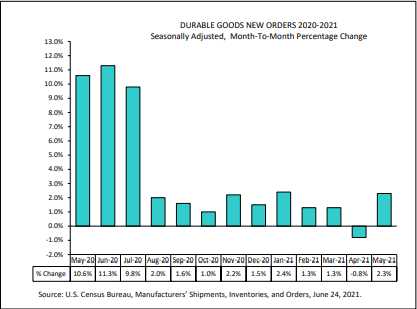

WHR is, of course, what the Durable Good Report is all about - home appliances.

The numbers have not been thrilling but WHR is kicking ass with near record profits last year and certainly this year.

| Year End 31st Dec | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | TTM | 2021E | 2022E | CAGR / Avg |

|---|---|---|---|---|---|---|---|---|---|---|

|

$m

|

20,891 | 20,718 | 21,253 | 21,037 | 20,419 | 19,456 | 20,489 | 21,844 | 21,816 | -1.41% |

|

$m

|

1,242 | 1,368 | 1,136 | 279 | 1,571 | 1,623 | 1,981 | 5.50% | ||

|

$m

|

783 | 888 | 350 | -183 | 1,184 | 1,081 | 1,362 | 1,504 | 1,378 | 6.66% |

|

$

|

9.83 | 11.5 | 10.3 | -2.93 | 19.5 | 17.1 | 21.4 | 11.7% | ||

|

$

|

12.5 | 14.3 | 13.5 | 6.68 | 16.3 | 20.4 | 24.7 | 23.8 | 23.2 | 10.4% |

|

%

|

+31.3 | +14.6 | -5.55 | -50.5 | +144 | +25.0 | +95.5 | +16.6 | -2.49 | |

|

x

|

10.9 | 9.03 | 9.36 | 9.60 | ||||||

|

|

0.656 | 0.542 | 3.10 | |||||||

Because the sector is out of favor, this baby has been thrown out with the bath water but $223 is only $14Bn in market cap for a company dropping $1.5Bn to the bottom line with probably 5% sales growth. They pay a 2.5% ($5) dividend but I just like the good old options play for the Long-Term Portfolio:

- Sell 5 WHR 2023 $200 puts at $25 ($12,500)

- Buy 20 WHR 2023 $200 calls for $42 ($84,000)

- Sell 20 WHR 2023 $230 calls for $28 ($56,000)

That's net $15,500 on the $60,000 spread that's currently $44,000 in the money. The upside potential is $44,500 (287%) at $230, which is very conservative. Of course we'll sell some short calls along the way but let's see earnings first. Selling just 5 Sept $230 calls for $7.50 would bring in $3,750 for 63 of the 553 days we have to sell, so we're in no hurry.