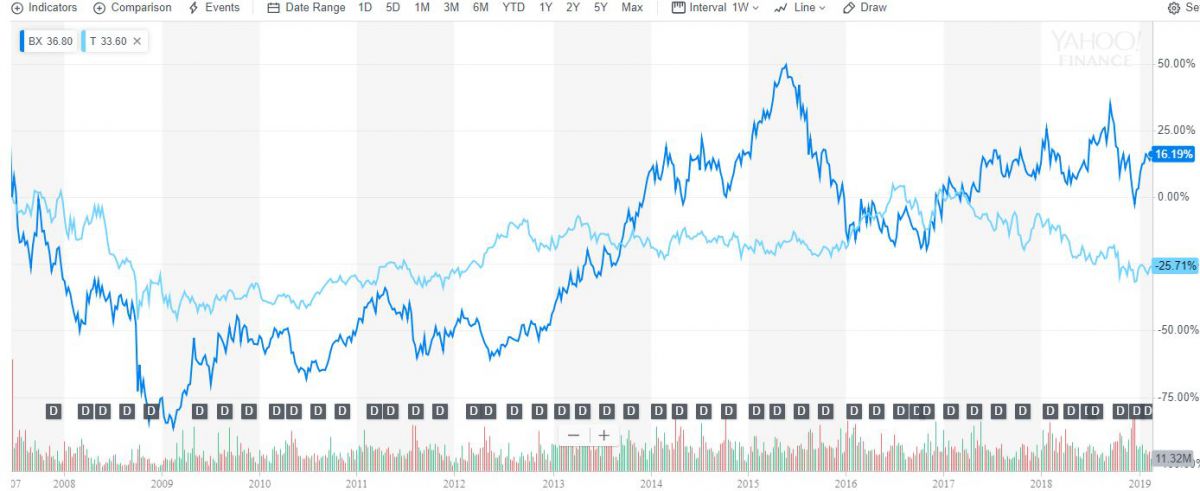

BX/QC - Well, they pay more dividends ($2.32 - 6.93%) than T ($2.04 - 6.62%) but "better has to include the risk factor and I think T at $30.83 is less risky than BX at $34 as their earnings very much go up and down with the market. T is underperforming now, which I call "cheaper" and note how T does not give you the highs or lows that BX gives you over time.

On the bright side though, BX is so volatile that you can sell 2021 $33 calls for $4.50 and 2021 $30 puts for $3.50, which knocks $8 (23.5%) off the entry price so net $26 and called away at $33 is $7 + $4.64 so $11.64 at $33 is 34.2% over two years.

Of course, you could blow off the dividend and just buy the $28 calls for $4.20, selling the same $8 put and call set for a net $3.80 credit on 2x (the same as you'd be assigned with 1x the stock and 1x the short puts) and then at $33 you make $13.80 without all that silly stock. That's how I'd go.

As we know from experience, it's a lot easier to roll and re-position a spread if the stock goes bad than a more standard covered share.

With T, the combination of their stability, the $30.83 stock and the 2021 $28 calls at $4.20 and the $30 puts at $4.15 knocks $8.15 off so net $22.68 makes $5.32 at $28 and $4.08 in dividends is $9.40, which is 41.44% at $30 and I sure don't mind owning T under $30 (see above chart) and we're talking an average of $26.32 if assigned.