Binve discusses fractals and Elliott Wave analysis, at Market Thoughts and Analysis.

O Mandelbrot, O Mandelbrot

O Mandelbrot, O Mandelbrot

Your fractals are so pleasing

La la la laaaa la la la ……

Uncle binv is going to tell you a story about fractals, drawing heavily upon the **fantastic** post that columbia wrote in October – Fractals!!. Please read that post first.

One of the key behaviors / observations when it comes to Elliott Wave Analysis is that all market structures a) act on all degrees of trend simultaneously and b) are self-replicating on all degrees of trends. Thus, an impulse looks substantially the same whether it is a subminuette degree wave viewed on a 1 minute chart or a primary degree wave viewed on a weekly chart.

This does *NOT* mean the all impulse wave are perfectly proportioned copies of each other. The market is made of people and we are not clones. We have variability and so does stock market behavior. There is variability in the structure of all waves. But waves that perform the same function within the wave structure look *similar* at all degrees of trend.

Since the peak in Oct 2007, we have had several 5-wave sequences (impulse waves) moving downward and several corrective waves back up. In Elliott Wave parlance, the move from Oct 2007 to March 2009 was a primary degree wave, and the move from March 2009 to now is another primary degree wave.

One thing to take note of as you look at the following charts is the wave structure down followed by the wave structure up. The wave proportions for the Wave 1’s are not *identical*, but they are similar.

First – Minor (Blue) 1 of Intermediate (Pink) 1 of Primary 1. [click on charts to enlarge]

Wave 2 is 0.618 * Wave 1 in points

Wave 2 is 0.236 * Wave 1 in duration

Second – Intermediate (Pink) 1 of Primary 1.

Wave 2 is 0.500 * Wave 1 in points

Wave 2 is 0.500 * Wave 1 in duration

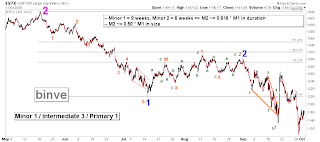

Third – Minor (Blue) 1 of Intermediate (Pink) 3 of Primary 1

Wave 2 is 0.500 * Wave 1 in points

Wave 2 is 0.618 * Wave 1 in duration

Before putting this in perspective in the larger count, notice that the structure of each Wave 1 down has a much clearer movement about it. They slice through resistance, sometimes almost vertically. Their purpose is to carry the overall price movement in the direction of the wave that is one degree higher. And after each impulse wave down, there needs to be a correction. In this case it is a Wave 2. These waves tend to meander. However even when they trend strongly, the internal price action is very overlapping. This is a key way to tell a trending corrective wave from an impulse wave.

And so what is interesting is that whether the price action took a couple of weeks to a couple of months to play out, the overall structure is very similar.

Next some stats

Wave 2 price retracements: 0.618, 0.500, and 0.500

Wave 2 time ratios: 0.236, 0.500, 0.618

And this limited sample set verifies what we see about Wave 1 – Wave 2 relationships in many other scenarios (on 1 minute charts, 5 minute, etc.). Wave 2’s typically (but not always) are deep retracement waves, meaning they retrace the previous Wave 1 by 50% to 62%. The duration of any corrective wave is much more variable. The time component is almost always a Fibonacci relationship too. In these cases we see between 24% and 62%. Sometimes Wave 2’s can be as long in duration as Wave 1’s, and much more infrequently, even longer (such as 162%).

Usually, it is one of these Fibonacci relationships: 50%, 62%, 79%, or 100%.

Stepping back at looking one degree higher, what do we see about the rally since March?

Fourth – Primary 1 (Black)

Currently Wave 2 is 0.500 * Wave 1 in points

Currently Wave 2 is 0.618 * Wave 1 in duration

We can see that Primary 2 has hit many of the targets that we expect to see in relation to Wave 1. Additionally there is a lot about the internal wave structure in P2 that also has some nice Fibonacci relationships: Just a Step Back

Conditions are ripe, from an Elliott Wave and Fibonacci Relationship perspective for Primary 2 to be done.

But just because conditions are ripe, does that mean we will begin P3 on Monday? **NO**.

P2 might not be done. It might rally up to the 62% level (1240) and take us out to July (100% of time as P1). That is another scenario where P2 would still be a viable proportion to P1.

The Elliott Wave count, just by itself, says we have reached important technical objectives and the count *could* be complete. However, when other factors are considered (bullish sentiment extreme among investors and fund managers, record lows of cash reserves in funds / many are "all-in", economic indicators if you dig below the surface, Fed liquidity statements) there is an increased possibility that this is the top of P2, if not close to it. I spent the last week establishing fresh short positions, but still have healthy cash reserves. I will add to shorts on a move higher or a confirmed breakdown. I do not like the risk / reward for being long here.

The Pragmatic Capitalist has a fantastic summary of predictions for 2010 from Wall Street and Investment Gurus THE ULTIMATE GUIDE TO 2010 INVESTMENT PREDICTIONS AND OUTLOOKS.

So just keep in mind that very smart investment minds have a very divided opinion on the economic situation and the state of rally and the current valuation of equities.