The MSM is so happy about the February Monster Employment Index!

They’ll tell you it’s up 10 points from January without mentioning that January was the worst month of the past 12 and, in reality, we are up just 2 points from last February when the shockingly poor data we were seeing sent the S&P all the way to 666 the next month. Today though, it is considered a reason to rally as people watching the MSM will believe anything the talking heads tell them because they don’t get shown the actual results and they trust their talking heads to have checked the facts carefully, rather than make them up, which is pretty much what they do.

We discussed the shenanigans of the ADP report in yesterday’s post and I did warn you that it was a fake rally based on happy headlines papering over poor data. As we expected, the market giddiness persisted until about 11:30 and then reality began to bite back. This was FANTASTIC for us as we were playing bearish into the rally but it’s very scary to hold bearish positions overnight but there’s no reason to hold options overnight when you pick up plays like our 9:54 Alert play on the DIA $103 puts, which averaged in at .77, hit $1 (up 30%) at 2:45 and finished the day at .94 (up 22%). You HAVE to learn to be satisfied with making 20% on day trades and cashing back out. Cash is flexible – overnight positions are not… In fact, since we did cash out yesterday, I was able to send out an overnight Alert to Members with a short on the oil Futures as they ran up to 80.50 which was good for a quick victory and then another this morning at $81, which is already up .30 with a .06 trailing stop (futures pay $10 per penny per contract so lots of fun for morning, pre-market trading!).

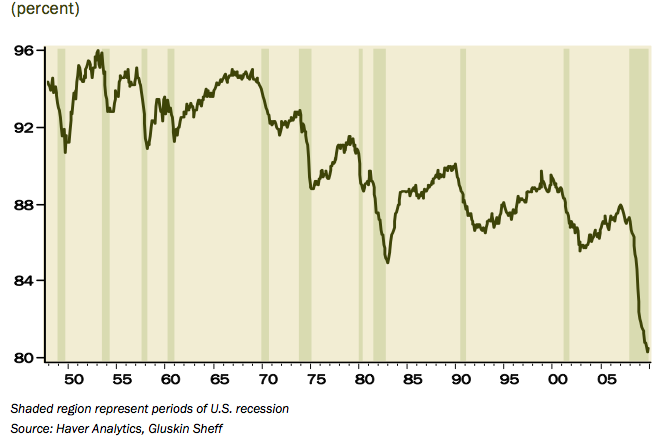

We went longer on our oil and gold shorts (in yesterday’s post it was GLL Apr $9 calls at .65) because we don’t expect them to resolve quickly but the chart on the left illustrates why we also firmly believe that this commodity rally is BS. This is a chart of the Employment to Population Ratio for Men 25-54 Years Old since WWII. Kind of puts a 2% year over year rise in the Monster Employment Index into perspective doesn’t it? 20% of the men in the United States of America between the ages of 25 and 54 ARE UNEMPLOYED! That is up 8% in 3 years.

We went longer on our oil and gold shorts (in yesterday’s post it was GLL Apr $9 calls at .65) because we don’t expect them to resolve quickly but the chart on the left illustrates why we also firmly believe that this commodity rally is BS. This is a chart of the Employment to Population Ratio for Men 25-54 Years Old since WWII. Kind of puts a 2% year over year rise in the Monster Employment Index into perspective doesn’t it? 20% of the men in the United States of America between the ages of 25 and 54 ARE UNEMPLOYED! That is up 8% in 3 years.

This will NOT turn around in one year. In fact, we need to add about 5M jobs to get back to the 20-year average of 13% unemployed so, unless tomorrow’s Non-Farm Payroll number comes in at +400,000, we are off track for a recovery – certainly for the kind of recovery commodity speculators are betting on! Speaking of Non-Farm Payrolls – let’s prepare ourselves for tomorrow’s nonsense numbers by taking a look at the hidden bonus jobs we expect to gain from the decennial hiring of 1.4 Million Census Workers between now and June.

![[CensusImpactJan2010.jpg]](http://4.bp.blogspot.com/_pMscxxELHEg/S43J-h0C_WI/AAAAAAAAHqQ/HVTtJdYv3NI/s1600/CensusImpactJan2010.jpg) Wow! That’s going to have quite an impact on our jobs numbers for the next few months but keep in mind these are TEMP jobs that convey skills that are usable only once per decade! Calculated Risk has this great chart that breaks down our hiring expectations for the next few months. So 25-50,000 bonus jobs in Februrary (reflected in tomorrow’s numbers) and close to 100,000 bonus jobs in March leading up to 350,000 hires in May – perfect timing for our anticipated run to 11,500 that month but let’s watch out for that shocking dip that will follow in June.

Wow! That’s going to have quite an impact on our jobs numbers for the next few months but keep in mind these are TEMP jobs that convey skills that are usable only once per decade! Calculated Risk has this great chart that breaks down our hiring expectations for the next few months. So 25-50,000 bonus jobs in Februrary (reflected in tomorrow’s numbers) and close to 100,000 bonus jobs in March leading up to 350,000 hires in May – perfect timing for our anticipated run to 11,500 that month but let’s watch out for that shocking dip that will follow in June.

There, now you have a better understanding of the factors that will influence jobs numbers for the next 6 months than the people on TV do, so you are now free to laugh at them when they tell you how surprising the gains are!

8:30 Update: 469,000 pink slips were handed out last week – about in-line with expectations, with 4.5M continuing claims, down from last month’s 4.6M. The great news for employers is how much productivity they can get out of the 80% of men 25-54 that are lucky enough to have jobs – Q4 Productivity has been revised up to an amazing 6.9%, meaning we now need 6.9% LESS people to do the same jobs as remaining workers are too terrified to take a vacation or a sick day or even a coffee break. So terrified, in fact, that Unit Labor costs are dropping 5.9% in the same period. Sure it’s a horrifying, deflationary sign but how cool if you are a slaveowner capitalist who captures employs thousands of victims middle-class workers who are now doing more work than ever for less wages and less benefits than we’ve had to pay since 1865! Ah capitalism, it’s amazing how easy you make it to justify the oppression of the masses!

Fortunately, having no job doesn’t mean you can’t shop in America and Same Store Retail Sales are up, Up, UP!!! Of course, we are up compared to last February, when the Dow was in the middle of a 2,500-point drop (Jan 6th-March 9th) and people weren’t exactly in a shopping mood but we’ll have fun today playing along at home as the MSM gushes over 5-10% improvements over last year’s comatose numbers. ALSO – keep in mind that these are SAME-STORE sales numbers, so when a chain closes 20% of their stores or a competitor goes out of business – we don’t count the zeros – we only count the "new" business that flows over to the remaining stores. So, on the whole, this is a meaningless and misleading number.

Fortunately, having no job doesn’t mean you can’t shop in America and Same Store Retail Sales are up, Up, UP!!! Of course, we are up compared to last February, when the Dow was in the middle of a 2,500-point drop (Jan 6th-March 9th) and people weren’t exactly in a shopping mood but we’ll have fun today playing along at home as the MSM gushes over 5-10% improvements over last year’s comatose numbers. ALSO – keep in mind that these are SAME-STORE sales numbers, so when a chain closes 20% of their stores or a competitor goes out of business – we don’t count the zeros – we only count the "new" business that flows over to the remaining stores. So, on the whole, this is a meaningless and misleading number.

We’d better hope that China’s sharp drop this morning was meaningless or misleading, and not the start of the trend we’ve been expecting as we accumulated shares in EDZ. The Hang Seng was harshly rejected by the 50 dma at 21,000 and pulled back 301 points (1.5%) to finish the day at 20,575. The Shanghai fell 2.4%, back to 3,023 dropping 1/2 of February’s gains in a single session. The Nikkei fell 1% and, sadly, back below 10,200 at 10,145 but happy for us as we grabbed those EWJ $10 puts in yesterday’s Member Chat for just 0.09! India didn’t get the memo and held flat for the day at the top of their spectacular 10% run-up so I like the EPI $23 puts at $1 as a short-term play on India catching up with their peers (or you stock people can just short it!).

Nothing happened in Asia but they went down. Compare this to last week when nothing happened and they went up and we have the makings of a change in sentiment. There was certainly noting in yesterday’s Beige Book to make Asian investors excited (see my Parsing the Fed’s Beige Book for the full analysis).

Nothing happened in Asia but they went down. Compare this to last week when nothing happened and they went up and we have the makings of a change in sentiment. There was certainly noting in yesterday’s Beige Book to make Asian investors excited (see my Parsing the Fed’s Beige Book for the full analysis).

In yet another reason to love TBT, Japan’s Housing Finance Agency is attempting to woo foreign investors by INCREASING the yields on state-backed mortgage bonds. This may be the opening shot in a very long war as debtor nations fight for a shrinking pool of investor cash to subsidize their non-stop spending. Both the ECB and the BOE left their rates unchanged today and Europe is down just slightly ahead of the US open where we may get yet another low-volume push for the first hour or so until somebody hits the sell button and dumps shares into all the bagholders, who are being herded like sheep to the slaughter by Cramer and his MSM cohorts.

Greece is still the word and even a rumor of a move regarding a possible resolution to the Greek tragedy send the Euro and the Pound flying up and down. So let’s enjoy this morning’s "good" news and we’ll see if we can get another nice entry on the USO puts and possibly a re-load on the DIA (same plan as yesterday) but we DO NOT want to be too short into the close as we may get an upside surprise on tomorrow’s Non-Farm Payroll number thanks to the census hiring.