You would think I would have a lot to say about the IPAD but I don't.

After all, I named the IPad back in December 2008 when I told Members: "AAPL just announced a deal to do Ebooks on IPhones and ITouch and that is the intermediate step towards the IPad, which should be a 2-3x size version of the IPhone that takes the place of a Kindle or a laptop or a notepad or…" I also ran a very close to accurate picture of the IPad back on Sept 11th (and the live images are here), which documents our bullish take on AAPL all the way from $85 and reiterated in Sept at $170 (but we were out at $213 Tuesday, back in at $202 yesterday for the ride back up as we got our expected sell-off during the Apple event) – so this is all old news for us at PSW.

Back in September I said: "So we are happy, happy AAPL owners and Piper Jaffray’s Gene Munster thinks AAPL can sell 2M units of the IPad at $600 each to generate an additional $1.2Bn in revenues in 2010 and I think he’s low. Also, it should be noted that we went with GLW back in December on the premise that millions of touch-screen IPads would use a lot of high-end glass." I am very pleased that the basic model came in $100 lower than my target but, as with IPods – who buys the basic model? Delivery in 60 days means I should hit my sales targets no problem and I it doesn't look like GLW will be the supplier of IPad glass (LPL seems more likely) but the demand for glass will still be stunning and GLW is up 26% since September so we're not going to whine about it (I still like them).

OK, enough about toys, on to the President, who gave his State of the Union Address last night, making the following notable points (my notes in brackets):

OK, enough about toys, on to the President, who gave his State of the Union Address last night, making the following notable points (my notes in brackets):

I'm proposing that we take $30 billion of the money Wall Street banks have repaid and use it to help community banks give small businesses the credit they need to stay afloat. I'm also proposing a new small-business tax credit, one that will go to over 1 million small businesses who hire new workers or raise wages. While we're at it, let's also eliminate all capital gains taxes on small-business investment and provide a tax incentive for all large businesses and all small businesses to invest in new plants and equipment. (Good for the Russell)

This problem is not going away. By the time I'm finished speaking tonight, more Americans will have lost their health insurance. Millions will lose it this year. Our deficit will grow. Premiums will go up. Patients will be denied the care they need. Small-business owners will continue to drop coverage altogether. I will not walk away from these Americans, and neither should the people in this chamber. (nothing concrete there)

It's time to require lobbyists to disclose each contact they make on behalf of a client with my administration or with Congress. It's time to put strict limits on the contributions that lobbyists give to candidates for federal office. With all due deference to separation of powers, last week, the Supreme Court reversed a century of law that I believe will open the floodgates for special interests, including foreign corporations, to spend without limit in our elections. I don't think American elections should be bankrolled by America's most powerful interests or, worse, by foreign entities.

If the Republican leadership is going to insist that 60 votes in the Senate are required to do any business at all in this town, a supermajority, then the responsibility to govern is now yours, as well. Just saying no to everything may be good short-term politics, but it's not leadership.

Each time a CEO rewards himself for failure or a banker puts the rest of us at risk for his own selfish gain, people's doubts grow. Each time lobbyists game the system or politicians tear each other down instead of lifting this country up, we lose faith. The more that TV pundits reduce serious debates to silly arguments, big issues into sound bites, our citizens turn away. No wonder there's so much cynicism out there. No wonder there's so much disappointment.

Our administration has had some political setbacks this year, and some of them were deserved. But I wake up every day knowing that they are nothing compared to the setbacks that families all across this country have faced this year.

The spirit that has sustained this nation for more than two centuries lives on in you, its people. We have finished a difficult year. We have come through a difficult decade. But a new year has come. A new decade stretches before us. We don't quit. I don't quit. Let's seize this moment, to start anew, to carry the dream forward, and to strengthen our union once more.

I am often accused of being too liberal so I'm going to throw my Fox fans a bone by pointing out that I'm a little disillusioned by how little we've accomplished in the 24 months since candidate Obama gave the response to George Bush the 2nd's final State of the Union Address. I think the problem Obama is having with his supporters (and yes, I am one of them) is that we voted for change. We voted to throw the bums out yet the bums seem to be very much still in charge and business is being conducted as usual. I'll say one thing for GB2, he busted heads – he didn't let a Democratic Congress, the Bill of Rights or even the Constitution stand in the way of getting what he wanted so what the hell is wrong with Obama? Why are we still having these discussions without the action to back them up?

Well, I'd love to dwell on politics but it's a busy morning. We had our Fed indecision yesterday and you needed a magnifying glass to read the faint tea leaves in their statement. The Fed dropped its December concerns about the housing markets and was more positive on business spending (although that was not what we saw in the Beige Book) and they upgraded the revovery from "weak" to "moderate" and that's about it. What they did not do, was extend the time to wind down some QE programs and, in fact, put hard dates on the end of them and that gave a brief boost to the dollar, tanked commodities and gave me a chance, at 2:39 to put out a note to members to flip bullish with the DIA $103 calls at $1.23.

Usually, I make a call like that right with my normal parsing of the Fed statement but we were distracted by the end of the AAPL conference and my 2:24 Alert to Members on the Fed concluded with: "FORGET THE FED – $499 for the IPad!!!! BUY AAPL, Sell AMZN, Sell HPQ, Sell Dell – game over!!! Buy T (March $26s are .75)." Walt Mossberg quickly agreed with my take on Apple's rivals and the T March $26 calls shot up to .95 so we took that money and ran (good thing too!) but I still like T long-term as it seems their partnership with AAPL is still going. VZ got hammered on a short-sighted downgrade from FBR and we thank that analyst for giving us an in at $29.75 as well as it's bandwidth, Bandwidth, BANDWIDTH in the future that will matter if everyone is going to be walking around with portable MP3 television screen/web browsers instead of books.

You also have to love Google on this news as more and more eyeballs will spend more and more time on-line and that's good for ad revenues AND, as I have often noted in the past, GOOG has been cornering the market on dark fiber since 2005 and estimates are they have enough to form their own telco at this point or, possibly, something more specialized to a new generation of web devices that will dominate the market the way IPods took over the portable music market. It will be interesting and we should think of GOOG as a nice commodity play on bandwidth, as well as a company that happens to make a few bucks selling ads or whatever it is they officially do…

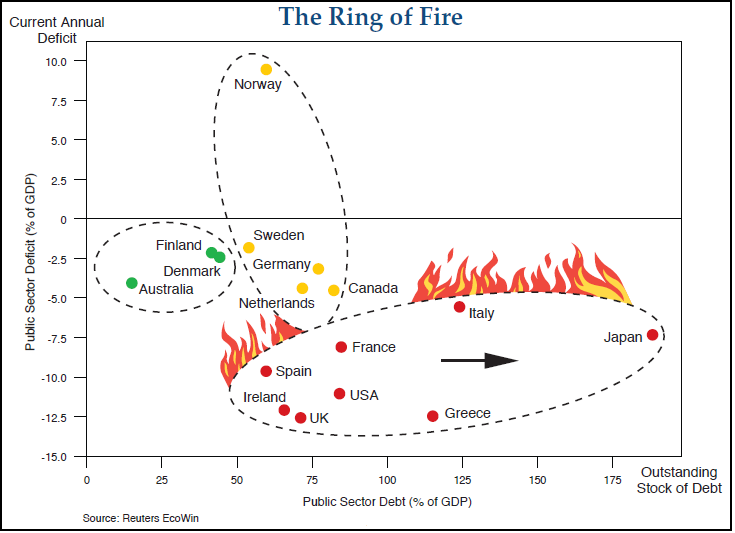

We were discussing last week what island nations we can relocate to when it all hits the fan in the US and the peasants start revolting but what we didn't discuss is what nations to avoid NOW. Fortunately, Barry Ritholtz has provided us with a chart from Bill Gross's Annual Address highlighting nations that are in what he calls "the Ring of Fire" which, ironically, does not include the Scandanavian countries from Wagners "The Ring" but does, of course, include the US, where Johnny Cash had a hit single with the same title:

As Johnny Cash said about the US economy: "I Fell Into A Burning Ring Of Fire, I Went Down, Down, Down and The Flames Went Higher. And It Burns, Burns, Burns – The Ring Of Fire." Gross warns of the deleveraging yet to come and reminds us that good fund managers need to take the long view – echoing what I told members 2 weeks ago when we went back to mainly cash at 10,700 because, as another country singer said: "You have to know when to hold 'em, know when to fold 'em, know when to walk away and know when to RUN."

Bill sees 5-6 years of deleveraging ahead of us, as do many market bears but I question their underlying premise. Who says we have to deleverage at all? It seems to me that the G20 leaders have decided to go "ball to the wall" with debts they can NEVER hope to repay and perhaps it's Bill Gross that's deluding himself thinking his Trillions of dollars worth of bonds will actually be redeemed as governments choose de-leveraging over de-faulting. As I have often said, everyone is partying like it's 1999, and that may include the debt buyers, who are gorging themselves on record credit spreads as if Japan and the USA are "too big to fail." Perhaps they need to consider the possibility that "too big to fail" can also be "too big to bail!"

Anyway, as Monty Python points out, you've gotta love Norway. They have their own oil, run a surplus, have the highest per capital income in the EU ($72,000 vs $42,000 US), cover 100% of the population with health care and will surely benefit from global warming. NOK is from Norway (actually Finland but same thing to Americans so I'm going with it as a transition) and they just reported great earnings with a 65% rise in Q4 net profit. Overall Euro-Zone Economic Confidence came in a little better than expected this morning but SI announced they are cutting 2,000 more jobs in Germany and ECB President, Jean-Claude Trichet, supported Obama's plan to rein in large banks and Trichet has a LOT more power than Obama to make it happen so the European markets backed off, dropping about half their gains from a +1% open.

Barry had another nice chart yesterday that gives us a nice, graphical representation of why the removal of stimulus is so terrifying to Wall Street. Very close to 50% of China's economy was based on stimulus spending last year and that was nothing compared to Saudi Arabia's 85% (no kidding!) and, of course, in sheer dollar volume, the US dwarfs them all with over 1/3 of our massive $14Tn economy aimed at stimulating ourselves:

Over in Asia, both the Hang Seng and the Nikkei had 1.5% bounces which are, of course, 20% retraces of their 7.5% drops. Better late than never as we now feel smart for getting out of our FXP and EDZ plays as we expected a bounce in the very least. Banks and commodities led the decline in Asia as George Soros finally joins me in predicting that gold will be the next bubble to burst while also warning that by proposing imminent "exit strategies" from the unprecedented support handed out to troubled banks and consumers, governments around the world could be in danger of triggering a double-dip in the global economy, saying:

I think that since the adjustment process to the recession is incomplete, there is a need for additional stimulus. Some countries, like the US and European countries, have plenty of room to increase their deficits. The political resistance to doing so increases the chances of a double dip in the economy in 2011 and after that.

There's a ton of interesting things going on over in Davos and I'll be catching up on that over the weekend as it's not often the Gang of 12 holds open meetings so we like to keep our eye on them. We are still trying to be bullish on the markets and this morning we are likley to retest the bounce levels I predicted on Monday, which are: Dow 10,300, S&P 1,105, Nasdaq 2,225, NYSE 7,100 and Russell 625 with the Russell being the only index not to pull it together so far so we'll be watching them closely as our key indicator. Oil bounced right off our $72.50 target yesterday and now we'll see if they make their bounce back over $75 (20% retrace of drop from $84+) with gasoline right on the critical $2 line and nat gas (inventories at 10:30) looking weak at $5.24.

There's a ton of interesting things going on over in Davos and I'll be catching up on that over the weekend as it's not often the Gang of 12 holds open meetings so we like to keep our eye on them. We are still trying to be bullish on the markets and this morning we are likley to retest the bounce levels I predicted on Monday, which are: Dow 10,300, S&P 1,105, Nasdaq 2,225, NYSE 7,100 and Russell 625 with the Russell being the only index not to pull it together so far so we'll be watching them closely as our key indicator. Oil bounced right off our $72.50 target yesterday and now we'll see if they make their bounce back over $75 (20% retrace of drop from $84+) with gasoline right on the critical $2 line and nat gas (inventories at 10:30) looking weak at $5.24.

Copper briefly failed our critical $3.20 line yesterday but seem to be holding it (remember when we were worried about our FCX shorts?) and silver is hovering around $16.50 while gold is holding our line at $1,088, which we noted is interestingly the same as our breakdown target on the S&P and both Carl Jung and Sting tells us not to ignore sychronous events so we'll be watching both closely for warning signs. Our 5% "must hold levles" remain: Dow 10,165, S&P 1,088, Nas 2,200, NYSE 7,000 and RUT 620 with 3 of 5 below = BAD!

Be careful out there, it's still very tricky trading!