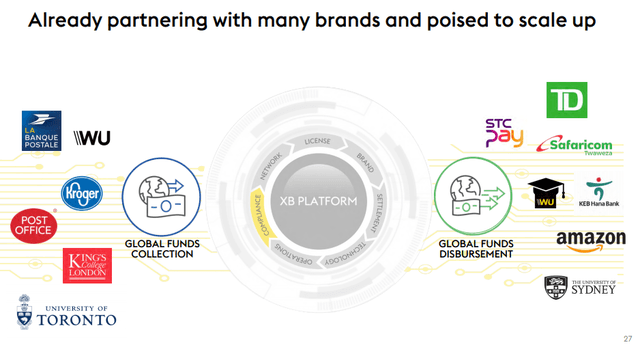

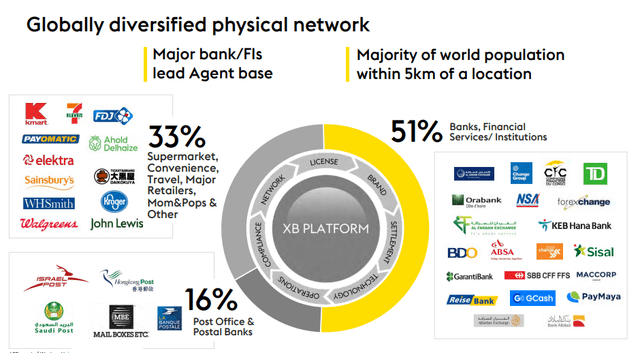

WU/Jeddah - WU's strength is their global presence - they are like an emerging market play.

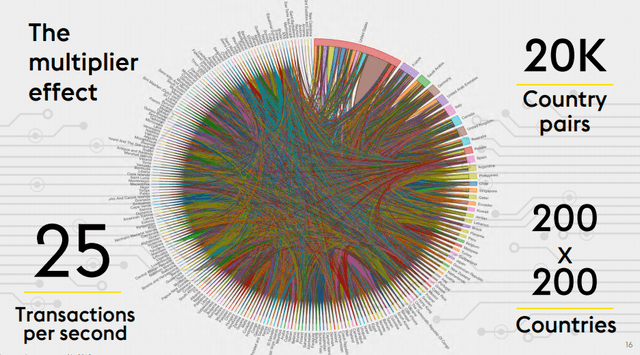

Western Union operates a payment network in 200 countries with 20,000 country pairs in a network that makes 25 transfers every single second.

WU options go out to 2023 and they are not likely to fail $20 so, the trade I'd make there it:

- Sell 10 WU 2023 $25 puts for $4.75 ($4,750)

- Buy 40 WU 2023 $22 calls for $3 ($12,000)

- Sell 40 WU 2023 $25 calls for $1.70 ($6,800)

That's net $450 on the $12,000 spread with $11,550 (2,566%) upside protection and we're a bit aggressive about owning 1,000 shares at $25.11 if things go wrong but then we Rawhide and turn it into a long-term trade if we have to.

NAK/Swamp - 0.50 is where we usually buy but we already have it at 0.50 so I would want to see 0.30 before I was motivated to DD (assuming it wasn't for a good reason). Otherwise, the plan is to sell 1/2 at $1 which then makes it free and THEN we can DD again at 0.50 to average 0.25.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

The case for investing in Northern Dynasty Minerals (NYSEAMERICAN:NAK) stock involves an ongoing court case, burgeoning commodity opportunities, and many other variables.

Source: Shutterstock

Source: ShutterstockThere will be no quick, overnight answer to whether NAK stock is an obvious investment or not, but I’m going to make the case that there is a lot of reason for optimism currently.

The case hinges upon the company receiving the right to follow through with its mining plans in southwest Alaska.

If that is successful, then the next hurdle is longer term hope that copper truly returns the projected opportunities it is projected to in the coming years and decades.