TGIF! We had a really great week thus far, and I want to close it out with looking into a long term position. Yesterday, we had a fairly successful day as we closed two positions in Exide Technologies (XIDE) and Quiksilver (ZQK). XIDE was our Overnight Trade from Wednesday that we entered at 4.00. The company reported stellar earnings, and I was able to sell yesterday morning at 5.45 for a 38% gain in just one day!!! Quiksilver, which was our Play of the Week, was entered on Tuesday at 4.60. We were looking to gain 4-6% for the week and were able to exit yesterday at 4.78. I wish we would have continue holding it, however, as the company reported very strong earnings and is up 11% today. Our Short Sale of the Day, yesterday, in ERY was a hold for the day. We bought in the morning at 11.60, and we sold it at the end of the day at 11.40 for a near 2% gain. It was a great day. The market is looking quite terrible today, so it is a great time to open a new long position.

TGIF! We had a really great week thus far, and I want to close it out with looking into a long term position. Yesterday, we had a fairly successful day as we closed two positions in Exide Technologies (XIDE) and Quiksilver (ZQK). XIDE was our Overnight Trade from Wednesday that we entered at 4.00. The company reported stellar earnings, and I was able to sell yesterday morning at 5.45 for a 38% gain in just one day!!! Quiksilver, which was our Play of the Week, was entered on Tuesday at 4.60. We were looking to gain 4-6% for the week and were able to exit yesterday at 4.78. I wish we would have continue holding it, however, as the company reported very strong earnings and is up 11% today. Our Short Sale of the Day, yesterday, in ERY was a hold for the day. We bought in the morning at 11.60, and we sold it at the end of the day at 11.40 for a near 2% gain. It was a great day. The market is looking quite terrible today, so it is a great time to open a new long position.

As a preview, the graph on the left shows you the average amount of cups of coffee an adult in each country consumes on a daily basis. It is pretty staggering to see how much is consumed, but it is also interesting to see the business potential in the industry. I guess those Scandinavians really love their coffee. Interestingly, producers are not big consumers. It may have something to do with weather…

And onto the investment…

Long Term Investment: Green Mountain Coffee Roasters Inc. (GMCR)

Thesis

The coffee industry is one that has been dominated by only a few players for years. The likes of Starbucks, Maxwell House, Folger’s, and more recently Dunkin’ Donuts have ruled the market share of coffee. Over the past few years, however, Green Mountain Coffee Roasters has begun to establish itself as another major player in the industry through its two-pronged

approach of selling coffee beans and grounds through distributors and selling instant-brew machines through its Keurig brand that offer single cup servings of coffee and tea right into a cup rather than pot.

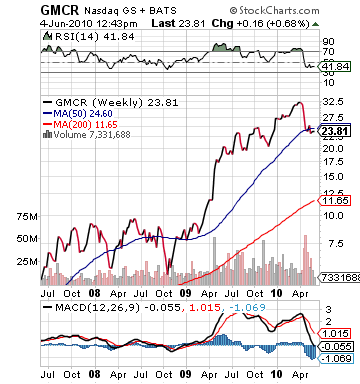

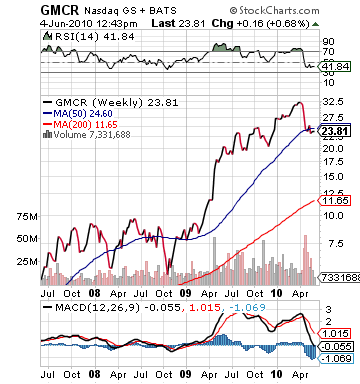

In the past five years, GMCR has increased its revenue by 400%. The company has increased its income by 500%. The company has seen substantial growth, and it is actually surpassed Folger’s and Maxwell House in sales this past year. The company’s stock as a result has taken the same path over the past five years, rising from 2.30 a share five years ago to 24.00 per share today – an increase of nearly 950%, and today’s price is down from a high in the 33s the company saw earlier this year. Green Mountain has definitely gotten its foot in the door and established itself as a leader in the coffee industry; however, the company has grown at phenomenal rates over the past few years. The company in its latest quarter for the first time could not meet the estimates that people were expecting with the same extraordinary growth rate.

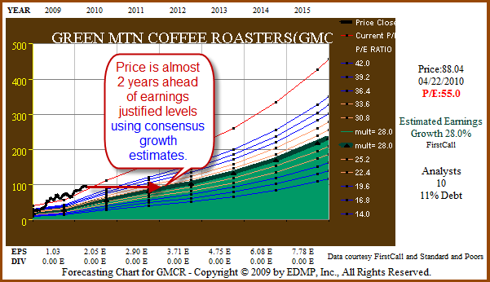

The problem with GMCR is that it has had significant growth. It is up over 6,000% in ten years, and as a result, it has an extremely high valuation. The company recently did a 3-1 stock split to attempt to pyschologically improve that shares are cheaper than they actually are, but it does not change the stocks P/E ratio, which is sitting well above 40. At any signs of weakness, this stock price will come crashing down. What has fueled its recent drop from $33 to $24? It was a combination of a weak market, combined with the fact that the company reported lower than expected outlook for its next quarter. Even though the company had 68% increase in sales, the company could not meet expectations.

Since 2007, the growth rate of the company has been at over 60%. As Chuck Carnevale comments in his article,

How to Tell if Its Time to Sell, Part 2, “forecast from ten analysts reporting to FirstCall of 28% growth for the next five years. Zacks reports a consensus 5-year forecast of 31% earnings growth. Both of these numbers are consistent with longer history and could conceivably be achieved. On that basis, Green Mountain Coffee Roasters is a sound sell candidate.”

One of the ways that the company continues to see growth is by a number of buy-outs. The company has continued to buy up its distribution line and sellers of its Keurig brand. Recently, the company completed another acquistion of Diedrich Coffee. One of the issues with this is that the company is lacking a lot of free cash flow. In the past six years, the company has only finished two years with free cash flow, and in the past two years they have had negative cash flow of over $55 million.

Further, the company has very low net margins. They do no turn a lot of revenue into income with net margins around 5-6%. Most strong long term investments are around 15% because it means the company does not have a lot of selling, general, and administrative expenses and interest payemnts. GMCR has really great gross margins above 25%, but they have net margins around 6%. That discrepancy shows way too much money is being serviced into debt and administrative expenses. The company’s profitability will need to have a lot of sustained revenue growth to cover the expenses in debt and takeovers.

As they start to reach limits in selling capacities, they will being to start to see problems in profitability.

Another issue to raise is that GMCR is seeing is accounts receivable outgrow its sales at an alarming rate. A company never wants to have a much higher perecentage growth in accounts receivable over sales. The company has seen accounts receivable grow in Q1 of 2010 100%, while sales only grew 77%. The problem here is that inventory starts to build up as the company thinks too greatly to the future, and it causes inventory markdowns, lower profitability, and costs of storage.

The company’s ability to be efficient has gotten better over the years, and it has allowed the company to continue to see great growth. Yet, in 2010 so far, the company is seeing the days sales outstanding start to rise, the cash conversion cycle decreasing, and inventory turnover taking much longer. There is definitely an issue in GMCR’s distribution line that is going to need to be fixed because again it will threaten the company’s ability to expand.

All these issues with an overvaluation create a major dilemma for the company, and competition still looms…

Finally, GMCR has competition. Starbucks, Maxwell House, Folgers, Dunkin’ Donuts, McDonald’s, and others are all in this industry. These are established companies that have lost market share to GMCR’s success. Each of these companies is beginning to realize that the K-Cup is extremely successful product. In the fast-paced economy in which we live, the single serving cup is a great way to get coffee and go. Starbucks released their VIA line and Maxwell House is about to undergo a major promotions campaign in Q3 of 2010. These companies will not be undone and should begin to tap into GMCR’s recipe for success. The competition is definitely there, and while GMCR has created a small economic moat with its K-Cup idea, the idea is obviously one that can be adapted by other companies established.

Valuation

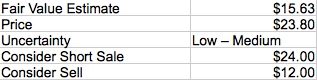

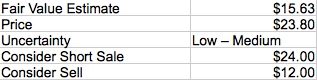

My fair value estimate for Green Mountain Coffee Roasters is $15.63 per share based on a discounted cash-flow analysis.

The company has seen incredible growth in its operating income in the past five years, but the amount of growth the company has seen will start to decline. As that declines, the company will not be able to maintain its extreme valuation. Additionally, the company has shown a number of financial issues with profitability and efficiency this year, which should threaten the company. Further, they have no free cash flow, which is the red alarm that further growth is threatened. My estimated available cash flow starts at $160 million for this year, which is a best-case scenario for the company moving forward.

Risk

Risk is medium with Green Mountain Coffee Roasters. The company has been for the past couple years been told it could not continue at this rate, and they have. Yet, over the past couple years they have improved everything from growth, to profitability ratios, to financial health, to efficiency. For the first time, we are starting to actually see these numbers start to not be able to maintained or slow down. That threatens the company. Yet, the K-Cup is very popular, and if the company can overcome some of the obstacles and maintain a high level of growth, there stock is in good shape.

Management & Stewardship

President and CEO Lawrence J. Blanford has been with the company since May of 2007. He has a background in consumer goods but on the technology side. He was involved with Philips, Maytag, and Royal Tech before involving himself with Green Mountain. One issue with with Green Mountain is that it does not seperate its CEO and President title. Another issue with Blanford is that he has in just three years seen his compensation triple while most other board members have seen no increase. One positive is that the company’s Chairman and former CEO before Blanford, Robert Stiller, holds a 51% stake in the company. Therefore, he treats the company like a shareholder. The move from him to Blanford was seen as a move to help take the company to the next level.

Overview

Growth: The company has seen a 550% increase in its operating income in the past five years. These results have been pretty stable in growth, but the company has seen a slowdown in year-to-year growth this year. It saw a 100% increase from 08-09, but it is only expecting a minor increase of less than 20% this year.

Profitability: The company should continue to maintain its operating margins above the 10% range, which is very high. The company will continue to remain profitable, but the amount of SG&A and interest expenses the company has continue to demand a lot of revenue. As that slow downs, profitability will decrease. Additionally, the lack of any free cash flow is a deteriment to profitability.

Financial Health: The company is in very solid financial condition. The company has decreased its current liabilities over the past few years and has a solid current ratio. The company does have some long term debt, but it has been reduced significantly over the past couple years, as well.

Entry: We are looking to get involved in a short sale at 24.05 – 24.15.

Exit: We are looking to cover around 17-18, which is where I have my fair value estimate for GMCR.

Stop Loss: None

Good Investing,

David Ristau

TGIF! We had a really great week thus far, and I want to close it out with looking into a long term position. Yesterday, we had a fairly successful day as we closed two positions in Exide Technologies (XIDE) and Quiksilver (ZQK). XIDE was our Overnight Trade from Wednesday that we entered at 4.00. The company reported stellar earnings, and I was able to sell yesterday morning at 5.45 for a 38% gain in just one day!!! Quiksilver, which was our Play of the Week, was entered on Tuesday at 4.60. We were looking to gain 4-6% for the week and were able to exit yesterday at 4.78. I wish we would have continue holding it, however, as the company reported very strong earnings and is up 11% today. Our Short Sale of the Day, yesterday, in ERY was a hold for the day. We bought in the morning at 11.60, and we sold it at the end of the day at 11.40 for a near 2% gain. It was a great day. The market is looking quite terrible today, so it is a great time to open a new long position.

TGIF! We had a really great week thus far, and I want to close it out with looking into a long term position. Yesterday, we had a fairly successful day as we closed two positions in Exide Technologies (XIDE) and Quiksilver (ZQK). XIDE was our Overnight Trade from Wednesday that we entered at 4.00. The company reported stellar earnings, and I was able to sell yesterday morning at 5.45 for a 38% gain in just one day!!! Quiksilver, which was our Play of the Week, was entered on Tuesday at 4.60. We were looking to gain 4-6% for the week and were able to exit yesterday at 4.78. I wish we would have continue holding it, however, as the company reported very strong earnings and is up 11% today. Our Short Sale of the Day, yesterday, in ERY was a hold for the day. We bought in the morning at 11.60, and we sold it at the end of the day at 11.40 for a near 2% gain. It was a great day. The market is looking quite terrible today, so it is a great time to open a new long position. approach of selling coffee beans and grounds through distributors and selling instant-brew machines through its Keurig brand that offer single cup servings of coffee and tea right into a cup rather than pot.

approach of selling coffee beans and grounds through distributors and selling instant-brew machines through its Keurig brand that offer single cup servings of coffee and tea right into a cup rather than pot. growing and will continue to grow, is slowing down, and those two words truly do threaten GMCR.

growing and will continue to grow, is slowing down, and those two words truly do threaten GMCR. As they start to reach limits in selling capacities, they will being to start to see problems in profitability.

As they start to reach limits in selling capacities, they will being to start to see problems in profitability. The company has seen incredible growth in its operating income in the past five years, but the amount of growth the company has seen will start to decline. As that declines, the company will not be able to maintain its extreme valuation. Additionally, the company has shown a number of financial issues with profitability and efficiency this year, which should threaten the company. Further, they have no free cash flow, which is the red alarm that further growth is threatened. My estimated available cash flow starts at $160 million for this year, which is a best-case scenario for the company moving forward.

The company has seen incredible growth in its operating income in the past five years, but the amount of growth the company has seen will start to decline. As that declines, the company will not be able to maintain its extreme valuation. Additionally, the company has shown a number of financial issues with profitability and efficiency this year, which should threaten the company. Further, they have no free cash flow, which is the red alarm that further growth is threatened. My estimated available cash flow starts at $160 million for this year, which is a best-case scenario for the company moving forward. President and CEO Lawrence J. Blanford has been with the company since May of 2007. He has a background in consumer goods but on the technology side. He was involved with Philips, Maytag, and Royal Tech before involving himself with Green Mountain. One issue with with Green Mountain is that it does not seperate its CEO and President title. Another issue with Blanford is that he has in just three years seen his compensation triple while most other board members have seen no increase. One positive is that the company’s Chairman and former CEO before Blanford, Robert Stiller, holds a 51% stake in the company. Therefore, he treats the company like a shareholder. The move from him to Blanford was seen as a move to help take the company to the next level.

President and CEO Lawrence J. Blanford has been with the company since May of 2007. He has a background in consumer goods but on the technology side. He was involved with Philips, Maytag, and Royal Tech before involving himself with Green Mountain. One issue with with Green Mountain is that it does not seperate its CEO and President title. Another issue with Blanford is that he has in just three years seen his compensation triple while most other board members have seen no increase. One positive is that the company’s Chairman and former CEO before Blanford, Robert Stiller, holds a 51% stake in the company. Therefore, he treats the company like a shareholder. The move from him to Blanford was seen as a move to help take the company to the next level.