/SI/Tommy - But it's on a weak Dollar so we have to wait for the Dollar to bounce and see where /SI bottoms out. Could get worse.

Gold is holding up well though as Central Banks are hoarding it again.

INTC/Mike - You would think $45.50 is cheap enough as that's just over $200Bn and they dropped $21Bn to the bottom line last year and this year is guided lower but only about 5% lower though now we're back to the 2018 avg price so maybe it's the mover to $59 that was silly, not the move back to $45.

| Year End 29th Dec | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | TTM | 2019E | 2020E | CAGR / Avg | |

| $m | 52,708 | 55,870 | 55,355 | 59,387 | 62,761 | 70,848 | 70,843 | 68,660 | 71,693 | +6.1% | |

| $m | 12,291 | 15,347 | 14,002 | 13,133 | 18,050 | 23,316 | 23,020 | +13.7% | |||

| $m | 9,620 | 11,704 | 11,420 | 10,316 | 9,601 | 21,053 | 20,573 | 19,606 | 20,491 | +17.0% | |

| $ | 1.89 | 2.31 | 2.33 | 2.12 | 3.10 | 4.41 | 4.36 | +18.5% | |||

| $ | 1.92 | 2.36 | 2.39 | 2.40 | 3.16 | 4.40 | 4.35 | 4.29 | 4.58 | +18.0% | |

| % | -9.8 | +22.6 | +1.4 | +0.4 | +31.6 | +39.2 | +24.3 | -2.43 | +6.54 | ||

| x | 10.6 | 10.7 | 10.9 | 10.2 | |||||||

| x | n/a | n/a | 1.66 | 1.83 | |||||||

| Profitability | |||||||||||

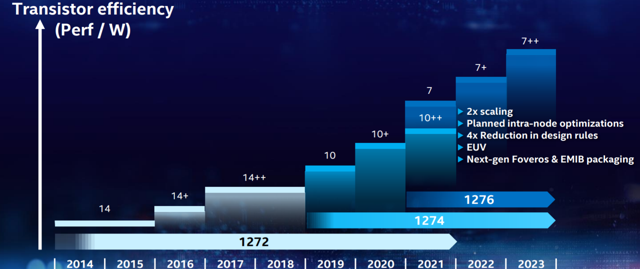

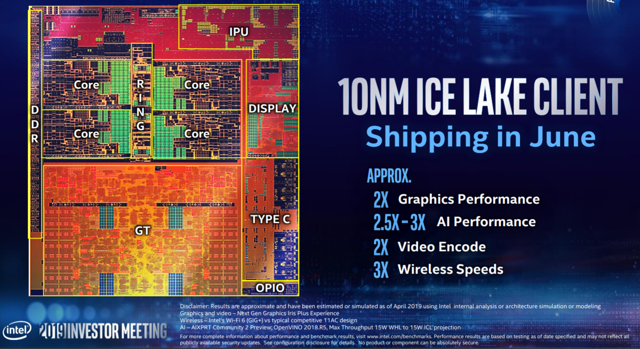

INTC tends to grow in spurts and their guide-down was related to the retooling they are doing to launch 10nm chips in 2020 and 7nm chips in 2021 (with Xe graphics that are supposed to be amazing). Coming out with 2 layers of massively better chips tends to depress current sales (companies put off buying now for better chips next year)

Also, keep in mind that this is a company spending $13Bn a year on R&D - if they ever need to hit their numbers, a very small R&D cutback would do the trick.