Courtesy of Mish

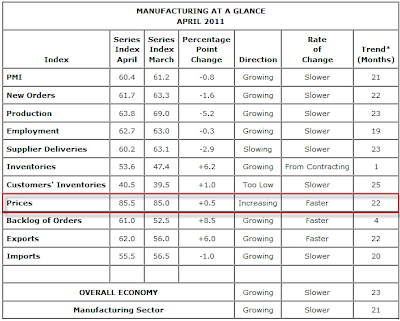

Today the Institute for Supply Management issued the April 2011 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in April for the 21st consecutive month, and the overall economy grew for the 23rd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM Report On Business®.

WHAT RESPONDENTS ARE SAYING …

- "Rapidly rising raw material costs putting extreme pressure on profits." (Food, Beverage & Tobacco Products)

- "Plastic resin product prices are climbing so fast that [suppliers] are attempting to increase prices on orders already accepted but not [yet] delivered." (Chemical Products)

- "Customers are rebuilding safety stock levels of inventory, and also trying to buy ahead of material price increases." (Plastics & Rubber Products)

- "Market continues to get stronger month over month. Recovery is faster than anticipated." (Transportation Equipment)

- "Pressure from offshore suppliers continues to mount with exchange rate increases and seasonal demand for capacity." (Miscellaneous Manufacturing)

Manufacturing ISM April 2011

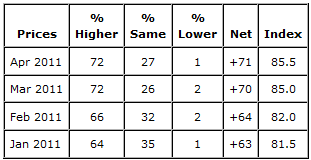

Prices Paid

The ISM Prices Index registered 85.5 percent in April, 0.5 percentage point higher than the 85 percent reported in March and the highest reading since July 2008 when the index registered 88.5 percent. This is the 22nd consecutive month the Prices Index has registered above 50 percent. A Prices Index above 49.4 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) Index of Manufacturers Prices.

Of the 18 manufacturing industries, 17 report paying increased prices during the month of April. No manufacturing industry reported paying lower prices on average in April.

Inflation Hysteria Part II

Barry Ritholtz at the Big Picture Blog comments on Short Memories (Fade the Inflation Hysteria, II)

Flashback to June 2008 (only three short years ago):

Headline CPI was running very close to 5.0 percent. The Fed funds rate was at 2.0 percent. Brent crude was $132/barrel. The Fed’s June 2008 minutes mentioned the word “inflation” 110 times (“deflation” and “disinflation” combined: zero), and also contained this caveat (emphasis mine):

With increased upside risks to inflation and inflation expectations, members believed that the next change in the stance of policy could well be an increase in the funds rate; indeed, one member thought that policy should be firmed at this meeting.

Fast forward one year:

Headline CPI was -1.2 percent (so much for the public’s ability to foretell inflation trends, but who didn’t know that?). The Fed funds rate had been lowered to its current range of 0.00 – 0.25 percent. Brent crude was $69/barrel. The Fed minutes were, amazingly, discussing “reduced concerns about deflation.”

Current day:

Bernanke’s prepared remarks and Q&A on Wednesday mentioned the word “inflation” 82 times. (The word “deflation”: twice.) It is unfortunate that “inflation” was far and away the dominant theme on Wednesday, swamping “jobs,” “employment,” and “unemployment” which, in my opinion, should have been the focus.

Of course, no two business cycles or economic environments are exactly the same, but it is unlikely that we will enter a period of sustained high inflation absent a more taut labor market, and that, unfortunately, still seems a ways off.

Inquiring minds may wish to read Fade the Inflation Hysteria, part I.

Amidst all the screams of hyperinflation, I side with Ritholtz that high inflation is unlikely, adding that hyperinflation is preposterous.

Instead, I propose we are in the midst of a central bank sponsored liquidity surge (not just the Fed but also the central bank of China) that has fueled another speculative bubble in commodities.