My what a crazy market we are having!

My what a crazy market we are having!

I’ve been chatting with Members since 4:30 this morning (see the end of yesterday’s Member Chat) and there’s a copy of my short premise on CMG (we shorted them after earnings in Member chat at $273.50) already sent in for free on Seeking Alpha so I feel like I’m already done for the morning at 7:30.

It’s been a crazy week as we have done our best to get more bullish – laying out our latest round of Breakout Defense Plays for Members this weekend (which we were able to fill again on yesterday’s dip back to Monday’s open) as well as long plays during the week’s chat sessions on XLF(Monday), KO and TBT (Tuesday), EGLE and SPY (Wednesday) along with yesterday’s busy bullish plays on DDM, CSCO and EGLE again as well as a complicated ratio spread on CMG that was a bit bearish but should be good on less than a 10% jump and pays best on a flat-line.

It wasn’t all longs. We like to BALANCE our plays – especially after we get a nice move up. So, on Wednesday we grabbed some PCLN puts and did a bearish NFLX call spread and we played NFLX puts yesterday as a day trade (went very well and now we can re-load) along with an earnings short on WYNN (winner!). All in all, it’s been a fun week and we can turn to Clark and Lana for the morning report on Egypt, CMG and food inflation:

Ah, it’s nice to have a professional news team. So much less work for me! What they didn’t discuss was the dollar. That will, of course, get a mention in the weekend edition of Stock World Weekly – who do a fantastic job of tracking that situation over time. Our bouncy U.S. buck is back to 78.68, up from a low of 76.88 (2.4%) at the beginning of last week. On the whole, the market has held up well against the rising dollar and that was the bullish sign we wanted and the basis for our new Breakout Defense plays as well as our move from 15% bearish/10% bullish and 75% cash to 20% bullish/15% bearish and 65% cash. As long as we hold Russell 800 along with our other breakout levels – we may as well enjoy the ride.

As I mentioned earlier in the week, we are concentrating our short-term bearish firepower on the high-flyers, as they can give us spectacular gains when they fail while hedging our long-term bullish positions to the point where we will be disappointed if we DON’T get a big sell-off. This is how we play stage one of a potential new leg up in the market. Our previous Breakout Defense Virtual Portfolio was put up on December 11th to take advantage of our Breakout 1 levels being reached (and those trades already accomplished their goal of making 5,000% in 5 Trades in this crazy straight-up market) and that was followed by our Secret Santa Inflation Hedges on December 25th – also all doing quite well, thank you as it turns out our "Secret Santa" was The Bernank – and he bought us a bag full of money!

As I mentioned earlier in the week, we are concentrating our short-term bearish firepower on the high-flyers, as they can give us spectacular gains when they fail while hedging our long-term bullish positions to the point where we will be disappointed if we DON’T get a big sell-off. This is how we play stage one of a potential new leg up in the market. Our previous Breakout Defense Virtual Portfolio was put up on December 11th to take advantage of our Breakout 1 levels being reached (and those trades already accomplished their goal of making 5,000% in 5 Trades in this crazy straight-up market) and that was followed by our Secret Santa Inflation Hedges on December 25th – also all doing quite well, thank you as it turns out our "Secret Santa" was The Bernank – and he bought us a bag full of money!

In between, of course, we have new trade ideas every day – there were over 100 trade ideas for Members in December alone, on top of what was in our two main virtual portfolios for the month. If the market does hold up, by the end of the month there will be another long virtual portfolio but we would really, Really, REALLY rather see a pullback before we deploy more capital on the long side – hedged or not!

Interestingly, in our short-term, very aggressive $25,000 Virtual Portfolio, we are still very bearish, with 4 of 6 positions looking for a short-term market correction. Of course, that virtual portfolio has to make about 15% a month to get to our $100K goal by the end of the year ($25,835 after 2 weeks) while our longer-term, larger virtual portfolios are happy to get over 20% in a year so it’s a very different stance based on making faster trades (virtual) and going with our gut. Overall, it makes for a great learning exercise as we review each trade and devise strategies to cope with rapidly changing market conditions.

We have the ever-changing Michigan Sentiment report at 9:55 this morning and the ECRI Index of Leading Economic Indicators at 10:30 but that’s it for the week. Next week is a DataPalooza, with Retal Sales on Tuesday along with Empire State (NY) Manufacturing, Import/Export Prices (more inflation), TIC Flows, Business Inventories and the NAHB Housing Market Index. Wednesday we get hit with the MBA Mortgage Purchase Index, Housing Starts, Building Permits, the PPI, Industrial Production/Cap Utilization and Crude Inventories. Keep in mind that the Fed’s Beige Book was quite clear in noting that Housing continues to be weak and Price Pressures continue to rise. Last time this set of data came out we had our last proper dip in the market – think about it…

We have the ever-changing Michigan Sentiment report at 9:55 this morning and the ECRI Index of Leading Economic Indicators at 10:30 but that’s it for the week. Next week is a DataPalooza, with Retal Sales on Tuesday along with Empire State (NY) Manufacturing, Import/Export Prices (more inflation), TIC Flows, Business Inventories and the NAHB Housing Market Index. Wednesday we get hit with the MBA Mortgage Purchase Index, Housing Starts, Building Permits, the PPI, Industrial Production/Cap Utilization and Crude Inventories. Keep in mind that the Fed’s Beige Book was quite clear in noting that Housing continues to be weak and Price Pressures continue to rise. Last time this set of data came out we had our last proper dip in the market – think about it…

More inflation data to finish the week with Thursday’s CPI Report, which was running a very hot non-core 0.5% in December. Of course we get our usual Initial Jobless Claims and the fabulous Philly Fed report for February, which was a surprisingly strong 19.3 in January led by exploding prices that were pretty much ignored by the MSM and our beloved Fed Chairman, who maintains that high prices are a problem for nasty little poor people in foreign countries and not anyone he cares about.

Data has not been a friend to the markets lately, nor have earnings, with many, many misses in the small caps now that we are past all the "great" news from the multi-nationals, who have greatly benefited from more and more outsourcing of US jobs as well as massive tax breaks and stimulus handed to them by our Government and ultra-low interest loans from the Fed and their per IBanks.

GLUU guided down, as did BR, CVH, HGG, TEVA, DSCM, SWIR, USNA, WCN, CSC, ATVI, AKAM, AMKR, OSUR, TQNT, PEP, PULS, TKLC, NILE, CPKI, LF, MOVE, RSG and WMGI this week. That is against improved guidance from ATRO, VSH, ASYS, ATML, CBL, NTGR, PPS, LRN, GTS, AAP and HGR. So that’s 23 companies lowering guidance this week (did I mention Pepsi?) and 11 raising their guidance.

Cramer says the bottom line is: "When people say it’s the end of the world just because of some financial or governmental upheaval, you need to put that event into the perspective of earnings," Cramer said. "If there is no impact or if there is a chance that something can go right, perhaps you should think twice before you bail on stocks. Instead you should be ready to pounce when others panic."

Cramer says the bottom line is: "When people say it’s the end of the world just because of some financial or governmental upheaval, you need to put that event into the perspective of earnings," Cramer said. "If there is no impact or if there is a chance that something can go right, perhaps you should think twice before you bail on stocks. Instead you should be ready to pounce when others panic."

Clark says: "Cramer is an idiot."

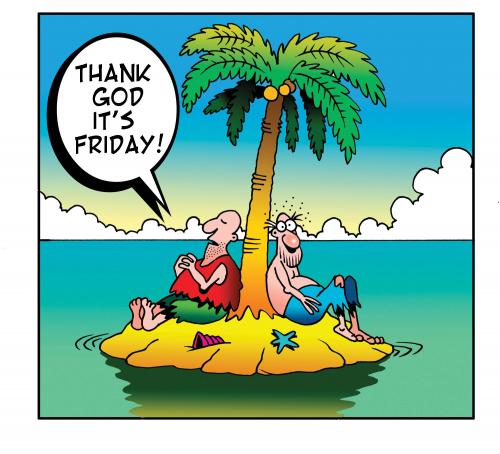

I’ve got my money on the silly cartoon being right (meaning Clark, not Cramer – I can see where that statement could easily be confused!).

Have a great weekend,

– Phil