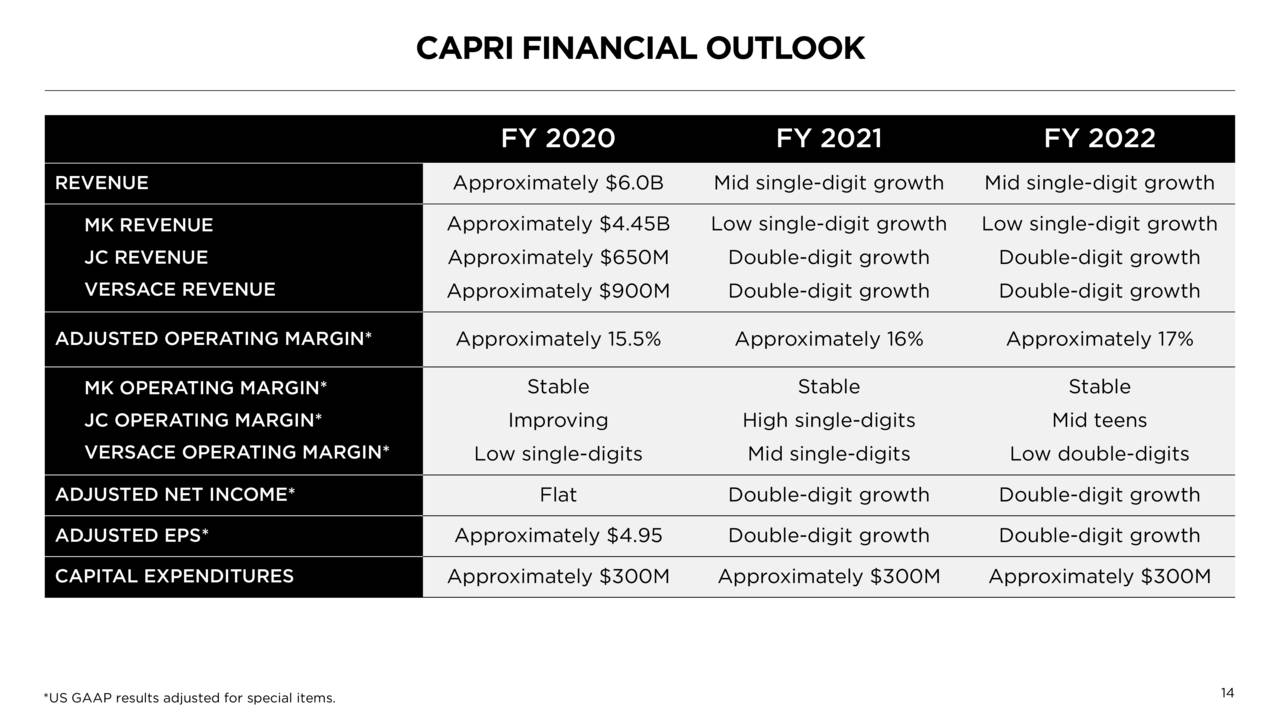

| Year End 30th Mar | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020E | 2021E | CAGR / Avg | |

| $m | 3,311 | 4,371 | 4,712 | 4,494 | 4,719 | 5,238 | 6,008 | 6,267 | +9.6% | |

| $m | 1,008 | 1,257 | 1,175 | 689.9 | 749.1 | 735 | -6.1% | |||

| $m | 661.5 | 881 | 839.1 | 552.5 | 591.9 | 543 | 761.4 | 828.8 | -3.9% | |

| $ | 3.22 | 4.28 | 4.44 | 3.29 | 3.95 | 3.58 | +2.2% | |||

| $ | 3.22 | 4.28 | 4.48 | 4.24 | 4.67 | 4.42 | 4.93 | 5.40 | +6.5% | |

| % | +63.1 | +32.9 | +4.6 | -5.5 | +10.3 | -5.5 | +11.6 | +9.62 | ||

| x | 7.50 | 6.72 | 6.13 | |||||||

| x | 0.65 | 0.70 | 0.58 | |||||||

| Profitability | ||||||||||

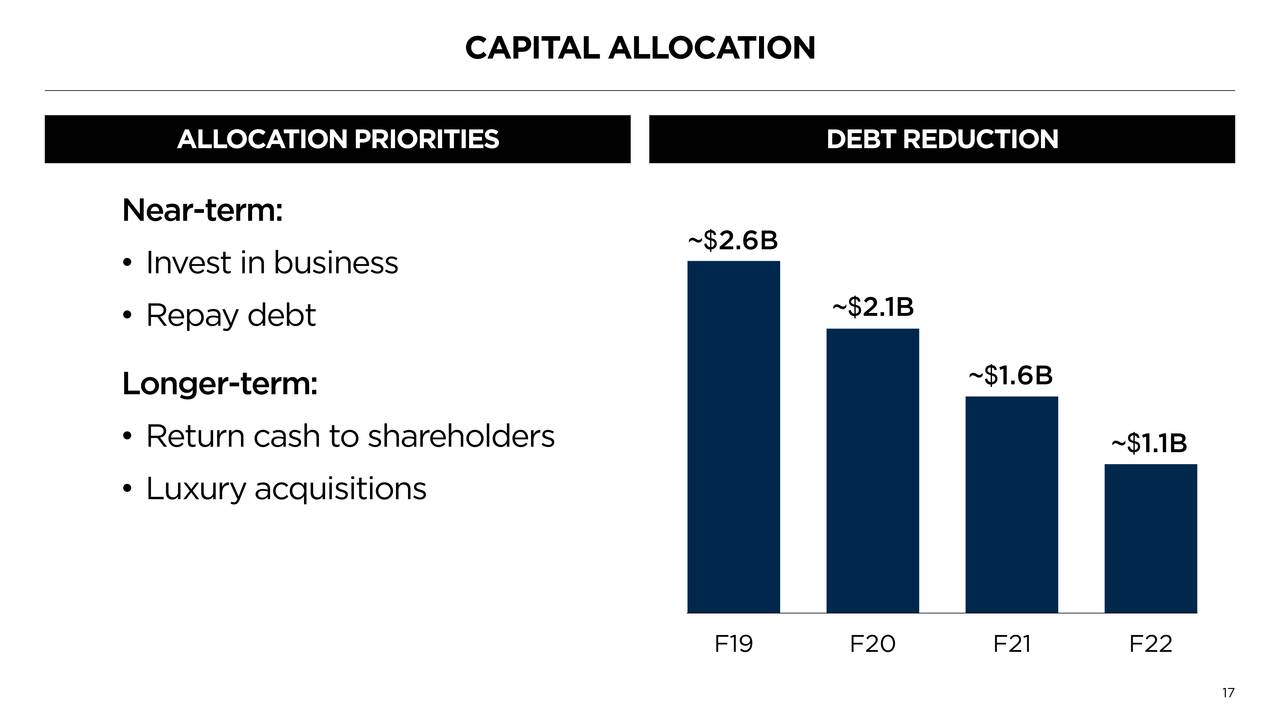

Fashion companies go in and out of fashion but the nuts and bolts of this company seem OK with $600M in profit on $6Bn in sales and the whole company is $5Bn at $33.75 so a reasonable enough play to play it the way we played RH for the LTP:

- Sell 10 CPRI 2021 $35 puts for $7.35 ($7,350)

- Buy 20 CPRI 2021 $30 calls for $9.50 ($19,000)

- Sell 20 CPRI 2021 $45 calls for $4 ($8,000)

That's net $2,650 on the $30,000 spread that's almost $8,000 in the money with a very conservative goal. If CPRI pops to $50, we can even sell a few quarterly calls for some income. The Oct $37.50s are $2 so if we sold just 5 that would put $1,000 in our pocket and 6 sales like that puts us deep into a credit on the spread - so we have that to look forward to. As it stands, the upside potential is $27,350 (1,032%) if they get back to $45. It is SO much more fun trading with a high VIX, right?