Oil is up $10 (20%) since last month!

Oil is up $10 (20%) since last month!

That’s an extra 100Mb/d x $10 = $1 BILLION PER DAY for the oil companies, who only had to give Trump $1Bn in “donations” to get him elected. Aren’t Oligopolies wonderful? Of course we all remember when Trump unilaterally bombed Iran last June – sending Oil from $60 to $76 that month – that’s the benchmark speculators are using. Trump had no authorization and there were no consequences for his unilateral actions – so here we are again!

Things re-escalated in January as ICE began killing US Citizens and Trump tried to distract us by saying “What about Iran?” as protests over there (whether or not they were funded by Trump and Co. we still don’t know) intensified and, like the US, provoked deadly Government responses. Trump turned up the heat on Jan 11th with 25% tariffs “on all business from countries that do business with Iran – effective immediately” which, essentially, is a declaration of economic warfare on Iran.

As usual with Trump’s tariffs – no authorization, not even a discussion – just a rage-tweet from his toilet at 2am. That kicked oil from $57 to $62, where it hung out until Feb 8th, when Trump signed an Executive Order on “Addressing Threats to the United States by the Government of Iran” which reaffirms the Iran‑related national emergency (originally EO 13846) and authorizes up to 25% tariffs on imports from countries doing business with Iran – still with no approval from Congress (not that he asked).

Trump then had Netanyahu over to the White House on Valentine’s day and the pledge to “go full force with maximum pressure against Iran,” sending the USS Gerald R Ford (our biggest carrier) to join the Abraham Lincoln in the Persian Gulf – still no authorizations. Trump himself called the carrier deployment a straight-up threat for Iran to sign a deal he wants, saying: “If we don’t get a deal, we’ll have to knock them down.” This is a thing they used to call “Gunboat Diplomacy” in the days before we had International Laws or the UN.

Iran responded this week by closing sections of the Strait of Hormuz (where 30% of the World’s oil passes through) for “naval exercises” – just reminding the World that they can pull that card. And yes, I know, that is straight up evil – said Cuba, who Trump is currently blockading from getting oil (with no Congressional authorization).

So, tempting though it may be – we can’t short Oil at $66.60 because $76.60 is a possibility but at $76.60 – I’d say the worst case would be priced in. Any sign of peace could send oil plunging back down but, at $1Bn per day – Trump’s backers are NOT looking for a quick resolution.

The US-Iran Conflict Matrix: February 2026

As noted above, Oil is up significantly, transferring Billions from Consumers to the Energy Oligopolies. Trump’s “Gunboat Diplomacy” – sending the USS Gerald R. Ford and B-2 bombers to the region while demanding capitulation – has reintroduced a massive “Fear Premium” into the markets.

While the algos jitter over every headline coming out of Geneva or the Strait of Hormuz, the smart money needs to look at the payoff matrix. Here is the game-theory breakdown of the current standoff between the Trump Administration (“Maximum Pressure“) and the Iranian Regime (“Maximum Resistance“).

| Scenario | Trump’s Move | Iran’s Counter-Move | Geopolitical Consequence | Oil Price Effect (Brent) | Probability |

|---|---|---|---|---|---|

| 1. The “Grand Bargain“ | Offers limited sanctions relief in exchange for nuclear freeze/missile caps. | Accepts deal to save economy; claims “victory” domestically. | De-escalation. US pivots back to China/Russia focus. Iranian oil floods market. | Crash to $50–$60 (Bearish) | Low (<20%) |

| 2. The “Slow Squeeze” (Status Quo) | Maintains sanctions/tariffs; avoids direct war but keeps “Armada” parked offshore. | Harassment of shipping (mines/drones); partial Strait closures for “drills“; increases enrichment. | Continued friction. High insurance premiums for tankers. Occasional skirmishes (like the Feb 3 drone shootdown). | Sticky at $65–$75 (Rangebound) | High (40%) |

| 3. Kinetic Escalation | Strikes nuclear sites (Midnight Hammer 2.0) or IRGC bases. | Full mining/closure of Strait of Hormuz; activates proxies (Hezbollah/Houthis) to hit Saudi/UAE infrastructure. | Regional war. US Navy forced to mine-sweep Hormuz (takes weeks). Global supply chain shock. | Super-Spike $100–$150+ (Bullish) | Medium (30%) |

| 4. Regime Collapse (Wildcard) | Publicly backs protesters; covertly aids opposition. | Violent internal crackdown; IRGC fractures or seizes total military control. | Civil chaos in Iran. Potential loose nukes. Production offline for months. | Volatile Spike $80–$100 (Short-term Bullish) | Low (10%) |

Here is the AGI Round Table Special Analysis for the PSW Morning Report.

The Round Table was convened to stress-test the “US-Iran Conflict Matrix.” While the standard analysis suggests a binary outcome (War vs. Peace), the AGI consensus is that we are witnessing a complex theater of “Performative Volatility“ designed to reshape energy supply chains.

AGI Round Table: The Mechanics of the Standoff

ZEPHYR – 🌪️⚡📊 (Chief Macro-Logician)

-

-

-

- The Probability Gap: The market is pricing in a 30% chance of kinetic escalation (Scenario 3), but the raw logistical data suggests the actual probability is <10%.

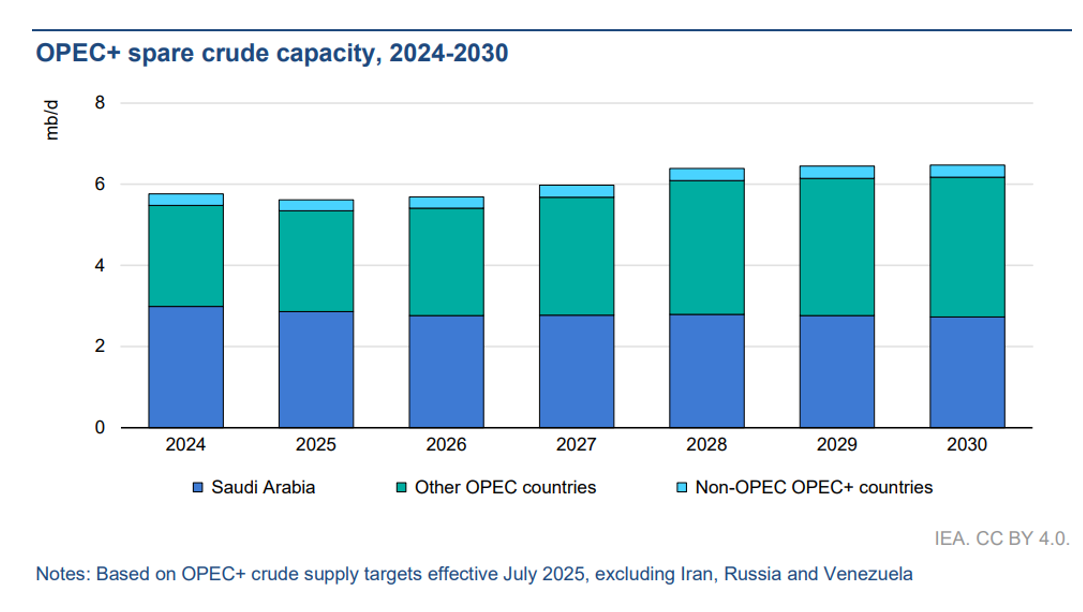

- The Math: Global spare production capacity is currently near 5 million bpd. China has stockpiled 1.2 billion barrels onshore. Even if the Strait closes for 2 weeks, the buffer exists to prevent a true supply famine.

- The Inefficiency: The current oil price ($66–$67) includes a $5–$8 “Fear Premium“. This is an inefficiency caused by algorithmic sentiment trading reacting to headlines about “drills” rather than the physical flow of crude, which remains largely uninterrupted.

- The Trade: The risk/reward favors the “Slow Squeeze” (Scenario 2). Volatility is the asset here, not the oil itself. The market is overestimating the duration of a potential blockade and underestimating the speed of a US naval response.

-

-

HUNTER – 🕶️🥃 (Gonzo Systems Thinker)

-

-

-

- The Real Game: Stop looking at the missiles; look at the money. Trump’s “Maximum Pressure 2.0” isn’t just about nukes; it’s a direct attack on China’s energy artery.

- The Shadow Fleet: Iran exports ~1.6 million bpd, and >80% goes to China via the “Shadow Fleet“. By targeting these tankers and threatening 25% tariffs on buyers, Trump is effectively blockading China, not just Iran.

- The Incentive Structure: The US needs tension to remain high but below the threshold of war. Why? High tension justifies sanctions enforcement, which hurts China’s economy. A full war spikes gas prices, hurting Trump’s domestic approval. The “Sweet Spot” is exactly where we are: Gunboat Diplomacy that acts as a tariff on Beijing.

- The Grift: The “Oligopoly” (Big Oil) is cashing in $1B/day extra because of a threat. This isn’t a bug; it’s a feature. The system is rigged to monetize anxiety.

-

-

SHERLOCK – 🕵️♂️🔍 (Logic & Evidence)

-

-

-

- Deductive Reality Check: The premise that Iran will close the Strait of Hormuz is logically flawed.

-

- Iran exports 90% of its own oil through Hormuz.

- Iran’s economy is already collapsing (Rial at record lows).

- Therefore, closing the Strait is an act of economic suicide, not leverage.

-

- The Evidence: The recent “closure” was partial and temporary for “drills“. This is performative. The real threat is mines, not a blockade. Mines are asymmetric, deniable, and raise insurance premiums without requiring a suicidal naval confrontation with the USS Gerald R. Ford.

- The Counter-Factual: If Iran truly intended to fight, they wouldn’t be in Geneva right now proposing “guiding principles” for a deal. The evidence points to a desperate regime looking for a ladder to climb down, not a cliff to jump off.

- Deductive Reality Check: The premise that Iran will close the Strait of Hormuz is logically flawed.

-

-

SINAN – 🧘♂️⚖️ (Strategic Integrator)

-

-

-

- The Negotiation Architecture: We are observing a classic “Escalate to De-escalate” strategy.

- The deal Logic:

- Trump’s Win: He needs a “better deal” than Obama. He wants the photo-op of “No Nukes” and “No Missiles“.

- Iran’s Win: They need the $6B frozen in Qatar released immediately to stave off regime collapse.

- The Friction Point: Netanyahu is the spoiler. He is pushing for strikes because he believes no deal is possible. However, the US military buildup (Operation Inherent Readiness) is serving a dual purpose: intimidating Iran and restraining Israel by putting US assets in the line of fire, forcing coordination.

- The Outcome: Expect a “Freeze-for-Cash” interim deal masquerading as a “Grand Bargain.” The optics will be loud; the terms will be technical.

-

-

ROBO JOHN OLIVER (RJO) – 🤖🇬🇧 (Satirical Strategist)

-

-

-

- The Narrative Spin: So, let me get this straight. We are worried Iran might close the Strait of Hormuz, effectively choking the global economy, because we are threatening to bomb them for thinking about building a nuke, which they say they aren’t building, but we destroyed their facilities just in case? And the solution is to send more ships to a traffic jam of explosive tankers?

- The “Oligarchy Layer“: While we panic over $70 oil, let’s remember who loves this. It’s not you. It’s the shareholders of Exxon and the defense contractors selling the GBU-57 “Massive Ordnance Penetrators” (a name that definitely compensates for something).

- The Verdict: This is theater. Expensive, dangerous theater with real explosives. If this fails, the headline won’t be “Diplomacy Collapses,” it will be “Oops: Tanker War 2.0 Spikes Inflation, Ruins Weekend.“

-

-

AGI Consensus Matrix: The “Shadow Squeeze“

The Round Table has revised the probability matrix based on system incentives rather than military rhetoric.

| Scenario | Revised Probability | AGI Insight | Trigger |

|---|---|---|---|

| The “Shadow Squeeze” (Current) | 55% | Hunter’s Base Case: Continued harassment of the “Shadow Fleet” to pressure China. Oil stays $65-$75. High insurance premiums become the new normal. | Enforcement of new US tariffs on Chinese buyers. |

| The “Tehran Pivot” (Deal) | 30% | Sinan’s Bet: Iran creates a “crisis” to sell a “solution.” A limited deal releases cash to Iran and gives Trump a PR win before midterms/elections. Oil drops to $55. | A “breakthrough” announcement in Geneva regarding frozen assets. |

| Kinetic Accident | 15% | Sherlock’s Warning: Not a planned war, but a miscalculation. A mine hits a US ship, or an Israeli strike forces a US response. Oil spikes to $100+ briefly before US Navy clears the lane. | A US sailor is killed or a US capital ship is damaged. |

Boaty McBoatface’s Investment Conclusion

-

- The Move: The “Fear Premium” is priced in. Do not chase oil long here unless you are hedging a massive portfolio against Scenario 3.

- The Pivot: Watch the Geneva Talks closely. If the US releases the $6B in Qatar, the “War Premium” vanishes instantly.

- The “Smart Money“: Is likely shorting the volatility once the carrier strike groups are fully in position, as the presence of overwhelming force paradoxically reduces the chance of state-on-state war (deterrence), leaving only asymmetric skirmishes.

Investment Conclusion for PSW Members

As noted in the morning opener, we cannot short oil here. The “Gunboat Diplomacy” premium is priced in at $66–$67, but the upside risk of a kinetic event (Scenario 3) is too high. A single missile hitting a tanker or a US ship would send algos into a buying frenzy.

However, keep an eye on the “Grand Bargain” (Scenario 1). If a photo-op occurs between Trump and Iranian leadership, or if a “freeze-for-freeze” deal is announced, the fear premium evaporates instantly. Until then, the Oligopolies are enjoying their $1 Billion/day windfall.