She knows how hard her heart grows – under the nuclear shadows.

She can't escape the feeling, repeating in her head.

When after all the urges, some kind of truth emerges,

We felt the deadly surges – Discovering Japan

Can you believe we STILL don't know what's going on in Japan?

How amazing is it that we can fix a broken solar panel on a Mars lander (180M miles away) yet we can't get a straight answer on what's going on at a nuclear reactor 5,500 miles away?

Doesn't that seem odd to you? Either nuclear energy if EXTREMELY unsafe because – when it breaks down – even the experts can't figure out what's wrong, if there is anything wrong or what to do about it if it's wrong – OR – there's a huge cover-up and that means that we are allowing these potential weapons of mass destruction to fall into the hands of Big Business – who apparently are willing to lie to the public and cost-benefit the lives at stake against their quarterly reports. Frankly, I'll take my chances with Iran's government running a nuclear program before I'd let TEPCO operate another facility.

As people in California are beginning to learn – "not in my back yard" doesn't work when your back yard includes Japan. As I said on TV the other day, I'm not pro-nuke and I'm not anti-nuke but TEPCO is doing a good job of getting me there as this crisis unfolds. Not since Larry, Moe and Curly went into the plumbing business have we seen a repair job fall apart this completely. Even the Excelon CEO, who seems like a very reasonable and very trustable guy, still makes safety decisions based on cost. They HAVE to – they are in it for the money and that's just good Capitalism, right?

As people in California are beginning to learn – "not in my back yard" doesn't work when your back yard includes Japan. As I said on TV the other day, I'm not pro-nuke and I'm not anti-nuke but TEPCO is doing a good job of getting me there as this crisis unfolds. Not since Larry, Moe and Curly went into the plumbing business have we seen a repair job fall apart this completely. Even the Excelon CEO, who seems like a very reasonable and very trustable guy, still makes safety decisions based on cost. They HAVE to – they are in it for the money and that's just good Capitalism, right?

This is a very fine example of how Capitalism can, when exercised freely without Government regulation – destroy our entire planet. Sure they can wreck economies with risky derivative trading and sure they can rob people through jacked-up commodity costs and endless fees for every possible aspect of handling the money you own but that's just good, old-fashioned Capitalism and, if you don't like it – go to China you commie bastard.

Sure they pollute the air and the water and make unsafe cars and homes and push unhealthy foods and deadly, expensive drugs on the American public and sure they don't pay their taxes but they do pay whatever it takes to control our politicians as well as the MSM so they can continue to screw us over AND make us like it…

That's fine, we're used to that. But doesn't this kind of bother you? There are 400 plants around the World and we had about 65,000 nuclear warheads in various countries in 1985 – at the end of the cold war – each one cabable of doing far more damage than we've seen so far at Fukushima or 3-Mile Island or even Chernobyl (and we forget Tokaimura in 1999, Fukui in 2004, Hamm-Uentrop in 1986, Frenchtown Michigan in 1966 and Idaho Falls in 1961 – ALL nuclear accidents where radiation was released and yes, there were deaths – I am so sick of people lying on TV and saying no one has ever died from a nuclear accident – it's BS!).

Also BS is the over-reaction of the markets to the accident. As I just pointed out, although an obvious tragedy – this is not the first time a reactor has melted down and it won't be the last time one melts down. According to WikiPedia, this is the 6th time in 50 years we've had a major incident (level 4+ with radiation escaping into the environment) and that's not even counting military stuff like when the Russian nuclear submarine sank to the bottom of the Ocean, where it can poison the food chain for 100,000 years.

Also BS is the over-reaction of the markets to the accident. As I just pointed out, although an obvious tragedy – this is not the first time a reactor has melted down and it won't be the last time one melts down. According to WikiPedia, this is the 6th time in 50 years we've had a major incident (level 4+ with radiation escaping into the environment) and that's not even counting military stuff like when the Russian nuclear submarine sank to the bottom of the Ocean, where it can poison the food chain for 100,000 years.

Three Mile Island hit the US on March 28th, 1979 and, twenty-eight hours after the accident began William Scranton III, then lieutenant governor, appeared at a news briefing to say that Metropolitan Edison, the plant's owner, had assured the state that "everything is under control". Later that day, Scranton changed his statement, saying that the situation was "more complex than the company first led us to believe".

As the week progressed, 140,000 people were evacuated within 5 miles of the plant and clean-up did not begin until August of 1979 and took until December 1993 to complete at a cost of $1Bn. What happened to the stock market in March of 1979? Well, the S&P fell from 102.12 on the 28th to 100.90 on April 2nd and bottomed out at 98.06 in May (down 4%) and was back at 110 at the end of August (when clean-up began) and 450 in December of 1993. What's the moral of that story? LIFE GOES ON!

So let's all grow a pair and buy some socks while they're on sale, OK?

That's what we've been doing this week, of course, in our Member Chat. The VIX is up to 30 again and only 26% of the stocks in the S&P 500 are above their 50-Day Moving Averages – now that's what I call a sale!

It's been a long time since we found so many things to buy and we'll almost be sorry to see the markets pop but that's what we played for this morning and now the key is going to be whether or not we hold it. We STILL don't know what's going on in Japan so this is a technical bounce that we will likely be shorting into as we pop back off our flat-line for the year anything less than holding 1% gains today will be a very bearish indicator.

Notice how we came to rest right on the line which was, of course, predicted as our Breakout 2 Levels that we have been watching for AN ENTIRE YEAR. Now everyone understands why I never felt the need to draw up any new levels above the 100% line, right?

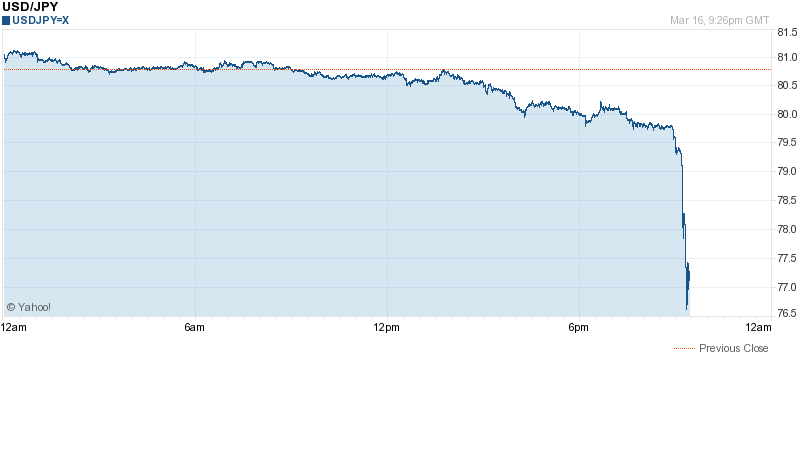

Of course we'd BETTER get a nice move this morning as the Dollar fell all the way to 76.15 this morning and the Yen had a fun trip last night with the futures blowing through the all-time low (1995) against the dollar at 79.75 and plunged all the way down to 76.39 in what we had decided in Member's Chat last night was nothing more than fear-mongering and manipulation. My comment to Members during the plunge was: "I think they are just busting on people who made the very obvious trade of Yen weakening ahead of BOJ action but WOW! I wish I had the guts to buy off the 78 line but I’m going out and that could be seppuku!"

We're back at 78.86 now – isn't that AMAZING? What complete BS the market is sometimes… Anyway, so we had that manipulative fun to close off what I thought was a manipulative day where investors were assaulted by bad news all day long – almost as if someone (Cough, Goldman! Cough, cough) was trying to drive all the weak hands out of position ahead of the winding down of the plant crisis in Japan and the announcement of the emergency G7 meeting tomorrow which is, more likely than not – going to result in MORE FREE MONEY!

Even AAPL was played like a fiddle with a downgrade by JMP Securities (can be confused with JPM, right?) and that tanked the Nasdaq as AAPL fell 4% but now, MIRACULOUSLY, CS took a look at THE SAME COMPANY this morning and declared that they were UNDERVALUED by about 60% – putting a $500 target on the company by the year's end. That should be a nice Nasdaq booster today!

Even AAPL was played like a fiddle with a downgrade by JMP Securities (can be confused with JPM, right?) and that tanked the Nasdaq as AAPL fell 4% but now, MIRACULOUSLY, CS took a look at THE SAME COMPANY this morning and declared that they were UNDERVALUED by about 60% – putting a $500 target on the company by the year's end. That should be a nice Nasdaq booster today!

Anyway, as I said (and it's almost 9:30 so I have to go to work now), we're still skeptical – especially with a poor Industrial Production Report for Feb at -0.1% vs +0.6% expected by idiot economists (I don't really have to call them experts anymore, do I? I mean, come on, they are like 0 for 50 so far this year) but that's OK because our friends in Big Business are making up for it by paying people 0.5% less DESPITE a 0.2% RISE in the average work-week. Isn't that special?

385,000 lost their jobs entirely last week and the CPI jumped 0.5% so sucks for the newly unemployed when they go grocery shopping. That's why we're bargain hunting – but we're also going to be hedging while we're shopping.

Be careful out there!