BFI +1.72%May 17, 2022 11:12 AM ETBTIG stayed positive on BurgerFi International (NASDAQ:BFI +2.4%) after taking in the restaurant operator's earnings report.

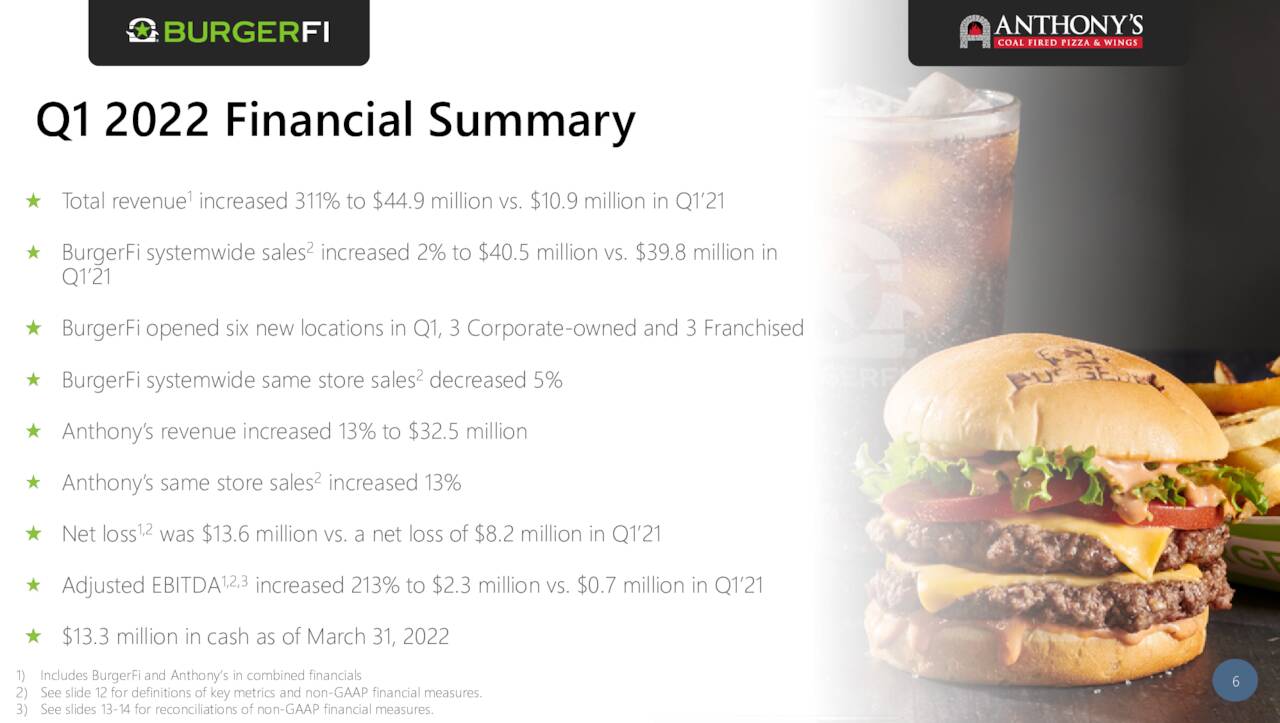

"Though BurgerFi same-store sales were sizably below our estimate, mostly owing to the Omicron disruption, revenue and adjusted EBITDA were largely in-line with our estimates owing to stronger Anthony's sales," noted analyst Peter Saleh.

Saleh and team see the BFI quarter as the low point for the year with sales and restaurant margins forecast to show steady improvement through the year as COVID fades, menu pricing builds and heightened commodity inflation is lapped.

BFI is still rated at Buy at BTIG with the chain's development opportunity, margin potential and sales recovery all noted. Lower industry-wide valuation multiples led BTIG to cut its price target to $8.50 from $11, which after the more than 50% drop this year still leaves plenty of upside potential.

Read BurgerFi's (BFI) earnings call transcript for a detailed breakdown on how the company is approaching price increases across its menu.

I'm surprised to see BFI so low. $3 is $64M in market cap and they have 118 locations so we're valuing at just $542,372 per location (93 are franchises, 25 owned). Only $45M in debt is not a big deal, $15M in cash and maybe a $24M burn this year (started 2019 with $33.6M in sales). At $64M, give them until 2025 and they should be at $400M in sales with $20M in profits at least and $64M won't even be comprehensible as a low.

They also acquired Anthony's Coal Fired Pizza and Wings, which I think was a good add for them.

- They do have options but very thinly traded but, in the Future is Now Portfolio, let's sell 40 of the 2024 $2.50 puts for $1 as that's a net $1.50 entry so we're collecting $4,000 with a $6,000 risk if they go BK - nothing wrong with that.