Japan has the same Prime Minister!

That is big news after having 5 different ones the past 4 years. With the last PM lasting just 9 months, word was Kan was going to challenge the record for shortest term after being forced into this election just 3 months after being elected the first time. When we talked about this yesterday, the race was considered "too close to call" but the incumbent Mr. Kan ended up winning 60% of the vote – kind of makes you wonder how far off our own pollsters are with their early election calls…

Now the stage is set for the Oct 4th meeting of the BOJ, where action must be taken to get the Yen under control. Ozawa was clearly better for the Dollar, as he favored strong intervention to bring the Yen down including a program of both QE and stimulus and they Yen blasted to 15-year highs on the result of this election, now at just 83 Yen to the Dollar, down from 120 in 2007 (30%) with a 15% move up since May. This is TERRIBLE for Japanese exporters, who get paid relatively less for everything they sell but it’s good news for commodity pushers, who get paid in devalued Dollars.

To what extent is Japan’s deflation simply a function of their currency appreciating an average of 10% a year? If their deflation rate is 2% then doesn’t that mean it’s really an 8% INflation rate masked by a too-strong currency? Perhaps that’s why the people of Japan, who get paid in Yen and shop with Yen, strongly preferred Kan, who was only really opposed, in the end, by Parliament, where he won 206 to 200 – the Japanese version of the US Senate. This means that, like Obama, it will be very difficult for Kan to get anything done despite his popular support and, also like our own Senate: "Having witnessed the shaky ground he stands on, opposition parties are licking their chops to begin their attacks on Mr. Kan," said Koichi Nakano of Sophia University.

Doesn’t it make you feel good to know that, despite our cultural differences, politicians around the World are all the same – just a bunch of power-hungry, vindictive bastards who put their own interests ahead of the people who they are supposed to represent? Like Obama, Kan still faces difficulties navigating what the Japanese call a "twisted parliament," where the DPJ has a minority in the upper house, following a drubbing—under his leadership—in July elections. This gives opposition parties power to block most types of legislation, much like our own filibuster-plagued Senate..

Doesn’t it make you feel good to know that, despite our cultural differences, politicians around the World are all the same – just a bunch of power-hungry, vindictive bastards who put their own interests ahead of the people who they are supposed to represent? Like Obama, Kan still faces difficulties navigating what the Japanese call a "twisted parliament," where the DPJ has a minority in the upper house, following a drubbing—under his leadership—in July elections. This gives opposition parties power to block most types of legislation, much like our own filibuster-plagued Senate..

The Nikkei only fell 22 points this morning but we’re done with last week’s EWJ play, which was a gamble ahead of the election and, since the premise of the election change is gone, it’s no longer interesting. The rest of Asia doesn’t mind a strong Yen – it means they get to sell more stuff to the Japanese. The Hang Seng and the Shanghai were flat but the BSE jumped another 138 points (0.72%) to 19,346, still the World’s leading index.

Not only did the Yen hit new highs but the Yuan moved up against the dollar on rumors that the Chinese will allow their currency to appreciate to head off talk of trade sanctions from Washington. “China doesn’t want to see the relationship with the U.S. get hurt because of the currency issue,” said Lu Ting, a Hong Kong-based economist at Bank of America-Merrill Lynch. “There will be more space for yuan appreciation also because signs show the economy will have a soft landing.”

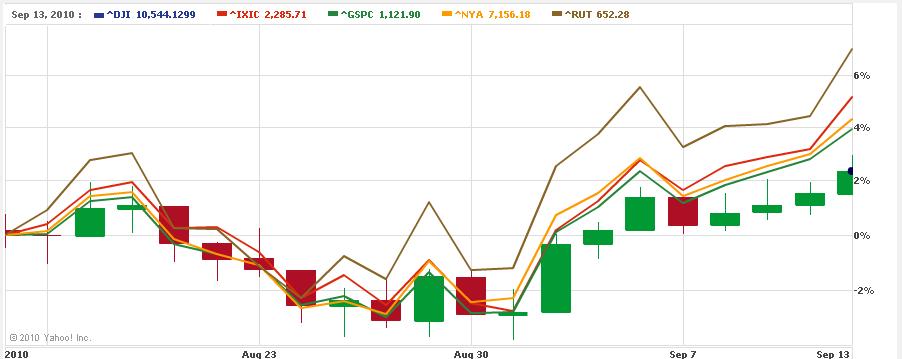

Europe is flat ahead of the US at 8:25 and we’re waiting for retail sales reports as our indices are all hovering around 5% gains for the last 30 days, but already well over 5% off the late August lows, where everyone was panicking and my commentary on the sell-off on the 31st was: "I still think it’s all BS. I’m still more in favor of buying off these levels than selling but I am getting VERY lonely over here." Fortunately, the move since then has given me that hope we were looking for:

Russell 650 was the key to happiness we were looking for, now we’ll see if they can hold it! Our 2.5% watch levels were Dow 10,455, S&P 1,100, Nas 2,255, NYSE 7,000 and Russell 650 but one day does not a breakout make although the NYSE already popped the 5% mark with the S&P testing yesterday so happy days may finally be here again if we can get over the 5% hump at: Dow 10,710, S&P 1,123, Nas 2,310, NYSE 7,140 and Russell 666. That 666 line on the RUT has been very ominous for us al year so we will be hedging up at these levels, using the 3 of 5 rule on the 5% line to flip back to bullish.

Retail sales are up a better-than-expected 0.4% for August. Well, BTE than economists but not better than we expected because we pay attention to hard data, not the nonsense that’s spewed by the MSM. The Beige Book was pretty clear on the matter last week and just yesterday, one of our Members asked me if I thought it was a good idea to short BBY and I said:

Retail sales are up a better-than-expected 0.4% for August. Well, BTE than economists but not better than we expected because we pay attention to hard data, not the nonsense that’s spewed by the MSM. The Beige Book was pretty clear on the matter last week and just yesterday, one of our Members asked me if I thought it was a good idea to short BBY and I said:

BBY – I don’t know, I think electronics are selling so I’d go for the Dec $35s at $2.30 to give yourself a little room in case they do take off. You stand to make $1.20-$3 if all goes very well and you risk a $2 move up that costs you about the same. I like the idea better if they have a big run up (200 dma is $38.50) and there’s excitement to sell into but not so much as it is now.

As it turns out, BBY’s earnings are up 60% on a 3% increase in sales and the stock is up 10% in pre-market trading, looking very good to hit the $38.50 target. Not all retail sales are sparkling though. Gasoline sales were up 1.9% (go VLO!) but, as also mentioned in the BBook, durable goods dragged us down with furniture sales off 0.5% and appliances down 1.1%. Still, core retail sales (ex-auto) were a huge relief – up 0.6% vs. up 0.3% expected by those expert economists. Notably, the rise in retail sales exactly mirrors the 0.3% increase in wages in the August Employment Report, once again proving that nothing is better for the economy than hiring people and paying them well enough to shop.

Of course, this is not the plan of the GOP or the Tea Party for 2011 as the Tea Party Express called for a repeal of Health Care Legislation yesterday, saying: "Unfortunately we will not be able to pass repeal legislation until there are 60 amenable senators to avoid a filibuster and a Republican president to sign it. By the time such a majority is secured, Obamacare will be well on its way to becoming another entrenched, immortal entitlement program. Therefore, a more immediate and comprehensive strategy is in order to ensure this train wreck of a law doesn’t leave the station.”

This repeal tactic is similar to the one planned for Social Security. As Conservative pundit Karl Denninger pointed out last month, the attack on Social Security payments can be based on the 1960 Supreme Court decision of Flemming .v. Nestor, which held that Congress reserved the right to alter, amend or repeal any provision of the Act. According to Denninger:

This repeal tactic is similar to the one planned for Social Security. As Conservative pundit Karl Denninger pointed out last month, the attack on Social Security payments can be based on the 1960 Supreme Court decision of Flemming .v. Nestor, which held that Congress reserved the right to alter, amend or repeal any provision of the Act. According to Denninger:

There is no "debt" owed to those receiving entitlement benefits through these programs.

They are legally welfare programs which Congress can modify or even eliminate at any time without triggering any sort of Consttutional or "full faith and credit" problem, or any other legal obligation to those who have allegedly "paid in" to them over their working lives.That is, your FICA and Medicare taxes are in fact a simple tax and your Social Security and Medicare benefits are in fact a simple welfare program.

So the eyes are clearly on the prize this fall as Republicans look to fund those tax cuts by going after the $800Bn annual Social Security obligation…. oh, excuse me, welfare program but I wonder what will happen when that $800Bn is removed from the economy and what will happen to the $2Tn of assets that were paid in… oh, excuse me, taxed by the retirees and what will happen to the $4Tn the government borrowed… oh excuse me, stole from the fund (lock box)?

It’s going to be an interesting election season – be very careful out there!