Courtesy of Henry Blodget of The Business Insider

The Republicans have had 12 hours to digest the news that President Obama plans to propose a "Millionaire’s tax" on annual incomes over $1 million.

I’ll say anything to suck up to rich people.

Image: AP Photo/Carolyn Kaster

As expected, they’re freaking out.

And if they had a good argument as to why such a tax was a terrible idea, we’d be happy to say so. But so far anyway, they don’t.

Obviously, no one likes higher taxes. And it’s no surprise that the potential target of higher taxes will squawk in protest as soon as the idea is proposed. But if the country is to begin to find a way out of its massive debt-and-deficit problem, it’s important to separate the self-interested squawking from actual logic.

The Republic arguments against Obama’s millionaire’s tax boil down to the following:

- Raising taxes on millionaires will kill their ambition and discourage them from working

- Raising taxes on millionaires will punish successful people for being successful

- Raising taxes is always a terrible idea–the problem is spending

- Taxes are a form of theft: The government has no right to take our money away

- Raising taxes in a weak economy will further weaken the economy

Of these reasons, only the last one is valid. Raising taxes in a weak economy might, in fact, further weaken the economy (or the private sector, anyway). This weakening effect will certainly be less than it would if one raised taxes on the middle class, but it still could weaken the economy. And that’s why it’s important to consider the tax carefully and phase it in over time.

Just admit it: He’s right on this one.

The rest of the Republican counter-arguments are just silly, self-serving, or obstructionist. Let’s take them one by one, ending with the one that seems most persuasive to reasonable people.

"Taxes are a form of theft." This is just ridiculous. It’s like arguing that paper money is illegal. We live in a Democratic society, with well-defined laws and processes. In this society, people have agreed that the government has a right to collect taxes and spend money. If you don’t like that, then get the law changed. But until then, save your breath.

"Raising taxes is always a terrible idea–the problem is spending." It is certainly true that one of the problems is spending–and spending does need to be cut. But few reasonable non-partisan economists think that we can solve our budget-and-debt problems just by cutting spending. Unless we radically reshape and re-size the government–something that would have a huge and almost certainly negative impact on the economy–we also need to raise the percentage of GDP that is collected in taxes. The only question is who is going to pay for that.

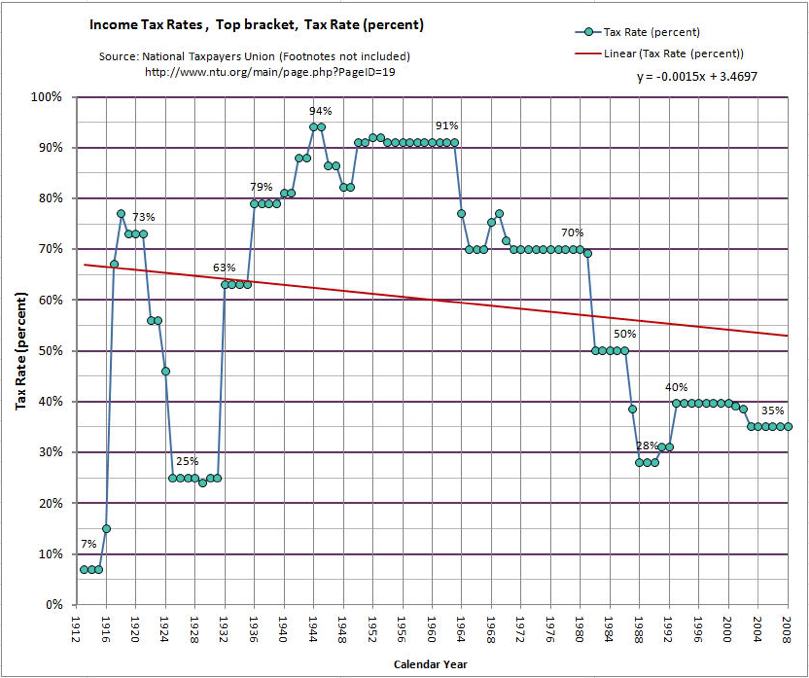

Think today’s top tax rate is "high"? Think again. Click for more…

Image: National Taxpayers Union

"Raising taxes on millionaires will punish successful people for being successful." Oh, please. And raising taxes on the middle-class will punish middle-class people for not having enough money to be able to afford higher taxes. And raising taxes on poor people will punish poor people for being poor. Taxes "punish" whoever has to pay them. This is just a way of saying "tax someone else–not me."

"Raising taxes on millionaires will discourage society’s most productive people from working." This is the argument that even reasonable people sometimes espouse. But it’s absurd. No one is proposing raising the top tax bracket to 90%, the way it was in the 1950s (when, by the way, the economy was tremendously successful). No one is proposing raising it to even 80% or 70% or 60%. Even the most aggressive tax-rich-people proponents are talking about raising the top bracket a few percentage points, to the Clinton era 39% or so. Anyone who says with a straight face that successful, ambitious people will kick back in a chez longue because the government is going to take 40 cents of every dollar in income instead of 35 cents is an idiot, an ideologue, or a liar.

And how about Obama’s "millionaire’s tax" specifically? Will that "discourage investment," as the Republicans are howling?

Not if it’s constructed intelligently.

In the past, the Republicans have argued forcefully (and often persuasively) that making $250,000 in certain communities does not make someone "rich"–and, therefore, that framing a tax increase on these folks as a "tax on the rich" is unfair.

But Obama’s new tax is not targeted at people making $250,000 a year. It’s targeted at those making more than $1 million a year, of which there are only about 145,000 people in the country.

Now, even today, and even in New York City, $1+ million a year is still a pretty healthy income. It is extremely hard to argue that those making $1 million a year or more are not rich. (They may not feel rich, and they may be desperately strapped and indebted and losing ground, but those are different issues. They boil down to spending choices and personal responsibility, not income.)

So it is reasonable to suggest that these folks can, or at least should, be able to afford to pay a bit more.

And, importantly, if Obama’s millionaire’s tax is aimed at income and not capital gains or dividends, these $1+ million earners will NOT be "discouraged from investing."

On the contrary, they will be encouraged to invest.

Why?

Because they will be encouraged to take less in salary and reinvest more in their companies.

If a small business earns $1+ million a year, and the owner "passes through" all this income and pays taxes on it, Obama’s "millionaire’s tax" will encourage this owner to do the following:

- Pay him or herself less

- Hire more people or otherwise reinvest the money in the business (so it won’t be taxed)

These moves, in turn, should do two things:

- Help create new jobs (which will help the overall economy)

- Help grow the owner’s business, thus increasing his or her net worth

Eventually, the owner can sell the business. And assuming the capital gains tax is still less than the income tax, this will actually have been a smarter and more tax-efficient way for the owner to get rich than paying him or herself a huge salary every year.

And the same goes for those paid huge salaries at big companies, as well as passive investments in equities.

So there’s a strong argument to be made that Obama’s proposed millionaire’s tax will encourage investment, not discourage it.

Bottom line, if the Republicans want to make some compelling arguments why a millionaire’s tax is a horrible idea, we’re all ears. But we haven’t heard any yet.

SEE ALSO: GET READY FOR A DISASTER OF BIBLICAL PROPORTIONS: We’re Running Out Of Everything