I'm not worried, are you?

Congress sure doesn't seem worried as they aren't even coming back to work until 11 am this morning with only 13 hours left until 2012 ends and all those horrible, nasty things kick in. Of course, those horrible, nasty things, in summary, amount to paying more taxes and spending less money – isn't that what we need to do if we are ever going to get serious about paying down our debts?

Fear of the Fiscal Cliff gave us a horrible day on Friday, more so in the Futures, after the markets closed, than during trading hours, where the S&P technically closed at 1,402, down 1.1% for the day. After the bell, the fireworks really began, as clearly Congress was not able to make a deal and that sent the thinly-traded futures flying down another 1%, with the S&P hitting 1,382.25 at the low and, even now (7:30), they are still trading at 1,387.

Fortunately, as I mentioned in Friday Morning's post, we had our DIA March $124 puts for a hedge (now $2.65) and, ahead of the close, I reminded Members they were still a good trade at $2.35 for nice cover into the weekend. We also have our more aggressive TZA hedges, of course, and they will keep us warm on cold winter nights if we have a proper market collapse.

Fortunately, as I mentioned in Friday Morning's post, we had our DIA March $124 puts for a hedge (now $2.65) and, ahead of the close, I reminded Members they were still a good trade at $2.35 for nice cover into the weekend. We also have our more aggressive TZA hedges, of course, and they will keep us warm on cold winter nights if we have a proper market collapse.

We also discussed going back to the well on our disaster hedges and, in that same comment, I listed 8 more nice put plays our Members could use for protection should we actually go over the cliff with all the bad reactions the pundits are expecting.

I hear on CNBC that the the Defense Industry will lay off 800,000 people on Jan 2nd which would, if true, save an immediate $40Bn a year if those are all $50,000 jobs. Seems to me, it would have been easier just to not build 400 F-35 jets at $107M each as LMT only employs 123,000 total people so, even if they shut down the company due to the loss of the F-35, it would cost 677,000 less jobs that way.

Or maybe CNBC's numbers are complete and utter BS but they feel completely free to spread their propaganda because they know the American people can't perform simple math and that their Conservative viewer base never engages in any critical thinking – as long as what they hear reinforces what they already believe.

Or maybe CNBC's numbers are complete and utter BS but they feel completely free to spread their propaganda because they know the American people can't perform simple math and that their Conservative viewer base never engages in any critical thinking – as long as what they hear reinforces what they already believe.

That's the essence of the entire fiscal cliff – we are simply going back to tax rates that used to exist at a time when this country was much more prosperous (cough, Clinton, cough, cough) as well as back to pre-pointless war levels of Military spending. The truth of the matter is that Defense jobs are not efficient jobs. In order to put a $30,000 salaried soldier in the field, our military spends $850,000 but it's $1.2M in Afghanistan due to the harsh conditions. Those are just 2011 figures, in 2012, the number is estimated to move up to $1.4M – none of which includes an improvement in the soldier's salary or benefits.

Are we a bunch of idiots or what? Republicans are fighting to cut off unemployment benefits and keep the military spending even though extending unemployment benefits for 10M families will cost $30Bn – about the same as it costs to keep 30,000 soldiers in harm's way. Idiots, definitely idiots…

Why do they do this? Because nobody in the top 1% makes any money helping 10M families avoid poverty – the unemployed take that $300 a week and just waste it on things like food and heat and clothes for their kids, and most of that money filters back into the local economy and helps other local merchants while $26,000 per week, per soldier, goes to fatten the wallets of all sorts of GOP contributors in highly concentrated payments for items with huge profit margins. What could be more American than that?

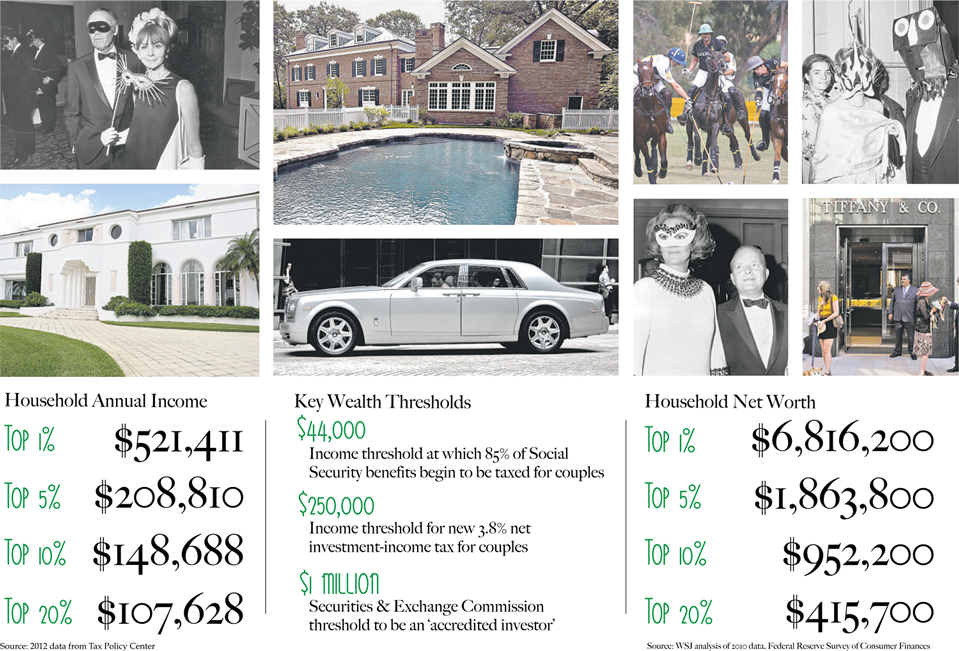

And, by the way, the WSJ wants people to stop thinking they are in the top 1% and has conveniently broken down the numbers so you people can learn your proper place and stop thinking you're as good as those of us in the top 1%. According to the WSJ (via Barry Ritholtz):

“The top 1% of U.S. households have a net worth above $6.8 million or at least $521,000 in income, according to data from the Federal Reserve and the Tax Policy Center in Washington. The cutoffs for the top 5% are $1.9 million in net worth, or $209,000 in income.”

That's right, $521,411 a year is the cut-off for the top 1% and you have to fall another 9% just to be earning $148,688 a year so stop putting in applications at our club – you're just embarrassing yourself!

Even the WSJ is being disingenuous here though, because the top 5% includes the top 1% and the top 10% includes the top 5% because the reality of how much richer the top 1% are than everyone else would really make you sick. How do we figure it out? Well, if the top 1% have an average of $6.8M and the top 5% have an average of $1.8M then we can multiply the $1.8M by 5 and we get $9M and then subtract the $6.8M that the top 1% have and that means the next 2-5% (4 brackets) get to share the remaining $2.2M and, in fact, have just $550,000 each in net worth so the WSJ is lying to you by a factor of 3+ even if you are in their core top 5% readership. Anything to perpetuate the myth that America has a fair distribution of wealth.

Why does the media keep lying to us? Because the media is controlled by the same wealthy people who LIKE making 10x more than the people just a couple of percent below them and 100x more than the people who are 10% below them but they also realize that this is so ridiculously unfair that those people would eventually revolt if they knew the ugly truth and they may also, in fact, expect those people in the top 1% (and I include our Corporate Citizens in this group) to pay their fair share to support this nation that gives so much to them.

You can't balance the budget when people who make 10x more than the average household are taxed at the same rate as the people below them. Do you know what that leads to? It leads to them accumulating assets that are 1,000x more than the people below them and, at that rate, it doesn't take very long before the people who "only" make 10x more than the average person to have ALL the assets and then it doesn't matter whether they pay the bottom 99% or not – as they can only use their money to buy what the top 1% are selling – because they have nothing of their own.

Think of it like a game of Monopoly, where you all do the same job (play the game, roll the dice) but 1 person out of 10 gets 10x more money when they pass go and 10x more money whenever they get bonuses from Chance or the Community Chest. Why? Because they were born that way, mostly. How long will it take before they wipe out all the other players?

Can you "work harder" than them and win the game or is it fairly inevitable that they will win because the rules are set up to give them a tremendously unfair advantage? And, more than that, are the rules set up to give you a tremendously unfair DISadvantage?

Ain't that America?

That's what this Fiscal Cliff BS is all about – the rich don't want to pay more taxes and they don't care if the whole country goes to Hell in a hand-basket because all those programs they are so eager to cut don't affect them or the rest of their 1% friends and family, nor do they much affect the next 4% who they generally rub elbows with in their day to day life.

And they'll keep playing that game and do everything they can to convince you to keep playing that game because it's their game and they know that, as long as they can keep finding suckers to play by their rules – they are going to get richer and richer and richer and that makes them more powerful and lets them make more rules that favor themselves.

So happy, happy new year – same as the old year most likely – unless you do something about it.