Not much happening overnight.

Not much happening overnight.

Dollar at 80.30 as we wait on Bernanke at 9:30. The Euro is still dead at $1.296, Pound up to $1.615 as BOE holds rates steady (easing was expected). 79.65 Yen to the Dollar and 1.201 EUR/CHF shows those guys are still serious about supporting the Euro at all costs – and it must be costing them a fortune to do this.

I would say anyone who is holding large Euro positions and isn't taking advantage of the fact that the Swiss are backstopping it to get out is very foolish. The Euro is closer to dissolving now than it was last year. Greece will default on $500Bn in debt, Portugal will either default or need a huge bailout, as will Spain and just because Italy and France and Ireland are quiet at the moment, doesn't mean they are fixed either.

Clearly the only reason the Euro is holding $1.29 is because the Swiss are buying it – this is certainly not a reason to be holding the currency. If the Dollar were only staying over 80 because Canada was buying them to keep the Loonie from going to $1.20 – would that mean you should stay in or get out before the game falls apart?

If the Euro is artificially strong, then the Dollar is artificially weak and if the Dollar begins to rise (and the BOJ would love to see that) then we know there will be a dip in the price of dollar-denominated equities and commodities. So we need to continue to tread carefully because much of what we currently see is based on this artificial construct of a relatively weak Dollar and a relatively strong Euro – and that's distorting reality in many ways.

Also keep in mind that these little CB money-printing schemes can go on much longer than one would think logical so it's more of a big-picture sort of observation than an actionable item other than I sure wouldn't want to tie up too much money in Euros – just in case the SNB does run out of money one day.

Also keep in mind that these little CB money-printing schemes can go on much longer than one would think logical so it's more of a big-picture sort of observation than an actionable item other than I sure wouldn't want to tie up too much money in Euros – just in case the SNB does run out of money one day.

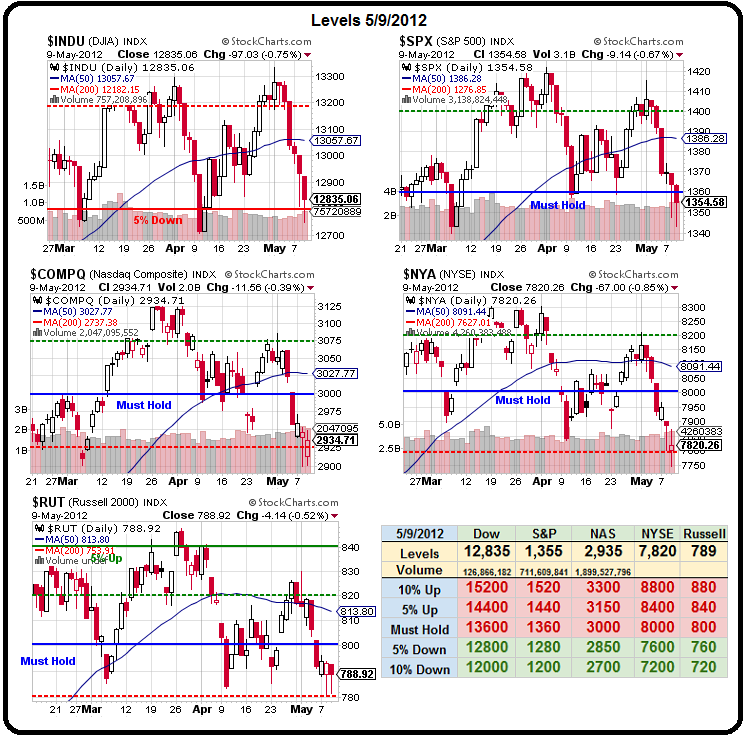

The S&P did put in a solid show of holding around 1,360 and that's all it takes sometimes – just one of our majors to hold their 5% lines can give the others reason rally back to theirs.

As to the gaps – it's not about those or the intraday, it's about where we close each day. We got a blow-off top on May 1st and, since then, it's been down every day, now 1,354 so 56 point drop is 4%, which is where a 5% drop would bounce to (20% retrace) and 95% of 1,410 is 1,339.50 and that's close enough to 1,340 so it's natural that we should slow down as we enter this zone where some bots will be buying the 5% dip.

The strong bounce (40% retrace) from here goes to 1,366 and that's what we'll need to see now to call a reversal – anything between 1,340 and 1,366 is just noise in a downtrending channel. So it doesn't matter whether the S&P goes up or down – the only thing that matters is which side it breaks to but, in absence of new data – I'd say this is the pullback we've been looking for and I'm more apt to buy the F'ing dip here and I'll be looking to make bearish covers IF we fail 1,340 but, otherwise, I'll treat this as the bottom of the range until it proves otherwise.

We've been bottom-fishing with lots of bullish trade ideas this week as we unwind our short positions along the bottom of our expected range. We haven't gone aggressively bullish yet – just doing our usual bottom-fishing at what we HOPE (not a valid investing strategy) is a bottom because – if it's not – it's a long, long way down to our next set of supports.

We've been bottom-fishing with lots of bullish trade ideas this week as we unwind our short positions along the bottom of our expected range. We haven't gone aggressively bullish yet – just doing our usual bottom-fishing at what we HOPE (not a valid investing strategy) is a bottom because – if it's not – it's a long, long way down to our next set of supports.

The Futures are up this morning (as we expected) in anticipation of Bernanke waving the QE wand at 9:30. That's not going to happen and what we really care about is watching how the markets handle that afterwords.

I think the quick trade of the morning will be shorting the S&P (/ES) below the 1,360 line (with very tight stops, of course) in the Futures as it SHOULD be a tough nut to crack on the way up and gives us a clear exit signal. We flipped bullish on oil Futures yesterday off the $95 line (now $97.22) and of course we like playing XLF to bounce off $15. It's amazing how fast the market went from nothing worth buying to a shopper's paradise in just the first 10 days of May! My comment to Members in yesterday's morning Alert was the most bullish since March:

Meanwhile, this is early-stage panic and it's a good opportunity to go long on a few things like CHK, CSCO, AAPL, GLW, GNW, FTR, FCX, AA, BA, BAC, GMCR (yes, I said it!), HOV, HPQ, OIH, SVU, WFR… You get the idea. It's a good time to sell puts against stocks you REALLY want to own if they drop another 20% – just in case they don't!

Woops, 10:30 already. Big build in oil – 3.7Mb but gasoline down 2.6Mb and distillates down 3.3Mb so a net draw is bullish for oil – game on for long /CL plays and that should give us a bit of a bottom overall!

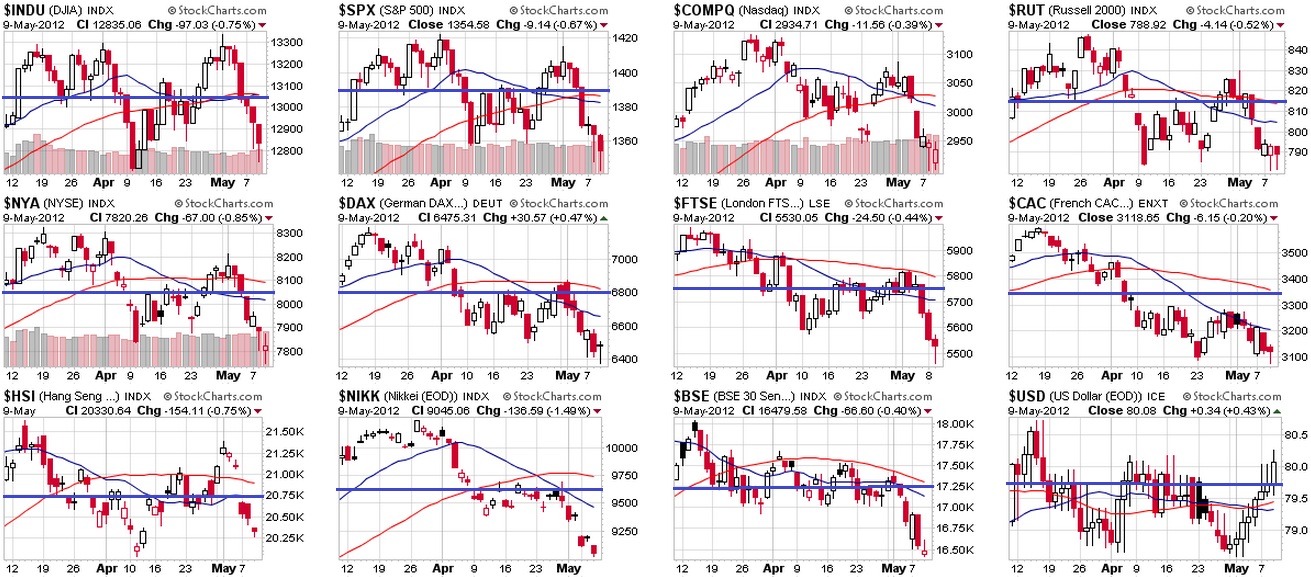

That was pretty good timing as we pretty much were off to the races at 10:30 as we put in a firm bottom and headed higher most of the day but, as I mentioned above – these are just the weak bounces we expected so far and not a signal of a true trend reversal, nor will there be until our major Global indexes prove to us they can get back over their falling 20 dmas (50% retrace lines in blue):

Not a pretty picture overall. Keep in mind we are doing our early bottom-fishing only because we THINK we're bouncy here and we THINK Bernanke and Co may hint at more QE and spark a rally but we're very skeptical until we are firmly back over those 50% lines and we'll be adding some nicely aggressive bearish plays if we fail to hold our current levels.

775 was my prediction for the Russell bottom back from early March and that lined up with Dow 12,700 and S&P 1,350 (who knows what the Nas will do with AAPL and all those crazy Momo stocks?) and that was based on the DATA of PMI and ISM that was coming in at the time. In the intervening period, the trends we identified early on have held steady so we have no reason to change our bottom target.

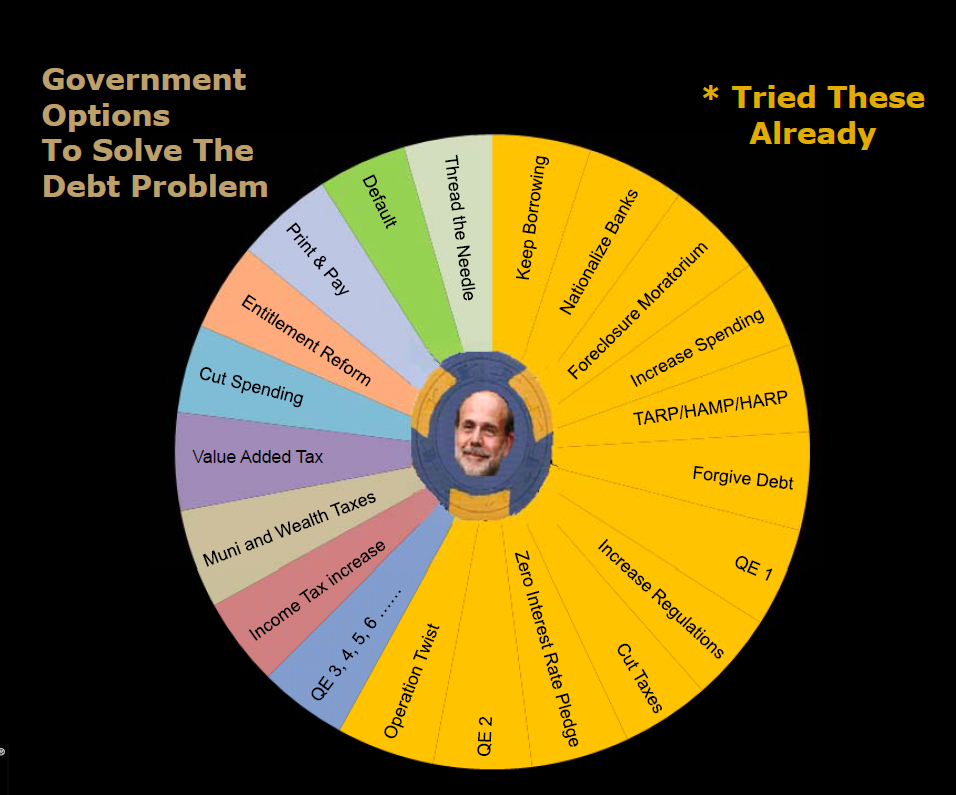

Mostly we are watching and waiting today. Waiting on The Bernanke as well as the 1pm 30-year note auction, where the Treasury hawks off another $16Bn in debt to throw on the pile. As you can see from this DoubleLine chart, we are are running out of things to try but we've dragged our first dozen options out over the past 4 years so we probably have another 3 before we become Greece to the 10th power – so let's enjoy this golden age – we may never see another!

Pre-market we are looking good, with the S&P over that 1,362 line so we'll have a very clear bearish indicator if the markets open and the selling begins and we push back below that critical 1,360 mark. Oil (/CL) topped out at $97.50 and that's back to where we'd rather be short than long so it's going to be a tricky morning overall so let's be careful out there.