Sure we had a small sell-off yesterday after the Fed (and we made over $4,000 just on our Nasdaq (/NQ) shorts during our Live Trading Webinar!), as we expected but this morning the markets are back to their usual pre-market pumping with /NQ right back to 7,250, which is right where we began shorting the Nasdaq in yesterday morning's Report.

Along with riding the Nasdaq to 7,210 for an $800 per contract gain, the S&P (/ES) Futures fell from our 2,790 shorting line back to 2,775 and that was good for $750 per contract gains while the Russell (/TF) fell from 1,685 back to 1,677 and that was good for gains of $400 per contract so, all in all – it was a fun day trading the futures and contratulations to all our Webinar participants.

We can't short this morning, even tough we're back to the same(ish) levels as we don't have that downside catalyst from the Fed though I am very surprised the market is just shaking off the FACT of a rising rate environment. What will it take to get this market to correct? Robert Mueller filed a request yesterday for 150 subpeonas – I know we're supposed to pretend politics have nothing to do with investing but don't you think that might be a little disruptive?

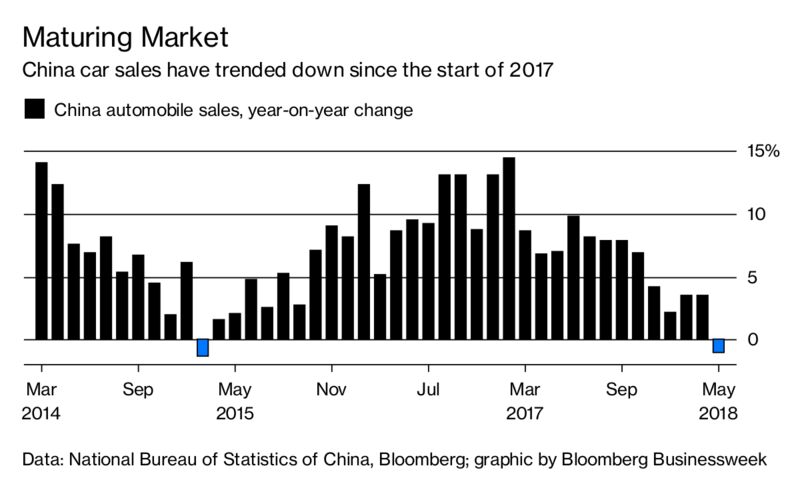

If indicting half the Government doesn't bother you, how about China missing the mark on both Industrial Output and Retail Sales? Fixed Asset Investment Growth was also lite at 6.1% vs 7% expected. Chinese Auto Sales posted the first negative change since March of 2015 and their market corrected 20% into 2016 after that. Maybe this time is different – I sure hope it isn't the same.

The Hang Seng was down 1% this morning, as was the Nikkei but our markets don't seem to care – that's stuff that's happening in other countries we either hate or won't let into our country, so who cares? LMC Automotive forecasts that, in addition to falling demand for cars in China, Japan and Europe, Trump's tariffs are also likely to knock out 10% of US Auto Sales – and that's before any retaliation from the G6. While selling less cars, the aluminum and steel tariffs are going to increase costs to auto makers substantially yet, so far, investors are ignoring these headwinds.

Our own Retail Sales blasted higher in May, up 0.8% vs 0.4% expected at $502Bn but it was mostly gasoline, which was up 12.4% and makes up 10% of Retail Sales so + 1.2% from gasoline and all other retail sales subtracted 0.4% so yay, I guess, for the people who don't know how to parse a report which is, unfortunately, pretty much everybody!

In fact, Cramer is squeaking over how great the Retail Sales number and telling the CNBC viewers they should run out and overpay for bubble stocks because this time is truly different. Actually, this report is a great example of how damaging high gas prices are as consumers are simply paying more money to get the same output from their vehicles and that, in turn, forces them not to spend money on other things. 0.8% of $502Bn is $4.016Bn and last month Gasoline sales were $41.979Bn and this month they are $46.387Bn – up $4,408Bn – that's the entire month/month gain as well!

In fact, Cramer is squeaking over how great the Retail Sales number and telling the CNBC viewers they should run out and overpay for bubble stocks because this time is truly different. Actually, this report is a great example of how damaging high gas prices are as consumers are simply paying more money to get the same output from their vehicles and that, in turn, forces them not to spend money on other things. 0.8% of $502Bn is $4.016Bn and last month Gasoline sales were $41.979Bn and this month they are $46.387Bn – up $4,408Bn – that's the entire month/month gain as well!

Overall, wages are getting lower under Trump, dropping dramatically since the GOP Tax Cuts were passed in December and down 0.18% for the year – the second consecutive down year for wages after 4 years of recovery under Obama. I'm not allowed to have an opinion on that if I want to see this article published at Seeking Alpha so you'll have to draw your own conclusions – probably just a coincidence or perhaps even "fake news".

Lower wages are great for Corporations but they suck for humans and a study by the National Low Income Housing Coalition just found that there is NO affordable housing in the United States (defined s requiring less than 30% of your income) for median-income workers (the bottom 50%). In New York, California and Washington DC – you have to earn over $30 an hour to afford a 2-bedroom rental.

From the report (emphasis added):

A full-time worker earning the federal minimum wage of $7.25 needs to work approximately 122 hours per week for all 52 weeks of the year, or approximately three full-time jobs, to afford a two-bedroom rental home at the national average fair market rent. The same worker needs to work 99 hours per week for all 52 weeks of the year, or approximately two and a half full-time jobs, to afford a one-bedroom home at the national average fair market rent.

In no state, metropolitan area, or county can a worker earning the federal minimum wage or prevailing state minimum wage afford a two-bedroom rental home at fair market rent by working a standard 40-hour week. In only 22 counties out of more than 3,000 counties nationwide can a full-time minimum wage worker afford a one-bedroom rental home at fair market rent. These 22 counties are all located in states with a minimum wage higher than $7.25. Higher minimum wages are important, but they are not the silver-bullet solution for housing affordability.

Bernie Sanders wrote a preface to the report saying "It is unconscionable that in the richest country in the world, workers cannot find an affordable place for their families to live."

At least someone cares…