The World is still going to Hell but LOOK – FACEBOOK!

The World is still going to Hell but LOOK – FACEBOOK!

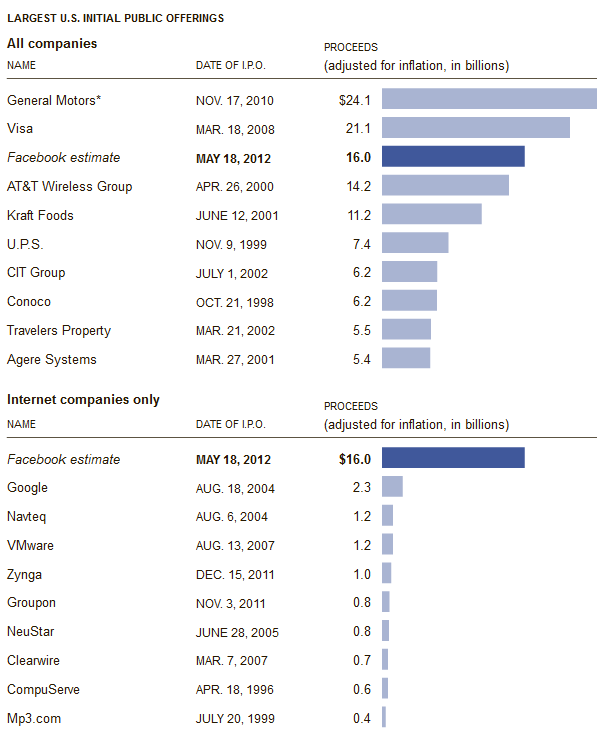

Ah, Facebook will save us. They have magical powers and will turn around the $60,000,000,000,000 Global equities markets with their $16,000,000,000 IPO, right? I mean, who are we to question the power of Social Media – probably the single biggest drainer of productivity in the history of all mankind?

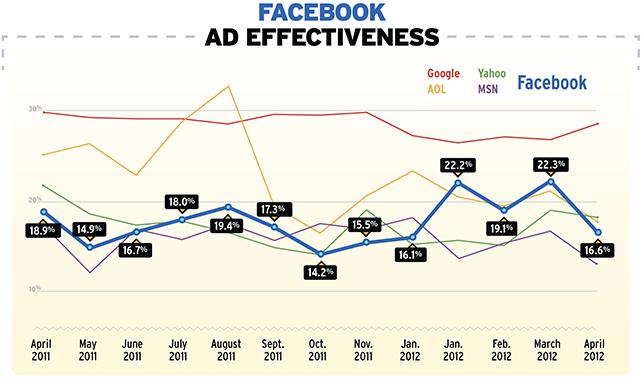

How many Billions of hours of lost productivity have Facebook's 900M users put in over the past few years? How much is it worth to turn millions of people into couch potatoes and can those ever-fattening eyeballs be converted into advertising Dollars? That's the real question as Facebook currently does a pretty crappy job of converting – roughly 1/6th as good at it as Google is.

That won't matter to the people buying Facebook in a Frenzy this morning as they release about 400M shares at $38 a share and I predicted we'd end the day at $45 but maybe $50 or even $55 on a spike up during the day. We at PSW don't have much interest in playing these silly stocks until there are puts to buy (5/29) and then, if they are still in this nosebleed range – we will be very excited to short the hell out of this stock, which is really worth $25 tops.

So we are rooting for Facebook, as it will be two weeks before we can short them with options and we would love to see them at any idiotic valuation at that point. Even with 900M users, a $100Bn valuation says Facebook's users are worth over $100 each. Yelps users are worth just $20, Instagram's $30 and Twitter's $70 – but Twitter isn't public either so that valuation is nonsense.

So we are rooting for Facebook, as it will be two weeks before we can short them with options and we would love to see them at any idiotic valuation at that point. Even with 900M users, a $100Bn valuation says Facebook's users are worth over $100 each. Yelps users are worth just $20, Instagram's $30 and Twitter's $70 – but Twitter isn't public either so that valuation is nonsense.

In fact, no public company values users like Facebook is and 900M means not all these users are Americans or even Europeans, where the average per-capital GDP is about $40,000. No, we're into Asia and the 3rd World here were it's more like $5,000 per person on average. Are we really supposed to believe that Facebook will convert just as much revenue from a man who makes 100 rupees a day as they do from the average US consumers on steroids?

900M Facebook users spend an average of 20 minutes a day on the site. That works out to 16,000 YEARS of productivity per day spent on Facebook. That is an entire 8-hour day of work by 17.5 MILLION people used up each day on Facebook.

Think about that. At just $20,000 a year, that's $350Bn of lost productivity to Facebook – God help us all if they are successful and it spawns dozens more sites like this – the entire $16Tn GDP productivity of the US can be sucked up by just 45 companies like Facebook! But, back to my point (I'm as surprised as you are that I had one) – valuing Facebook at $100Bn is pretty much saying that you and your $350Bn worth of buddies will be handing 1/3 of your annual salary to Facebook somehow. I know you like to think you are very valuable, I know I do, but doesn't that seem a tad over-priced to you?

Well, we're going to throw overpriced right out the window at $38 and possibly move on to crazy at $42 (another $10Bn), madness at $46 (+$20Bn), insanity at $50 (+$30Bn), psychosis at $54 (+$40Bn) and OMG are you freakin' kidding me at $58, where Facebook would be adding another $60Bn to it's already $100Bn market cap – all through the magic of trading just 15% of the actual shares of the company. Do you see why we are chomping at the bit to short them?

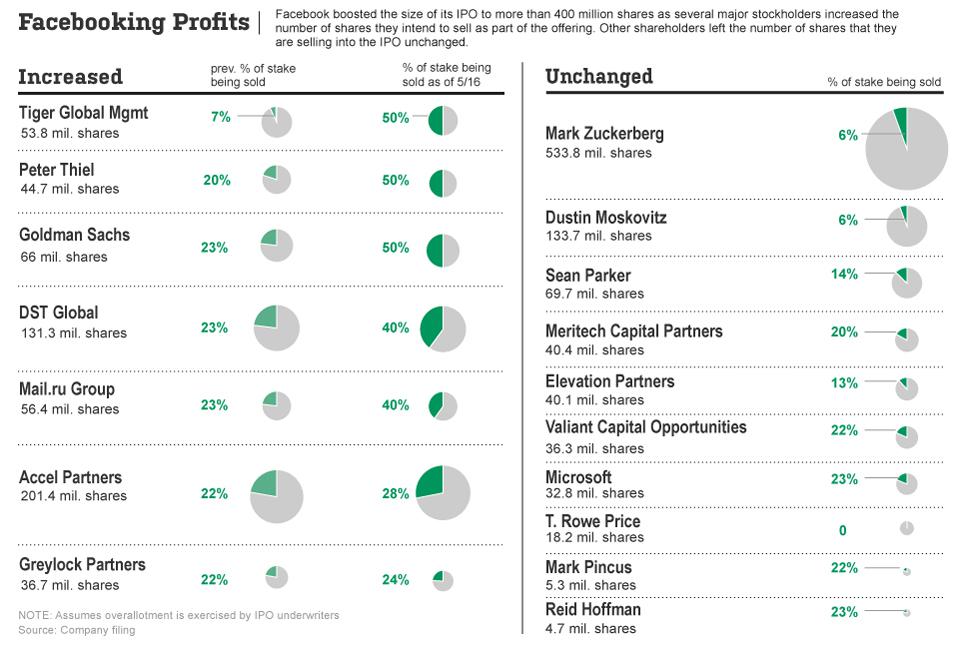

Our biggest worry is that people aren't as dumb as they seem and, like GS (66M shares), DST GLobal (131M shares), Peter Thiel (44M shares) and Tiger Global (53M shares) they will be dumping the stock at the open – taking the money and running at the $100Bn valuation. If that happens, as I said to Members this morning, I think the QQQ July $45 puts at .10 have a good chance of being a 10-bagger as the Nasdaq goes into free-fall.

We took a bullish flyer, however, into yesterday's close with the TQQ (ultra-long Nasdaq) June $55 calls at .50 as a fun way to play a possible Facebook pop but, on the whole, we're still pretty bearish and more so after yesterday as we added back not only the Long Puts we discussed in the morning post but, in our Morning Alert to Members, we suggested the DIA June $120 puts at $1.25, which finished the day right at the money at $1.50 (up 20%) as well as the TZA June $22/26 bull call spread for $1 (with offsets), which also shot up 20% to $1.23 as the Russell gave up another 2% yesterday.

We took a bullish flyer, however, into yesterday's close with the TQQ (ultra-long Nasdaq) June $55 calls at .50 as a fun way to play a possible Facebook pop but, on the whole, we're still pretty bearish and more so after yesterday as we added back not only the Long Puts we discussed in the morning post but, in our Morning Alert to Members, we suggested the DIA June $120 puts at $1.25, which finished the day right at the money at $1.50 (up 20%) as well as the TZA June $22/26 bull call spread for $1 (with offsets), which also shot up 20% to $1.23 as the Russell gave up another 2% yesterday.

We went more bullish in our very aggressive $25,000 Portfolio but we also added a very aggressive SQQQ hedge – just in case. Even if Facebook does rally the markets this morning (the IPO releases at 11), I can't see going into the weekend more than a tiny bit bullish as we await the result (or non-result) of the G8 meeting at Camp David this weekend.

None of the bad stuff went away folks – we simply have bad news fatigue at the moment – even I don't feel like going over it this morning (see news and my pre-market commentary in this morning's chat if you must) but it's still out there and STILL, the only reason to be bullish is the promise of Deus ex Machina – the "Machine God," in the form of the Fed and the other Central Banksters, who will come down from the heavens and once again shower the top 1% with Trillions in cash so we can extend and pretend for another 6 months (that's all $1Tn buys now) while we foreclose on another few million homes and wag our fingers at the poor and tell them how they need to tighten their belts.

Have a great weekend,

– Phil