What a week to do an IPO!

What a week to do an IPO!

Will Facebook save the markets tomorrow with a successful roll-out of the largest IPO of all time or will it be the straw that breaks the camel's back, with a disappointing open that sends the Nasdaq off a cliff along with their entire over-priced sector? Either way – this is going to be fun.

We can argue the merits of Facebook's value (or lack thereof) all day long but, scam or not, it's very likely FB will set off a buying frenzy in the space and we finish the week off with a bang. If that doesn't happen – I will be very, very bearish but from what I'm hearing and the way they are extending the offer and raising the price – it's way oversubscribed. Also, we have to consider that people are cashing out 1-5% of their holdings to raise cash for FB on Friday – sure it's moronic, but that's what people do so you have to put yourself in a position of someone who wants to put 5% of your portfolio in to Facebook (the way you wish you had put 5% into Google at $80 when they IPO'd) tomorrow – what would you be doing with the rest of your portfolio today?

Meanwhile, the rest of the World is falling apart with Europe turning sharply lower as Spain sells bonds at record high yields (5.106% for 4-year notes) this morning after announcing that their Q1 GDP was -0.4% at the same time as Moody's indicates they will be cutting the credit ratings of 21 Spanish Banks this evening AND, to top it all off – there is a run on Bankia, which Spain nationalized last week – with $1.3Bn pulled from accounts this past week! This sent Spain's markets down 1.6% and Italy (who is next) fell 2%, sending the Euro down 1% to $1.2668 and the Pound followed it down to $1.5832 (while EUR/CHF holds steady at 1.2009 in the most blatant currency manipulation ever witnessed).

Meanwhile, the rest of the World is falling apart with Europe turning sharply lower as Spain sells bonds at record high yields (5.106% for 4-year notes) this morning after announcing that their Q1 GDP was -0.4% at the same time as Moody's indicates they will be cutting the credit ratings of 21 Spanish Banks this evening AND, to top it all off – there is a run on Bankia, which Spain nationalized last week – with $1.3Bn pulled from accounts this past week! This sent Spain's markets down 1.6% and Italy (who is next) fell 2%, sending the Euro down 1% to $1.2668 and the Pound followed it down to $1.5832 (while EUR/CHF holds steady at 1.2009 in the most blatant currency manipulation ever witnessed).

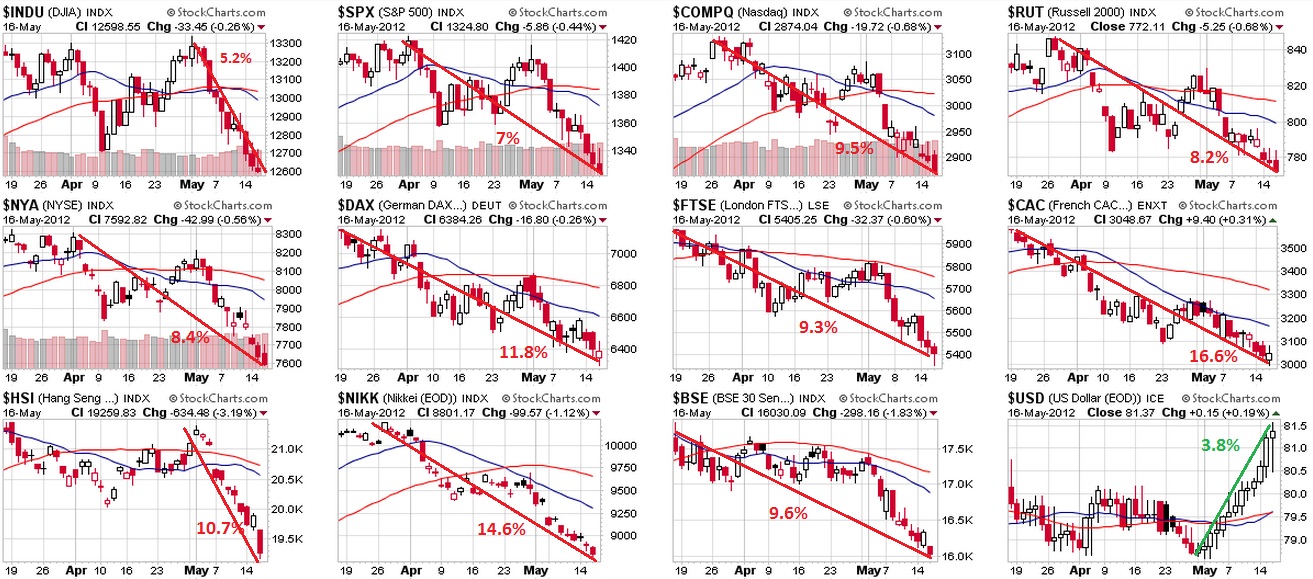

Wow – that's a lot of bad stuff! Maybe too many bad things – as in a bit suspicious that all this bad stuff happens at once – as if maybe someone WANTS to force a panic bottom? If so, I applaud them – we certainly needed to shake things up a little and nothing gets a rally finally going like a good old blow-off bottom. This morning's 0.5% drop in the futures looks more like a flush to me than a sustainable move and I think we may take advantage of a morning dip (if it lasts) to firm up some put selling on our Twice in a Lifetime list as we test some 10% drops in our International Markets – a nice, bouncy area in the very least:

Ugly, isn't it? On the one hand, we are very worried that this could be the prelude to a 2008-style market melt-down, where we still have another 20% or more to fall but, on the other hand – we fear the Fed and their endless intervention, which makes it foolish to be too bearish on this market. Cashy and cautious is how we're playing this but we're willing to lose a little doing some bottom-fishing here and, if we're wrong, we either stop out or load up those disaster hedges (see yesterday's post or Monday's post), which will put a ton of cash in our portfolios in the event of a sell-off.

In Member chat yesterday, we were discussing our disaster hedges and I pointed people towards a classic post titled "Hedging for Disaster – 5 Plays that Make 500% if the Market Falls" that we used in April, 2010 to ride out a similar dip with style. Hopefully Facebook won't disappoint us tomorrow and I'll be able to write up a full post over the weekend but, if not, I'll certainly be putting up a few new trade ideas in Member Chat – just in case!

In Member chat yesterday, we were discussing our disaster hedges and I pointed people towards a classic post titled "Hedging for Disaster – 5 Plays that Make 500% if the Market Falls" that we used in April, 2010 to ride out a similar dip with style. Hopefully Facebook won't disappoint us tomorrow and I'll be able to write up a full post over the weekend but, if not, I'll certainly be putting up a few new trade ideas in Member Chat – just in case!

I don't want to oversell the short case here. We've been layering our shorts since Friday, the 4th, when I titled the morning post "The Blow Jobs Deal to the Market Could be Huge" and my comment on the release of the Jobs numbers at 8:30 (which caused a pre-market rally) was:

I don't think these numbers are good at all and it's just more evidence that the economy is not picking up and still has significant weakness. If suckers want to buy into these terrible numbers – let them, it's a good chance for us to add some more shorts because your entire bullish premise cannot be that the economy sucks so badly that our Uncle Ben might give us another Trillion to play with to distract us for another year.

We didn't allow ourselves to get sucked into the pre-market pump job yesterday, following through withour plan from the morning post to use a quick momentum trade (DIA) to ride out the morning move up and thank goodness we held those short positions as I really think we'd be missing them this afternoon (or Monday for that matter!).

At the time we were already loaded for bear (see that Thursday's post and our Long Put List) and we only needed to add two additional disaster hedges that day in Member Chat:

At the time we were already loaded for bear (see that Thursday's post and our Long Put List) and we only needed to add two additional disaster hedges that day in Member Chat:

- EDZ June $12/15 bull call spread at $1.10, selling $13 puts for $1 for net .10, now $2.35 – up 2,250%

- EDZ July $13/17 bull call spread at $1, selling $12 puts for $1.10 for a .10 credit, now $1.70 – up 1,800%

So, when your hedges make 2,250% on a 7% drop in the S&P – they tend to provide good cover for your bottom fishing – even when you enter too early. In fact, a non-Member asked me yesterday about how you can adjust a too-early entry on CHK at $18 and my reply was:

A nice trick for CHK is – let's say you bought it for $18 and you are a dumb-ass who doesn't hedge or cover or enter by selling puts and now CHK is $14. You can sell the stock ($14) and sell the 2014 $10 puts for $3.30 and buy the 2014 $10/20 bull call spread for $4 and that means you are left in the $10 spread that's $4 in the money for net .70 so all CHK has to do is flatline at $14 and you make $3.30 back but you free up $13.30 in cash (using some margin for the short puts) and you get all of the upside to $20 with a max profit of $9.30 less the $4 you lost in the first place is still a respectable $5.30 if CHK gets back to $20, which is way better than you'd do with your $18 basis.

Meanwhile, your worst case to the downside is CHK is put to you at net $10.70, which is 23% lower than it is now so – FOR FREE – you are getting 23% of additional downside protection, drastically lowering your break-even and taking 90% of your cash off the table.

THIS is why people subscribe to Philstockworld – we teach you how to do this stuff!

Options are not scary – they help you to be flexible and give you the tremendous ability to hedge your portfolio so you can survive any sort of market turmoil. We try to stay balanced and have trade ideas that will profit in either market direction – when you have one position that makes 2,250%, it makes up for a lot of 20% losses on the "wrong" side of the portfolio, doesn't it?

Options are not scary – they help you to be flexible and give you the tremendous ability to hedge your portfolio so you can survive any sort of market turmoil. We try to stay balanced and have trade ideas that will profit in either market direction – when you have one position that makes 2,250%, it makes up for a lot of 20% losses on the "wrong" side of the portfolio, doesn't it?

Yesterday I called for taking the money and running on our Long Put List (initiated 3/15, last full update: 4/19) and our final outs were:

- AXP July $52.20 puts at $1.38, now $1.20 – down 13%

- BIDU June $115 puts at $2.10, now $2.95 – up 40%

- CAT May $95 puts at .95, now $3.30 – up 247%

- CMG June $375 puts at net $7.05, now $4.90 – down 30%

- FAS July $60 puts at $2, now $3 – up 50%

- GE Sept $19 puts at $1, now $1.30 – up 30%

- GOOG Jun $540 puts at net $5.45, now $5 – down 8%

- HD Aug $50 puts at net $2.50, now $3.20 – up 28%

- IBM Jul $180 puts at net $2.05, now $1.90 – down 7%

- ISRG July $430 puts at net $5.20, now $4 – down 23%

- IWM Aug $71 puts at net $2.10, now $2.45 – up 17%

- KO Aug $70 puts at net $1.70 now .72 – down 57%

- LVS June $55 puts at net $3.35, now $7 – up 108%

- MA July $370 puts at net $8, still $8 – even

- MMM July $82.50 puts at net $1.82, now $1.90 – up 4%

- PCLN July $620 puts at $9, now $23 – up 155%

- QQQ July $61 puts at $1, now $1.80 – up 80%

- V Sept $100 puts at $2.60, now $2.55 – down 2%

- XRT June $62 puts at net $3.05, now $3.70 – up 21%

Not too bad with 12 of 19 winners and, of course, we took advantage of exits on some like CMG, that were earnings plays but we're ignoring that. These are not positions we WANTED to win – they were there to protect us in case there was a major market sell-off. The fact that 7 of our 19 picks went against us is one of the reasons we DON'T think this sell-off is all that bad yet and, of course, if we do fail to hold 1,320 on the S&P and 775 on the RUT – then it's game back on for those 7 as we have cheaper entries now than we did back in March.

I think AXP, MA and V would be my 3 favorite shorts if Europe begins to melt down but, as I said above, I think this is a blow-off bottom and it's time to buy, not sell – we'll see how things play out….