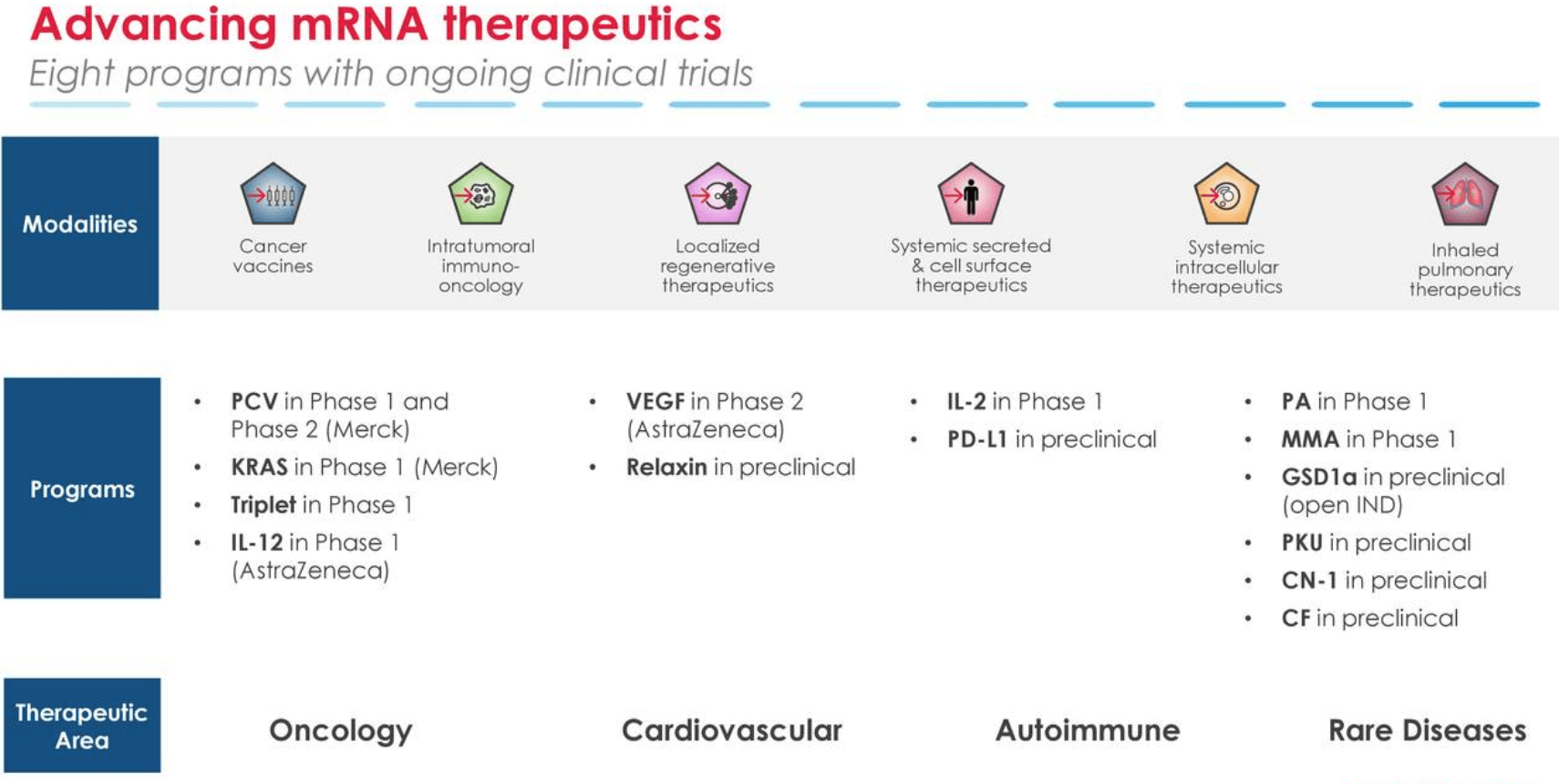

LLY expects to make $7.5Bn with their weight-loss pills but MRNA can come up with a vaccine so you don't gain the weight in the first place. That's not where Moderna's focus is, however, their current pipeline looks like this:

We'll hear more about it on their May 4th Conference Call but these were the original goals for the company – Covid was just a bonus that proved their methodology could lead to workable vaccines – why abandon them now? Traders (not investors) are certainly feeling the pressure as the stock is 66.6% off it's highs but that's a sign to invest, not divest.

All Biotechs are taking a beating this quarter and yesterday, in our Live Trading Webinar, we were discussing putting more eggs in fewer baskets and MRNA is still our favorite (not counting PFE) but we have a severe loss in our Long-Term Portfolio on that spread:

| MRNA Short Put | 2024 19-JAN 200.00 PUT [MRNA @ $142.43 $-3.36] | -5 | 10/5/2021 | (631) | $-12,500 | $25.00 | $54.18 | $-73.00 | $79.18 | $1.97 | $-27,088 | -216.7% | $-39,588 | ||

| MRNA Short Put | 2024 19-JAN 180.00 PUT [MRNA @ $142.43 $-3.36] | -10 | 1/13/2022 | (631) | $-40,150 | $40.15 | $23.75 | $63.90 | - | $-23,750 | -59.2% | $-63,900 | |||

| MRNA Long Call | 2024 19-JAN 150.00 CALL [MRNA @ $142.43 $-3.36] | 20 | 1/21/2022 | (631) | $120,000 | $60.00 | $-15.73 | $44.28 | $-0.73 | $-31,450 | -26.2% | $88,550 |

In context, of course, we promised to buy $280,000 worth of MRNA stock and we're down $82,288 though we did buy back the short calls with a net $24,000 gain so that's a net net $52,288 loss, which is only 20.8% of our commitment to $280,000 worth of the stock. Also, notice the stock is down 25% since January so we were better off with the options play than owning the stock. That's because our short puts were PROMISES to buy the stock if it got cheaper, rather than paying $200 at the time.