Well, you can certainly see why we've been holding 50/50 all week.

Well, you can certainly see why we've been holding 50/50 all week.

We talked about there being a lot of "pinning" during member chat on Friday and Dr. Brett pointed out a very good Wikipedia entry on the subject, something all option traders should be aware of come expiration day but pinning cannot explain a very disappointing week in which we topped out just 3.5% over our 8,650 center line and failed to hold even that at the week's end.

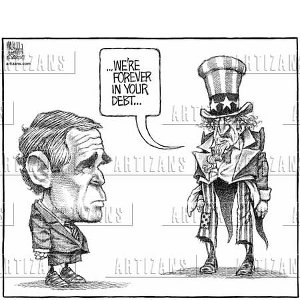

I had said in last weekend's wrap-up that we needed strong leadership and firm action on the Auto bailout on top of the much-anticipated rate cut to get to our 9,100 target and clearly, after disappointing and then downright spooking the markets by holding off until Friday morning, it was once again a case of far too little, far too later to make a difference in the markets as we couldn't even break 8,800 on Friday's auto boost. Notice that the Fed cut took us to 8,950 and the auto bailout gave us 200 more points three days later so it could have been possible that, had the two been timed together, we could have broken 9,100 and had a much better-looking technical picture on Wednesday. Bush already had shoes thrown at his this week and the NYTimes has an excellent article this weekend laying out the case for how this administration totally destroyed the US economy through poor policy and inept handling of the results of the poor policies so I won't embellish here – let's just say things did not go so well this week and not point fingers (or throw shoes).

![[Perp+walk.jpg]](http://3.bp.blogspot.com/_MA4eCEd1SZQ/R9f0iUWoDxI/AAAAAAAAAnE/A7-Fq4la_uE/s1600/Perp%2Bwalk.jpg) We are still dealing with the aftermath of the Madoff scandal and, like the bank failures, until we have a clear idea of what the damages are and who is going to be affected, it's very hard to move forward. Also, the timing of the incident made it too late for most people to pull money out of hedge funds so a lot of latent damage is to be expected in Q1 and traders are dreading the possible effect of another round of liquidation-mania that took us lower than low Q4. Just when we thought it was over – they pull their money back out!

We are still dealing with the aftermath of the Madoff scandal and, like the bank failures, until we have a clear idea of what the damages are and who is going to be affected, it's very hard to move forward. Also, the timing of the incident made it too late for most people to pull money out of hedge funds so a lot of latent damage is to be expected in Q1 and traders are dreading the possible effect of another round of liquidation-mania that took us lower than low Q4. Just when we thought it was over – they pull their money back out!

It is stil, very much a day trader's market and we're having a relatively easy time picking short-term momentum plays and an even easier time selling premium to other people whose option positions gyrate up and down wildly but end up expiring worthless much more often than not. The difference is, of course, timing. When we are day trading, we pick our entry and exit targets and, since the market goes up and down like mad, it's often easy to find a point at which we can get out profitably. On the other hand, when we sell options, WE control when our caller or putter will exit so we simply reverse the logic and take them out at an INopportune time or let them expire worthless.

Adam from Daily Options Report hit the nail on the head Friday saying: "The single most dangerous thing I hear on TV is the constant desire to ascribe causality to EVERY SINGLE MARKET TWEAK. OK, maybe that's the second most dangerous thing after "anything you hear on Power Lunch." But seriously, if it's a pattern to exploit, great, Really doesn't matter all that much why it happens."

We looked for new patterns but the only sure thing we can count on lately is gravity. In our roller coaster stock market that's been going on since early October, there is virtually no uphill action that hasn't been brought about by stimulus. Massive, massive stimulus has been applied to the Global markets, particularly the US and we are literally within 100 points of where we sold off to in the collapse of October's first week. That is the entirety of Q4, now about to be tucked away for good as a flatline. Like any roller coster, you went up and down and spun around so fast you may have even gotten sick but, in the end, you get off at the same place you got on.

On Monday we led off the week with me noting about the lack of movement on the auto bail-out over the weekend: "Clearly this uncertainty is holding back the US markets" and Monday's action was indeed clearly uncertain as we drifted back down to 8,500 but then rocketed back to retest 8,650 before a quick closing sell-off. In the morning post I was concerned with that as well as the massive government debt and Russia's worsening currency crisis. Not surprisingly, gold finally came off the floor and shot up from just over $800 on Monday to $875 on Wednesday before falling all the way back to $825 on Friday – even in gold, it's a day trader's market.

On Monday we led off the week with me noting about the lack of movement on the auto bail-out over the weekend: "Clearly this uncertainty is holding back the US markets" and Monday's action was indeed clearly uncertain as we drifted back down to 8,500 but then rocketed back to retest 8,650 before a quick closing sell-off. In the morning post I was concerned with that as well as the massive government debt and Russia's worsening currency crisis. Not surprisingly, gold finally came off the floor and shot up from just over $800 on Monday to $875 on Wednesday before falling all the way back to $825 on Friday – even in gold, it's a day trader's market.

Despite Monday's poor performance, I was confident enough in the physics of our roller coaster model to call the next day "Take off Tuesday" and we put our rally caps on in the morning but with tempered expectations as it simply did not look likely we'd get to our 9,100 target for the day's end. We drifted along the 8,650 line right up to the Fed and then flew up 300 points on the announcement but we stayed bearish over the failure at our levels as well as my bearish outlook on oil, which I pointed our was a very poor speculative choice, even at $42 a barrel.

So Tuesday was a great day for us. We were positioned perfectly, I predicted the move dead on including the fact we would drift along 8,650 ahead of the Fed and then pop, I was bearish on oil and XOM and I even predicted GE would announce they are dropping guidance after the bell – not bad for a Tuesday! Another good call was for us all to have already gone to selling Jan calls and puts last week as I was very concerned about the VIX going down. This week the VIX fell 25% despite the Dow going up, then back down 400 points.

After Tuesday's "spectacular" close, I warned on Wednesday morning: "Yesterday can be summed up as "The Fed offered to refinance my debt at 0% and the markets barely gained 5% – what a major disappointment!" I set 912 as our make or break line on the S&P and you can see how we broke it Wednesday afternoon. I predicted we'd hold 8,800 on the morning sell-off and that's exactly what we did but our failure to break back over Tuesday's highs left us bearish into Wednesday's close. looking for the downside targets I set that morning.

After Tuesday's "spectacular" close, I warned on Wednesday morning: "Yesterday can be summed up as "The Fed offered to refinance my debt at 0% and the markets barely gained 5% – what a major disappointment!" I set 912 as our make or break line on the S&P and you can see how we broke it Wednesday afternoon. I predicted we'd hold 8,800 on the morning sell-off and that's exactly what we did but our failure to break back over Tuesday's highs left us bearish into Wednesday's close. looking for the downside targets I set that morning.

Wednesday night, I used the picture on the left in our Big Chart review to emphasize again the physics of our roller coaster model. The Fed gave us all the push it had, we got to the top of the tracks and it was time for gravity to pull us back towards the ground. As with any good roller coaster, as you are flying down at high speeds you wonder if the ground is really going to hold and that's what our level watching is all about. Sometimes you do break through the floor but there's always another one down below. As I said on Wednesday night: "Gravity is a bitch."

The bitch was certainly back on Thursday but my closing statement of Wednesday night said it all, even if you weren't there for the turn call during member chat earlier on Wednesday: "Please, please, please keep in mind that 40% is a very sad bounce off of a 50% drop – the proverbial dead cat! Every time I hear the MSM say we are having a 20% rally off the bottom it reminds me how pathetic most people are at math. When a stock falls from $100 to $1 and then goes to $2 – should we all run out and cry "RALLY TIME?" Of course not, it’s silly and it’s not much less silly to think we are rallying when we go from an oversold (we hope) 50% off back to 40% off – what’s key is figuring out where the real bottom is as that is the only thing we can be sure will stand up to the relentless pull of market gravity." What really kills me is that I say things like that and the next day people ask me if I think we're rallying…

Thursday morning I pointed out that the 554,000 jobs we lost that week meant that Obama's goal of creating 2.5M new jobs would only replace the ones we lost since the election. Still I said "IT'S NOT GOING TO BE ENOUGH" to put your money into "safe" investments like stocks and bonds as they will never keep up with the inflation that is sure to come from all this social tinkering. You can give 5M people $40,000 jobs for "just" $200Bn – that's how easy it is to stimulate the economy and if you've sat through the last couple of months and you don't think the government is going to buy as many jobs as necessary – then you need to go back as you have certainly missed something! Money WILL be thrown at this problem because money CAN solve this problem in the short term and, as the great economist John Maynard Keynes famously said "The long run is a misleading guide to current affairs – In the long run, we shall all be dead."

So the Fed goes to zero, the Nikkei goes to zero, the BOE is going to zero and even Trichet may take the ECB there. We are expecting global intervention on the dollar before the end of the year and we bounced very sharply to close the week, just as I predicted we would off the 200 dma at 77. We discussed it in depth Thursday morning and I said in the post: "Will this help oil? No, nothing will help oil because there is still no demand and there won’t be demand until people go back to work. Chrysler just shut down US manufacturing for "at least a month", costing 300,000 workers 8.5% of their jobs. By OPEC’s logic, that should make the price of Chrysler cars go up in value right? Oil’s inability to hold $40 this morning should send XOM et al even lower." At the top of that morning post, I discussed the XOM $85 puts we had taken as a momentum play the day before at $2.60 – those puts finished the week at $9.90.

Thursday afternoon there was a great article in Phil's Favorites by Louse Story relating to how the men who pushed people into oil at $120 a barrel and XOM at $90 a share took Billions in bonuses based on "profits" at the IBanks and brokerages that have since all been reversed and were, in fact, losses. MER, for example, paid out $6Bn in bonuses on $13.5Bn in pre-bonus earnings in 2006 yet in 2008 we find out that 2006 was actaully a massive loss and all those paper profits they paid bonuses on are gone, gone, gone… There is no difference betwen what MS, GS et al did to their clients, their shareholders and the American people and what Bernie Madoff did to his clients – one just has government approval and one doesn't!

Thursday night, we also got word that Chrysler was taking a month-long holiday from making cars by shutting down all US manufacturing operations (yet the executives will be paid in full for driving to Washington) and I noted by that logic, according to OPEC this should make their cars go up in value. In reality, a glut is a glut but, unlike oil, which was all made about 200 Million years ago, you CAN stop making cars. If there were 50 years worth of cars buried in the ground in thousands of locations around the world, you can damn well bet no one would be paying $250,000 for a Maybach!

We picked the FXP Jan $25s on Friday morning as a hedge against a market meltdown as China seemed to have the most room to fall if things headed south on us on Monday. Gold pulled back as we expected but that's a long-term play and oil, in the form of USO, was a trade we were happy to get out of mid-day as that floor really did cave in. We still think this is a floor for oil but now they have to prove it to us. The auto bailout finally came in the morning on Friday but, sadly, that seems to be it for the year

![[Appetite for Risk]](http://s.wsj.net/public/resources/images/P1-AO067A_INVES_NS_20081221183217.gif) Still, we did not fail all of our Friday "must hold" levels, where I had said: "ANYTHING less than holding 8,650, 900, 1,550, 5,600 and 480 is flat out unacceptable." We are looking for sector rotation and the first half of sector rotation is money coming OUT of the old leadership. Sometimes this money is parked in short-term notes, driving the price down while investors wait for the right signal to get back in. It's rather doubtful we'll be getting it on a holiday week next week but I am hoping to see signs that we are not the only bottom fishers out there.

Still, we did not fail all of our Friday "must hold" levels, where I had said: "ANYTHING less than holding 8,650, 900, 1,550, 5,600 and 480 is flat out unacceptable." We are looking for sector rotation and the first half of sector rotation is money coming OUT of the old leadership. Sometimes this money is parked in short-term notes, driving the price down while investors wait for the right signal to get back in. It's rather doubtful we'll be getting it on a holiday week next week but I am hoping to see signs that we are not the only bottom fishers out there.

Investors pulled $79Bn out of the markets in October, which is huge but there's still $20Tn worth of certificates left. How far down can fear drive the markets? Is there a bottom? These are the questions we hope to answer going forward but, with just 5 full trading days left in 2008, we may just have to wait 'till next year to find out.

"For many investors, this has been a glimpse into the abyss," says Terrance Odean, a finance professor at the University of California, Berkeley, who has studied the behavior of individual investors. "They have been told that if you save regularly for retirement and buy and hold, you will be fine. Now, people see a possibility that this will not be the case."