THREE THINGS I THINK I THINK

Courtesy of The Pragmatic Capitalist

1) Why do we celebrate more debt?

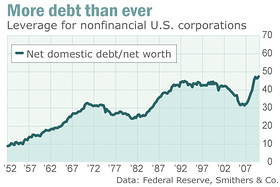

Few things get investors more excited than a buyout. In recent weeks there has been a sudden flurry of merger activity. This has only fed the media’s incessant chatter about “cash on the sidelines” (which is entirely false) and has perpetuated the myth of “strong” corporate balance sheets. As we showed many weeks ago corporate balance sheets are not nearly as strong as most would like to think. In fact, from a

“The debt repayments made during the financial crisis were brief and minimal: tiny amounts, totaling about $100 billion, in the second and fourth quarters of 2009.

Remember that these are the debts for the nonfinancials — the part of the economy that’s supposed to be in better shape. The banks? Everybody knows half of them are the walking dead.

Central bank and Commerce Department data reveal that gross domestic debts of nonfinancial corporations now amount to 50% of GDP. That’s a postwar record. In 1945, it was just 20%. Even at the credit-bubble peaks in the late 1980s and 2005-06, it was only around 45%.”

John Hussman was quick to pounce on these notions of “strong balance

“Interestingly, some observers lament that corporations and some individuals are holding their assets in “cash” rather than spending and investing those balances, apparently believing that this money is being “held back” from the economy. What is preposterous about this is that the “cash” that companies and individuals are observed to be holding is primarily in the form of government securities and base money created over the past couple of years, which somebody has to hold at every point in time until those liabilities are retired. This is not money that is waiting to be spent. It is a stack of IOUs representing resources that have already been squandered, and nowsomebody has to hold these pieces of paper until they are retired.”

So, when I see BHP Billiton bidding for Potash and relying on $45bn in bank loans I just have to ask myself:

“Why in the world is this a good thing?”

I’m generalizing to some extent here (because not all deals are done with debt) but I still have to ask myself why we all think the private sector really needs more debt? Do corporations really need to eat each other up simply because their executives have run out of creative ways to actually generate organic growth from within?

Previous booms in M&A have often been followed by economic downturns. The most pronounced of which was the M&A boom heading into the current credit crisis. With the private sector still deeply indebted you just have to wonder why the market is convinced that more debt is a good thing. Ben Bernanke just wants the banks to lend. Tim Geithner doesn’t understand why consumers won’t borrow. The equity markets celebrate every debt laden “Merger Monday”. The media is just begging consumers to whip out those credit cards and spend money they don’t really have. At what point do we realize that more debt is not the solution to the problem of debt?

2) Yesterday’s odd rally

There were rumors that yesterday’s rally in equities was due to chatter of consolidation in the homebuilding sector. The homebuilder index closed up 3% as many of these stocks rallied despite bad news in the home sales reports from the previous two days. Most of these companies are debt laden and leveraged and have, in my opinion, been contributing to the problems in the US housing market by simply piling on more supply to a market that is already oversupplied.

The CitiGroup analyst who sparked the takeover rumors listed several companies that were potential targets and potential suitors. The average debt to equity ratio of these companies was 1.8 while the potential suitors came in only marginally better with an average debt to equity ratio of 1.65. A quick glance at their balance sheets shows a deeply troubled industry that has largely hung on due to a government price fixing scheme and demand that has been pulled from several quarters into the future.

These companies often get lost in the bailout discussion due to the overwhelming level of aid that was provided directly to the banks (who catch all the headlines), but you have to wonder how most of these homebuilders would have fared had we not provided so many different incentives that helped boost up this market. Even more worrisome (and controversial) is the seemingly endless building that these companies seem to add to the market. As Annaly Capital recently said:

“unless we hear about a big uptick in bulldozer sales, the experience of the car market may also be accompanied by a downdraft in home prices.”

Perhaps for his next stimulus bill President Obama will purchase several hundred thousand bulldozers from a well known American company (perhaps inside reason for this CEO’s bullishness?) and immediately begin hand out a few hundred thousand jobs to people who will drive them thru these desolate housing projects. A stop by the corporate headquarters of several of the homebuilding companies wouldn’t hurt either. Of course I kid, but the level of government intervention in many of these markets has not only been destructive, but is incredibly frustrating. The very fact that I am still discussing this credit crisis absolutely sickens me. The fact that I have been right about the failure of most of these government programs is beyond maddening. But I digress….

Why the entire equity market would rally on news that this sector is ripe to take on more debt and become more powerful is beyond me. This strikes me as yet another case of equity investors jumping on the “what’s good for the next 3 months is good for me” bandwagon as opposed to the belief that we should be implementing and promoting market behavior that is for the long-term benefit of us all. Will we ever learn? At the heart of this obsessive short-term perspective is the government itself which continues to promote short-term fixes to long-term problems. Bank bailouts, housing tax credits, cash for clunkers and on and on. Is it all just an attempt to prop up markets in time for your next election or is there actually anyone in power who gives a damn about the long-term well-being of this country?

3) Get rid of Obama’s economic team

3) Get rid of Obama’s economic team

Representative Boehner finally got something right on the economic front. He says Obama should fire his economic team and he’s dead right. Although I disagree with parts of Boehner’s economic policy (particularly his incessant fear mongering about the imminent USA bankruptcy) I think he’s finally onto something here. We need real change in Washington.

Thus far, Obama’s economic team has proven that they’re mirror images of our past failures. Larry Summers is the third piece in the Rubin, Greenspan triumvirate who helped create these banking behemoths and then proceeded to bankrupt the private sector by running a budget surplus. Geithner is the fox in the hen house. This man was the President of the NY Fed when all of these banks were overdosing on leverage. And then there is Bernanke, who technically isn’t part of Obama’s team, but has done nothing but help prop up zombie banks while producing absolutely zero private sector recovery. This is a man who has rinsed and repeated Greenspan’s same “flawed” monetarist thinking. Some people call him creative. I’ll give him that. He’s a creative monetarist, but that doesn’t excuse the fact that he failed to even account for the possibility of a housing bubble, has misdiagnosed this balance sheet recession as a pure banking crisis and then applied the exact wrong cure. It’s embarrassing that we are even having this “double dip” discussion just months after the first recession technically ended.

I’m sure you can tell that this recession is frustrating me….As I’m sure it is frustrating us all….

***

Photo courtesy of Jr. Deputy Accountant