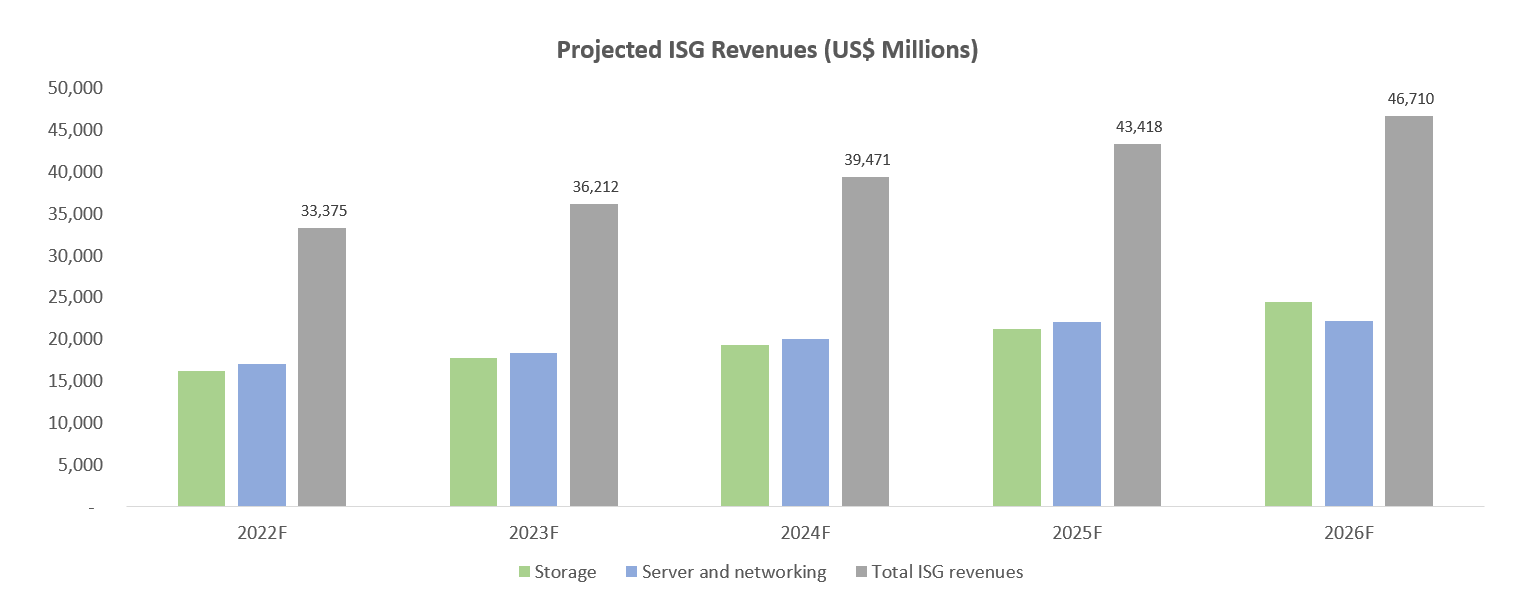

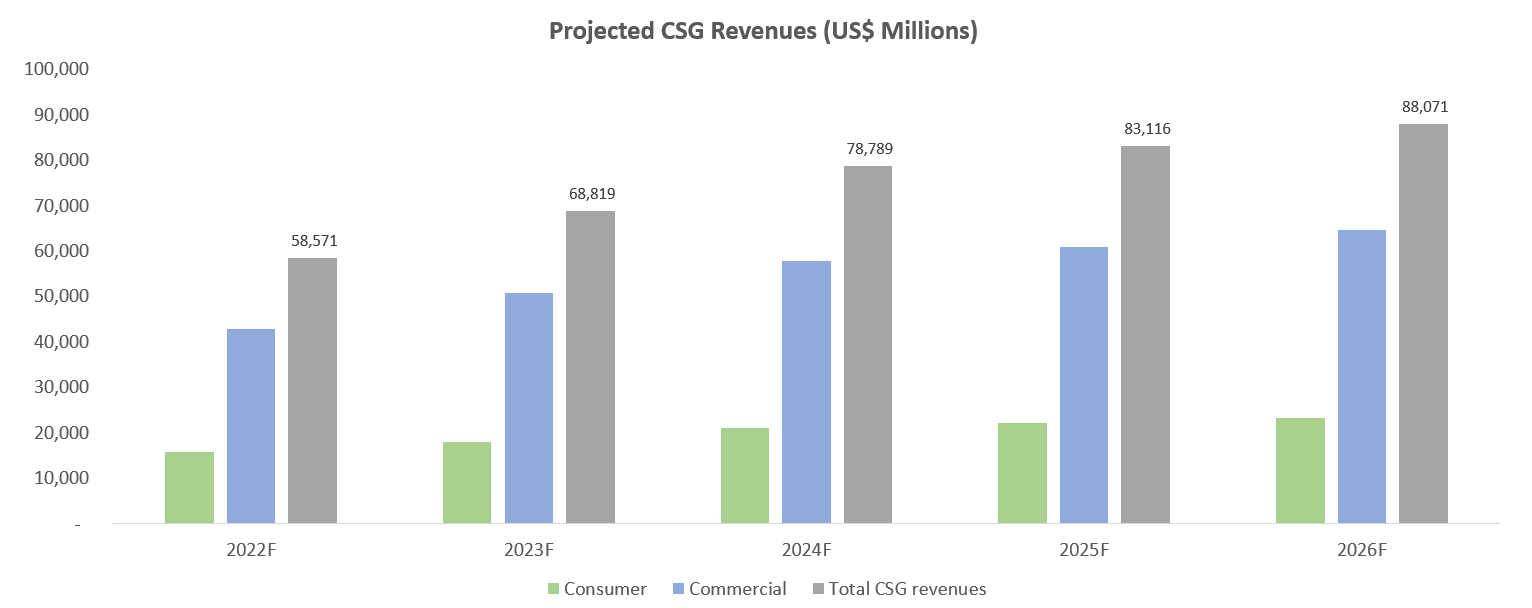

DELL/John - They are really not getting credit for their Solutions Group, which has improved margins greatly and essentially drives 80% of the revenues now but it's mixed in with hardware sales and people still think of them as a hardware company. Getting rid of VMWare in the fall really spooked investors and they are down about 20% but I agreed with DELL and think cloud has run it's growth course and I think they cashed out ($9.3Bn) on top there. They also went right back into cloud services with Apex - so I don't really see a negative getting out of VMW. They project good, solid growth in the Integrated Service Group and some short-term fast growth in Consolidated as well:

The bottom line is Dell projects $104.5Bn in revenues for 2023 (they are one of those companies that starts in Dec) with $5.2Bn in profits and that's very good for $37Bn at $49.50. Goldman just said this about them on Friday and sent the stock tumbling:

Dell Technologies (NYSE:DELL) shares fell slightly in premarket trading after Goldman Sachs downgraded the the IT company and removed it from its Conviction Buy List, citing outperformance and fundamental headwinds.

Analyst Rod Hall downgraded the stock to neutral from buy and lowered the price target to $61 from $68, noting that since Dell completely spun out VMware (VMW), the value has been unlocked.

"We continue to believe DELL remains inexpensive compared to its peers, but we see increasing fundamental headwinds hindering this value unlock," Hall wrote.

Lowering their target to $61 shouldn't stop us from buying them under $50, right? I wouldn't want to get too crazy but, in the LTP, we have no fear of owning 1,000 shares for $50 - so it's essentially free money to us to sell 10 of the 2024 $50 puts for $7.50.