Reminder: Pharmboy is available to chat with Members, comments are found below each post.

Here’s a company that Pharmboy wrote up in April – with several updates. The stock has been bouncing around the price it was trading at when Pharmboy first entered a long position, and he still likes this trade. Caveat: Phil likes the idea of waiting for the company to "screw up" and the stock to drop lower before entering a position.

That’s why there are buyers and sellers, but there are not promises.- Ilene

United Therapeutics (UTHR) is a biotech company developing and selling pharmaceutical products for the treatment of cardiovascular disease. It has also been expanding into the viral and cancer arenas. The company has been profitable since ’04, and the stock has had a nice run since the market crash in 2008, rising from $24/share to its current price of around $64.50 (as of May 31, 2011). (Figure 1)

United Therapeutics (UTHR) is a biotech company developing and selling pharmaceutical products for the treatment of cardiovascular disease. It has also been expanding into the viral and cancer arenas. The company has been profitable since ’04, and the stock has had a nice run since the market crash in 2008, rising from $24/share to its current price of around $64.50 (as of May 31, 2011). (Figure 1)

Figure 1. 2 yr stock price of UTHR

I think the stock still has strong potential to go higher. The company has a market cap of almost $3.8B, a forward looking P/E value of 20, and a operating margin of 27%. Revenue growth as been a whopping 52% year over year, and UTHR’s mainstay product, Remodulin, used to treat pulmonary arterial hypertension (PAH), is making in-roads into a very competitive field.

As discussed in the company’s February earnings call, UTHR’s total revenue for the three months ended December 31, 2010, was $166.5 million, up from $108.9 million for the quarter ended December 31, 2009. Net income for the three months ended December 31, 2010, was $9.5 million or $0.17 per basic share, compared to a net loss of $3.3 million or $0.06 per basic share for the quarter ended December 31, 2009. For the year ended December 31, 2010 (Table 1), UTHR had net income of $105.9 million, or $1.89 per basic share and $1.78 per diluted share, compared to $19.5 million, or $0.37 per basic share and $0.35 per diluted share, for the year ended December 31, 2009. Bottom line: revenues and income are growing rapidly!

Table 1. 2009 vs. 2010 Revenues by Product

| 2009 | 2010 | |

| in $M | ||

| Remodulin | 332 | 404 |

| Tyvaso | 20 | 152 |

| Adcirca | 6 | 36 |

|

Telemedicine products and services |

11 | 11 |

| Licensing | 1.2 | 1.2 |

| Total Revenues | 370 | 604 |

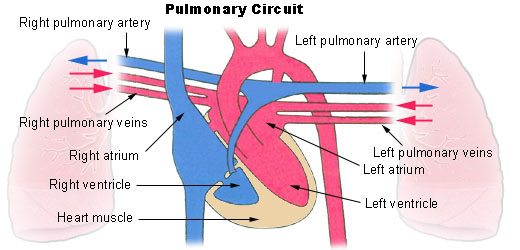

What is Pulmonary Arterial Hypertension (PAH) and how is it treated?

PAH is an increase in blood pressure in the pulmonary artery, pulmonary vein, or pulmonary capillaries — i.e. hypertension in the lung vasculature. Due to a failure to oxygenate the blood sufficiently, PAH leads to symptoms of

"shortness of breath, dizziness, fainting, and other symptoms, all of which are exacerbated by exertion. Pulmonary hypertension can be a severe disease with a markedly decreased exercise tolerance and heart failure. It was first identified by Dr. Ernst von Romberg in 1891. According to the most recent classification, it can be one of five different types: arterial, venous, hypoxic, thromboembolic, etc….

Treatment

"Treatment is determined by whether the PH is arterial, venous, hypoxic, thromboembolic, or miscellaneous. Since pulmonary venous hypertension is synonymous with congestive heart failure, the treatment is to optimize left ventricular function by the use of diuretics, beta blockers, ACE inhibitors, etc., or to repair/replace the mitral valve or aortic valve."

[…]

Prostacyclin (prostaglandin I2) is commonly considered the most effective treatment for PAH. (Wikipedia)

UTHR’s drug for PAH is Treprostinil and it was originally developed by GSK and Pharmacia. Treprostinil is a synthetic analogue of prostacyclin (PGI2) – a vasodilator (opens up the vessels allowing for greater blood flow). It is considered to be the most effective treatment for PAH. Treprostinil is marketed under the trade names Remodulin for infusion, and Tyvaso for inhalation.

Figure 2. PAH

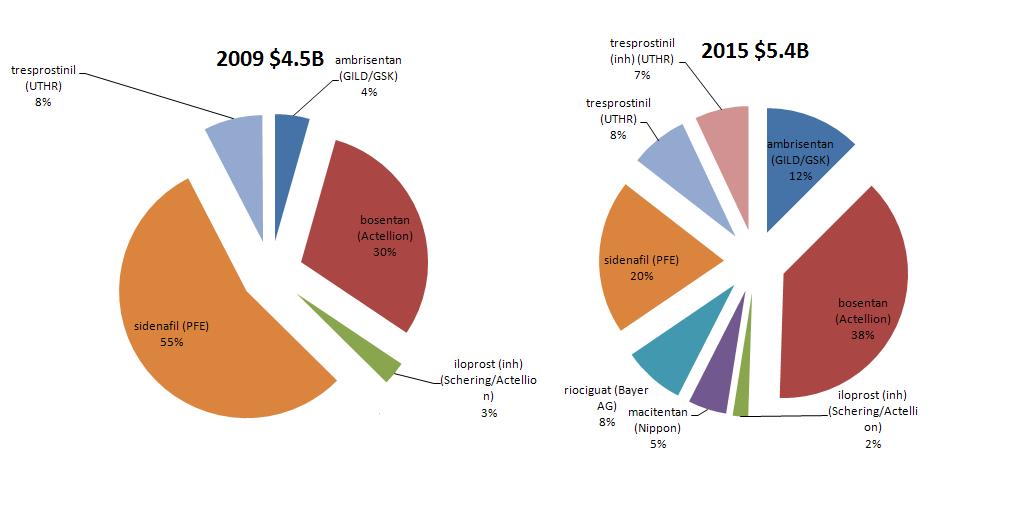

Below are two pie charts – one of the 2009 market for treatments of PAH, and the other of the projected market in 2015. UTHR is poised to take a bigger share of the PAH market IF Treprostinil remains compelling enough for doctors to prescribe it. PFE’s sildenafil is the clear market leader for PAH, but the market is ripe for consolidation. (Sildenafil is called Revatio for the treatment of PAH, and Viagra when used to erectile dysfunction, ED.)

Figure 3. PAH market.

UTHR also markets the drug Adcirca (tadalafil) – Celais….the PDE-5 inhibitor for erectile dysfunction. It’s mechanism of action is the same as that of Viagra’s. Tadalafil is currently marketed in pill form for treating erectile dysfunction under the name Cialis. It is marketed under the name Adcirca for treating pulmonary arterial hypertension. (Wikipedia)

From Pubmed Health:

Tadalafil (Cialis) is used to treat erectile dysfunction (impotence; inability to get or keep an erection) in men. Tadalafil (Adcirca) is used to improve the ability to exercise in people with pulmonary arterial hypertension (PAH; high blood pressure in the vessels carrying blood to the lungs, causing shortness of breath, dizziness, and tiredness). Tadalafil is in a class of medications called phosphodiesterase (PDE) inhibitors. It works to treat erectile dysfunction by increasing blood flow to the penis during sexual stimulation. This increased blood flow can cause an erection. Tadalafil treats PAH by relaxing the blood vessels in the lungs to allow blood to flow easily.

UTHR launched Adcirca in the EU, Japan and the US in 2009, but sales are slow to pick up due to PFE’s sildenafil dominating the market.

UTHR’s Pipeline

1. The oral version of Treprostinil is in Phase 3 trials for for the potential treatment of peripheral vascular disease (PVD), scleroderma and pulmonary arterial hypertension (PAH). An oral version of Treprostinil will avoid the pain of subcutaneous infusion and the risks of continuous intravenous infusion.

I believe that the drug will work for PVD and PAH, but the scleroderma trial is an interesting one. Actellion (competitor) tried bosentan (an endothelin receptor antagonist) in scleroderma and it worked in subjects with digital ulcers, but it remains unclear that bosentan will ever be approved as a scleroderma treatment. The rationale for treprostinil working in scleroderma are strong, and data are due out in the next few months.

2. Beraprost-MR (under license from Tolay) is another oral analogue of prostacyclin PGI2 for PAH. It is still in Phase 2 studies. Based upon the structure and mechanism of action, it should work, but how well it works, compared to what is already on the market, is an open question.

3. IW001 (ImmuneWorks and LungRx – two wholly owned subsidiaries of UTHR) were in Phase 1 clinical trials with IW001 for idiopathic pulmonary fibrosis (IPF) and transplant rejection. IW001 is an oral solution of Type V Collagen and how this is supposed to work is very interesting. First, IPF may begin as the result of an injury to the lung, possibly due to an infection, smoking, or other unknown event. This injury induces an inflammatory response, attracting antigen-presenting cells to the lung and exposes Type V Collagen to these antigen-presenting cells, which phagocytose this protein. These antigen-presenting cells then migrate to a lymph node, where they present this auto-antigen to T cells. T cells activated against Type V Collagen, along with B cells, migrate back to the lung and the initial site of inflammation. These activated immune cells exacerbate the lung injury through a self-destructive autoimmune response against Type V Collagen. This leads to further fibrosis in the lung, and eventually lung failure and death. Knowing this, ImmuneWorks and UTHR are trying to develop potential immune tolerance therapies for people with IPF and for those awaiting a lung transplant. Essentially, they are trying to trick the immune system into ‘calming down’ with the reactions to ‘self’ proteins, thus slowing down the immune response. It is a novel approach, but there are many types of collagen, so I’m not sure a therapy directed towards one type is the answer.

4. Cancer: UTHR is developing ch14.18 and 8H9 mAb.

a. Ch14.18 is an anti-GD2 monoclonal antibody 3F8, for the potential diagnosis (as 131I-3F8) and treatment of cancers, including neuroblastomas. One has already been developed by a Lexigen Pharmaceuticals (no data have been reported since 1998!), but recently, a paper in the New England Journal of Medicine showed that another ch14.18 treatment along with two other treatments showed remarkable results in that the new treatment cuts down a high-risk cancer’s recurrence rate over a 2-year period by 20 percent – and that is a major leap forward – even if the cancer is not among the most common types. I think this will be rocketed through the FDA, so watch closely, although the total number of patients is small (less than 650/yr diagnosed). It remains to be seen how well it performs in broader range trials.

b. 8H9 is a mouse monoclonal antibody licensed from Memorial Sloan-Kettering Cancer Center for solid brain tumors. It reacts with several epitopes in brain tumors, and It is way too early to even jump on this one and dissect it.

UTHR is reliant on its PAH pipeline for the near future. As the population ages, and PAH becomes more prevalent, its revenue due to PAH treatments will likely benefit. I believe the company is a take over target. As an investment, I like a very conservative spread, as the stock is volatile. I like buying the January 2012 $60/65 Bull Call Spread for $2.50 or better, coupled with the sale of the $45 Puts for $3 or better. That provides a $0.50 credit for the $5 spread, and I would be happy to own this company at $44.50 for a long term hold if the stock is put to me.

Ilene again:

Note for each bull call spread, Pharmboy would sell 1 put.

Addendum: Phil writes: "I don’t consider UTHR a value play, it is priced for huge growth and, if it missteps, then you will indeed be stuck with the stock. I’d at least give it a chance to test the 200 dma at 62.50 before putting money into it but I’d rather buy AFTER it screws up in the $50s. You can sell the puts now if you REALLY want them down there but I’d rather just keep a watch and sell puts when they are in more of a fall."

UTHR fell as low as $62.56 today and bounced up from that area. It is currently trading around $63.26. The new prices for Pharmboy’s trade are:

The January 2012 $60/65 Bull Call Spread would be about $2.20 (buying a $60 call for $12 and selling a $65 call for $9.80 – net $2.20)

The January 2012 $45 Put is $3 – the trade is to SELL not buy the put.