Hello Oxen Report Readers,

Hello Oxen Report Readers,

Yesterday, I recommended an Overnight Trade of the Day in Pioneer Natural Resources Co. (PXD). The company, an independent oil producer, announced a surprise on their EPS estimates. The company earned 0.18 EPS vs. the expected 0.05. The company’s stock did not take off quite like I had wanted in pre-market, but it is up 1.5% on very light volume. We should look to get out of this one for 3-4% today, which is feasable given the market’s outlook.

Which brings me to our Pick of the Day…

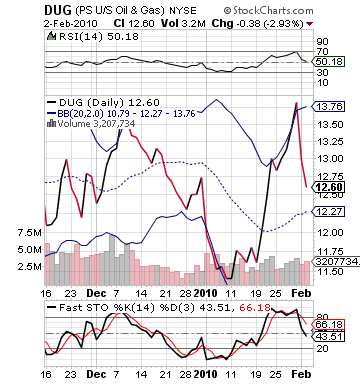

Buy Pick of the Day: Ultrashort Proshares Oil and Gas ETF (DUG)

Analysis: Its a confusing day in the market for sure. We got very good numbers from the ADP Nonfarm Employment Change for the month of January. We saw only a 22,000 persons decrease vs. the expected 40,000 and December’s 60,000. To me, it was a pretty significant number. On top of this, we saw great earnings from market leaders like Pfizer and Time Warner. Even overseas was pretty good. Asia is up and Europe is about neutral. Yet, we see futures having risen into the green after the employment news but already lost momentum. This neutral reading on the market can only be a result of the market worrying itself into the red.

Therefore, I suspect that we are headed down this morning, and the small run up we have seen in oil over the past few days may be over starting today. The NYMEX is already down this morning, and it is going to be pretty difficult for the crude inventories to top the nearly 4 million barrel drop it saw last week. I think investors are looking to make profits today and sell off, which will give a boost to inverse ETFs across the board. I like DUG the best, though, because of its direct affiliation with the market news today.

Over the last few days, DUG has dropped 8% after a significant run the prior weeks. Yet, the significant drop has moved it into the middle of its bollinger bands, and it has actually passed into oversold area in fast stochastics. This points to the fact that short term the ETF has seen some selling, and the lower price should attract investors.

I think the worry is obviously we cannot make 2-3% in the morning before the announcement of inventories, and they are good. Yet, the market futures continue to dwindle away, and I do not see any reason why DUG can’t move this morning. Further, we have the inventories that could boost DUG. Set your stop losses just in case and try to exit by 10:30 if possible. Yet, I do think hitting a 4 million drop will be hard and anything less should be a disappointment.

Entry: We are looking to enter in the 12.55 – 12.65 range.

Exit: We are looking for 2-3% gains before exiting.

Stop Loss: 3% on bottom of entry price.

Good Investing,

David Ristau