Here we go again!

Here we go again!

We were moving along nicely when John Boehner decided to throw a temper-tantrum if he didn't get his way and his way is now know as "Plan B", which of course, sounds like the kind of thing a 10 year-old would come up with because that's the level we're now dealing with as the GOP is forced to show America their true colors as they throw the middle class and the poor under the bus to protect their wealthy benefactors – apparently at all costs.

Plan B has no spending cuts – that was all BS – the GOP doesn't really care about spending. They are, after all, the ones who spent us into this deficit in the first place. Plan B simply raises tax cuts to include people who make $1M – that's PER YEAR, not Millionaires who accumulate $1M over the course of their working lives but people who make $1,000,000 in 12 months – about $20,000 PER WEEK.

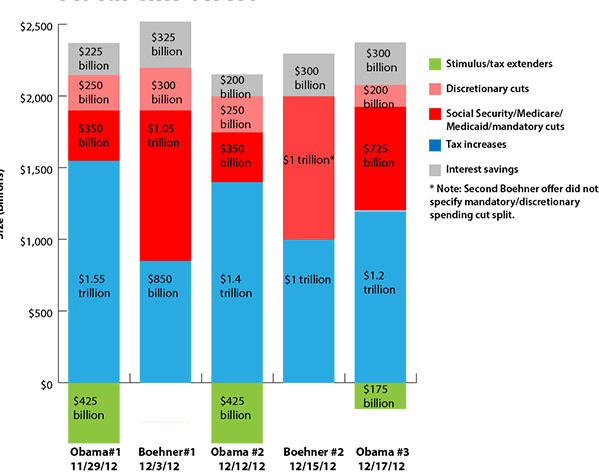

That's who the Republicans are holding the rest of the country hostage for. Look at the chart on the right and see who Boehner wants to pay for those tax cuts for people who make $20,000 PER WEEK – it comes from cutting $650 BILLION Dollars from Social Security & Medicare as well as cutting the $425Bn President Obama would like to use to stimulate our still-struggling economy, in order to help those many millions of people who don't earn $20,000 PER WEEK enjoy a few luxuries like heat and food.

That's who the Republicans are holding the rest of the country hostage for. Look at the chart on the right and see who Boehner wants to pay for those tax cuts for people who make $20,000 PER WEEK – it comes from cutting $650 BILLION Dollars from Social Security & Medicare as well as cutting the $425Bn President Obama would like to use to stimulate our still-struggling economy, in order to help those many millions of people who don't earn $20,000 PER WEEK enjoy a few luxuries like heat and food.

Boehner would be a great cartoon villain if he wasn't so chillingly real. The entire GOP could teach the Star Wars Empire a thing or two about subjugating the masses but this time they have really gone too far. Today's idiotic vote for the GOPs "Plan B" is a colossal waste of time when we are, in fact, only minutes away from a deadline that has the potential to trash the entire US economy.

The markets didn't like Boehner's end run one bit yesterday and we went straight to Hell following his announcement in the afternoon (see Dave Fry's chart). That's right, the GOP doesn't give a crap about investors either – fortunately we were already wary yesterday morning because we've seen them trash the economy before (on the first rejected TARP vote) and we followed through with our plan to add some protection during yesterday's Member Chat.

The markets didn't like Boehner's end run one bit yesterday and we went straight to Hell following his announcement in the afternoon (see Dave Fry's chart). That's right, the GOP doesn't give a crap about investors either – fortunately we were already wary yesterday morning because we've seen them trash the economy before (on the first rejected TARP vote) and we followed through with our plan to add some protection during yesterday's Member Chat.

Yes, it was back in September of 2008 when the Republicans, at 4pm on the day of the vote, suddenly rejected the hard-fought compromise and pushed ahead with their own "Plan B" – which, at the time, called for a 2-year suspension of Capital Gains (so they could max profits from the crash lows) and, as I noted at the time:

- Mr. Boehner pressed an alternative that involved a smaller role for the government, and Mr. McCain, whose support of the deal is critical if fellow Republicans are to sign on, declined to take a stand. The talks broke up in angry recriminations, according to accounts provided by a participant and others who were briefed on the session, and were followed by dueling news conferences and interviews rife with partisan finger-pointing.

- In the Roosevelt Room after the session, the Treasury secretary, Henry M. Paulson Jr., literally bent down on one knee as he pleaded with Nancy Pelosi, the House Speaker, not to “blow it up” by withdrawing her party’s support for the package over what Ms. Pelosi derided as a Republican betrayal. “I didn’t know you were Catholic,” Ms. Pelosi said, a wry reference to Mr. Paulson’s kneeling, according to someone who observed the exchange. She went on: “It’s not me blowing this up, it’s the Republicans.” Mr. Paulson sighed. “I know. I know.”

Now it's deja vu all over again as the same John Boehner pulls the same idiotic last minute moves that crashed the economy last time. The S&P was at 1,100 that day and looked to be bottoming out from the fall from 1,500 but this simple act, at the time, nudged the markets over another cliff and sent us down to 750 – down another 32% – within two months and most of that (to 850) came within the next 7 days. Don't tell me John Boehner has forgotten what kind of detrimental effect this kind of BS can have on the US economy – he just doesn't care.

Now it's deja vu all over again as the same John Boehner pulls the same idiotic last minute moves that crashed the economy last time. The S&P was at 1,100 that day and looked to be bottoming out from the fall from 1,500 but this simple act, at the time, nudged the markets over another cliff and sent us down to 750 – down another 32% – within two months and most of that (to 850) came within the next 7 days. Don't tell me John Boehner has forgotten what kind of detrimental effect this kind of BS can have on the US economy – he just doesn't care.

I said yesterday it was time to go back to being "cashy and cautious" and, in Member Chat, we hedged with DIA puts, TZA spreads and USO shorts (off the $90 line, which is available again this morning!) beginning first thing in the morning with my 9:54 Alert to Members.

Make no mistake about it – we are, for the most part, Members of that top 1% and we are thrilled, from a market standpoint, to have the evil Boehner destroying the markets and panicking out the retail sheeple so we can swoop in and go bargain hunting with our sidelined cash. We are the rich people that the GOP manipulates the market for.

Unlike most of the top 1% – we just think its wrong. Just because it's wrong, doesn't mean we won't take the free money that's being offered to us but at least we'll complain about it and I'll point out to you how you are being screwed over by the Big Boys and their GOP lackeys and we'll do what we can to try to change the system so it's more fair – but the real change is only going to happen if you, in the bottom 99%, who make less than $165,000 per year, WAKE THE F*CK UP and realize how these people are screwing you – over and over again.

Your life is a joke to them, your Government Health and Retirement benefits you've contributed to your entire life is nothing more than a pension fund to be pilfered in the eyes of the Republican Party. Your job is offshorable and your security only matters if their friends can make money pretending to protect it by charging $500 for a hammer and $75 for each sandwich served to a trooper in Afghanistan – those are the Government handouts and those are what Boehner and company are fighting to protect. This madness has to end people!

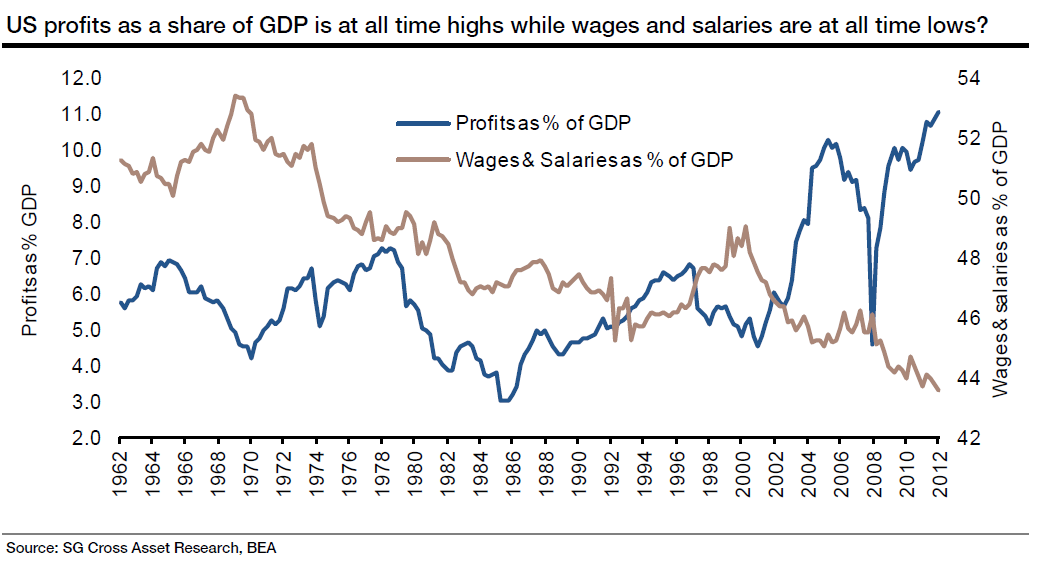

With any luck, the World will end tomorrow and we won't have to worry about this nonsense any more but, if it doesn't, we should really think about making some changes in this country. This morning, we got an upward revision to GDP, from 2.7% to 3.1% for Q3 and Corporate Profits jumped another $45.7Bn for the quarter, a massive increase from the $21.8Bn gain in Q2. How do they do it? By screwing over the workers, of course – as you can clearly see from this chart:

Wake up bottom 99% – you are being screwed over time after time and year after year with a 12% reduction in wages as a percent of GDP since 2000 alone! Thank you Republicans may I have another? You friggin' suckers! This country will never get back to prosperity as long as you keep believing that what's good for Corporations is good for America – it's simply not the case. And don't forget, those wages and salaries INCLUDE the massive compensation given to the CEOs and the top 1% within the Corporations – if you broke that money out – you'd see that wages for the bottom 99% are at an all-time low while Corporate profits are, of course, at an all-time high.

As I said, we're in the top 1% – this is great for us. We'll be BUYBUYBUYing these companies that you get shaken out of and we will be hedging ourselves against the inevitable inflation that will wipe out the rest of your savings later this decade but yes, we'd like to see the system change and become more fair – but if you people in the bottom 99% can't see the need for change and keep supporting these economic criminals – then we can't help you.

Sorry.