SKT/John - I'm for buying more - people are idiots:

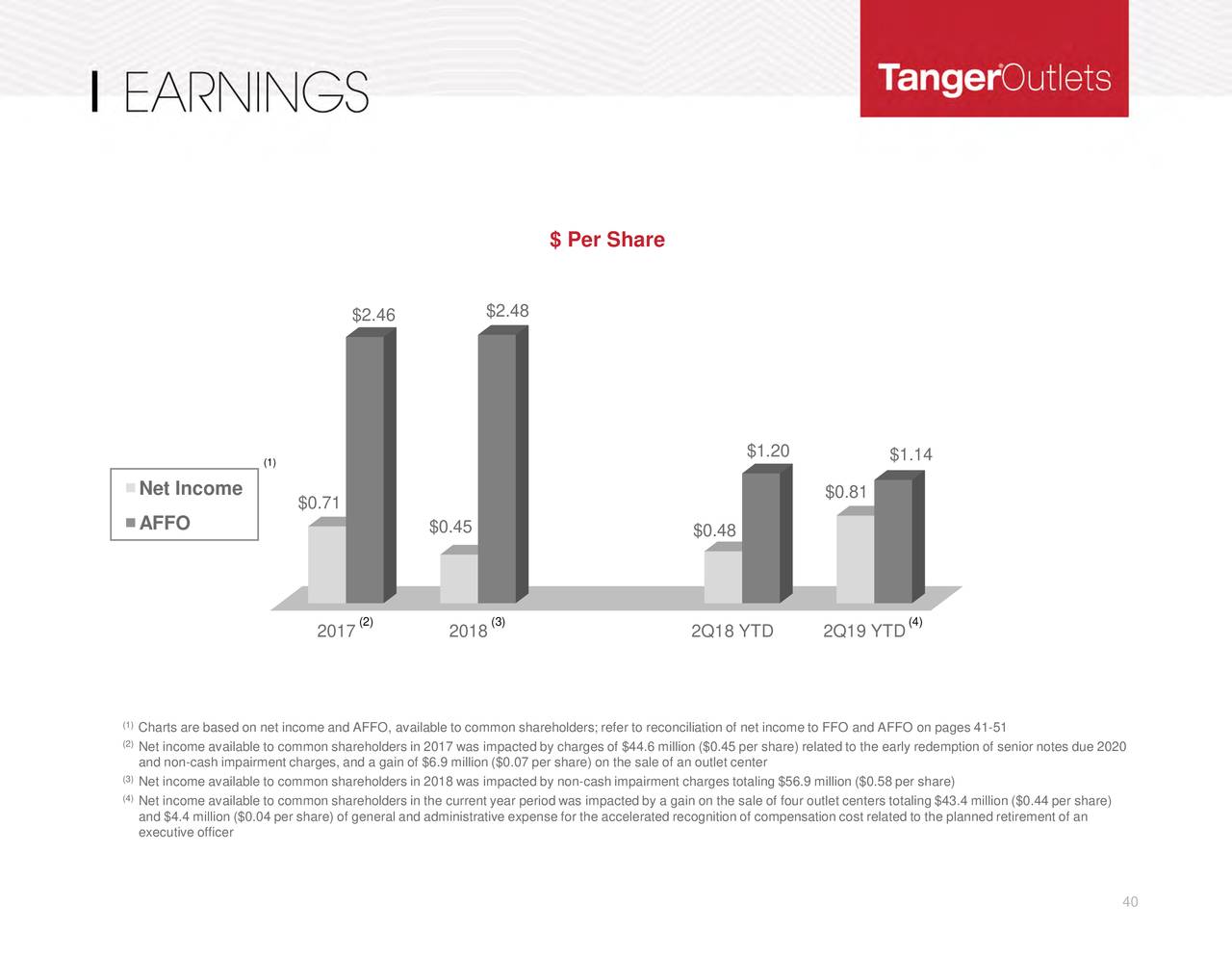

Tanger Factory Outlet Centers (NYSE:SKT) sees 2019 adjusted FFO per share $2.25-$2.31; compares with consensus estimate is $2.23.

Improves guidance for 2019 same-center NOI change to -1.50% to -2.25% from prior range of -2.00% to -2.75%, partly reflecting H1 outperformance.

SKT +0.6% in after-hours trading.

Q2 adjusted FFO per share of 57 cents, beating the average analyst estimate of 54 cents, compares with 60 cents in the year-ago quarter.

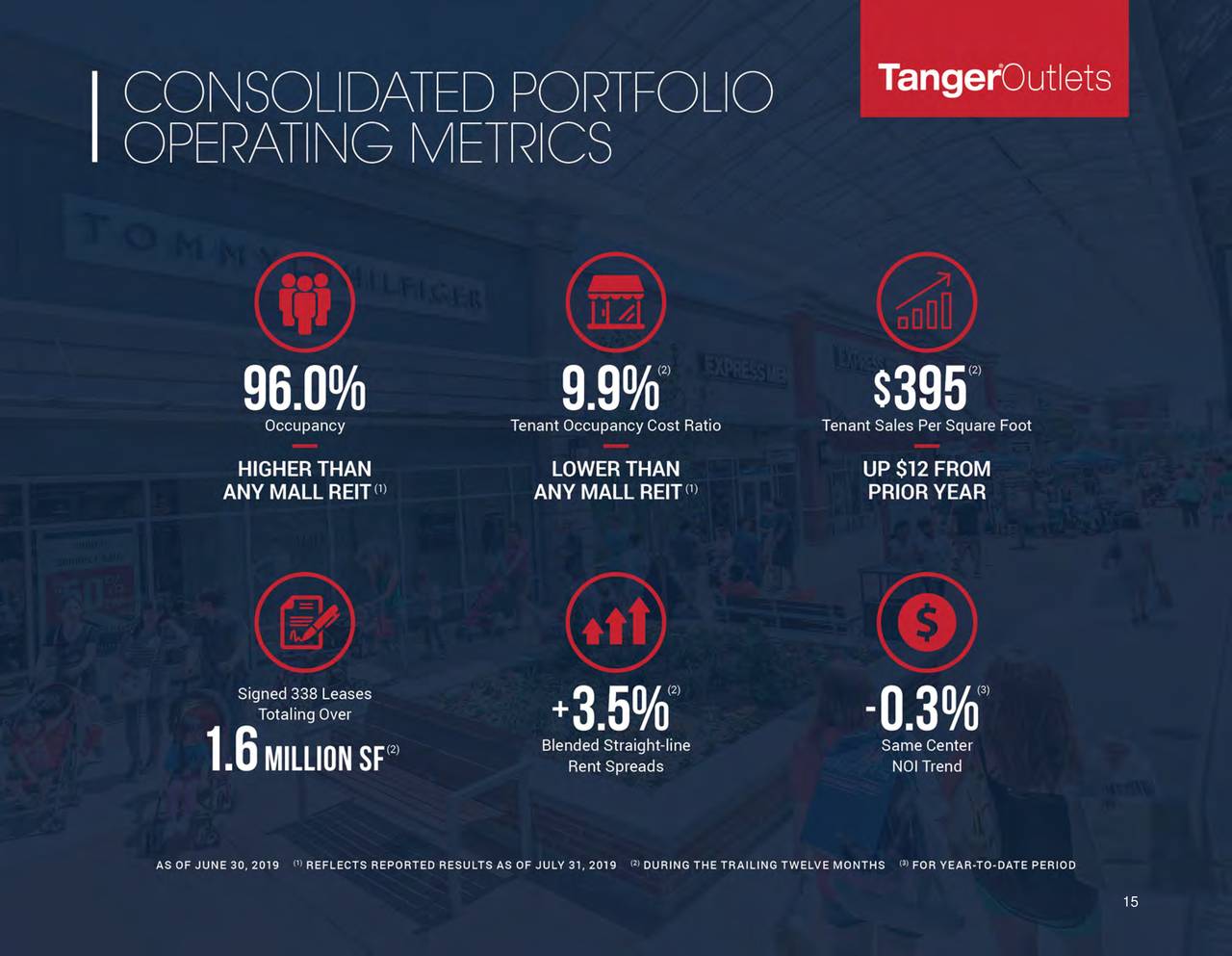

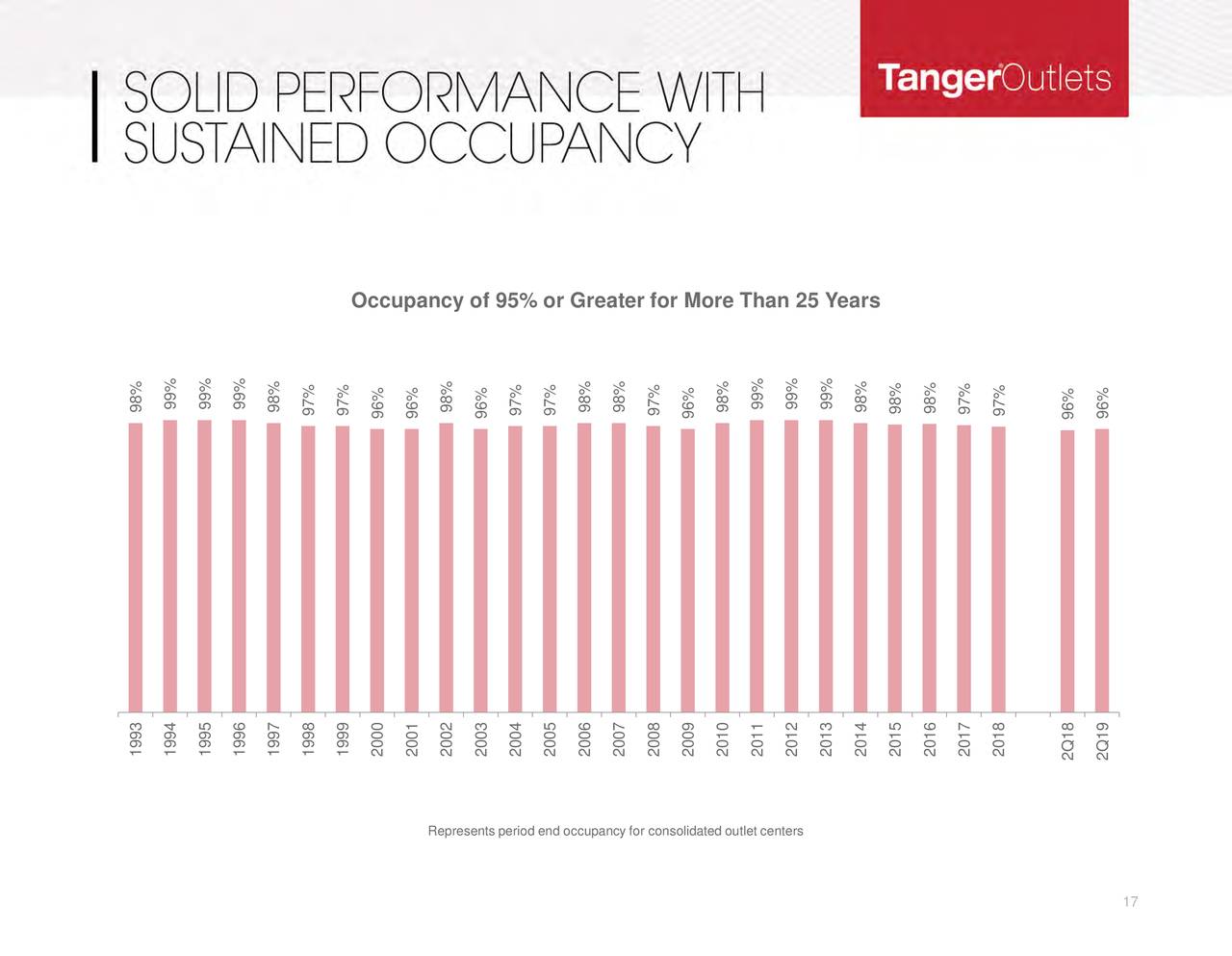

Consolidated portfolio occupancy rate was 96.0% on June 30, 2019 vs. 95.4% on March 31, 2019.

Q2 same-center NOI for the consolidated portfolio fell 0.1% and 0.3% YTD due to impact of prior bankruptcies, lease modifications, and store closures.

Conference call on Aug. 1 at 8:30 AM ET.

Previously: Tanger Factory FFO beats by $0.03, misses on revenue (July 31)

Occupancy fell from 95.9% to 95.4% and rents are down a bit with incentives due to their competition flooding the market with offers but, overall, the results are great.

In the LTP, our last adjustment was:

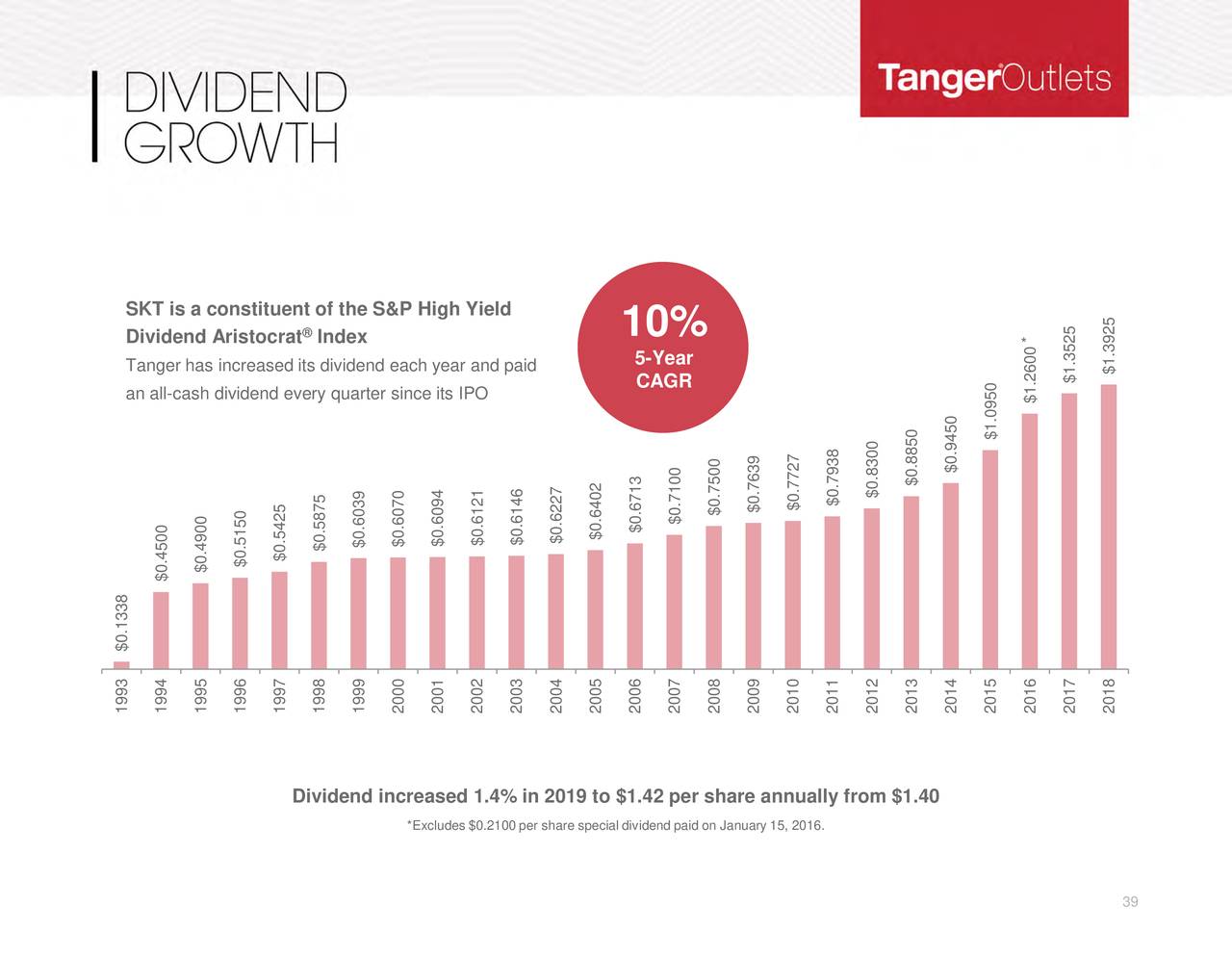

- SKT – I think they are very unfairly beaten down but it will be a long, slow recovery. Let's buy back the 20 short Jan $20 calls for 0.10 and we can roll the 20 short Jan $22.50 puts at $6.80 ($13,600) to 40 of the Jan $17.50 puts at $2.40 ($9,600) for net $4,000 as we don't mind owning more this cheap and we did make $8,000 on the short calls and we sold the $22.50s for $5,400 so $13,400 in our pockets would pay for 20% of the assignment – if that happens so really our net on 4,000 more shares would be about $14 – that's what we're promising to do with this move. Meanwhile, they are paying a $1.42/share dividend (7/30 is the next ex-date).