Courtesy of EconMatters

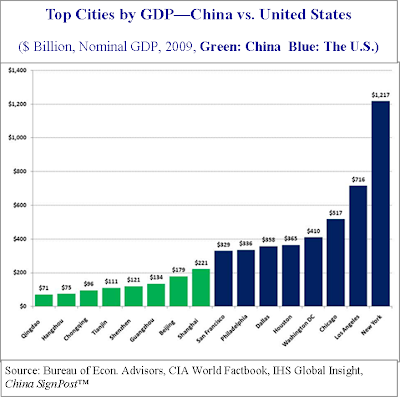

China SignPost™ did an interesting analysis on the top eight cities of China based on economic output. The study finds China’s eight largest cities still trail the eight largest U.S. cities substantially in terms of economic output.

For instance, Shanghai, the largest Chinese city with the highest economic production, and a fast-growing global financial hub, is far from matching or surpassing New York, the largest city in the U.S. and the economic and financial super center of the world. In fact, Shanghai was trailing the 8th-largest U.S. city–San Francisco–by nearly 50% in 2009 (See Chart). By the way, China SignPost™ picked eight cities because of the number 8’s significance as a sign of good fortune in Mainland China.

As to finding an equivalent GDP counterpart in the U.S., the $221-billion economic output in 2009 of Shanghai put it on par with Seattle. Beijing, ranked no. 2 in China, is equivalent to Phoenix’s GDP (See Map.) In terms of purchasing power parity adjusted economic output, based on 2009 data from the IMF, Shanghai was worth about $400 billion—roughly equivalent to Washington DC and larger than Dallas or Houston.

|

|

Source: National Bureau of Statistics, IHS Global Insight, China SignPost™

|

Social-economically, the analysis found a stark contrast between the U.S. and China in the urban-suburban-rural divide. Chinese cities represent a greater proportional concentration of wealth and consumption, whereas suburbs and satellite cities are often the areas of significant wealth in the U.S. And some areas in the Midwest, West, and Southwest of the U.S. are further boosted by natural resources such as energy and agriculture, and tourism.

Not surprisingly, due to a higher degree of urbanization in the U.S., these 8 largest cities in China accounted for roughly 21% of GDP in 2009, while their U.S. peers accounted for nearly 30% of GDP in 2009. This also illustrates the relatively bigger role that China’s rural economy plays in the nation’s economic growth. China’s large pool of rural consumers and the substantial consumption growth potential is one factor that has attracted foreign investment flows.

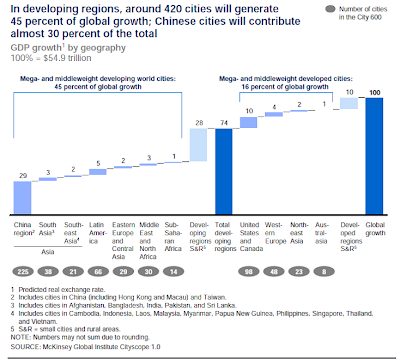

By nominal GDP, these major cities of China could be ranked in the global top 65 nation list. A McKinsey Global study estimated that from 2007 to 2025, the China region’s 225 cities included in the study alone will contribute an estimated 30% to the world’s projected increase in GDP. (See Graph)

|

| Chart Source: McKinsey Global |

Shanghai Composite Index has been up by 92.1% since 2000 outperforming almost all other major stock indices reflecting investors’ expectations for high future growth and returns. However, A separate McKinsey Global study calculates that based on the average return on equity (ROE), Chinese companies stocks are overvalued by 10-20%, and remain at a 20-30% premium above those in the United States and the European Union. That has led to the conclusion by McKinsey that Chinese companies would need significant operating improvements to justify the current valuation level.

Essentially, growth is not the problem for China, but nor is it the solution. The liberal lending and free capital post-financial-crisis has exacerbated inflationary pressure, created potential bubbles in housing, non-performing loans and assets, and widened the income inequality between regions. China’s banking sector is grossly inefficient, and capital structure remains fragile. The estimated $1.6 trillion debt racked up by Chinese cities and local governments is another potentially big land mine.

Beijing is mindful of these issues, and has been implementing policies and measure to take some of the froth out of the economy while still focusing on long-term growth. Shanghai composite has declined over 22% since March 9, 2009, outpacing seven other world indices as tracked by our guest blogger Doug Short. That suggests some of the heat has gradually been taken out, which should be long-term positive sign.

But considering China is the single largest buyer in many base commodities, which are linked to a number of large but resource-centric nations, not to mention a significant weight in various stock indices, one may expect things that go ‘kaboom’ in China will reverberate throughout the world.