I'm digging for green shoots but you have to sift through a lot of manure to find them this week!

I'm digging for green shoots but you have to sift through a lot of manure to find them this week!

A few weeks ago I complained that the MSM was irrationally exuberant and I couldn't find any negative articles (outside of PSW, of course, where people thought we were too negative calling for a correction) and now, less than a month later, you can hardly find anyone who doesn't think we're going back to the March lows. I stand by my statement to Members in yesterday morning's Alert where I said: "It’s ridiculous for the Dow to go back to 7,500 and ridiculous for the S&P to go back to 800. While it’s easy to make squiggly lines on a chart show 10% drops ahead (which seems like a normal 50% retrace of the gains overall) I just think it’s dead wrong from a valuation perspective so I’m not inclined to play it, especially when those valuations are about to slap you in the face over the next few weeks. Maybe I’m wrong and maybe earnings will suck and Q2 will be a miss and guidance will be lower but right now I say - Show me the misses."

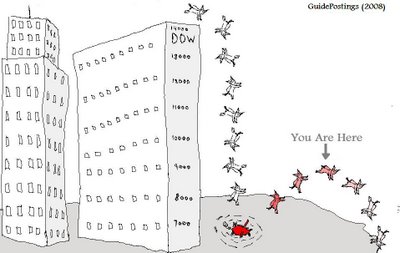

So I said Cramer was an idiot to be herding his sheeple into stocks when the Dow was at 9,000 and now I am saying Cramer is an idiot for stampeding the herd out of stocks at 8,000? Am I that fickle? Not really, I just believe we are in a fairly tight trading range. On June 17th I warned on June 24th, as the market "rallied" back to 8,500 I warned we were simply in the midst of a "dead cat bounce" - using the following, very descriptive graphic:

We played oil to top out at $70 for a whole month before it finally fell and I had warned people to stay out of the USO oil fund on June 6th (20% higher than here), but perhaps the last straw was when I pointed out that China was buying oil in bulk for $16 a barrel and even that was a ridiculously expensive price that more sensible buyers would not pay.