In case you were wondering, like I was, what Geithner’s Notice of Proposed Determination excluding FX swaps and forwards from Dodd-Frank requirements was all about. – Ilene

Courtesy of Bruce Krasting

Treasury is today issuing a Notice of Proposed Determination providing that central clearing and exchange trading requirements would not apply to FX swaps and forwards.

The basis for Tim’s big decision was made clear in the Treasury announcement:

In contrast to other derivatives, FX swaps and forwards always require both parties to physically exchange the full amount of currency on fixed terms that are set at the outset of the contract.

Okay! Got that? Interbank FX is excluded from D-F because it requires a settlement. Unlike FX futures that have zero expectation of actual cash settlement (AKA: A bet) the FX spot and forward market requires that the parties exchange the currencies.

I think many people will like this distinction. The thinking is that if actually delivery of a commodity or currency is required, then it is a commercial transaction and not a bet speculation. But actually those folks don’t understand how the system works.

Tim Geithner knows how it works inside and out. He worked on the Fed desk in NY. Therefore he knows that the basis for his decision is flawed. The simple answer is that only a small fraction of interbank FX spot and forward transactions are actually settled for cash. They are netted out and settled by an outfit called CLS.

What’s CLS? A good description comes from Tim’s former employer, the Fed:

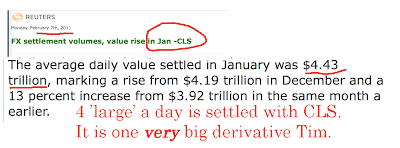

Is CLS a big deal? Does this outfit settle the lion’s share of all interbank spot and forward settlements?You bet it does. The Feb. numbers were a Multi-Trillion dollar blow out:

As a result of CLS 98% of all FX spot and forward transactions are netted out and settled with no delivery of the underlying currencies. So the argument that Tim has put forward in defense of his big choice is actually bogus. And he knows it.

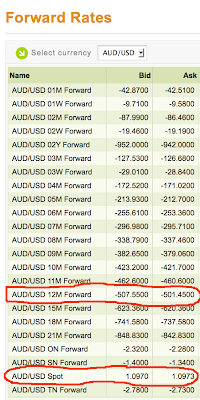

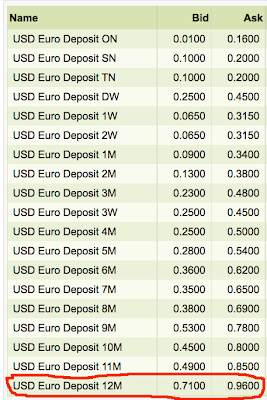

Let me take you in a different direction on this. A guess on how the D-F FX market carve-out will be exploited. Follows are three slides of the spot/forward swap/Euro deposit rates for the AUDUSD. There are a bunch of numbers (sorry). I circle the numbers to focus on. I’ll try to make this easy. (Note: all currency pairs have similar swap rates)

Take the mid point of each of the swaps/rates for one year AUDUSD. Those numbers are:

Put this together.

The interest differential is 4.60% (5.43 – .83).

The swap differential is .0505, divide that by the spot rate of 1.0970 and you get 4.60%. Bingo!

Some observations on this:

Ergo: Dodd-Frank has no teeth.

Ergo: We’re living in Joke Town.