Wow, what a Monday!

Wow, what a Monday!

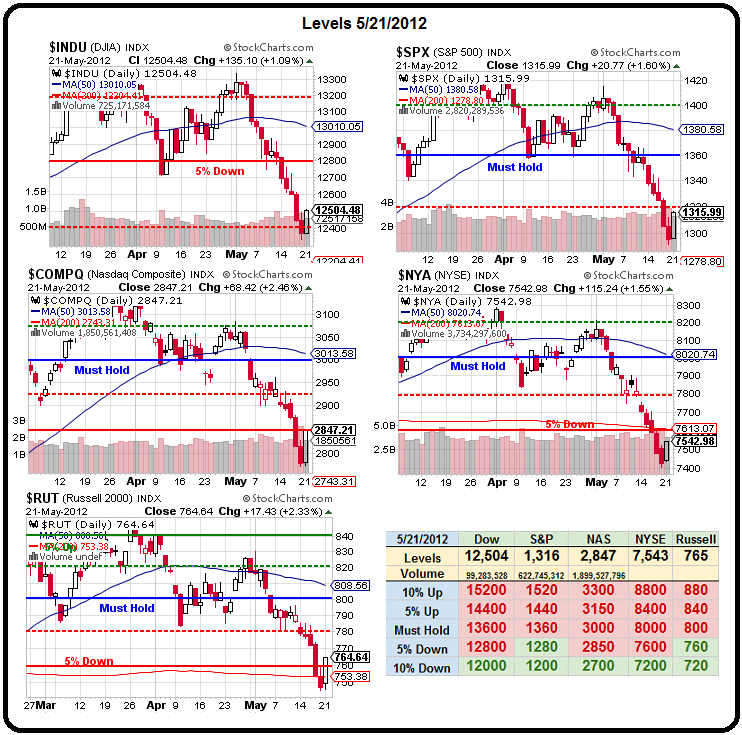

The Nasdaq and the Russell already hit our 2% bounce goals and the Dow needs another point with just half a point making the mark for the NYSE and the S&P – not bad for a day's work…

EVERYONE is TALKING about bailouts and easing but, so far, no concrete action has been taken and we don't believe we can get more than a strong bounce (40% retrace of the drop) without ACTUAL stimulus coming through. Those lines would be:

- Dow – 12,750 (12,540 is 20% retrace/weak bounce)

- S&P – 1,343 (1,319)

- Nas – 2,900 (2,840)

- NYSE – 7,720 (7,560)

- RUT – 780, (765)

As you can see from the Big Chart, the Nasdaq stopped dead at their -5% line at 2,850 so we'll be watching that one very closely and the S&P is just under its -2.5% line at 1,320 so those are our major goals for the day along with turning the Russell and the other weak bounce lines green. Those are the 2% bounces we expected in yesterday's post but we certainly didn't expect them in one day!

We had gone into the session expecting to flip more bearish after betting on the bounce Friday afternoon but it was a very strong day overall and none of our warnings (see Morning Alert) were tripped so we ended the day a little more bullish as we tweaked our FAS Money Portfolio even more bullish by uncovering our primary January bull call spread. On the other hand, we left our bear hedges in place on the $25,000 Portfolio, so we're not ready to go all the way on our first bullish date.

We had gone into the session expecting to flip more bearish after betting on the bounce Friday afternoon but it was a very strong day overall and none of our warnings (see Morning Alert) were tripped so we ended the day a little more bullish as we tweaked our FAS Money Portfolio even more bullish by uncovering our primary January bull call spread. On the other hand, we left our bear hedges in place on the $25,000 Portfolio, so we're not ready to go all the way on our first bullish date.

All three of my stock picks from this week's Stock World Weekly gave us the entries we were looking for and some nice gains yesterday as CHK opened at $14.25 and finished at $14.91 (up 4.6%), HPQ opened at $21.42 and jumped to $21.89 (up 2.1%) and XLF gave us our $13.77 entry but is still playable at $13.90 (up 1%) and, of course, our aggressive FAS Money move was to take advantage of the lagging XLF index.

Of course the more fun way to play XLF would be our trade idea from yesterday's Member Chat, which was to sell the Jan $12 puts for .75 and buy the Jan $13/14 bull call spread for .59, which nets a .16 credit on the $1 spread so no cash committed (but about $1.20 in margin) and a potential $1.16 upside (725%) if XLF maintains $14 through Jan expirations and the worst case is you have XLF assigned to you at net $11.84, which is a 15% discount to the current price (see "How to buy Stocks for a 15-20% Discount" for more on this strategy).

XLF was, of course, one of our "Secret Santa's Inflation Hedges for 2011" and that one was the Jan 2012 $12/13 bull call spread for .80, selling the Jan 2012 $11 puts for .40 for a not too ambitious net .40, which yielded our expected 150% gain on cash in January – but not without giving us a good scare in the fall!

XLF was, of course, one of our "Secret Santa's Inflation Hedges for 2011" and that one was the Jan 2012 $12/13 bull call spread for .80, selling the Jan 2012 $11 puts for .40 for a not too ambitious net .40, which yielded our expected 150% gain on cash in January – but not without giving us a good scare in the fall!

Notice on Dave Fry's XLF chart, we're HOPING (not a valid investing strategy) that the center channel of the last 3 years holds up and gives us a bullish signal – that's iffy at the moment and it's not going to happen without some proper intervention (see yesterday's discussion on the G8, etc.). If we fail to hold that $13.50 line on XLF – we will be backing off that bullish position pretty quickly and then waiting PATIENTLY for the retest of $11.

None of this stuff matters if we can't even complete our weak bounce levels and that won't matter if we can't move on and recapture our strong bounce levels and that won't even matter if we can't take back those "Must Hold" lines on the Big Chart but we already have plenty of bearish hedges – we're protecting those by playing for a bullish bounce but, if that bounce never comes – then game back on for the bears!

We had hoped BBY's earnings would provide a turning point for the stock and the sector and they did report a 25% drop in Q1 earnings to .46 per $18 share but, stripping out costs tied to their restructuring, it's more like 72 cents per share (up 10.7%) on a 2% increase in revenues BUT, there was an extra week this year so let's call that in-line. While BBY may be nothing to get too excited about – it's hardly the disaster that's baked into the price after dropping almost 50% since those Q1 2011 earnings last year.

“Best Buy is in a turnaround, and the strategic priorities we laid out at the beginning of the year are just the first phase of the changes to come,” said Mike Mikan, CEO (interim) of Best Buy. “We know we have to better adapt to the new realities of the marketplace, and we are creating a long-term plan designed to make Best Buy more relevant with customers and position the company for sustained, profitable returns in the years ahead. First quarter results were in-line with our expectations, and we are reaffirming our previously provided annual guidance for fiscal 2013.”

Those expectations are for $3.60 per $18 share (p/e ratio of 5) in earnings in addition to paying out a .64 annual dividend (now 3.5%). We're already in BBY with short put positions in our $25KP but I have to say I'm really liking them this morning as the CC merely confirms what we expected but, surprisingly, the stock is not moving higher – yet, and makes a nice pre-market opportunity at $18. There is a persistent myth that AMZN (we're short) will take over all retail and BBY and others are suffering but the same was said about catalog sales over 100 years ago – why hitch up the wagon and drive to the store when Sears or Wells Fargo will deliver it right to your door? Silly humans – they never learn…

In other silly human activity – Europe.

In other silly human activity – Europe.

Do I really need to elaborate on that? Yes, they are still a disaster. So much so that the OECD has cut their 2012 Eurozone GDP forecast to -0.1% – that's a recession folks! Our forecast was RAISED from 2% to 2.4% and China (our manufacturing floor) was raised from 8.2% this year and 9.3% next year DESPITE China's attempts to keep a lid on growth. Japan is +2% this year (after the weak quake year) but drops to 1.5% next year and the OECD warns that the global "recovery" is both "fragile and uneven."

Nothing to change my premise that US Equities remain the best place to put your money. We're short on TBills (TLT) and we won't touch commodities due to weak global demand (oh and Iran is "fixed" and oil may dip below $90 very shortly) and we're very much "Cashy and Cautious" at the moment but, if we can hold our Futures lines (12,400, 1,300, 2,500 and 750) and get back to those strong bounce levels – we're going to want to dip deeper into our "Twice in a Lifetime" list and pick up some of these bullish laggards – like BBY and XLF because – come on – where the Hell else are you going to put your money if not US Equities?