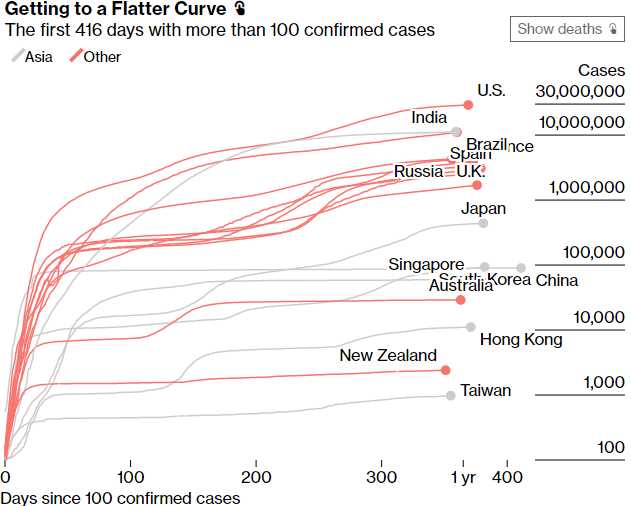

And, of course, keep in mind that China moved quickly to rapidly contain their pandemic so their economy wasn't as destroyed as our was thanks to Trump's denial of the virus and the problems it was causing. China still hasn't had their 100,000th infection despite hitting 80,000 last June while the US had 50,237 new cases yesterday.

And, of course, keep in mind that China moved quickly to rapidly contain their pandemic so their economy wasn't as destroyed as our was thanks to Trump's denial of the virus and the problems it was causing. China still hasn't had their 100,000th infection despite hitting 80,000 last June while the US had 50,237 new cases yesterday.

Globally, 312,051,418 of our 8,000,000,000 people have been vaccinated or, less than that - since that's the number of DOSES that have been administered, not the actual number of people. That's only about 3% for those of you keeping score (or planning on sending out orgy invitations).

There's another few Trillion Dollars that have to be spent. Figure at least $100 x 8Bn people is $800Bn right there and, since it's a Government project, triple that cost at least but it has to be done and it has to be done globally or all we will end up doing is wiping out the easy to kill strains of Corona and leaving the super-strains to fester in other parts of the World until they come back here to infect us again. No one's even talking about the next stage of the vaccination program because we don't have enough doses for our own orgies yet but it does need to be done - and soon!

That's why Pfizer (PFE) is still a bargain at $34.35 - the WHOLE WORLD needs to be vaccinated, not just the US. And we'll probably need to be re-vaccinated next year too. Yes, JNJ and MRNA are good too but it's PFE that's stupidly cheap at $34.35, which is a market cap of $191.5Bn for a company that made $16Bn in 2019 and $9.6Bn last year and projects $18Bn in earnings this year - and that doesn't even take into account the massive vaccine sales that are still a wild card.