The Last Ponzi Game

Courtesy Lee Adler of the Wall Street Examiner

This is an extended excerpt from the WSE’s Professional Edition.

This is an extended excerpt from the WSE’s Professional Edition.

A heavy Treasury auction schedule with a big settlement on Thursday was enough to contribute to keeping stock prices (SPX) in check this week, but not to knock down Treasuries. Demand for US Government paper is so great it simply engulfs even heavier than expected levels of new supply. The massive capital flight out of Europe is now confined to the only game in town, the US Treasury market, the last great Ponzi game still operating.

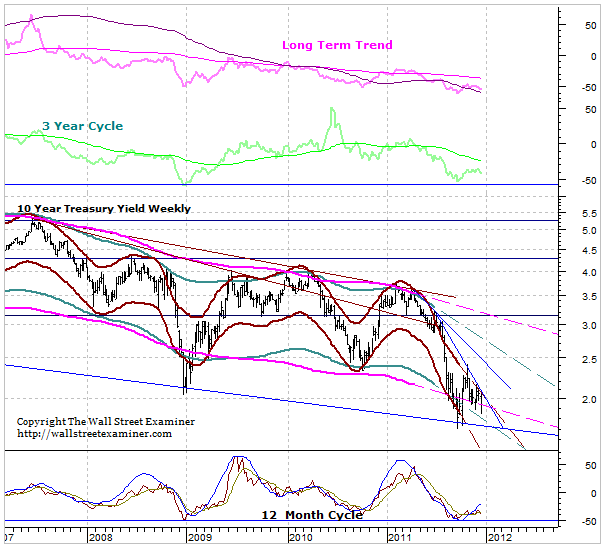

This won’t end well, but it won’t end until it ends, and the technical signals suggest that won’t be in the short run. Yields appear to be still headed lower, and that’s bad news for stocks given the recent correlation between lower yields and lower stock prices. As I’ve illustrated in the accompanying Fed Reports, there isn’t enough liquidity to power both markets toward higher prices simultaneously. It’s either one or the other. Eventually I expect a shortage of liquidity to negatively impact both markets, but we’re not there yet.

Withholding tax collections remain weak, and the government continues to need to raise substantially more cash than the TBAC had estimated it would need. That means that the economy is significantly weaker than government forecasters had foreseen just 6 weeks ago when these estimates were issued. The clues were available in the data at that time and I correctly guessed that the auctions would begin to balloon in size. Normally this would be problematic for the markets, but not in the current environment.

At the same time, foreign central bank purchases of Treasures have fallen off a cliff. Again, that would normally be extremely problematic. But it just doesn’t matter because panicked institutions fleeing Europe are like the Coneheads consuming mass quantities of all available US Treasury paper. In fact, the demand is overwhelming the massive supply. Tidal waves of panic capital flight have been flooding into the Treasury market in never before seen amounts, both in terms of the indirect bid and the bid by Primary Dealers, of whom 1/3 are European banks.

The panic buying has been concentrated in the 4 week bill, but there was also a jump in the bid for longer term paper, particularly the 10 year note (TNX) this week. The 4 week bills are where the real panic is. This is short term cash looking for a safe place to park. At the same time, the increase in nervous buying is pushing out on the curve enough to continue to push yields down for a while longer. It’s also pushing the dollar higher. The dollar (DXY) faces a critical test at 82.

Get regular updates on the US housing market, and stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market…stay ahead of the herd. Click this link to try WSE’s Professional Edition risk free for 30 days!

Pic credit: Sox First