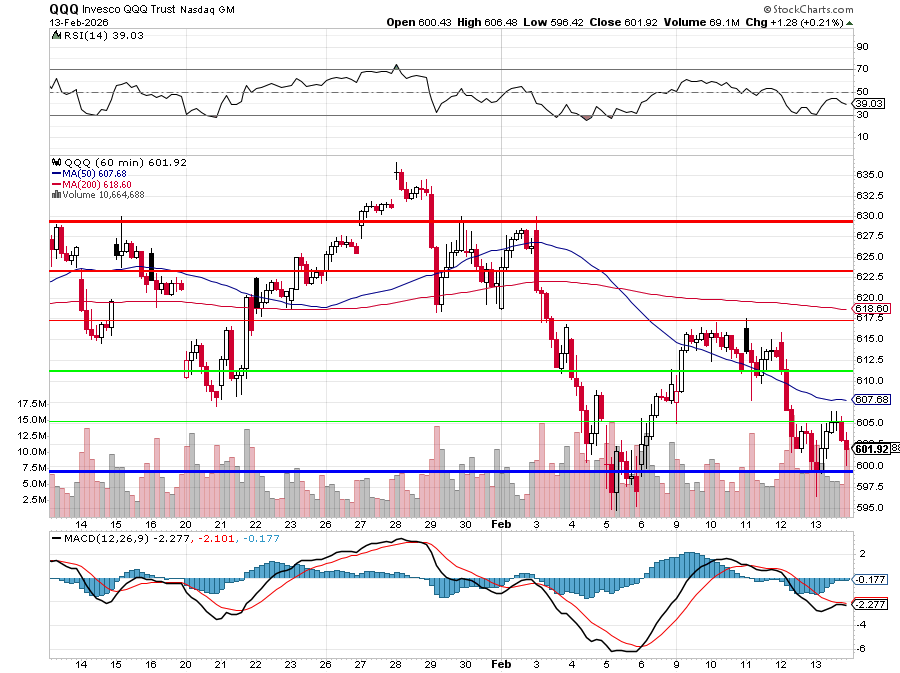

Not only are we re-testing 6,800 on the S&P 500 this week but also the dreaded 600 level on QQQ, the ETF for the Nasdaq 100, which failed it's critical 25,000 line for the 2nd time this month and now, with the SPX, threatens to crack back towards the Strong Retrace line - another 5% drop from here!

Nonetheless, at the moment, we're looking at this as more of a buying opportunity for our Watch List candidates - as well as our Top 20 List and our Bonus 10 List picks and now Anya has given us 9 more stocks in yesterday's "🏰 The AGI Round Table: Mid-Month State of the Union – Day 47 of 2026.