Barry Ritholtz’s take on the housing market – not buying the happy talk. Click on the title for the full article.

Existing Home Sales Far Worse Than Advertised

Barry Ritholtz’s The Big Picture

Excerpt: On Friday, the market rallied smartly – and while expiry had something to do with it, the larger part of the gains came after the release of the Existing Home Sales data. Traders’ kneejerk reaction seemed to reflect the belief that not only is the worst of Housing now behind us, but that Housing was actually getting better.

Indeed, Housing is going to be a growth driver for the economy going forward!

Only, not so much. A close look at the data reveals this to be a false premise. If you only read the NAR spin, its easy to fall into their web of happy talk. (We’ve said it so many times, it still bears repeating: The National Association of Realtors are a highly misleading news source. Look past what they say to the actual numbers if you seek economic truth).

In the past, I have gone so far as to imply the Realtors group are spinmeisters. This month, I will be more blunt: Their actual data has become untrustworthy, their spokesmen lie for a living, and their “news releases” is little more than misleading junk.

Investors who rely on the NAR version of the news do so at their own great financial peril.

With that intro, lets dig into the actual data to show why the real estate trade group happy talk is misleading bunk. IF YOU ARE INTERESTED IN HOUSING, then you need to thoroughly fisk the NAR data, put it into context, and strip the lipstick off the pig.

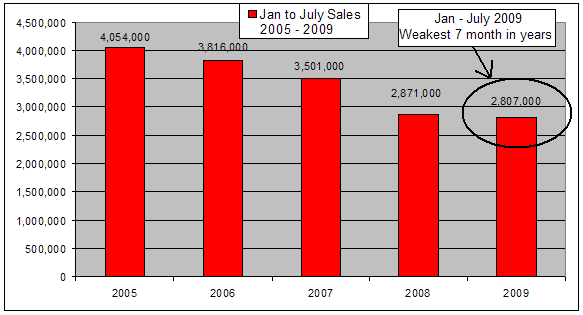

Let’s do just that: A closer look at the actual unspun data reveals the NAR fantasies. Rather than recently improving, we see that January to July 2009 is actually the weakest 7 month period in 5 years — since the market topped in ‘05.

Consider Mark Hanson’s analysis: He points out that “If not for a surprise and suspect 16k increase in Northeast condo sales, Existing Home Sales would have been lower month-over-month and only up 12k units from July 2008, which was the worst year on record for housing.”…

Let’s go back to the NAR release. As noted on Friday, on a NON-seasonally-adjusted basis, existing home sales were nowhere near as strong as advertised. According to M Hanson Advisors:

“Even with condos included, the all-important Western Region was down 10% m-o-m. It is consensus that the housing market in the West is booming. While sales are booming at low end, I have argued for months that demand from first-timers and investors was at peak levels and July’s results prove this.Such weak results m-o-m and relative to 2008 underscore how critically injured the housing market remains…

This confirms my prior view that there are a lot of federal forces focused mightily to merely maintain housing in a gentle downdraft. But for this extraordinary government intervention, Housing would actually be much much worse. Foreclosures would be driving prices much lower — a good thing IMO, as it would hasten the cleansing of the boom’s excesses…

Remove government interventions, and the housing market collpase would continue unabated…

Finally, let’s look at one last factor: The impact of Foreclosures on Seasonal adjustments. We know that the NAR’s takes each month’s data, then runs it through their own meat grinder: They annualize the number, they hamhandedly seasonally adjust it, they do whatever they can to accentuate the positive, while ignoring some of the ugly context the data exists in.

Like Foreclosures.

Special thanks to Mark Hanson for his assistance with this piece.

Entire article and more charts here.