What a fantastic contrary indicator!

What a fantastic contrary indicator!

CNBC hit the panic button this weekend with their "Markets in Turmoil" special report where they trot out their crisis team of Jim Cramer and Maria Bartiromo in an attempt to stampede all the remaining sheeple out of the markets on Monday Morning (see our Friday morning post for our view on why we thought Friday's drop was going to be a bear trap).

"An awful May is replaced by the start of a frightening June" is CNBC's opening voice over and it gets dumber and dumber from there as "America's Financial News Network" bangs the fear drum right at Asia's open (9pm) and then uses the panic in Asia to prove their point to EU and US traders that there's something to worry about.

I could go on and on about how ridiculously evil this network is and how horrible it is that we allow these Financial propaganda networks to manipulate the markets to the benefit of the highest bidder but, in the long run – who cares? If you watch CNBC and take it seriously – just like people who watch Fox to find out what's going on in the World – you reap what crap you have sown.

We are not, in any way, gung-ho bullish but we're also not going to play bearish. On the whole, as we reviewed in this week's Stock World Weekly (available free this week!) – we are "wishy washy" in our positions, cashy and cautious and doing just a bit of bottom-fishing as we HOPE (not a valid investing strategy) that this is the bottom as we HOPE the G8 takes some rational action.

We are not, in any way, gung-ho bullish but we're also not going to play bearish. On the whole, as we reviewed in this week's Stock World Weekly (available free this week!) – we are "wishy washy" in our positions, cashy and cautious and doing just a bit of bottom-fishing as we HOPE (not a valid investing strategy) that this is the bottom as we HOPE the G8 takes some rational action.

We made a bullish play on the Futures at 9:13 last night, while CNBC was clearing out all the suckers at Dow (/YM) 12,000 but we took that money and ran as we popped over 12,075 (up $375 per contract) early this morning and flipped to a bullish play on oil (/CL) off the $82 line and those contracts are already $82.40 – up $400 per contract at 8am.

We were also very excited to see AAPL back at our buy point of $555 early this morning as AAPL is pure rocket fuel for the Nasdaq when it bounces and AAPL can move quickly back to $580 on any hint of good news and that's a 4.5% move up that should be good for a 2-3% pop in the Nasdaq – maybe more if the SOX stop dying for a day or two!

So thank you CNBC for being the blatantly manipulative joke of a network you are – we continue to make bank betting against you on a regular basis – just like the people who pull your strings… As we often say at PWS – "We don't care IF the game is rigged, as long as we can figure out HOW the game is rigged and place our bets accordingly."

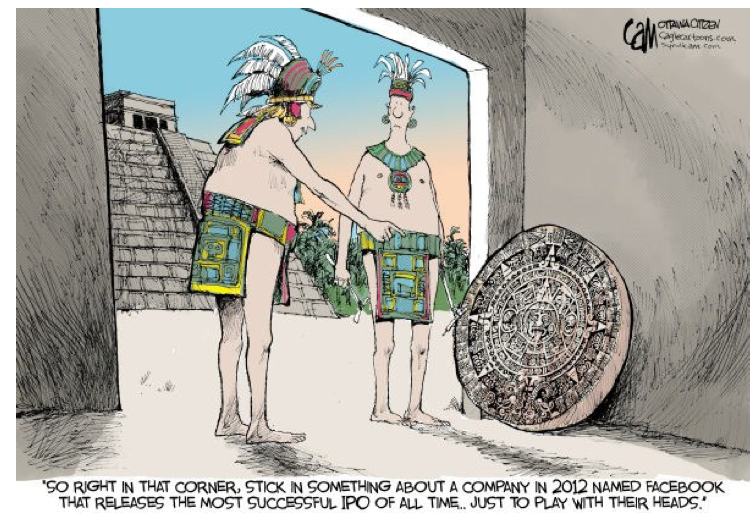

During Friday's excitement (over 300 comments in Friday's Member Chat) we played both sides of the fence but had aggressively long trade ideas for TLT (short at $130.36) as well as spreads on TQQQ ($41.96) and XLF ($13.50) – playing for the pop we anticipated this morning. We'll see how those go before we get all excited but our small, virtual portfolios are very bullish while our brand new Income Portfolio has a virtual $500,000 ready to deploy on the bull side as soon as we confirm that the World is not going to end (at least before December 21st).

During Friday's excitement (over 300 comments in Friday's Member Chat) we played both sides of the fence but had aggressively long trade ideas for TLT (short at $130.36) as well as spreads on TQQQ ($41.96) and XLF ($13.50) – playing for the pop we anticipated this morning. We'll see how those go before we get all excited but our small, virtual portfolios are very bullish while our brand new Income Portfolio has a virtual $500,000 ready to deploy on the bull side as soon as we confirm that the World is not going to end (at least before December 21st).

See my comments on "The Week Ahead" in Stock World Weekly as well as our chart of the action this week, which includes Euro-Zone GDP and mucho Fed speak although this morning Cleveland's Pianalto said: "The seasonal adjustment process could be behind the strong January and February prints and May's weak one, she says, but taken together they continue to give a picture of a slowly growing economy that needs no further stimulus."

Nonetheless, GS says: "Our confidence that the FOMC will ease policy once more at the June 19-20 meeting has also grown," and they see the Fed committing to purchases of MBS and Treasurys – "considerably more powerful than an extension of Operation Twist." Of course listening to GS is almost as bad for your portfolio as sticking with Cramer but the trick to GS is figuring out where they are in their own commitments and this is an early statement that's probably an accurate take on the Fed, rather than a manipulative attempt to scare people out of bearish positions (so they can get more for themselves, of course).

Nonetheless, GS says: "Our confidence that the FOMC will ease policy once more at the June 19-20 meeting has also grown," and they see the Fed committing to purchases of MBS and Treasurys – "considerably more powerful than an extension of Operation Twist." Of course listening to GS is almost as bad for your portfolio as sticking with Cramer but the trick to GS is figuring out where they are in their own commitments and this is an early statement that's probably an accurate take on the Fed, rather than a manipulative attempt to scare people out of bearish positions (so they can get more for themselves, of course).

Now it's 9:15 and oil is touching $83.40 and our Egg McMuffins are paid for (up $1,400 per contract and thrilled to take it and run!) so we really don't care what the market does this morning as we're wishy-washy with bets on both sides and cashy enough not to care which side wins but, for the sake of the well-being of the Global Economy – we are kind of rooting for the bulls this week!

It's going to be a very exciting week but it's ALL about Europe, not our own Fed. There will be many, many rumors but we need ACTION from the ECB, IMF, EU, BOJ, PBOC, BOE and the Fed in order to reverse this bearish trend – words just aren't going to do it for us anymore so, while we REALLY want to be bullish down here – we still need Mr. Market to show us the levels – starting with 1,284 on the S&P and 2,757 on the Nasdaq – the 200 dmas that MUST be taken back in order for us to get comfortable riding that bull again.